Daily Update - May 9, 2023

Selected stock price target highlights of the day

By Matthew Otto

SWKS

Skyworks Solutions reported its second fiscal quarter results for the period ended March 31, 2023. The company generated revenue of $1.153 billion, with GAAP operating income of $273.3 million and GAAP diluted earnings per share (EPS) of $1.46. On a non-GAAP basis, operating income was $386.1 million with non-GAAP diluted EPS of $2.02.

For the third fiscal quarter of 2023, Skyworks anticipates revenue to be between $1.050 billion and $1.090 billion, with non-GAAP diluted EPS of $1.67 at the midpoint of the revenue range. However,

Some notable business highlights for the second fiscal quarter include the delivery of Sky5® platforms for Samsung smartphones, enabling enhanced Power-over-Ethernet functionality with Cisco, launching Wi-Fi 6E and Wi-Fi 7 gateways for CommScope and ASUS, and securing 5G platforms with a leading mobile computing company.

The company issued weaker-than-expected fiscal third-quarter guidance. The company’s forecasted non-GAAP EPS of around $1.67 is lower than the consensus estimate of $2.06, while the expected revenue of $1.05 billion to $1.09 billion is also below analysts’ expectations of $1.15 billion. Nevertheless, Skyworks reported second-quarter earnings in line with expectations and revenue that beat estimates

Wall Street Action

Following Skyworks Solutions’ disappointing Q2 earnings and weak sales forecast for the current quarter, several analysts have revised their ratings and price targets for the company:

- Craig-Hallum analyst Anthony Stoss upholds a Buy rating but trims the price target from $130 to $125.

- Morgan Stanley analyst Joseph Moore keeps an Equal-Weight rating and reduces the price target from $114 to $104.

- Susquehanna analyst Christopher Rolland sustains a Positive rating and cuts the price target from $130 to $125.

- Stifel analyst Ruben Roy continues with a Buy rating and revises his former street high price target from $150 to $130.

- TD Cowen analyst Matthew Ramsay retains an Outperform rating and adjusts the price target from $135 to $125.

- Needham analyst Rajvindra Gill sticks with a Buy rating and modifies the price target from $140 to $130.

- B of A Securities analyst Vivek Arya persists with an Underperform rating and decreases the price target from $108 to $100.

- Baird analyst Tristan Gerra holds a Neutral rating and brings down the price target from $110 to $100.

- Mizuho analyst Vijay Rakesh reaffirms a Buy rating and lowers the price target from $135 to $125.

- Barclays analyst Blayne Curtis stands by an Overweight rating and amends the price target from $125 to $115.

- BMO Capital analyst Ambrish Srivastava downgrades Skyworks Solutions from Outperform to Market Perform and slashes the price target from $140 to $100.

Looking at AnaChart that most of the analysts still carry a positive note on the stock yet don’t uphold much upside potential. Skyworks had rebounded somewhat from $86 to $105 this year after a harsh loss of market value from $186 high in 2021.

PLTR

Palantir Technologies reported better-than-expected Q1 results and increased its guidance for the entire year of 2023. The company is focusing on its newly announced artificial intelligence platform, AIP, which has generated significant interest. The first version of AIP will be available to select customers this month.

AIP is combining machine-learning technologies and large language models like those used in OpenAI’s ChatGPT and Google Bard. The software will target both commercial and government customers, with CEO Alex Karp believing every large organization will soon require a system with these capabilities. AIP will be released to companies across various commercial sectors, including aviation, manufacturing, energy, banking, mining, pharmaceutical, and automotive industries

For Q1, Palantir posted revenue of $525 million, an 18% YoY increase, surpassing both the company’s guidance range and Wall Street’s consensus forecast. Adjusted earnings per share were 5 cents, one cent above Wall Street’s estimate. The company also achieved its second consecutive quarter of GAAP profitability, with a net income of $17 million or one cent per share.

Commercial revenue in Q1 reached $236 million, a 15% YoY increase, while government revenue was $289 million, a 20% YoY increase. Customer count increased by 41% YoY and 7% sequentially.

Palantir’s Q2 guidance includes revenue of $528 million to $532 million, slightly below Wall Street’s consensus forecast. The company expects to maintain GAAP profitability throughout the year.

Full-year revenue is now expected to be between $2.185 billion and $2.235 billion, with adjusted income from operations ranging from $506 million to $556 million.

Wall Street Action

- Goldman Sachs: Analyst Gabriela Borges keeps a Neutral rating and increases the price target from $8 to $9.

- Deutsche Bank: Analyst Brad Zelnick holds a Sell rating and lifts the price target from $6 to $7.

- Jefferies: Analyst Brent Thill continues with a Hold rating and raises the price target from $8.5 to $10.

Looking at AnChart we see that Palantir stock lost 75% of its market value in the last two years with analysts’ opinions split in the middle. Tyler Radke of Citi and Rishi Jaluria of RBC carry a negative note while Alex Zukin of Wolfe has a street high.

TREX

Trex Company has reported its Q1 2023 results:

- Net sales: $239 million

- Gross margin: 39.6%

- Net income: $41 million

- Diluted earnings per share: $0.38

- EBITDA: $69 million

- EBITDA margin: 28.8%

Outlook for Q2 2023 net sales is between $310 million and $320 million exceeding analysts’ guidance of $309.0 million.

The company’s Board of Directors has approved a new share repurchase program of up to 10.8 million shares.

Wall Street Action

- Benchmark: Analyst Reuben Garner keeps a Buy rating and increases the price target from $64 to $67.

- Loop Capital: Analyst Jeffrey Stevenson upholds a Buy rating and adjusts the price target upward from $64 to $65.

- DA Davidson: Analyst Kurt Yinger retains a Neutral rating and lifts the price target from $48 to $58.

- BMO Capital: Analyst Ketan Mamtora continues with a Market Perform rating and boosts the price target from $58 to $62.

- Credit Suisse: Analyst Dan Oppenheim persists with an Underperform rating and revises the price target upward from $43 to $47.

- B of A Securities: Analyst Rafe Jadrosich upgrades Trex Co from Neutral to Buy, and raises the price target from $54 to $66.

- Baird: Analyst Timothy Wojs keeps a Neutral rating and enhances the price target from $58 to $62.

- Barclays: Analyst Matthew Bouley sticks to an Equal-Weight rating and elevates the price target from $53 to $57.

Looking at AnaChart we see that the stock had lost more than half its value in the last year while most analysts didn’t forecast such an occurrence. Daniel Oppenheim of Credit Suisse stands out with partial success, the analyst is still bearish on the Trex stock.

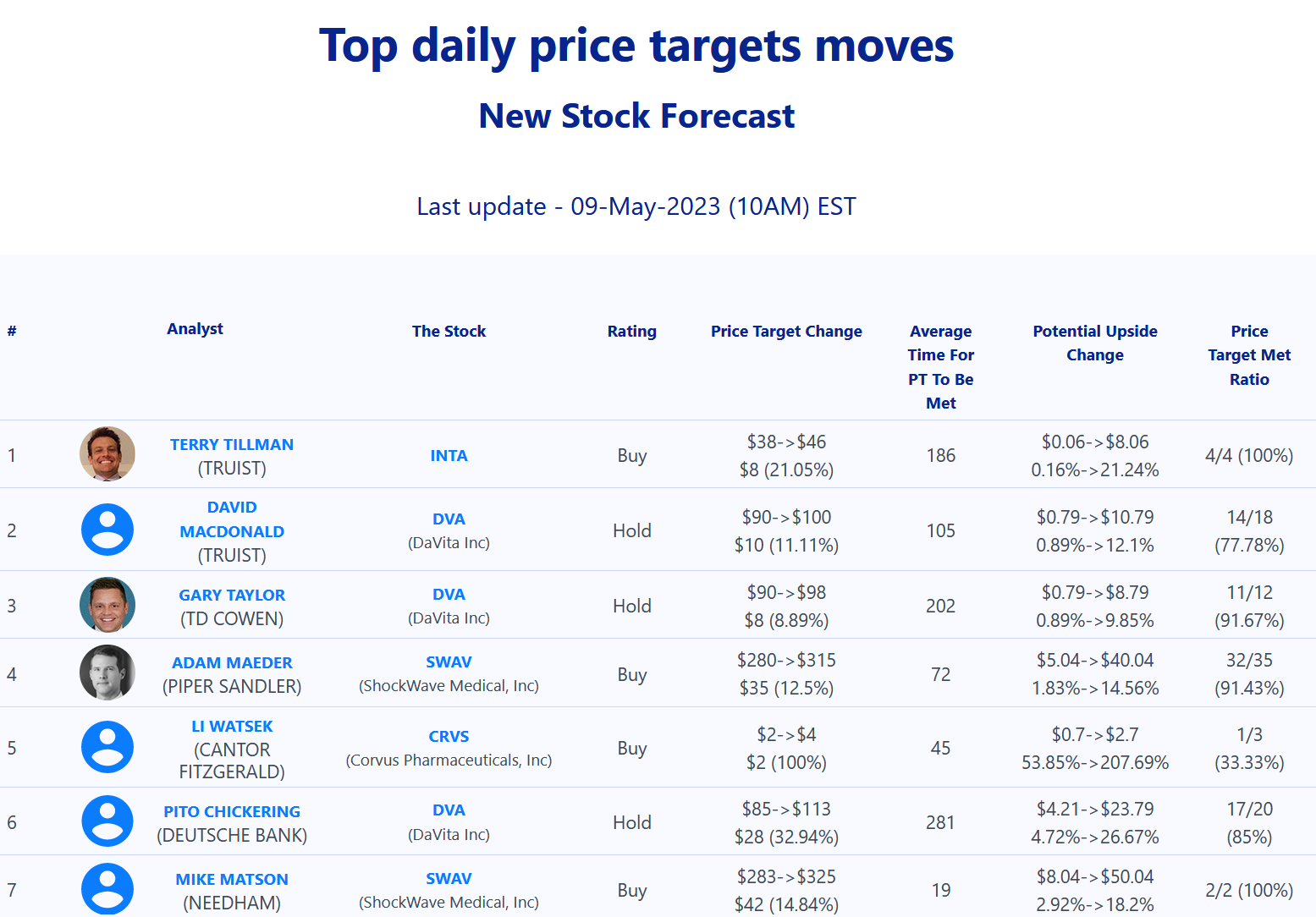

Daily stock Analysts Top Price Moves Snapshot