Daily Update - March 8, 2023

Selected highlights of the day

By: Matthew Otto

CrowdStrike

Reported impressive financial results for the fourth quarter and fiscal year 2023. The company achieved a record net new annual recurring revenue (ARR) of $222 million, leading to an ending ARR of $2.56 billion, a 48% YoY increase. Subscription revenue also grew by 48%, totaling $598.3 million for the quarter. The company’s cash flow from operations and free cash flow both reached record levels, totaling $273 million and $209 million, respectively.

CrowdStrike added 1,873 net new subscription customers in the quarter, representing 41% growth YoY. For the first quarter of fiscal 2024, CrowdStrike projected total revenue of $674.9 million to $678.2 million, and for the full fiscal year 2024, the projected total revenue was $2,955.1 million to $3,014.8 million. Income from operations is expected to be $107.1 million to $109.5 million for the first quarter and $474.0 million to $518.7 million for the full fiscal year. net income attributable to CrowdStrike is expected to be $121.1 million to $123.5 million for the first quarter and $535.9 million to $580.7 million for the full fiscal year. Net income per share attributable to CrowdStrike common stockholders, diluted, is expected to be $0.50 to $0.51 for the first quarter and $2.21 to $2.39 for the full fiscal year.

Wall Street Action:

- JP Morgan analyst Brian Essex increased his price target from $137 to $155 while maintaining an overweight rating.

- Wedbush analyst Taz Koujalgi increased the price target from $135 to $145 while maintaining an outperform rating.

- Stifel analyst Brad Reback increased the price target from $145 to $220 while maintaining a hold rating.

- Guggenheim analyst John Difucci reiterated the buy rating and increased the price target to $147 from the previous target.

- BTIG analyst Gray Powell maintained a buy rating and increased the price target from $148 to $163.

- Stephens & Co. analyst Brian Colley reiterated the overweight rating and increased the price target from to $161.

- RBC Capital analyst Matthew Hedberg maintained an outperform rating and increased the price target from $150 to $160.

- JMP Securities analyst Trevor Walsh reiterated the market outperform rating and increased the price target to $235.

- UBS analyst Fatima Boolani maintained a buy rating and increased the price target from $150 to $165.

- Evercore ISI Group analyst Peter Levine maintained an outperform rating and decreased the price target from $200 to $190.

- Barclays analyst Saket Kalia maintained an overweight rating and increased the price target from $155 to $165.

- Citigroup analyst Fatima Boolani maintained a buy rating and increased the price target from $145 to $155.

- BMO Capital analyst Keith Bachman maintained an outperform rating and increased the price target from $120 to $152.

DICK’S Sporting Goods

Reported its fourth quarter and full year results, delivering 5.3% growth in comparable store sales for the quarter. The company achieved record-setting full year net sales of $12.37 billion, up 0.6% compared to 2021 and up 41.3% compared to 2019. It also delivered full year earnings per diluted share of $10.78 and non-GAAP earnings per diluted share of $12.04. DICK’S Sporting Goods increased its annualized dividend to $4.00 per share, a 105% increase compared to 2022. For 2023, the company expects full year earnings per diluted share to be in the range of $12.90 to $13.80, including approximately $0.20 for the 53rd week, and comparable store sales to be in the range of flat to positive 2.0%.

The board of directors of DICK’S Sporting Goods declared a quarterly dividend of $1.00 per share. This represents an increase of 105% over the previous quarterly dividend per share and an annualized dividend of $4.00 per share. For the full year 2023, the company’s outlook includes earnings per diluted share of $12.90 to 13.80, including approximately $0.20 per diluted share for the 53rd week, comparable store sales of flat to positive 2.0% on a 52-week basis, and capital expenditures of $670 to $720 million on a gross basis, or $550 to $600 million on a net.

Wall Street Action:

- DA Davidson analyst Michael Baker increased the price target from $145 to $178 and maintained a Buy rating.

- Wedbush analyst Seth Basham increased the price target from $140 to $155 and maintained an Outperform rating.

- TD Cowen analyst John Kernan increased the price target from $166 to $175 and maintained an Outperform rating.

- Morgan Stanley analyst Simeon Gutman increased the price target from $165 to $175 and maintained an Overweight rating.

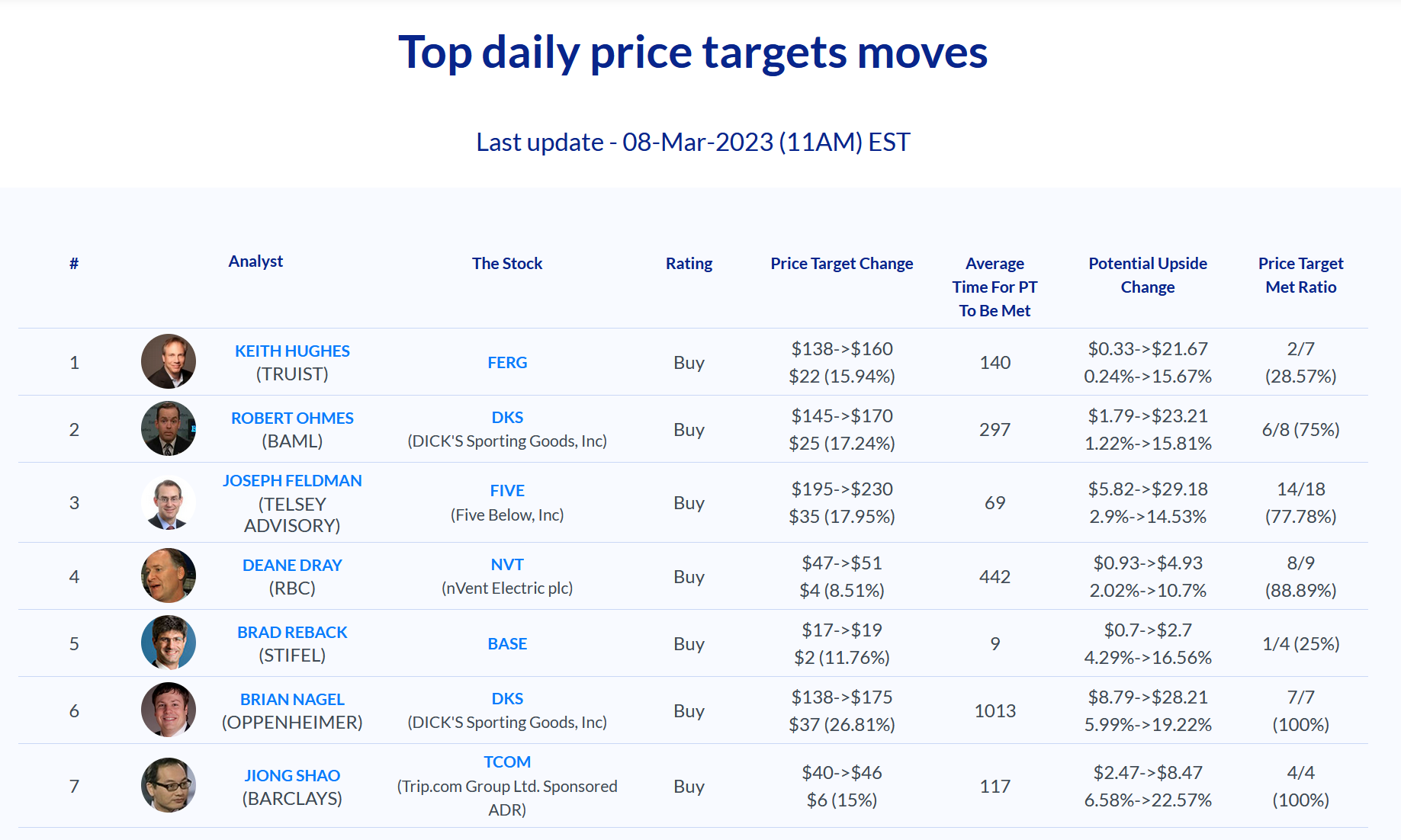

- B of A Securities analyst Robert Ohmes increased the price target from $145 to $170 and maintained a Buy rating.

- Oppenheimer analyst Brian Nagel increased the price target from $138 to $175 and maintained an Outperform rating.

- Barclays analyst Adrienne Yih increased the price target from $139 to $174 and maintained an Overweight rating.

- Citigroup analyst Paul Lejuez increased the price target from $140 to $144 and maintained a Neutral rating.

- Telsey Advisory Group analyst Joseph Feldman increased the price target from $135 to $165 and maintained an Outperform rating.

- JP Morgan analyst Christopher Horvers is maintaining his Neutral rating while increasing his price target from $125 to $148.

- Evercore ISI Group analyst Warren Cheng is setting an Outperform rating lifting hus price target from $160 to $200.

- Stifel analyst Jim Duffy has a Hold rating with upgraded price target from $112 to $157.

TSLA

- Adrian Yanoshik, analyst at Berenberg, has downgraded Tesla from ‘Buy’ to ‘Hold.’ but upgraded his stock forecast from $200 to $210.

Energy Vault

Has reported its fourth quarter 2022 earnings results, highlighting revenue of $100.3 million driven by the company’s gravity energy storage territory expansion and execution ahead of schedule on a California 275MWh storage project with expected completion in July 2023. For the year ending December 31, 2022, revenue totaled $145.9 million, reflecting strong project ramp-up from contracts executed in Q3 2022. The company exited 2022 with total cash of $286.2 million and no debt on the balance sheet. Energy Vault also signed two new gravity EVx licensing and royalty agreements in Europe and the Middle East, representing the company’s first formal entry into these regions for future EVx deployments. Construction of the first Energy Vault (GESS) EVx, a patented energy storage technology that uses excess renewable energy to lift heavy cylindrical blocks and then lowers them to release the stored energy as electricity, in China continues to advance, with expected completion and commissioning of all electronic and power generation components on track for Q2 2023.

Energy Vault expects its total revenue to be between $325 million to $425 million in 2023, which reflects a core growth of approximately 2x-3x over 2022. The gross margin is expected to be in the 10-15% range, and the adjusted EBITDA for the full-year 2023 is expected to be in the range of $(50) million to $(70) million.

- TD Cowen analyst Thomas Boyes remains reaffirmed his Outperform rating and reduced his price target from $9 to $6.5.

Marinus Pharmaceuticals

Has reported net product revenue of $2.3 million for the fourth quarter of 2022 and $2.9 million for the full year of 2022. The company is expecting ZTALMY net product revenues of $15 million to $17 million for the full year ending December 31, 2023. Marinus is actively recruiting Phase 3 clinical trials in refractory status epilepticus and tuberous sclerosis complex, with data expected in the second half of 2023 and Q1 2024, respectively. The company’s cash and cash equivalents were reported as $240.6 million as of December 31, 2022.

Marinus has provided guidance for the fiscal year 2023, anticipating ZTALMY U.S. net product revenues to range between $15 million and $17 million, while BARDA revenues are expected to be between $8 million to $11 million. The company also expects total GAAP operating expenses, which include SG&A and R&D, to fall within $165 million to $175 million, with an estimated $16 million for stock-based compensation.

- Cantor Fitzgerald analyst Charles Duncan has reiterated an “Overweight” rating and raised his price target to $28.

- RBC Capital analyst Brian Abrahams has maintained his “Outperform” rating and lowered his price target from $23 to $22.

- JMP Securities analyst Jason West has maintained a “Market Outperform” rating and reduced his price target from $19 to $18.

- HC Wainwright & Co. analyst Douglas Tsao has reiterated his “Buy” rating set his price target at $27.

AAPL

- According to a research note from Wedbush analyst Dan Ives, he has increased his price target on Apple’s stock (AAPL) from $180 to $190 and maintained an Outperform rating on the stock.

Quoted on Barrons, Ives noted that demand has rebounded in China following a weak December due to the country’s strict Covid-19 lockdown policy, which was rolled back early that month. Despite the uncertain macro backdrop, Ives is confident in the steady demand curve for the flagship iPhone 14 Pro in March/June and expects continued market share gains as people upgrade their phones to newer models. He estimates that approximately 25% of current iPhone users haven’t upgraded their device in four or more years.

Tremor International

Tremor International, a digital advertising company, reported its Q4 2022 and full-year financial results, showing a record CTV spend and expanded market share. The company achieved a record Q4 CTV spend of $99.6 million, up 59% YoY, and a record CTV spend of $283.6 million for the full year, up 41% YoY. Tremor also achieved a Q4 2022 adjusted EBITDA of $36.9 million and a full-year adjusted EBITDA of $144.9 million.

Tremor’s acquisition of Amobee allowed it to create cross-planning capabilities and position for increased market share gains and partnerships in 2023. The investment in VIDAA is expected to generate revenue benefits starting in late 2023. The company had a net cash position of $115.5 million as of December 31, 2022, and achieved a net retention rate of 80% during 2022.

Prediction

For the full year 2023 financial outlook due to ongoing global economic uncertainties, including rising inflation and interest rates, supply chain constraints, geopolitical conflicts, and the residual effects of the COVID-19 pandemic. Management anticipates incremental improvements in H2 2023, driven by completing the integration of Amobee, expected revenue benefits from the company’s investment in VIDAA, and tempered improvements in the global advertising demand environment. Tremor estimates its full year 2023 Contribution ex-TAC to be approximately $400 million and full year 2023 Adjusted EBITDA to be in the range of approximately $140 million to $145 million. In 2023, the company expects revenue tied to its core programmatic activities to grow by approximately 5% on a combined pro forma basis, while non-core performance business revenue is expected to decline year-over-year.

- Lake Street analyst Eric Martinuzzi is maintaining a Buy rating while decreasing his price target from $12 to $10.

- RBC Capital analyst Matthew Hedberg maintains an Outperform rating but decreases his price target from $15 to $13.

- Needham analyst Laura Martin reiterates her Buy rating on the stock and set her stock forecast $10.

First Watch Restaurant Group

Has reported its 2022 financial results and provided an outlook for the fiscal year ending December 31, 2023. The company achieved a 21.5% increase in total revenues, and same-restaurant sales and traffic growth of 14.5% and 7.7%, respectively, when compared to 2021. For the first two periods of the current quarter, the company reported same-restaurant sales and traffic growth of 15.7% and 8.5%, respectively. First Watch has opened 43 system-wide restaurants across 16 states, resulting in a total of 474 system-wide restaurants across 29 states.

The company reiterates its long-term annual financial targets, including percentage unit growth in the low double digits and same-restaurant sales growth of approximately 3.5%.

- Jon Tower, the Citigroup analyst, has reduced his price target for a stock from $21 to $20, while still maintaining a Buy rating.

- Brian Vaccaro, the Raymond James analyst, has lowered his price target from $23 to $22 but continues to maintain an Outperform rating.

- Andrew Charles, Cowen analyst, has reiterated his Market Perform rating and a $17 price target.