Daily Update - March 9, 2023

Selected highlights of the day

By: Matthew Otto

Asana’s CEO

Dustin Moskovitz, has disclosed plans to buy up to 30 million shares at $700 million. Moskovitz already holds a 58.3% stake in the company, and he believes that Asana’s shares are undervalued. He will purchase the shares under a structured trading plan, with purchases running between June 8 and Dec. 29 of this year. The company reported revenue of $150.2 million for the fourth quarter ended Jan. 31, up 34% from a year earlier. Asana sees revenue of $150 million to $151 million for the fiscal first quarter, and revenue of $638 million to $648 million for the fiscal year ending January 2024. with a non-GAAP loss of 18 to 19 cents per share. Street consensus estimates were for revenue of $150 million and a loss of 23 cents per share

The company projects revenue to be between $638 million and $648 million, up 17% to 18%, with a non-GAAP loss of 55 to 59 cents per share. Street estimates had called for revenue of $646 million and a loss of 80 cents per share. The company’s fiscal 2024 guidance reflects improvement towards profitability year over year. Annualized revenues from customers spending $100,000 or more grew 80% year over year.

- RBC Capital analyst Rishi Jaluria has reiterated his “Underperform” rating for Asana and maintained a price target of $10

- Oppenheimer analyst George Iwanyc has maintained an “Outperform” rating for Asana and raised the price target from $25 to $28.

- DA Davidson analyst Robert Simmons has upgraded Asana from “Neutral” to “Buy” and raised the price target from $18 to $21

- Baird analyst Rob Oliver has maintained a “Neutral” rating for Asana while raising the price target from $15 to $20.

- JMP Securities analyst Patrick Walravens has maintained an “Outperform” rating for Asana and raised the price target from $21 to $28

- Piper Sandler analyst Brent Bracelin has maintained a “Neutral” rating for Asana while raising the price target from $13 to $24.

MongoDB issued guidance

Stating that fiscal-year 2024 revenue will rise 15% to 18%, lower than expectations for 26% growth. However, total revenue of $361.3 million for Q4 fiscal 2023, an increase of 36% YoY. The subscription revenue was $348.2 million, an increase of 35% YoY, and services revenue was $13.1 million, an increase of 59% YoY. MongoDB Atlas revenue increased by 50% YoY, accounting for 65% of total Q4 revenue. The company’s total revenue for the full year fiscal 2023 was $1,284.0 million, an increase of 47% YoY.

- Citi analyst Tyler Radke maintains a Buy rating and lowers his price target from $295 to $290.

- RBC Capital analyst Rishi Jaluria reiterates MongoDB with an Outperform rating and maintains a $235 price target.

- Goldman Sachs analyst Kash Rangan maintains a Buy rating on MongoDB but lowers the price target from $325 to $280.

- Needham analyst Mike Cikos maintains a Buy rating on MongoDB and raises the price target from $240 to $250.

- Mizuho analyst Matthew Broome maintains a Neutral rating on MongoDB but lowers the price target from $220 to $180.

- Oppenheimer analyst Ittai Kidron maintains an Outperform rating on MongoDB but lowers the price target from $320 to $270.

- JMP Securities analyst Patrick Walravens maintains a Market Outperform rating on MongoDB and raises the price target from $215 to $245.

- Barclays analyst Raimo Lenschow maintains an Overweight rating on MongoDB but lowers the price target from $264 to $257.

Noodles & Company

Announced their Q4 and full year 2022 financial results, reporting an 18.9% increase in total revenue to $136.5 million for Q4 2022 compared to Q4 2021. The company-owned comparable restaurant sales increased 10.2%, while franchise restaurants increased 1.3% and system-wide grew by 8.7%. The company’s net income in Q4 2022 was $1.0 million, compared to a net loss of $4.7 million in Q4 2021. Noodles & Company also opened five new company-owned restaurants during the quarter. For the full year 2022, the company’s total revenue increased 7.2% to $509.5 million, and they opened 16 new company-owned restaurants and three franchised restaurants. However, the restaurant contribution margin decreased 200 basis points to 13.9%, and the adjusted EBITDA decreased 13.3% to $33.1 million from $38.1 million.

Noodles announced its business outlook for the first quarter of fiscal year 2023 and the full fiscal year. The company expects total revenue of $125 million to $128 million, comparable restaurant sales in the high-single digits, and restaurant level contribution margins of 12.5% to 12.8% for the first quarter. For the full fiscal year, the company expects restaurant level contribution margins of 16.0% to 17.0%, adjusted EBITDA of $45 million to $50 million, and adjusted EPS of $0.10 to $0.20. The company also plans to open new restaurants with a system-wide growth of approximately 7.5%, with most of the openings being company-owned. Capital expenditures are expected to be $53 million to $58 million in 2023.

- Benchmark analyst Todd Brooks maintains Noodles with a Buy and reiterates the $10 price target. Stephens & Co. analyst Joshua Long reiterates a price target of $7 for Noodles and maintains their “Overweight” rating.

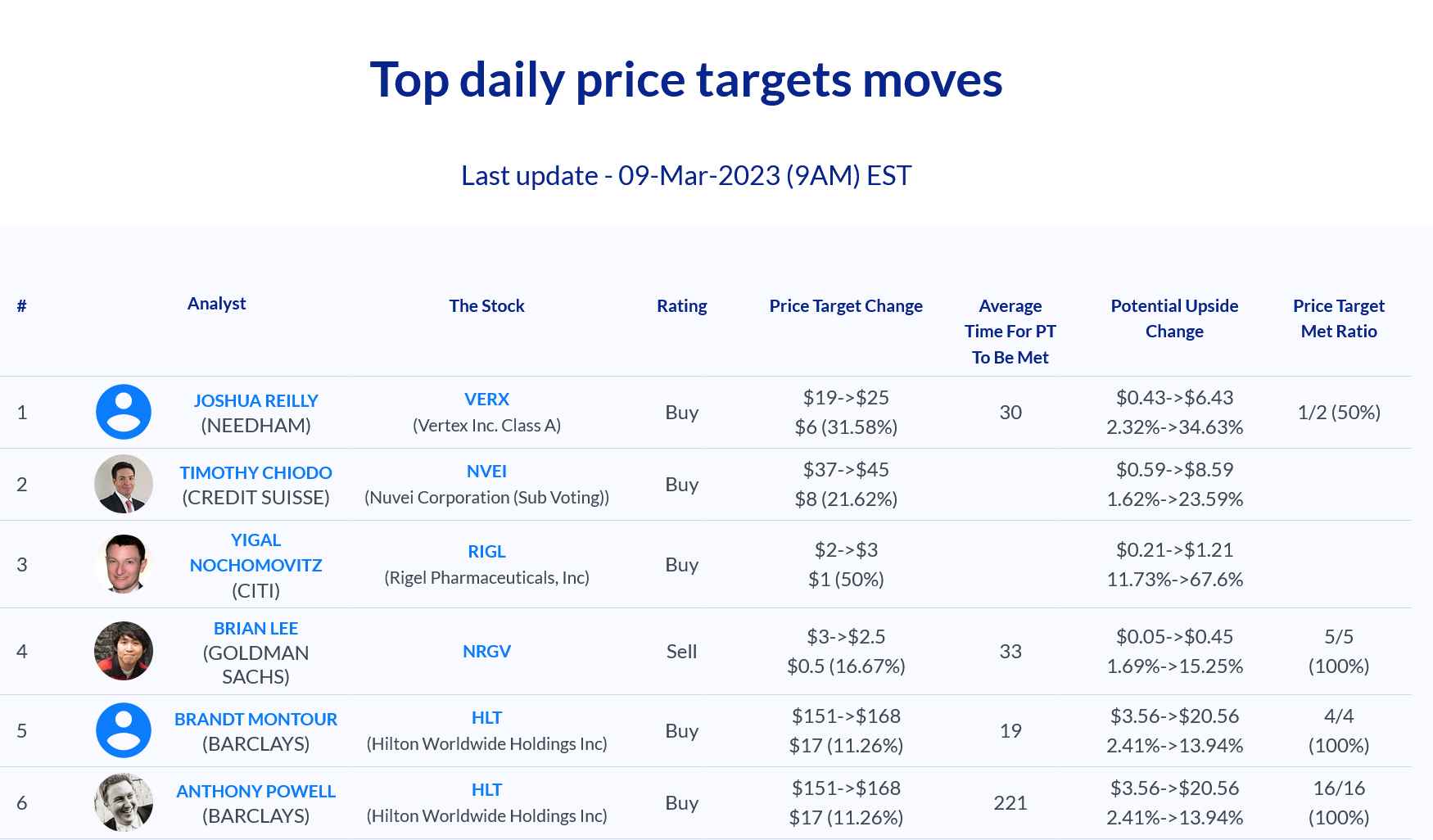

HLT

Hilton Worldwide Holdings is upgraded by Barclays analyst Brandt Montour from Equal-Weight to Overweight and the price target is raised from $151 to $168. The analysts expressed appreciation for the company operations

.

SmartRent

Has reported Q4 and full year 2022 financial results showed positive growth with a 52% increase in revenue and continued margin improvement. Total revenue for the year was $167.8 million, up 52% from 2021, and Q4 total revenue was $40.6 million, an increase of 17% from the previous year. SaaS revenue saw a 251% increase to $27.8 million from $7.9 million in 2021. Adjusted EBITDA was $(75) million for the full year and $(14) million for Q4, and the company had a cash balance of $218 million at the end of the year.

- Deutsche Bank analyst Sidney Ho maintains SmartRent with a Buy rating and lowers the price target from $6 to $5.

- Cantor Fitzgerald analyst Brett Knoblauch maintains an Overweight rating and lowers the price target from $4.25 to $4.

- Morgan Stanley analyst Erik Woodring maintains an Equal-Weight rating and raises the price target from $2.9 to $3.1

Earthstone Energy

Earthstone Energy reported their financial and operating results for Q4 and full year 2022. Q4 highlights included net income of $185.2 million and adjusted net income of $147.2 million, adjusted EBITDAX of $338.0 million (up 296% YoY), and average daily production of 104,766 Boepd (up 246% YoY). Full year highlights included net income of $650.6 million and adjusted net income of $586.0 million, and adjusted EBITDAX of $1.1 billion (up 347% YoY). Earthstone reaffirmed their 2023 guidance, with a capital budget of $725-$775 million, the drilling of 82 gross / 62.7 net operated wells, and participation in 1.4 net non-operated wells. They expect production to average between 96,000 and 104,000 barrels of oil equivalent per day, with about 44% being oil.

- A Buy rating from Benchmark analyst Subash Chandra was received, who maintains their price target of $30.

Pharmaceutical company Aquestive Therapeutics

Has reported its financial results for Q4 and full year 2022, as well as updated investors on key business objectives for 2023. The company confirmed it is on track to initiate a pivotal study for its AQST-109 product, an epinephrine sublingual film used to treat allergic reactions, in Q3 2023. Additionally, Aquestive is continuing its work with the US Food and Drug Administration on bringing Libervant to market and exploring new capabilities for its manufacturing business. The company amended its existing license and supply agreement with Indivior, extending the term until August 2026. Aquestive’s Q4 revenues totaled $10.7m, down 4% YoY, while its net loss was $12.4m, compared to $28.9m YoY.

Aquestive has provided its 2023 financial outlook, which includes total revenue of $37 to $41 million and a non-GAAP adjusted EBITDA loss of $31 to $36 million. The revenue guidance no longer includes proprietary net sales for Sympazan, but includes manufacturing and supply revenue and royalty fees. The outlook also includes focused R&D investments related to the development of AQST-109.

- Wedbush analyst Andreas Argyrides has upgraded Aquestive Therapeutics from Neutral to Outperform and raised the price target from $3 to $4