Daily Update - March 24, 2023

Selected highlights of the day

By: Matthew Otto

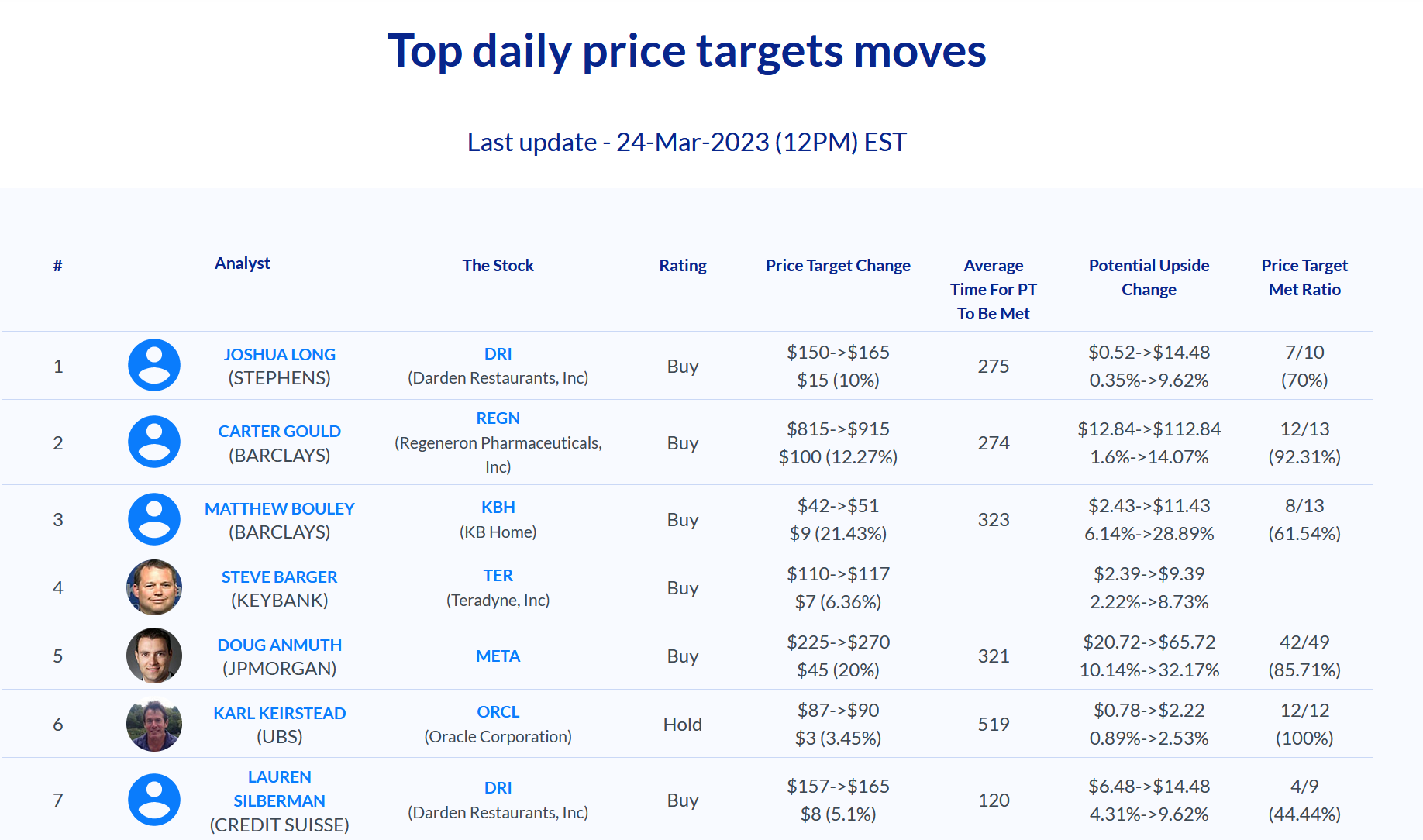

Darden Restaurants

Continues receiving positive feedback as a follow up to this week’s news.

- RBC Capital’s Christopher Carril has maintained an “Outperform” rating and raised the price target from $160 to $165.

- BMO Capital’s Andrew Strelzik has maintained a “Market Perform” rating and increased the price target from $145 to $150.

- Oppenheimer’s Brian Bittner has reiterated an “Outperform” rating and set a price target of $175.

- Credit Suisse’s Lauren Silberman has maintained an “Outperform” rating and raised the price target from $157 to $165.

- Citigroup’s Jon Tower has maintained a “Buy” rating and raised the price target from $165 to $169.

- Baird’s David Tarantino has maintained a “Neutral” rating and increased the price target from $148 to $152.

- Raymond James’ Brian Vaccaro has maintained an “Outperform” rating and raised the price target from $160 to $165.

- Barclays’ Jeffrey Bernstein has maintained an “Overweight” rating and raised the price target from $168 to $173.

- Wedbush’s Nick Setyan has reiterated an “Outperform” rating and set a price target of $165.

- Stephens & Co.’s Joshua Long has maintained an “Overweight” rating and increased the price target from $150 to $165.

TikTok got grilled in Congress

CEO Shou Chew faced tough questioning from both Republican and Democratic members during a five-hour House hearing on Thursday. The focus of the hearing was on the company’s ties to China and the Chinese Communist Party. The opening remarks by Rep. Cathy McMorris Rodgers set the tone for the hearing as she described TikTok as “a tool to manipulate America,” and said the app “should be banned.” Chew was repeatedly asked about TikTok’s relationship with parent company ByteDance and whether the Chinese Communist Party controls the company. He said TikTok doesn’t spy on Americans on behalf of China and that the company doesn’t post or remove content from the platform at the CCP’s request, but the committee remained skeptical. The hearing has increased the possibility of Congress imposing a ban on TikTok in the U.S., unless ByteDance agrees to sell or spin off the company. The outcome of the hearing has led to a rise in share prices of other online ad sellers such as Meta Platforms, Alphabet, and Snap.

- Barclays analyst Ross Sandler has maintained an “Overweight” rating on Meta and raised his price target from $260 to $270.

Regeneron and Sanofi’s

Jointly developed asthma drug, Dupixent, has shown promise in treating chronic obstructive pulmonary disease (COPD), according to new data from a phase three clinical trial. The drug reduced bad bouts of COPD by 30% compared to a placebo over 52 weeks. COPD is a life-threatening respiratory disease and the third leading cause of death globally, with smoking being a key risk factor. The new data could make Dupixent the first new treatment for COPD in over a decade. J.P. Morgan analyst Chris Schott said the latest results exceeded expectations and could lead to new COPD patients adding $1.5 billion to $2 billion in new sales for Dupixent.

- BMO Capital’s Evan David Seigerman maintained an “Outperform” rating and raised the price target from $1025 to $1040.

- Baird’s Brian Skorney maintained a “Neutral” rating and raised the price target from $756 to $800.

- Wells Fargo’s Mohit Bansal maintained an “Overweight” rating and raised the price target from $860 to $915.

- Barclays’ Carter Gould maintained an “Overweight” rating and raised the price target from $815 to $915.

- Jefferies’ Akash Tewari upgraded the rating from “Hold” to “Buy” and raised the price target from $675 to $925.

- Raymond James’ Dane Leone upgraded the rating from “Underperform” to “Market Perform”.

OUST

Lidar sensor provider Ouster announced financial results for the year ending December 31, 2022, reporting revenue of $41m with 27% gross margins, hitting its 2022 guidance. The company also secured a company-record $70m in bookings in 2022 and shipped new REV7 sensors to 29 customers in Q4 2022. Ouster shipped over 8,650 sensors for revenue in 2022, with 35% and 34% of sensors shipped in 2022 going to the industrial and robotics verticals, respectively. The smart infrastructure vertical represented 9% of the shipped sensors, while the automotive vertical accounted for 22% of sensors shipped. The company expects revenues to grow significantly in 2023 following the merger with Velodyne.

Wall Street was expecting Ouster to achieve approximately $15 million in sales for the first quarter of 2023. The company’s EBITDA came in at a loss of $23 million, slightly higher than the expected loss of $21 million.

- Cantor Fitzgerald analyst Andres Sheppard has maintained an “Overweight” rating on Ouster and lowered the price target from $5 to $3.

- Chardan Capital analyst Brian Dobson has downgraded Ouster from “Buy” to “Neutral” and announced a price target of $1.

Accenture

Reported better-than-expected earnings and revenue for its second fiscal quarter, but lowered its full-year revenue growth expectations from 8-11% to 8-10% in local currency. The company also plans to cut around 19,000 jobs, or about 2.5% of its workforce, with more than half the departures coming in non billable corporate roles. Accenture’s CEO, Julie Sweet, said that the company is “taking steps to lower our costs in fiscal year 2024 and beyond while continuing to invest in our business and our people to capture the significant growth opportunities ahead.” Despite the lowered revenue growth expectations, Accenture raised its full-year free cash flow expectations to a range of $8.0 billion to $8.5 billion and continues to expect to return at least $7.1 billion in cash to shareholders through dividends and share repurchases.

- RBC Capital maintains an Outperform rating on Accenture and raises the price target from $335 to $340.

- BMO Capital maintains a Market Perform rating on Accenture and increases the price target from $310 to $327.

- JP Morgan reaffirms an Overweight rating on Accenture and raises the price target from $311 to $314.

- Citigroup maintains a Buy rating on Accenture and increases the price target from $300 to $310.

- Wells Fargo maintains an Equal-Weight rating on Accenture and raises the price target from $289 to $294.

Block

Received negative headlines after short seller Hindenburg Research published a report disclosing a short position in the company and accusing it of inflating user metrics and failing to prevent improper activity. However, despite the stock market reaction, the consensus on Wall Street remains bullish for the fintech company, with most analysts holding a Buy rating.

- Analyst Dan Dolev of Mizuho Securities acknowledged the report’s valid arguments but argued that other claims may hold less water, maintaining a Buy rating on Block and a price target of $93.

- Wedbush analyst Nick Setyan reiterates Block with an Outperform and maintains a $114 price target.

- Citi analyst Peter Christiansen maintains a Buy rating on Block with a $90 price target but raises concerns about fraud and KYC controls at Cash App.

- Atlantic Equities analyst Kunaal Malde downgrades Block from Overweight to Neutral and lowers the price target from $95 to $70.

Vor Bio

Has reported financial results for the three-month period and full year ended December 31, 2022, and provided a business update. The company is encouraged by the initial proof of concept demonstrated in patients treated in its VBP101 study,which supports the company’s founding vision that engineered hematopoietic stem cells can enable treatment options after AML transplant. The company is focused on rapid enrollment and plans to share additional clinical data later this year. Its IND for VCAR33ALLO is on-track for submission in the first half of 2023, which, together with trem-cel, has the potential to transform outcomes for patients with blood cancers.

- Oppenheimer’s Matthew Biegler reiterates Outperform rating and sets a price target of $18.

- JMP Securities’ Silvan Tuerkcan reiterates Market Outperform rating and sets a price target of $12.

- Baird’s Jack Allen maintains Outperform rating and lowers the price target from $38 to $22.

- HC Wainwright’s Swayampakula Ramakanth reiterates Buy rating and sets a price target of $17.5.

- Stifel’s Stephen Willey maintains Buy rating and lowers the price target from $17 to $16.

.