Daily Update - May 10, 2023

Selected stock price target highlights of the day

By Matthew Otto

ABNB

Airbnb released its Q1 financial results and Q2 guidance which did not meet Wall Street expectations. The company reported Q1 revenue of $1.8 billion, a 20% increase from the previous year and in line with their target range. Gross bookings increased by 19% to $20.4 billion, and nights and experiences booked grew by 19% to 121.1 million. Adjusted EBITDA was $262 million, up 14%, and free cash flow was $1.6 billion, up 32%.

The company also announced a buyback program of $2.5B.

Despite a strong start to 2023, the company’s Q2 guidance disappointed investors. Airbnb projected Q2 revenue between $2.35 billion and $2.45 billion, with the midpoint slightly below the Street consensus of $2.42 billion. The growth forecast for Q2 is between 12% and 16%. Airbnb also expects slower growth for nights and experiences booked due to an unfavorable year-over-year comparison, as well as flat adjusted Ebitda for Q2 and a lower margin due to the timing of marketing expenses.

Factors contributed to the drop in shares:

- Changing travel patterns: U.S. travel companies are adjusting their outlook for 2023 as pre-pandemic travel patterns return and consumers seek cheaper accommodation due to high inflation and recession fears. This shift in consumer behavior is affecting Airbnb’s bookings and average daily rates.

- Price sensitivity: Airbnb CEO Brian Chesky noted that people are more price-sensitive in North America, particularly in the U.S., where lower-priced listings have the highest occupancy.

- Competition: Analyst Nicholas Cauley from Third Bridge highlighted that Airbnb is facing fierce competition from rivals like Booking.com and Expedia’s Vrbo, making its future less certain.

- Efforts to remain competitive: Airbnb is equipping hosts with new tools to normalize pricing and starting marketing campaigns earlier in the year to attract cost-conscious travelers ahead of the peak summer season. The company expects average daily rates to remain pressured as vacationers return to lower-cost urban rentals.

Wall Street Action

- BofA Securities: Analyst Justin Post keeps a Neutral rating and reduces the price target from $145 to $135.

- Credit Suisse: Analyst Stephen Ju continues with a Neutral rating and cuts the price target from $160 to $150.

- DA Davidson: Analyst Tom White reaffirms a Buy rating and decreases the price target from $145 to $140.

- Morgan Stanley: Analyst Brian Nowak sustains an Underweight rating and lowers the price target from $100 to $95.

- Barclays: Analyst Mario Lu maintains an Equal-Weight rating and trims the price target from $128 to $112.

- Piper Sandler: Analyst Thomas Champion holds a Neutral rating and adjusts the price target from $131 to $117.

- Baird: Analyst Colin Sebastian revises the price target from $120 to an unspecified value.

- UBS: Analyst Lloyd Walmsley modifies the price target to $108.

- Jefferies: Analyst John Colantuoni updates the price target to $140.

- RBC Capital: Analyst Brad Erickson maintains a Sector Perform rating and reduces the price target from $135 to $105.

- Needham & Company: Analyst Bernie adjusts the price target to $150.

- Deutsche Bank: Analyst Leo Horowitz changes the price target to $102.

- Goldman Sachs: Analyst Eric Sheridan revises the price target to $97.

Looking at AnaChart we see that both Brian Nowak of Morgan Stanley and Eric Sheridan of Goldman Sachs were correct to stay bearish on the Airbnb stock with their calls in the beginning of the year.

EA

Electronic Arts beat Q4 booking estimates, driven by gamers sticking to familiar franchises such as “FIFA” and “Madden NFL”

EA CEO Andrew Wilson mentioned that brands like FIFA, Madden, and The Sims have performed well during these times. The company announced that “Lord of the Rings: Heroes of Middle Earth” and “Madden 24” would join “Star Wars Jedi: Survivor” in its lineup of titles for fiscal 2024.

The company reported net bookings of $1.95 billion in the fourth quarter, exceeding Refinitiv estimates of $1.76 billion, driven by record live services and strong engagement, particularly from the “FIFA” franchise, as stated by CFO Chris Suh. Three of EA’s titles, including “FIFA 23” and “Dead Space,” were among the top 10 best-selling games in the first three months of the year, according to data from market research firm Circana.

As the EA-FIFA partnership is ending, the company plans to launch a rebranded version of the game, “EA Sports FC,” this year, expecting low single-digit net bookings growth in fiscal 2024. EA’s forecast for fiscal 2024 net bookings is between $7.30 billion and $7.70 billion, compared with estimates of $7.52 billion, while the bookings outlook for the current quarter aligns with expectations.

Wall Street Action

- Wedbush: Analyst Nick McKay maintains an Outperform rating and raises the price target from $139 to $144.

- Credit Suisse: Analyst Stephen Ju keeps an Outperform rating and increases the price target from $138 to $142.

- Raymond James: Analyst Andrew Marok maintains an Outperform rating and raises the price target from $135 to $150, a street high on Electronic Arts.

- Wells Fargo: Analyst Conor Fitzgerald sustains an Equal-Weight rating and raises the price target from $135 to $145.

- Baird: Analyst Colin Sebastian retains an Outperform rating and increases the price target from $125 to $145.

- Barclays: Analyst Mario Lu continues with an Equal-Weight rating and raises the price target from $124 to $130.

- Stifel: Analyst Drew Crum raises the price target to $144.

- Roth: Analyst Eric Handler increases the price target to $138.

- Benchmark: Analyst Mike Hickey raises the price target to $144.

- BofA Securities: Analyst Omar Dessouky raises the price target to $135.

Looking at AnaChart we see that the Electronic Arts stock is traded not too far from it’s all time high with positive consensus from the analyst carrying a potential upside with their stock forecasts despiste losing a bit in 2023.

RIVN

Electric vehicle manufacturer Rivian Automotive reported a narrower-than-expected Q1 loss and confirmed it remains on track to meet a 50,000-vehicle production target for 2023. Key figures from the company’s Q1 report include:

- Loss per share: $1.25 adjusted vs. $1.59 expected

- Revenue: $661 million vs. $652.1 million expected

Rivian’s net loss reduced to $1.35 billion, or $1.45 per share, from $1.59 billion, or $1.77 per share, a year earlier. The company’s total revenue increased significantly from $95 million the previous year. Rivian had $11.8 billion in cash remaining as of March 31, down from $12.1 billion at the end of 2022. Capital expenditures for Q1 were $283 million, compared to $418 million in the same period last year.

Rivian has been focusing on reducing spending over the last few months in an effort to conserve cash. The company is currently producing the R1T pickup, R1S SUV, and a series of electric delivery vans for Amazon at its factory in Normal, Illinois.

Wall Street Action

- DA Davidson analyst Michael Shlisky maintains an Underperform rating and lowers the price target from $16 to $11.

- Goldman Sachs analyst Mark Delaney holds a Neutral rating and lowers the price target from $18 to $16.

- Mizuho analyst Vijay Rakesh keeps a Buy rating and lowers the price target from $35 to $30.

- Barclays analyst Dan Levy reiterated an Overweight rating and lowered the price target from $28 to $22.

- CFRA analyst Garrett Nelson upgraded from Strong Sell to Sell.

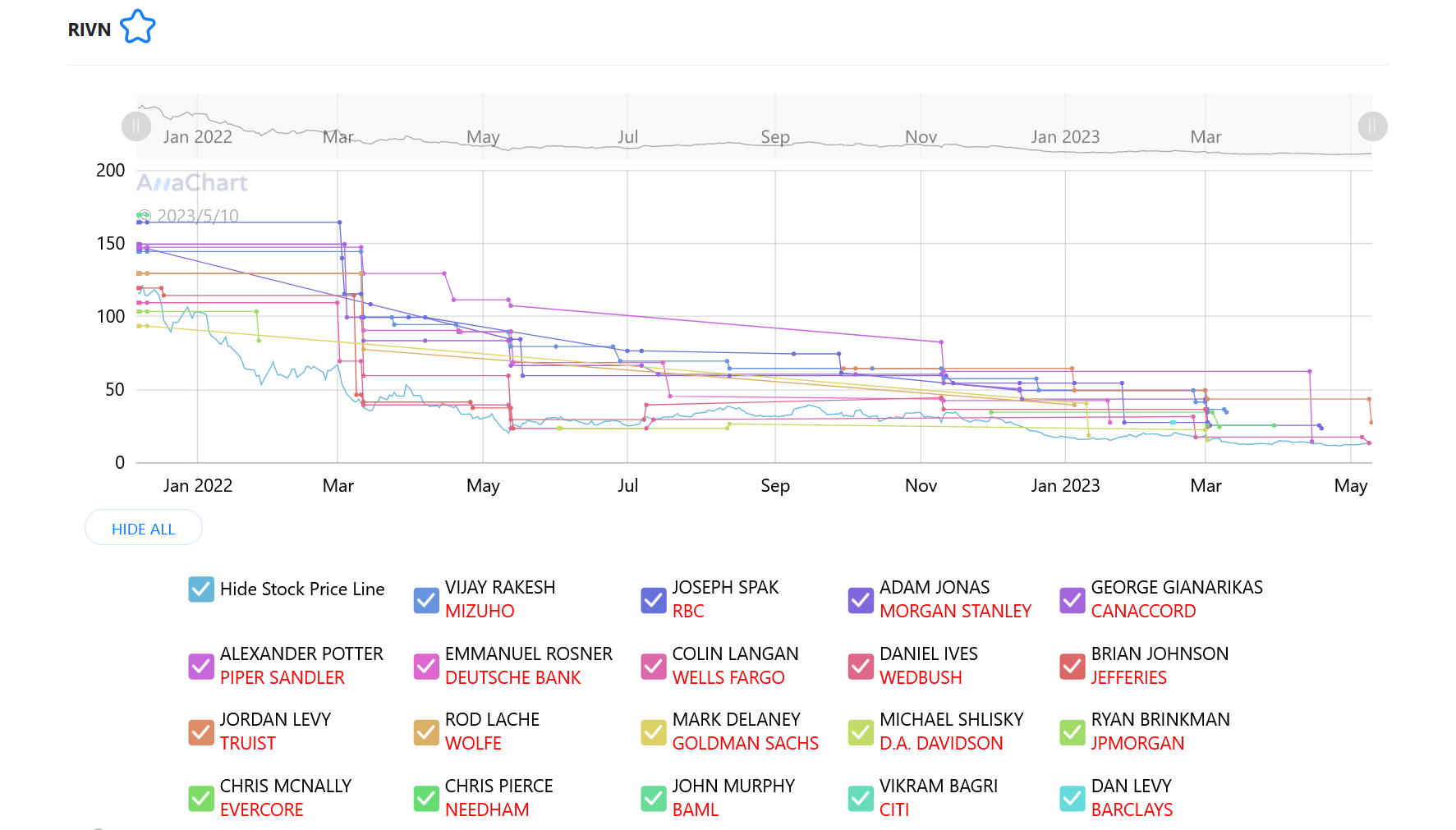

Looking at the snapshot below taken from ANaChart we see that Rivian stock had lost nearly 90% of its value since its IPO last year with all the analysts that cover the stock carrying a positive note the entire time.

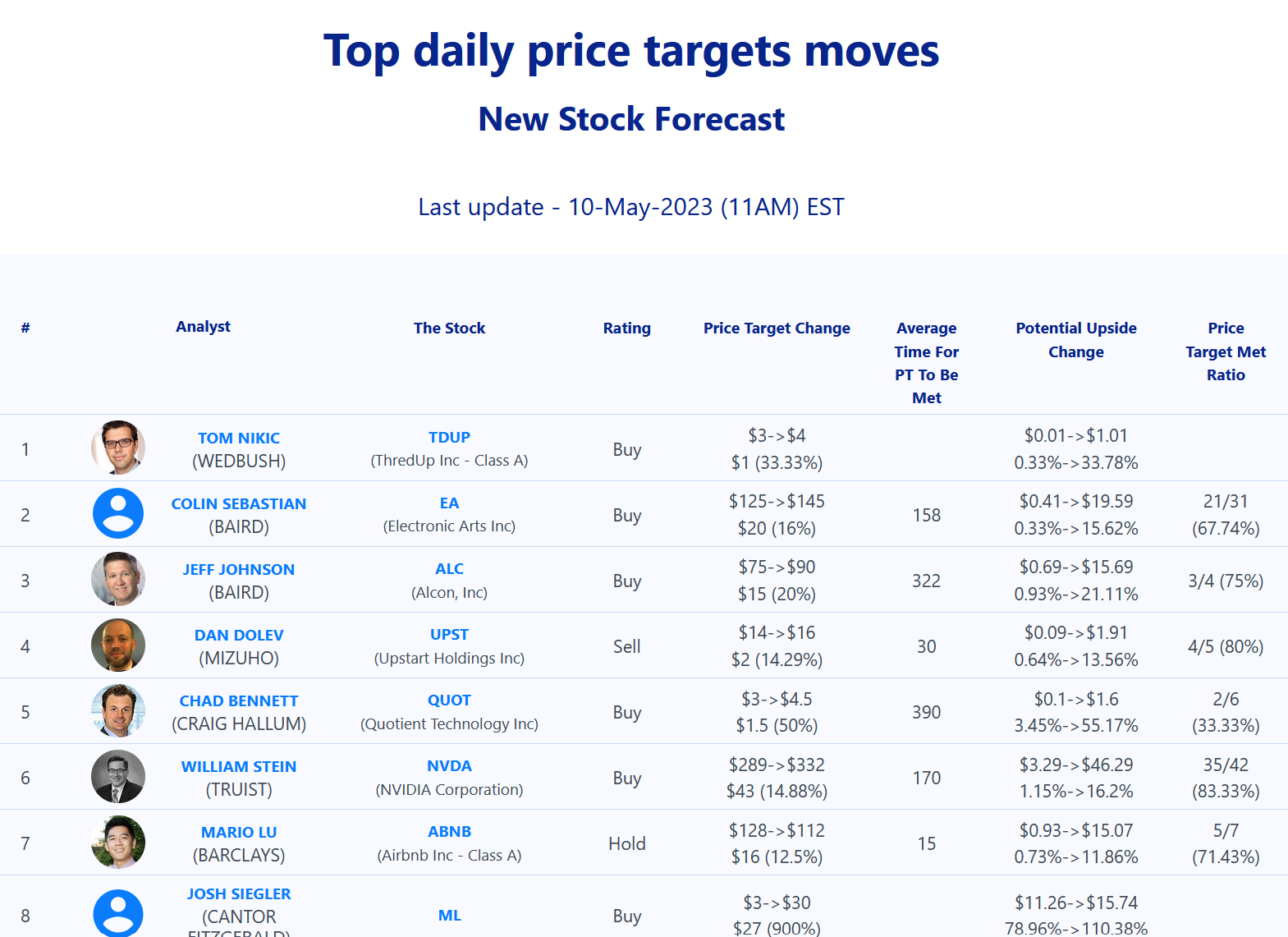

Daily stock Analysts Top Price Moves Snapshot