Daily Update - February 27, 2023

Selected highlights of the day

By: Matthew Otto

Taboola met guidance for Q4 and FY2022

They are projecting a positive free cash flow by 2023 with annual revenue of over $100M in 2024 assuming partial Yahoo rollout. Revenues of $1,401.2M and Gross Profit of $464.3M, ex-TAC Gross Profit of $569.6M indicate that they yielded results at the midpoints of the guidance while Non-GAAP Net Income was more than expected at $91.4M. Free Cash Flow in 2022 totaled to $18.6M while paying out net prepayments worth $15.3M and cash interest payments being at $20.7M level respectively. 2023 is expected to invest heavily as part of transition setup in anticipation of growth initiatives which should keep gross profit around $416-$436M with an ex-TAC Gross Profit estimated to be between $526-$546M for the year whilst anticipating Revenue to lie within the range stated ($1419 -$1469).

Outlook

2022 presented its own share of challenges in terms of advertising spending, yet Taboola’s financial performance stood solid. It was the second best year in their history for adding new publisher partnerships, amounting to over 90% higher revenue per month than had been accomplished in the past few years. The signing of a 30-year contract with Yahoo was particularly remarkable and regarded by CEO Adam Singolda as a “transformation” game changer. As far ahead as 2023 still looks unpredictable and hence presenting hardships that invite hard decisions needs; though, providing hope for recognition and restored growth near the back half of the year. Lastly, expectantly posted gains could be seen to considerably scale up by 2024, thus approximating to Adjusted EBITDA and Free Cash Flow registers of at least $200 million and $100 million respectively.

- Oppenheimer analyst Jason Helfstein adjusted his ratings of Taboola.com from an Outperform to a Market Outperform and lowered his price target from $4.5 to $4.

- JMP Securities analyst Andrew Boone maintained an Outperform rating while keeping the price target of $6 in place.

- Cowen & Co. analyst John Blackledge retained an overall Outperform rating and raised his price target to $6, up from $5.

- Credit Suisse analyst Stephen Ju stuck with his Outperform recommendation yet downgraded his price target to $5 from $6

- Needham analyst Laura Martin kept a Buy rating while increasing her price target of $3.5 to $5.

Adobe

As speculation ran wild that the Department of Justice plans to file a lawsuit seeking blockage against Adobe’s proposed $20 billion takeover of venture capital funded software company, Figma. Bloomberg reported that the government could go ahead and file a suit as early as March to stop the acquisition. It was also mentioned in reports that European regulators will be intently examining this movement as well.

Founded in 2012, Figma is an online platform used for collaborative designing of mobile and web interface applications; further comments from Adobe declared that they expect to close the deal by 2021. If successful this will at least triple the size of their largest transaction yet – with Adobe having bought technology provider Marketo for $4.75 billion two years prior.

In continuation to the provided report late Thursday from Autodesk:

- B of A Securities analyst Michael Funk maintained a Neutral rating and increased the price target from $225 to $240.

- JP Morgan analyst Stephen Tusa also maintained a Neutral rating but instead lowered the price target from $203 to $175.

- Credit Suisse analyst Sami Badri had an Outperform rating for Autodesk and a lower the price target from $325 to $250.

- Rosenblatt analyst Blair Abernethy reiterated a Buy rating while keeping his price target of $235.

NOVA

- Roth MKM analyst Philip Shen has expressed continued confidence in Sunova Energy Intl, maintaining a Buy rating and incrementally increasing his price target to $58.

- Credit Suisse analyst Maheep Mandloi reiterates his Outperform ranking and a price target of $43.

BBY

- The Telsey Advisory Group analyst Joseph Feldman has downgraded Best Buy from Outperform to Market Perform and his price target from $88 to $83.

An examination of the major macroeconomics at play for 2023 results in Feldman foreseeing high inflation and rising interest rate as detrimental factors for Best Buy’s profitability. This twin dynamic could push sales and profits substantially lower from what was previously expected.

UNP

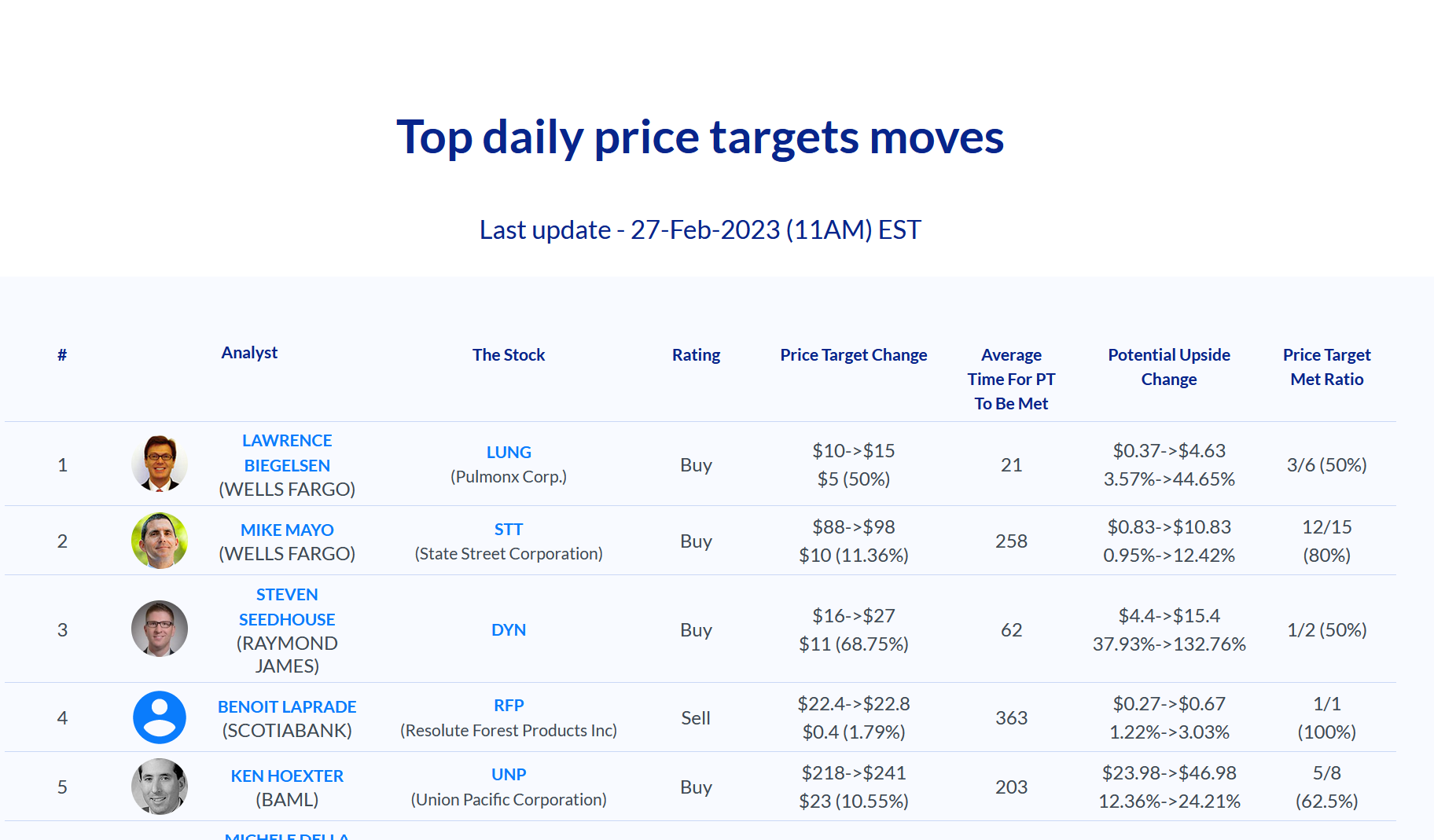

- B of A Securities – analyst Ken Hoexter raised from Neutral to Buy on Union Pacific with an upgrade to his price target from $218 to $241.

Looking ahead, Union Pacific have also revealed plans to name their successor in line to assume the leadership role when Chief Executive Officer Lance Fritz departs in 2023.

Alliant Energy

Announced last week the financial results for 2022. The GAAP earnings per share (EPS) increased to $2.73 bringing forth a 5% year-over-year gain from $2.63 in 2021. Excluding certain items, their adjusted EPS was also at $2.73 in 2022 as compared to $2.58 in 2021, resulting in 6% growth over the period under consideration. With these impressive figures, Alliant Energy affirmed its 2023 earnings guidance ranging between $2.82 and $2.96 each share.

- BMO Capital analyst James Thalacker maintained his Market Perform stance but lowered the price target for it from $59 to $58.

FDX

Last week, the union representing FedEx pilots unanimously approved a strike authorization vote, as attested to by a Wednesday press release. Although contract negotiations had been underway between FedEx management and the Air Line Pilots Association International’s FedEx Express Master Executive Council, discussions have since stalled and no future talks are currently on the calendar. Within the same press release, FedEx MEC chair Captain Chris Norman reflected upon recent events with frustration and dismay while conveying his intent: “The decision to move closer to a strike authorization vote is the result of nearly six months of federally mediated negotiations that has led to our disappointment with FedEx management’s actions at the bargaining table.”

- Evercore ISI Group analyst Jonathan Chappell maintained an Outperform rating with increasing his target price from $196 to $234.