Daily Update - May 3, 2023

Selected stock price target highlights of the day

By Matthew Otto

AMD

Advanced Micro Devices reported better-than-expected earnings for the first quarter of 2021, with adjusted earnings per share of 60 cents compared to a consensus call for 56 cents among analysts. Revenue came in at $5.4 billion, exceeding expectations for $5.3 billion.

However, the company gave a disappointing forecast for the current quarter, with revenue expected to be between $5 billion and $5.6 billion, slightly below the consensus call of $5.5 billion. AMD’s data-center unit revenue was roughly flat from a year earlier, while revenue in its client PC business fell by 65% versus the prior year. AMD’s shares were down 3.6% to $86.72 in after-hours trading.

Wall Street Action

- Susquehanna analyst Christopher Rolland maintains a Positive rating and raises the price target from $115 to $120.

- TD Cowen analyst Matthew Ramsay reiterates an Outperform rating but lowers the price target from $120 to $115.

- Raymond James analyst Srini Pajjuri maintains a Strong Buy rating and lowers the price target from $115 to $110.

- B of A Securities analyst Vivek Arya downgrades Advanced Micro Devices from Buy to Neutral.

- Citigroup analyst Christopher Danely keeps a Neutral rating but raises the price target from $76 to $85.

- JPMorgan analyst Harlan Sur raises the price target to $92 from $82 while maintaining a Neutral rating.

- Goldman Sachs analyst Toshiya Hari increases the price target to $97 from $92.

- Jefferies analyst Mark Lipacis raises the price target to $100 from $90 and reiterates a Buy rating.

Looking at AnaChart we see that opinion are divided between the analysts covering the stock with Aaron Rakers (WELLS FARGO) being one of the bullish analysts Christopher Danely (CITI) one the less optimistic about AMD.

SBUX

Starbucks Corporation reported strong second-quarter earnings and sales, beating expectations. The company posted adjusted earnings of 74 cents per share, exceeding estimates of 65 cents per share. Revenue reached $8.7 billion, a 14% increase compared to analysts’ projections of $8.4 billion.

Same-store sales grew by 11%, driven by higher transaction numbers and average ticket sizes. Notably, same-store sales in China rebounded with a 3% increase after a 29% decline in the previous quarter.

Despite the positive results, Starbucks’ stock fell 5% in after-hours trading, likely due to high expectations and a lack of guidance. The company reiterated its guidance for fiscal 2023, expecting revenue growth of 10-12% and earnings per share growth of 15-20%. Management stated that third-quarter earnings per share would grow at a slower pace, while fourth-quarter earnings per share would slightly exceed the range.

Wall Street Action

- Credit Suisse keeps an Outperform rating and raises the price target from $122 to $128.

- Baird maintains a Neutral rating and raises the price target from $105 to $110.

- Barclays stays with an Overweight rating and raises the price target from $123 to $127.

- JP Morgan maintains an Overweight rating but lowers the price target from $114 to $113.

- TD Cowen reiterates an Outperform rating and maintains a $120 price target.

- Stephens & Co. reiterates an Equal-Weight rating and maintains a $103 price target.

- Wedbush reiterates a Neutral rating and maintains a $110 price target.

- Evercore ISI analyst David Palmer raises the price target for Starbucks to $125.

- BTIG analyst Peter Saleh raises the price target for Starbucks to $125.

Looking at AnaChart we see analyst Sara Senatore (BAML) with the street high at $135 and Bernstein analyst Danilo Gargiulo of Bernstein being more pessimistic about the Starbucks prospects.

UBER

Uber Technologies has announced its financial results for Q1 2023, with gross bookings growing by 19% year-over-year to $31.4bn and revenue increasing by 29% YoY to $8.8bn up 29% from the same quarter last year, and a net loss of $157 million, compared to a net loss of $5.9 billion last year. The company reported a net loss of $157m, which includes a $320m net benefit due to net unrealised gains related to the revaluation of equity investments. Adjusted EBITDA of $761m was up by $593m YoY, and net cash provided by operating activities was $606m beating analysts’ expectations, and it expects to report gross bookings between $33 billion to $34 billion and an adjusted EBITDA of $800 million to $850 million for the second quarter of 2023.

CEO Dara Khosrowshahi said Uber had a “strong start” to the year and that the company’s global scale gives it a “significant data advantage” over competitors. Uber’s largest business segments, Mobility and Delivery, saw growth in gross bookings, with Mobility generating $4.33 billion in revenue and Delivery generating $3.09 billion. The company’s freight business, however, saw a decline in sales.

Wall Street Action

- JMP Securities analyst Andrew Boone reiterates with a Market Outperform and keeps a $55 price target.

- Susquehanna analyst Shyam Patil upgrades from Neutral to Positive and raises the price target from $40 to $48.

- Needham analyst Bernie McTernan maintains a Buy and raises the price target from $54 to $56.

- Mizuho analyst James Lee maintains a Buy and raises the price target from $50 to $55.

- Piper Sandler analyst Alexander Potter maintains an Overweight and raises the price target from $41 to $43.

- DA Davidson analyst Tom White reiterates with a Buy and sustains a $62 price target.

Looking at AnaChart we see that all the analysts have their price target above the stock price for Uber with Cowen analyst John Blackledge at Street High at $68 despite the fact that the stock had lost half of its market value in the last two years.

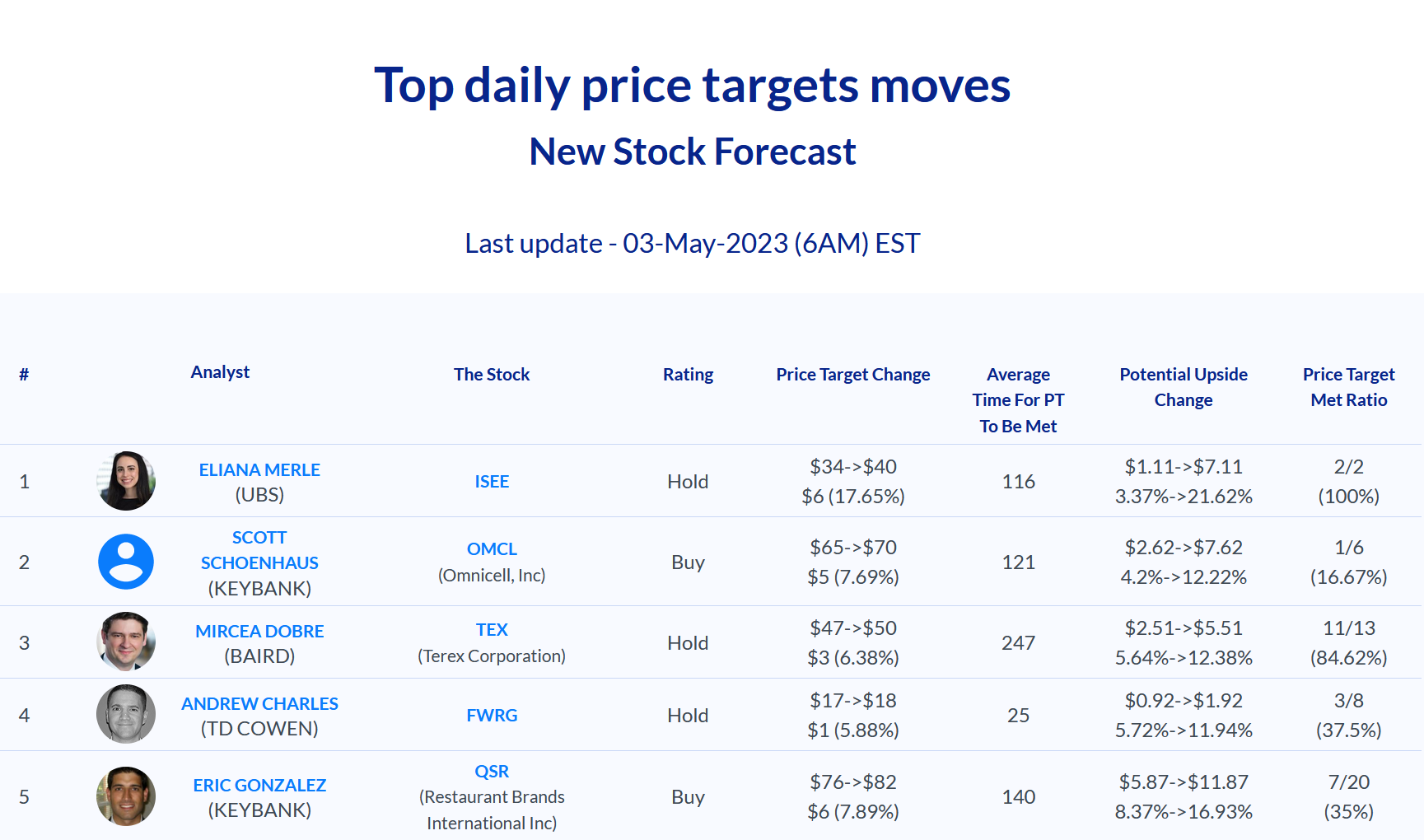

Above is a snapshot of the top daily stock price target moves on AnaChart