Daily Update - March 27, 2023

Selected highlights of the day

By: Matthew Otto

Caterpillar

Got downgraded by Robert W. Baird’s analyst Mircea Dobre who lowered his rating of Neutral to Underperform. Additionally, Mircea set a new price target of $185.00 down from the previous target of $230.00.

Baird’s reasoning for this downgrade is that they expect a “meaningful slowdown” in new small- and medium-sized nonresidential construction projects in 2024.

CRM

Activist investor Elliott Investment Management has decided not to push for its own directors to be nominated to the board of Salesforce, The company has raised its share buyback plan to $20 billion while signaling a retreat from M&A activity. Although Benioff has taken advice from some of the company’s activist investors, such as ValueAct and its CEO Mason Morfit, he has stated that he has no intention of leaving Salesforce and that there is a potential succession plan in place.

- Over the weekend, RBC’s analyst Rishi Jaluria kept Salesforce with an Outperform and a $225 price target.

Apache Corporation received attention

- Morgan Stanley’s analyst Devin McDermott keeps an “Equal-Weight” rating for APA, yet lowers his price target to $38.

- RBC Capital’s Scott Manhold Reiterates a “Sector Perform” rating, maintains a price target of $54.

- Raymond James’s analyst John Freeman leaves a “Strong Buy” rating but lowers his price target to $49.

Iovance Biotherapeutics

Has completed its rolling Biologics License Application (BLA) submission for lifileucel to the US Food and Drug Administration (FDA). Lifileucel is intended to treat advanced melanoma patients who progressed after prior anti-PD-1/L1 therapy and targeted therapy, where applicable. Iovance is pursuing accelerated approval in this indication after a successful pre-BLA meeting with the FDA. The BLA submission is supported by positive clinical data from the C-144-01 clinical trial with intent for commercialization to support a launch later this year.

- Yanan Zhu of Wells Fargo has assumed coverage of Iovance with an “Equal-Weight” rating and set a price target of $11.

- On the other hand, Joseph Pantginis of HC Wainwright & Co. has reiterated a “Buy” rating for Iovance Biotherapeutics and sets the price target at $38.

GLW

- Deutsche Bank analyst Matthew Niknam has upgraded Corning to a “Buy” rating and raised the price target to $38. Quoted on CNBC, Niknam, Corning is “turning a corner” on revenues and earnings per share, indicating that the company’s financial performance is improving.

OLLI

- Citigroup analyst Paul Lejuez has downgraded Ollie’s Bargain Outlet to a “Sell” rating and lowered the price target to $49. According to Lejuez, the company has a “difficult model to scale” and has seen weaker productivity with its new stores over the past several years.

TSLA

- Citigroup analyst Itay Michaeli has maintained a “Neutral” rating on Tesla and raised the price target from $146 to $192.

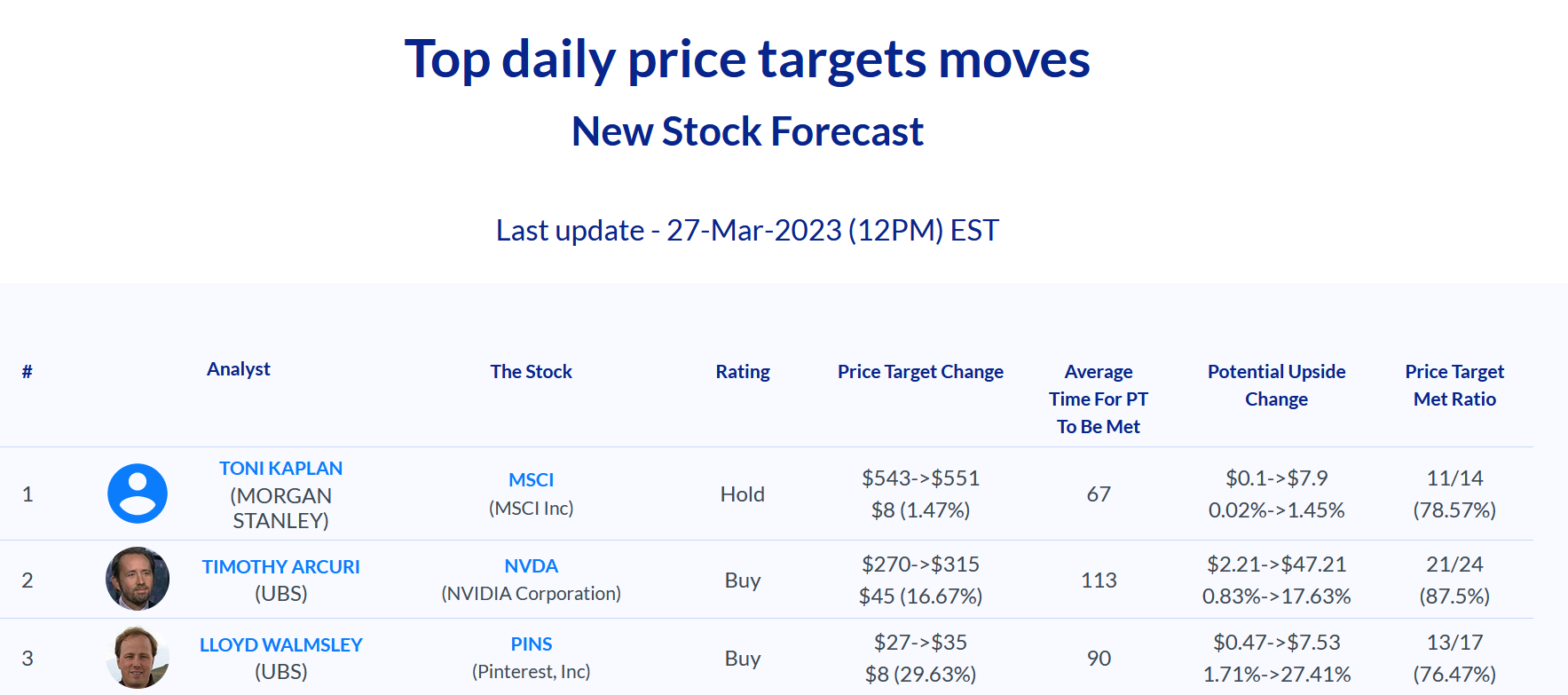

NVDA

- UBS analyst Timothy Arcuri has kept a “Buy” rating on NVIDIA and lifted his price target from $270 to $315.

DISH

Bernstein Liebhard has announced a securities class action lawsuit on behalf of investors who purchased or acquired Dish Network between February 22, 2021 and February 27, 2023, seeking to recover Dish shareholders’ investment losses. The lawsuit alleges that Dish overstated its operational efficiency and maintained a deficient cybersecurity and information technology infrastructure, making it unable to properly secure customer data and susceptible to access by malicious third parties. Dish also confirmed that a cyber-security incident caused a network outage, rendering its call center phone numbers unreachable and leaving customers with authentication issues when signing into TV channel apps using their Dish credentials. The stock price of Dish fell 6.48% on February 28, 2023, following the announcement of the incident.

- UBS analyst John Hodulik downgraded Buy to Neutral and lowered the stock forecast from $27 to $10.