Daily Update - March 2, 2023

Selected highlights of the day

By: Matthew Otto

CRM Layoffs

Salesforce reported a Q4 revenue of $8.38 billion, an increase of 14% YoY, with a loss of $98 million, an increase from the previous year’s loss of $28 million. The CEO announced a 10% employee cut in January, costing the company $828 million. Non-GAAP profits were reported at $1.68 per share, higher than their earlier forecast of $1.35-$1.37 per share. Salesforce anticipates a 10% revenue increase and expects to surpass Wall Street’s $34 billion consensus with an expected $34.7 billion revenue in January 2024. Management has also forecasted a non-GAAP operating margin of 27%. Shareholder buybacks are currently favored over mergers and acquisitions.

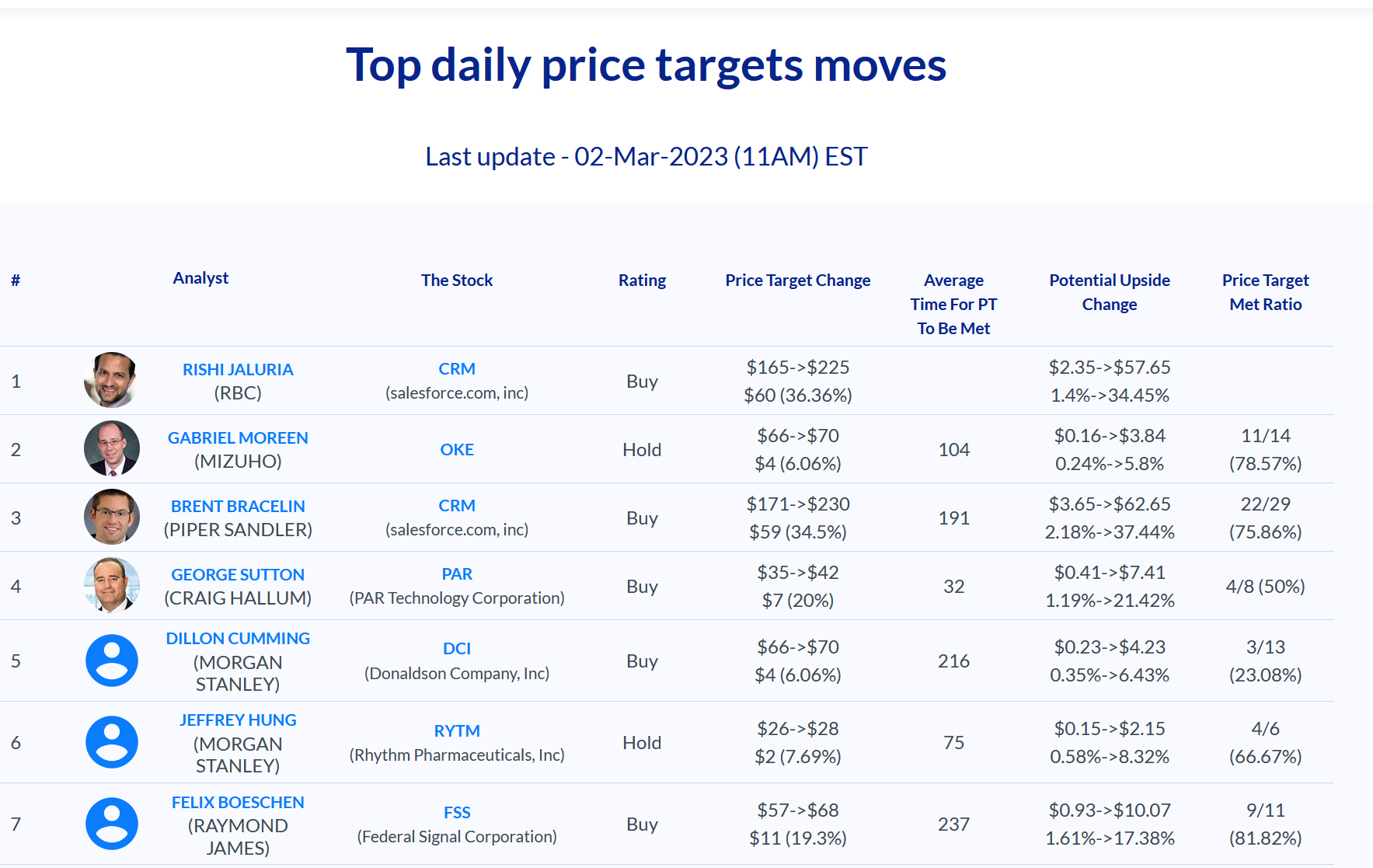

Wall Street gives a green light

- Loop Capital Yun Kim has maintained a Hold rating but has bumped the price target from $150 to $190.

- DA Davidson analyst Gil Luria has maintained a Neutral rating while raising the price target from $150 to $180.

- Evercore ISI Group analyst Kirk Materne kept an Outperform rating and raised the price target from $200 to $230.

- Canaccord Genuity analyst David Hynes had a Buy rating while increasing his price target from $180 to $215.

- Wells Fargo analyst Michael Turrin maintained an Overweight rating and raised his price target from $200 to $225.

- TD Cowen analyst J. Derrick Wood also rates Salesforce as an Outperform, bumping up his price target from $170 to $190.

- JMP Securities analyst Patrick Walravens reiterated a Market Perform rating and a price target of $250.

- Morgan Stanley analyst Keith Weiss is maintaining an Overweight rating, while raising the price target from $236 to $240.

- Mizuho analyst Gregg Moskowitz kept his Buy stance on Salesforce but raised its price target from $200 to $225.

- RBC Capital analyst Rishi Jaluria maintained an Outperform rating with an increased price target of $225, previously set at $165.

- BMO Capital analyst Keith Bachman set an Outperform and raised his price target of $185 to $230.

- BOFA Securities analyst Brad Sills lifted his price target of $235 from $200.

- Needham analyst Scott Berg upgraded his rating from Hold to Buy.

- Brian Peterson of Raymond James held a Strong Buy rating and increased his price target from $200 to $240.

- UBS Karl Keirstead maintains a Neutral rating and changed the price target from $162 to $210.

- Baird Rob Oliver reiterates Neutral rating while boosting the price target from $150 to $200.

- Macquarie’s Sarah Hindlian gave an Outperform rating and enhanced her price target to $225 up from $218.

- JP Morgan analyst Mark Murphy made an Overweight rating and raised his price target from $200 to $230.

- Wedbush analyst Daniel Ives stayed with an Outperform raising his price target from $200 to $220.

- Raimo Lenschow kept his Overweight rating while raising the price target from $195 to $225.

- Piper Sandler analyst Brent Bracelin retained an Overweight and raises his price target from $171 to $230.

Silvergate Capital

Is facing a financial crisis following the collapse of one of its customers, crypto exchange FTX. This has significant implications for the digital asset markets and regulation.

Silvergate has announced in an SEC filing that it won’t be able to file its annual report on time and is assessing its ability to continue as a going concern. The bank is facing challenges due to regulatory scrutiny, bankruptcies across the digital asset industry, and declining crypto prices. Shares in the company have already fallen by 90% over the past year, and the bank has had to sell more assets than expected, resulting in expected losses that could impact its capital ratio.

Silvergate also reported a $1 billion loss in Q4 2021, mostly due to having to sell assets at fire-sale prices to remain liquid and prevent a bank run triggered by FTX’s collapse in November. The bank had previously announced asset sales to repay a loan but is now re-evaluating its businesses and strategies. Silvergate has not commented beyond the filing, and this situation may mark the end of Wall Street’s support for the bank as a regulated option for investing in the digital asset space.

- JP Morgan analyst Steven Alexopoulos downgraded from Neutral to Underweight.

- Canaccord Genuity Joseph Vafi has downgraded from Buy to Hold and his price target from $25 to $9.

Okta

Has reported its financial results for the fourth quarter and fiscal year 2023. The company’s Q4 revenue increased by 33% year-over-year, with subscription revenue growing by 34%. Its current remaining performance obligations (cRPO) grew by 25% year-over-year to $1.68 billion. Okta also achieved a record operating cash flow of $76 million and free cash flow of $72 million.

In terms of Q4 financial highlights, Okta’s total revenue was $510 million, an increase of 33% year-over-year. Subscription revenue was $495 million, an increase of 34% year-over-year. The company’s subscription backlog, or RPO, was $3.01 billion, up 12% year-over-year. Okta’s total calculated billings increased by 18% year-over-year to $710 million. The company’s GAAP operating loss was $157 million, or (31)% of total revenue, compared to $214 million in Q4 of fiscal 2022. However, Okta achieved non-GAAP operating income of $46 million, or 9% of total revenue, compared to a non-GAAP operating loss of $24 million in Q4 of fiscal 2022. The company’s GAAP net loss was $153 million, compared to $241 million in the same quarter of fiscal 2022. Okta achieved non-GAAP net income of $52 million, compared to a non-GAAP net loss of $29 million in Q4 of fiscal 2022.

For the full fiscal year 2023

Okta’s total revenue increased by 43% year-over-year to $1.86 billion, with subscription revenue increasing by 44%. Total calculated billings increased by 24% year-over-year to $2.12 billion. The company’s GAAP operating loss was $812 million, or (44)% of total revenue, compared to $768 million in fiscal 2022. Non-GAAP operating loss was $10 million, or (1)% of total revenue, compared to non-GAAP operating loss of $74 million in fiscal 2022. Okta’s GAAP net loss was $815 million, compared to a GAAP net loss of $848 million in fiscal 2022. The company’s non-GAAP net loss was $7 million, compared to a non-GAAP net loss of $68 million in fiscal 2022. Okta achieved net cash provided by operations of $86 million, or 5% of total revenue, compared to $104 million, or 8% of total revenue, in fiscal 2022. Free cash flow was $65 million, or 3% of total revenue, compared to $87 million, or 7% of total revenue, in fiscal 2022.

Okta has provided its financial outlook

For the first quarter and full year fiscal 2024,the company expects total revenue of $509 million to $511 million, representing a 23% YoY growth rate, with a non-GAAP diluted net income per share of $0.11 to $0.12.

For the full year fiscal 2024, Okta anticipates total revenue of $2.155 billion to $2.170 billion, a 16% to 17% YoY growth rate, with a non-GAAP diluted net income per share of $0.74 to $0.79. Non-GAAP operating income for the year is expected to be in the range of $136 million to $145 million. Okta also expects current RPO to be in the range of $1.675 billion to $1.685 billion, reflecting a YoY growth rate of 19%.

Okta CEO Todd McKinnon stated on Barron’s

That the company is making progress in selling its customer identity software business and expects to eventually achieve a 50/50 split with its legacy employee identity management software. McKinnon also revealed that Okta recently secured a new customer, the popular chatbot ChatGPT from OpenAI, which uses Okta’s software for the login process.

- Adam Borg of Stifel decided to maintain a Buy and increased his price target from $90 to $100.

- Ittai Kidron of Oppenheimer maintained an Outperform rating and nudged the price target up from $85 to $95.

- Andrew Nowinski at Wells Fargo kept an Overweight and increased the price target from $76 to $98.

- Trevor Walsh of JMP Securities held a Market Outperform rating and bumped his prediction from $105 to $110.

- Keith Bachman of BMO Capital set an Outperform and lifted his price to $94 up from $80.

- Mizuho analyst Gregg Moskowitz maintained a Buy rating and raised the price target from $90 to $95.

- RBC Capital analyst Matthew Hedberg left an Outperform rating while increasing the price objective to $100.

- Stephens analyst Brian Colley set an Equal-Weight with a new price target of $84, up from $70.

- Bernstein’s Peter Weed had a Market Perform and raised his previous price target of $80 to of $92.

- Needham analyst Alex Henderson kept a Buy rating and bumped up the target figure from $90 to $100.

- MoffettNathanson’s Jackson Ader is with an Underperform but raised his price target from $71 up to $85.

Box

Has reported its financial results for the fourth quarter and fiscal year 2023. On the fourth quarter of fiscal year 2023, Box’s revenue was $256.5 million, a 10% increase YoY. Its remaining performance obligations were $1.245 billion, a 16% increase YoY. GAAP gross profit was $195.5 million, or 76.2% of revenue, compared to $168.7 million or 72.3% of revenue last year. Net cash provided by operating activities was $92.2 million, an 87% increase YoY.

Outlook

Box estimates that Q1 FY24 revenue will be between $248 million to $250 million, a 5% YoY increase. The expected GAAP operating margin is around 0.5%, and the non-GAAP operating margin is around 21%.

For the full year FY24, Box anticipates revenue in the range of $1.050 billion to $1.060 billion, a 7% YoY increase. The expected GAAP operating margin is around 4.5%, and the non-GAAP operating margin is around 25%.

Box expects GAAP net income per share to range between $0.17 to $0.23, while non-GAAP diluted net income per share is expected to be in the range of $1.42 to $1.48.

The weighted-average basic and diluted shares outstanding are expected to be approximately 145 million and 153 million, respectively. Analysts predicted revenue of $256 million, as well as profits valued at 34 cents per share.

- Morgan Stanley analyst Josh Baer has an Overweight rating and cut his price target from $39 to $37.

- Credit Suisse analyst Rich Hilliker reaffirmed an Outperform rating on holds the price target at $36.

Macy’s reported better-than-expected earnings for the fourth quarter

With adjusted diluted earnings per share of $1.88 and sales of $8.3 billion. Analysts had predicted earnings per share of $1.53 on sales of just over $8.2 billion.

Macy’s reported earnings that beat estimates, excluding a 17 cents income tax benefit linked to a favorable resolution of state litigation. The company’s inventory approach and gift-giving strategy helped, and inventory levels are now 18% below 2019.

For 2023, Macy’s expects sales between $23.7 billion to $24.2 billion, down slightly from $24.4 billion in 2022, and earnings per share in a range of $3.67 to $4.11, which is higher than the Wall Street consensus of $3.78. However, the company predicts that comparable-store sales will decline between 2% and 4% next year, following a 3.3% contraction in Q4. Macy’s also said that gross margin could contract up to 0.2 percentage points due to some inventory overhangs during the first quarter.

American Eagle Outfitters

Reported fourth quarter results with total net revenue of $1.5 billion, down 1% YoY, while Aerie revenue increased 8% YoY and American Eagle revenue decreased 8% YoY. The company’s gross profit of $507 million increased 4% YoY and reflected a gross margin rate of 33.9%. GAAP operating income was $74 million and non-GAAP operating income was $96 million, reflecting a 6.4% margin. AEO also announced a quarterly cash dividend of $0.10 per share. For the full year fiscal 2022, AEO’s total net revenue was flat YoY at $5 billion and Aerie revenue rose 9% YoY while American Eagle revenue declined 8% YoY.

AEO is optimistic for 2023, but is taking a noticeably cautious stance. They have put a special focus on reducing total company expenses and keeping their inventory as healthy and steadfast as possible. In terms of revenue, AEO expects it to either stay the same or increase in low-single digits by the end of the qualifying periods. The expectation for operating income is that it should stay relatively consistent with last year’s numbers during the first quarter, then range between $270 million and $310 million if all goes well throughout 2022. Previously, adjusted operating income was reported at $269 million that same year.

- Dana Telsey, an analyst with Telsey Advisory Group, has restated her recommendation for American Eagle Outfitters as Market Perform and a price target of $17.

TD Bank Group has completed its acquisition of Cowen Inc.

TD Securities, the investment banking unit of TD Bank, is acquiring Cowen, a diversified financial services firm. Cowen offers a range of services, including investment banking, research, sales and trading, prime brokerage, outsourced trading, global clearing, and commission management. This acquisition will help TD Securities accelerate its long-term growth strategy in the United States by adding complementary products and services.

Cowen has a renowned global research franchise and provides new capabilities in US equities, including a strong sales, trading, and execution platform. Cowen also has deep relationships with corporate and financial clients across key growth verticals.

After the acquisition, parts of the combined business will be known as TD Cowen. Jeffrey Solomon, Chair and CEO of Cowen, will join the senior leadership team of TD Securities and report to Riaz Ahmed, President and CEO of TD Securities.