Daily Update - May 17, 2023

Selected stock price target highlights of the day

By Matthew Otto

HD

The Home Depot has reported its first quarter fiscal results for 2023, revealing a decline in sales and earnings compared to the same period last year. The home improvement retailer saw sales drop by 4.2% to $37.3 billion, and comparable sales in the U.S. decrease by 4.6%. Net earnings for Q1 2023 were $3.9 billion, or $3.82 per diluted share, compared to $4.2 billion, or $4.09 per diluted share, in Q1 2022. The company attributes these results to lumber deflation and unfavorable weather, particularly in its Western division.

Home Depot has also updated its guidance for fiscal 2023, with sales and comparable sales predicted to decline between 2% and 5% compared to fiscal 2022. Operating margin rate is expected to be between 14.3% and 14.0%, with diluted earnings-per-share projected to decline between 7% and 13%.

According to Richard McPhail, Home Depot’s CFO, the revision in guidance is due to the negative impact on first quarter sales from lumber deflation and weather, further softening of demand, and continued uncertainty regarding consumer demand.

This downturn in sales represents the largest quarterly decline in more than a decade for the company, and the decision to cut its fiscal 2023 forecast so early in the year has concerned investors. Some analysts had hoped that recent trends might indicate consumers were simply postponing home-improvement projects due to a wet and stormy spring, but the company’s conservative outlook suggests this is not the case.

Wall Street Action

- CFRA analyst Ana Garcia downgraded Home Depot from Buy to Hold, with a new price target of $306.

- Loop Capital analyst Laura Champine lowered the price target to $280.

- Jefferies analyst Jonathan Matuszewski lowered the price target to $337.

- Credit Suisse analyst Karen Short maintained Home Depot with a Neutral stance, and lowered the price target from $320 to $310.

- Goldman Sachs analyst Kate McShane maintained Home Depot with a Buy rating, and lowered the price target from $340 to $330.

- Telsey Advisory Group analyst Joseph Feldman maintained Home Depot with an Outperform rating, and lowered the price target from $340 to $315.

- Morgan Stanley analyst Simeon Gutman lowered the price target to $320.

Looking at AnaChart we see that although the majority of the analysts carry a positive opinion on the Home Depot Stock, they already started adjusting their price targets lower in February with today being a continuation of the trend despite no substantial drop of the stock price.

VKTX

On Monday, Viking Therapeutics announced promising results from its Phase 2b VOYAGE study of VK2809, a liver-selective thyroid hormone receptor beta agonist, in patients with biopsy-confirmed non-alcoholic steatohepatitis (NASH). The study achieved its primary endpoint, showing statistically significant reductions in liver fat from baseline to Week 12 in patients receiving VK2809 as compared to placebo.

Key results include:

- Patients receiving VK2809 demonstrated a mean liver fat reduction of up to 52%.

- Up to 85% of patients experienced at least a 30% relative reduction in liver fat.

- VK2809-treated patients also showed statistically significant reductions in low-density lipoprotein cholesterol (LDL-C), triglycerides, and atherogenic lipoproteins compared with placebo.

- The adverse events, including GI-related AEs, were similar among VK2809-treated patients and placebo.

Wall Street Action

Yesterday,

- Oppenheimer analyst Jay Olson kept an Outperform rating and has raised the price target from $35 to $40.

- Stifel analyst Annabel Samimy maintained a Buy rating and has raised the price target from $25 to $30.

- BTIG analyst Justin Zelin reiterated a Buy rating and has lifted the price target from $31 to $36.

- Laidlaw analyst Yale Jen maintains a Buy rating and has upgraded the price target from $30 to $35.

Today,

- Raymond James analyst Steven Seedhouse kept an Outperform and raised the price target from $35 to $37.

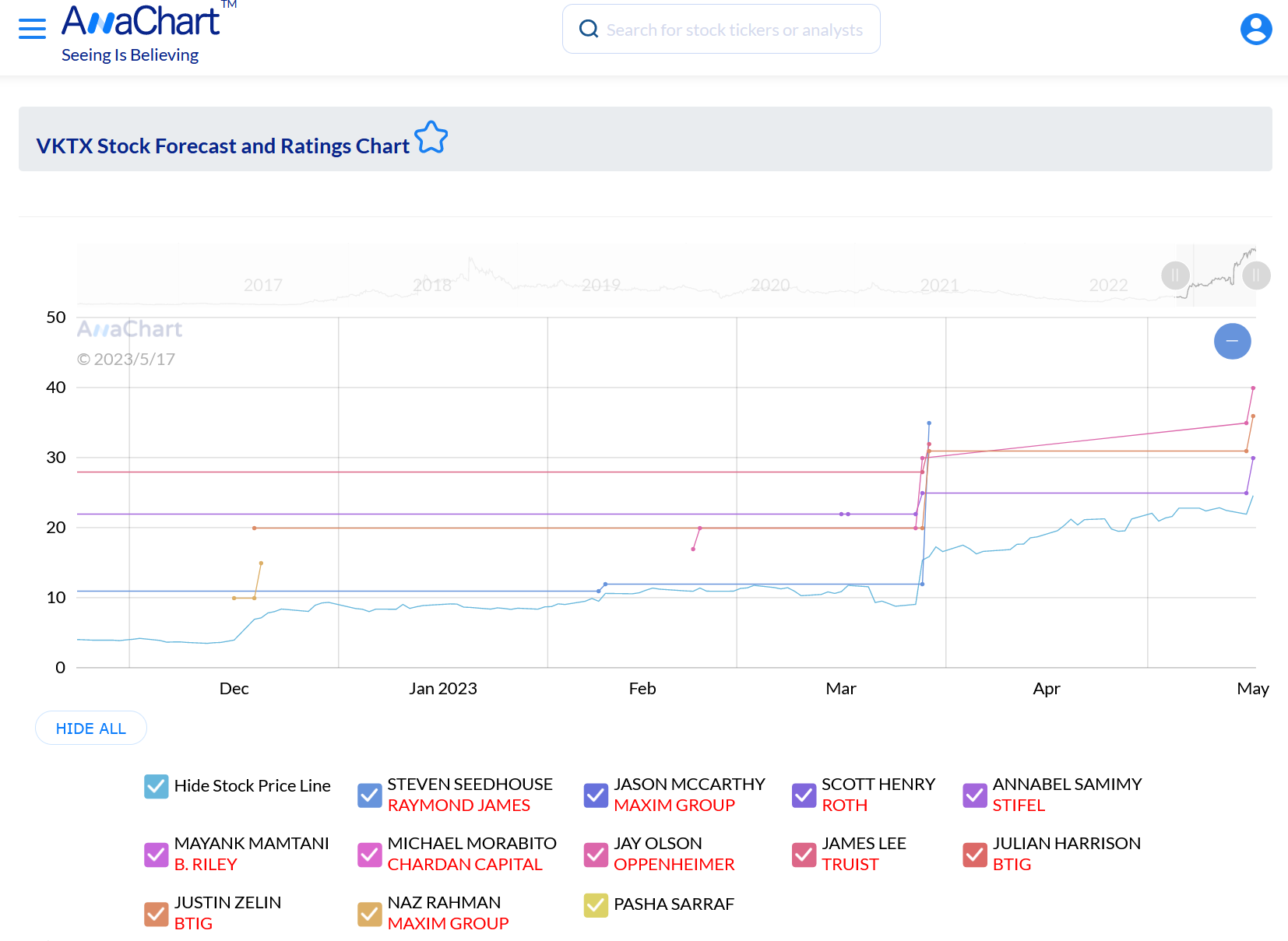

Looking at AnaChart we can see in the picture below that the Viking Therapeutics stock had already gone from $10 to $25 this year, a rare occurrence when most analysts covering the stock had successfully raised their price targets in advance earlier this year.

WIX

Wix.com reported its first-quarter 2023 financial results, Key highlights from the report include:

Revenue: Wix reported a total revenue of $374.1 million in Q1 2023, an increase of 10%.

Gross Margin: Non-GAAP gross margin increased to 67% in the first quarter, with non-GAAP Creative Subscriptions gross margin reaching 80%.

Outlook: For Q2 2023, Wix expects revenue to be $380 – $385 million, or 10 – 12% growth y/y. The consensus estimate for the revenue was $369.36 million. The company is increasing its full year outlook to $1,522 – $1,543 million or 10-11% y/y growth. The forecast exceeds the consensus estimate of $1,522 million.

The outlook for free cash flow, excluding HQ costs, has been increased for the year to $172 – $180 million.

Share Repurchase: Wix continued to repurchase this quarter, with a total of approximately $250 million of shares repurchased under the $300 million program.

Wall Street Action

- Brent Thill, an analyst at Jefferies, has increased his price target to $120.

- Alexei Gogolev, an analyst at JPMorgan, has also raised his price target to $89.

AnaChart shows that after the stock price had fallen from peak level two years ago at $300 to $75. Meanwhile the stock had stabilized with most analysts carrying a positive note besides few such as Trevor Young of Barclays.

Daily stock Analysts Top Price Moves Snapshot