Daily Update - March 30, 2023

Selected highlights of the day

By: Matthew Otto

Registration Hardware

Reported that its fiscal fourth-quarter earnings had fallen from the previous year. The adjusted profit of $2.88 per share also missed analysts’ estimates.

Some of the figures mentioned were:

- Fiscal 2022 revenues of $3.59 billion

- Adjusted operating margin of 22%

- Adjusted EBITDA margin of 25.9%

- Luxury home sales down 45% in the most recent quarter versus a year ago

- Over 70 new furniture and upholstery collections being unveiled in spring/summer

- Multibillion-dollar opportunity for expanding the RH brand globally, addressing new markets locally, and transforming North American galleries

- RH England, the Gallery at the Historic Aynho Park, a 73-acre 17th century estate, opening this summer with 3 full-service restaurants, the orangery, conservatory, and the loggia, plus 3 secondary hospitality experiences, the wine lounge, the tea salon, and the juicery

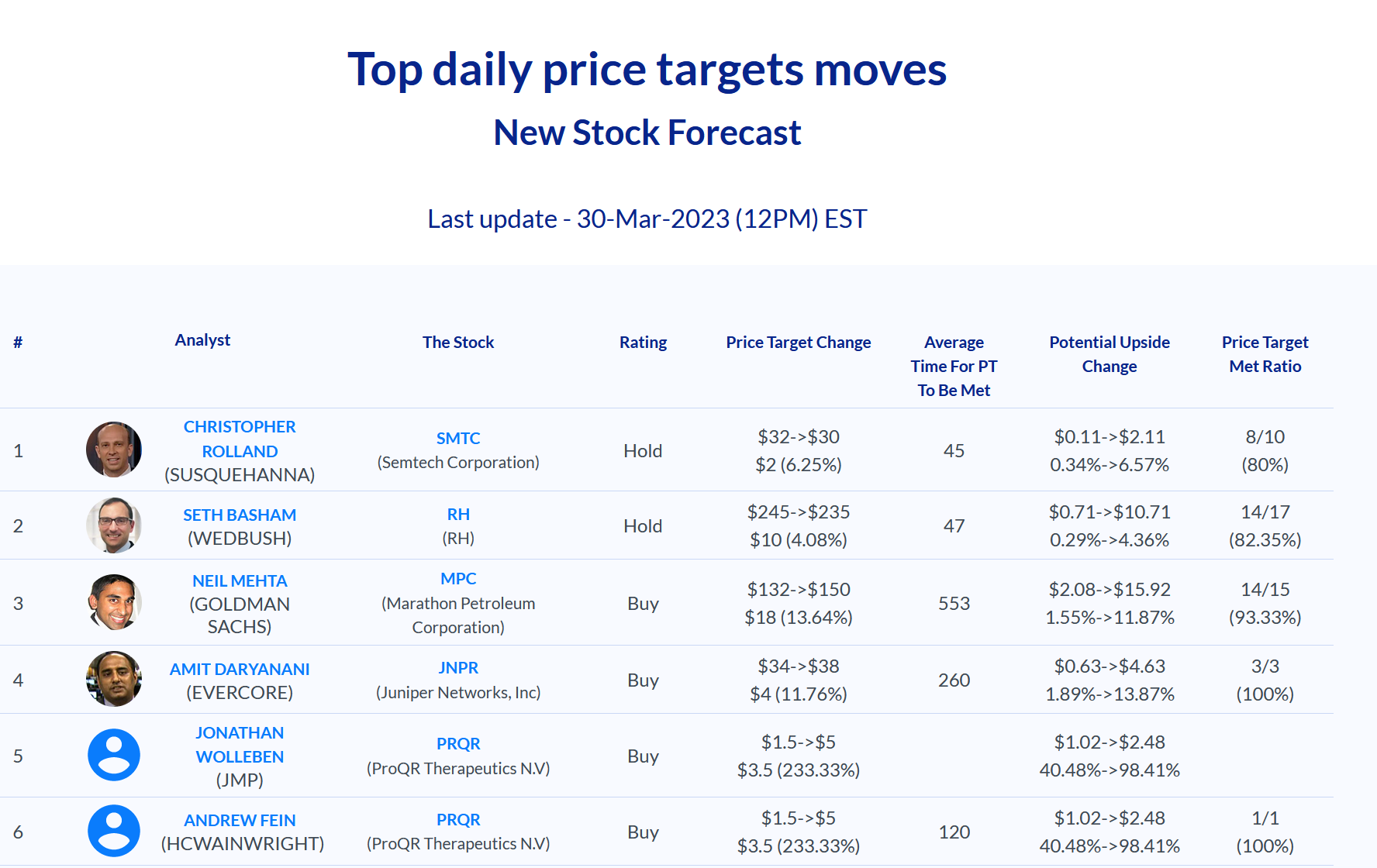

Several analysts have adjusted their stocks forecast on RH

- Morgan Stanley analyst Simeon Gutman reiterates a Equal-Weight rating and adjusts the price target to $275, down from $300.

- Wedbush analyst Seth Basham confirms a Neutral rating and revises the price target to $235, down from $245.

- Citigroup analyst Steven Zaccone maintains a Buy rating and lowers the price target to $330, down from $380.

- Baird analyst Peter Benedict maintains a Neutral rating and lowers the price target to $250, down from $300.

- Telsey Advisory Group analyst Joseph Feldman affirms a Market Perform rating and lowers the price target to $225, down from $280.

- UBS analyst Michael Lasser sets his price target to $255.

INTC

Intel’s announcement this week of the company’s next-generation data-center chips will be ready earlier than expected. This news comes after the company lost market share to rival Advanced Micro Devices.

- Wedbush analyst Matt Bryson reiterates Intel with an Underperform rating and maintains a price target of $20.

- Mizuho analyst Vijay Rakesh reiterates Intel with a Neutral rating and maintains a price target of $29.

- Raymond James analyst Srini Pajjuri maintains an Outperform rating on Intel and raises the price target from $33 to $35.

- Deutsche Bank analyst Ross Seymore raises the price target of Intel from $30 to $32.

- Susquehanna analyst Christopher Rolland reiterates a Neutral rating on Intel and maintains a price target of $26 while raising AMD’s price target from $88 to $112 and maintaining a Positive rating.

- Wells Fargo analyst Aaron Rakers has Advanced Micro Devices with an Overweight and raises the price target from $85 to $120.

Sprinklr platform

Has reported its financial results for Q4 and full year fiscal 2023 ended January 31, 2023. The company’s Q4 total revenue was $165.3 million, up 22% YoY, while its subscription revenue was $148.3 million, up 26% YoY. Sprinklr reported net cash provided by operating activities of $22.1 million and free cash flow of $16.3 million in Q4. The company’s total RPO was $719.5 million, up 26% YoY, and its cRPO was $485.2 million, up 23% YoY. Additionally, Sprinklr had 108 $1 million customers, up 32% YoY. For the full year fiscal 2023, the company’s total revenue was $618.2 million, up 26% YoY, while its subscription revenue was $548.6 million, up 28% YoY. Sprinklr provided guidance for Q1 and full fiscal year ending January 31, 2024.

Sprinklr provided guidance for the first fiscal quarter ending April 30, 2023, with subscription revenue between $153 million and $155 million, total revenue between $168 million and $170 million, non-GAAP operating income between $3 million and $5 million, and non-GAAP net income per share between $0.00 and $0.01, assuming 268 million weighted average shares outstanding.

For the full fiscal year ending January 31, 2024, Sprinklr provided guidance with subscription revenue between $644 million and $648 million, total revenue between $710 million and $714 million, non-GAAP operating income between $41 million and $45 million, and non-GAAP net income per share between $0.13 and $0.15, assuming 273 million weighted average shares outstanding.

Wall Street Action

- Pinjalim Bora of JP Morgan maintains an Overweight rating and the price target at $14.

- Patrick Walravens of JMP Securities upholds an Outperform rating and elevates the price target to $20 from $16.

- Michael Turrin of Wells Fargo retains an Equal-Weight rating and boosts the price target to $11.

- Parker Lane of Stifel maintains a Hold rating and raises the price target from $8 to $13.

- Matt VanVliet of BTIG is with a price target of $16.

- Elizabeth Porter of Morgan Stanley has her price target at $14.

PM

Philip Morris International received an upgrade from JP Morgan analyst Jared Dinges, who revised the rating from Neutral to Overweight, and boosted the price target from $109 to $116. DIngs had an Overweight rating in early 2022 that is going back to after a year.

Taysha Gene Therapies

Reported its fourth quarter and full year 2022, respectively. For the fourth quarter, the company reported service revenue of $2.5 million and total operating expenses of $57.6 million, resulting in a net loss of $55.7 million or $0.99 per basic and diluted common share. For the full year 2022, the company reported service revenue of $2.5 million and total operating expenses of $165 million, resulting in a net loss of $166 million or $3.78 per basic and diluted common share.

The report had a larger-than-expected loss for the fourth quarter of 2022, with earnings per share (EPS) of ($0.99), missing the analyst consensus estimate of ($0.41) by $0.58. The company’s revenue for the quarter was $2.5 million, falling short of the consensus estimate of $10 million.

- JMP Securities analyst Silvan Tuerkcan reiterates with a Market Outperform and maintains a $4 price target.

- Morgan Stanley analyst Michael Lapides maintains an Equal-Weight and lowers his price target from $3 to $1.

- Cantor Fitzgerald analyst Kristen Kluska maintains an Overweight and lowers her price target from $13 to $2.

- Chardan Capital analyst Geulah Livshits maintains a Buy and lowers her price target from $6 to $5.

- Truist analyst Joon Lee keeps a Buy and lowers the price target from $4 to $3

- Needham analyst Gil Blum reiterates a Buy and his $6 price target.

- Truist Securities analyst Joon Lee keeps a Buy and lowers the price target from $4 to $3.

.