Selected stock price target news of the day - December 15th, 2023

By: Matthew Otto

Costco’s Fiscal Performance Highlights Earnings and Resilient Growth

Costco Wholesale reported earnings of $3.58 per share, surpassing estimates of $3.41 per share, according to FactSet. With revenue reaching $57.8 billion versus the consensus estimate of $57.73 billion. Same-store sales witnessed a 3.8% increase, driven by demand for food and sundries. 6.3% rise in e-commerce same-store sales, fueled by a Black Friday weekend, which saw sales escalate in the mid-teens compared to the prior year.

Deflation in big and bulky items, including TVs and furniture sets, ranging from 20% to 30%, attributed to lower freight costs. Amidst the financial performance, the company welcomed 72 million paid household members in the first quarter, a 7.6% increase compared to the previous year. Shopping frequency also surged globally by 4.7%, with a 3.6% uptick in the U.S. Additionally, with plans to open 33 locations in fiscal 2024.

Analysts Express Optimism as Target Price Boosts

- Telsey Advisory Group analyst Joseph Feldman maintained an Outperform rating and raised the price target to $700 from $625.

- Jefferies analyst Corey Tarlowe increased the target price to $725 from $680.

- BMO analyst Kelly Bania reiterated an Outperform rating and revised the target price to $700 from $612.

- D.A. Davidson analyst Michael Baker raised the target price to $600 from $570.

Which Analyst has the best track record to show on COST?

Analyst Peter Benedict (BAIRD) currently has the highest performing score on COST with 64/64 (100%) price target fulfillment ratio. His price targets carry an average of $43.36 (7.79%) potential upside. Costco Wholesale stock price reaches these price targets on average within 187 days.

Chewy Unleashes New Era in Pet Care with Launch of Chewy Vet Care

Chewy has announced the launch of its new venture, Chewy Vet Care, marking an expansion into the veterinary care sector. The first Chewy Vet Care practice is set to open in South Florida early next year, with additional locations slated to launch throughout 2024. The pet health practices will offer a range of services, including routine appointments, urgent care, and surgery, all powered by Chewy’s custom-built open platform designed for a seamless and customer-friendly experience.

The expansion into veterinary care complements Chewy’s existing suite of services, including pet pharmacy, tele-triage services, pet insurance and wellness plans, eCommerce offerings, and 24/7 customer service.

Analyst Boosts Confidence with Increased Price Target

- Needham analyst Anna Andreeva maintained a Buy rating and increased the price target from $20 to $25.

Which Analyst has the best track record to show on CHWY?

Analyst Peter Keith (PIPER SANDLER) currently has the highest performing score on CHWY with 4/9 (44.44%) price target fulfillment ratio. His price targets carry an average of $2.68 (14.63%) potential upside. Chewy stock price reaches these price targets on average within 12 days.

Box Launches AI Consulting Services

Box has unveiled new consulting services aimed at guiding organizations in safely implementing AI content strategies across their operations. The services, available through Box Consulting, include tailored workshops, implementation roadmaps, managed deployment with training, and hands-on guidance. These offerings cater to enterprises seeking to harness the transformative potential of AI combined with their unique business content. The three specific AI services—Transform, Deploy, and Enable—cater to different needs, from strategic guidance to hands-on execution, making AI adoption accessible for businesses of varying scopes and resources.

Analyst Initiates Coverage on Box

- UBS analyst Rich Hilliker initiated coverage with a Buy rating and set a Price Target of $33.

Which Analyst has the best track record to show on BOX?

Analyst Rishi Jaluria (RBC) currently has the highest performing score on BOX with 11/17 (64.71%) price target fulfillment ratio. His price targets carry an average of $-4.32 (-17.06%) potential downside. Box stock price reaches these price targets on average within 314 days.

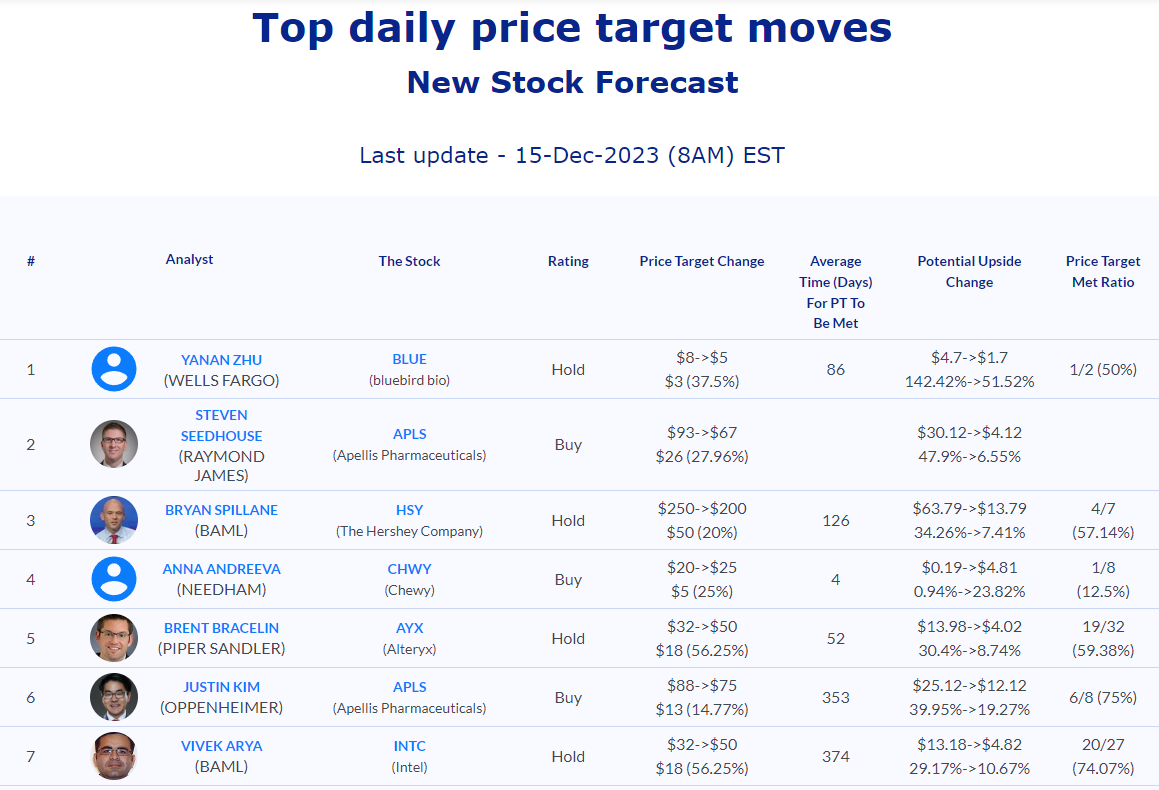

Daily stock Analysts Top Price Moves Snapshot