Daily Update - Jan 11, 2023

By: Matthew Otto

JinkoSolar has just unveiled its next-generation Tiger Neo family

Offering improved performance and reliability that makes it one of the world’s most powerful and efficient solar panel solutions. The upgraded series includes three panels with power outputs ranging from 445Wp (54 cells) to 635Wp (78 cells), all achieving up to 22.72% module efficiency level – a jump in bifacial factor technology allowing for 15-20% more yield compared to regular models.

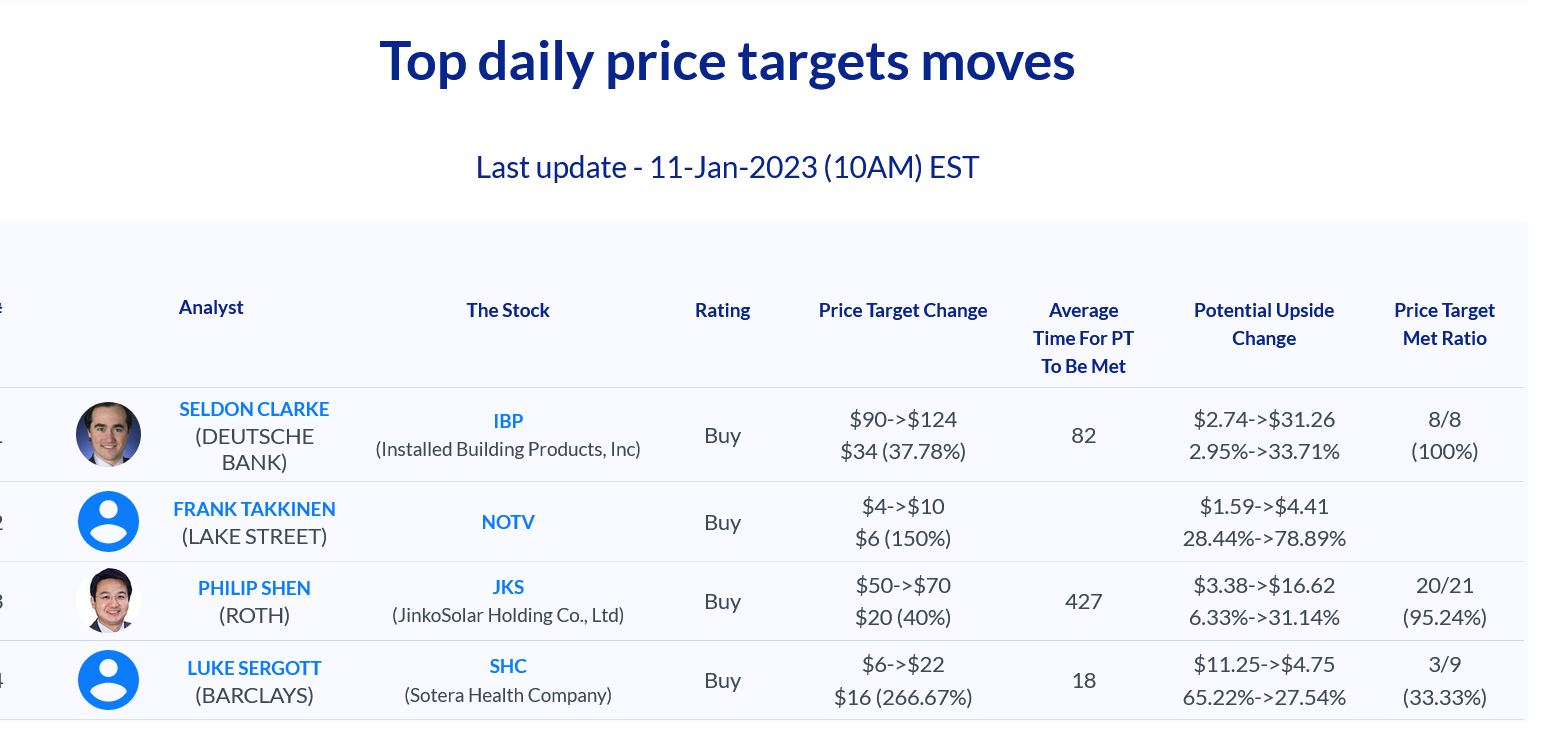

- Roth Capital analyst Philip Shen upgraded from Neutral to Buy rating and raised his price target to $70 from $50, a 40% increase.

Sotera sees relief in court

Sotera Health today revealed that its subsidiaries successfully negotiated agreements to settle over 870 cases against Sterigenics, involving the use of Ethylene Oxide. The settlements will amount to $408 million – but all parties must wait up 90-120 days before these are finalized and consents from plaintiffs have been obtained.

- Luke Sergott of Barclays leads with an upgrade from Underweight to Overweight accompanied by a higher price target — climbing from $6 up to $22.

- Mike Polark of Wolfe Research raised from Peer Perform to Outperform and setting his price target at $25 per share, up from $22.

C.H. Robinson Worldwide has seen a variety of opinion

- Morgan Stanley’s Ravi Shanker of JP Morgan maintained an Underweight rating but raised the price target to $67.

- Brian Ossenbeck downgraded the stock from Overweight to Neutral and lowered the price target to $90

- Todd Fowler kept his Overweight stance but decreased his previous forecast to $110.

- Jordan Alliger of Goldman Sachs had previously dropped his buy rating.

- Fadi Chamoun of BMO supported a Market Perform rating but revised the outlook downwards to $90

Amazon receives a negative note

For the last nine years (mostly while at JMP Securities), Citi analyst Ronald Josey has been a consistent champion of Amazon.com stock, maintaining mostly an Outperform rating and setting his price target higher than its then-current market value. Today he’s lowered it slightly to $140 after keeping his earlier projection at $160.

Toll brothers get approval from BOFA

B of A Securities analyst Rafe Jadrosich changed his opinion and upgraded Toll Brothers stock from Neutral to Buy with a $68 price target. Despite initially incorrectly predicting the drastic dip in share prices earlier this year, he’s confident that higher returns are on their way for investors.

URBN had a successful holiday season, as total company net sales increased by 2.3% compared to the previous year. The Free People Group saw a 15% boost in retailer segment comparable net sales and Anthropologie Group experienced 7% growth – both of which were partially offset by 10% decrease at Urban Outfitters. However, overall retail segment comparables still rose due to low single-digit positive increases in digital channel & store based sales across all brands.

Retail sees a small nudge

Urban Outfitters has been given a renewed focus, Deutsche Bank analyst Gabriella Carbone sees potential for growth, issuing her own Hold rating and raising price target to $25, whilst Morgan Stanley’s Kimberly Greenberger upgraded her forecast with an Equal-Weight rating and setting a new Price Target of $27.66.