Selected stock price target news of the day - December 1st, 2023

By: Matthew Otto

Marvell Navigating Challenges with an Eye on AI Opportunities

Marvell Technology Group forecasted a fiscal fourth-quarter revenue that is expected to remain relatively flat compared to the previous year. Analysts, however, seem undeterred, emphasizing the promising AI opportunity that Marvell presents. Oppenheimer analyst Rick Schafer expressed optimism, highlighting Marvell’s unique position in data-center AI with a range of offerings, including electro-optics, switching, storage, and custom ASIC chips. Schafer maintained an Outperform rating for Marvell stock, anticipating sales acceleration into 2024 driven by new product cycles and market share/content gains.

Earlier this year, Marvell made waves by projecting AI-related revenue of approximately $400 million in the current fiscal year, with expectations of doubling in the next fiscal year. Piper Sandler analyst Harsh Kumar, lowering the price target and reiterated an Overweight rating on the stock, emphasizing the sustained growth in the data-center business. Despite Marvell’s adjusted earnings for the October quarter dropping by 28% year-over-year to 41 cents a share, and sales down 8% at $1.42 billion, analysts believe that the worst may be behind them from a cyclical standpoint. Raymond James analyst Srini Pajjuri anticipates double-digit revenue growth potential for the next 2-3 years, providing an optimistic outlook for Marvell’s future despite the current market fluctuations.

Analysts Adjust Marvell Tech Ratings and Targets Amid Market Dynamics

- Raymond James analyst Srini Pajjuri maintained an Outperform rating and lowered the price target from $64 to $62.

- Needham analyst Quinn Bolton reiterated a Buy rating and a $65 price target.

- Keybanc analyst John Vinh kept an Overweight rating and lowered the price target from $80 to $70.

- Oppenheimer analyst Rick Schafer maintained an Outperform rating and set a $70 target price.

- Piper Sandler analyst Harsh Kumar reiterated an Overweight rating and lowered the price target to $70 from $75.

- Susquehanna analyst Christopher Rolland lowered the price target to $65.

- Wolfe Research analyst Chris Caso decreased the price target to $70.

Which Analyst has the best track record to show on MRVL?

Analyst Craig Ellis (B.RILEY) currently has the highest performing score on MRVL with 15/20 (75%) price target fulfillment ratio. His price targets carry an average of $13.85 (26.10%) potential upside. Costco Wholesale stock price reaches these price targets on average within 112 days.

UiPath Accelerates Digital Transformation: Q3 2024 Financial Triumphs

UiPath revealed financial results for the third quarter of fiscal 2024 with a 24% year-over-year increase in revenue, amounting to $326 million versus the consensus estimate of $315.61 million, coupled with a dollar-based net retention rate of 121 percent. Their Annual Recurring Revenue soared to $1.378 billion. As of October 31, 2023, the company showed a financial position of $1.8 billion in cash, cash equivalents, and marketable securities.

Looking ahead, UiPath anticipates continued success in the fourth quarter of fiscal 2024, projecting revenue in the range of $381 million to $386 million and ARR ranging from $1.450 billion to $1.455 billion by January 31, 2024.

Analyst Vote of Confidence: Price Targets Surge Across the Board

- Wells Fargo analyst Michael Turrin maintained an Equal-Weight rating and raised the price target from $18 to $20.

- Mizuho analyst Siti Panigrahi reiterated a Neutral rating and increased the price target from $18 to $22.

- Needham analyst Scott Berg held a Buy rating and raised the price target from $20 to $25.

- BMO Capital analyst Keith Bachman raised the price target to $24.

- Evercore ISI analyst Kirk Materne upgraded the price target to $24.

- RBC Capital analyst Matthew Hedberg increased the price target to $24.

Which Analyst has the best track record to show on PATH?

Analyst Keith Bachman (BMO) currently has the highest performing score on PATH with 5/10 (50%) price target fulfillment ratio. His price targets carry an average of $6.9 (18.48%) potential upside. UiPath stock price reaches these price targets on average within 6 days.

Dell Technologies Reports Fiscal Year 2024 Q3 Results

In Dell Technologies’ disclosed Fiscal Year 2024 Third Quarter Financial Results, the company reported a Q3 revenue of $22.3 billion versus the consensus estimate of $23.01 billion. Operating income stood at $2 billion, with a diluted EPS of $1.88, a $0.42 better than the analyst estimate of $1.46. Cash flow from operations reached $2.2 billion. The Information Solutions Group demonstrated a flat quarter-on-quarter revenue of $8.5 billion, marked by sequential growth in servers and networking revenue, particularly in AI-optimized servers, where customer demand nearly doubled. Within the Client Solutions Group, Q3 revenue amounted to $12.3 billion, experiencing an 11% decline primarily driven by a decrease in units. CSG operating income reached $0.9 billion or 7.5% of revenue.

Analysts Positive Ratings and Raised Price Targets

- Wells Fargo analyst Aaron Rakers maintained an Overweight rating and raised the price target from $80 to $85.

- Raymond James analyst Simon Leopold kept an Outperform rating and increased the price target from $68 to $82.

- Deutsche Bank analyst Sidney Ho raised the price target to $80.

- Goldman Sachs analyst Michael Ng boosted the price target to $86.

- Evercore analyst Amit Daryanani increased the price target to $85.

- JPMorgan analyst Samik Chatterjee raised the price target to $77.

Which Analyst has the best track record to show on DELL?

Analyst Michael Ng (GOLDMAN SACHS) currently has the highest performing score on DELL with 5/5 (100%) price target fulfillment ratio. His price targets carry an average of $2.82 (6.17%) potential upside. Dell Technologies stock price reaches these price targets on average within 23 days.

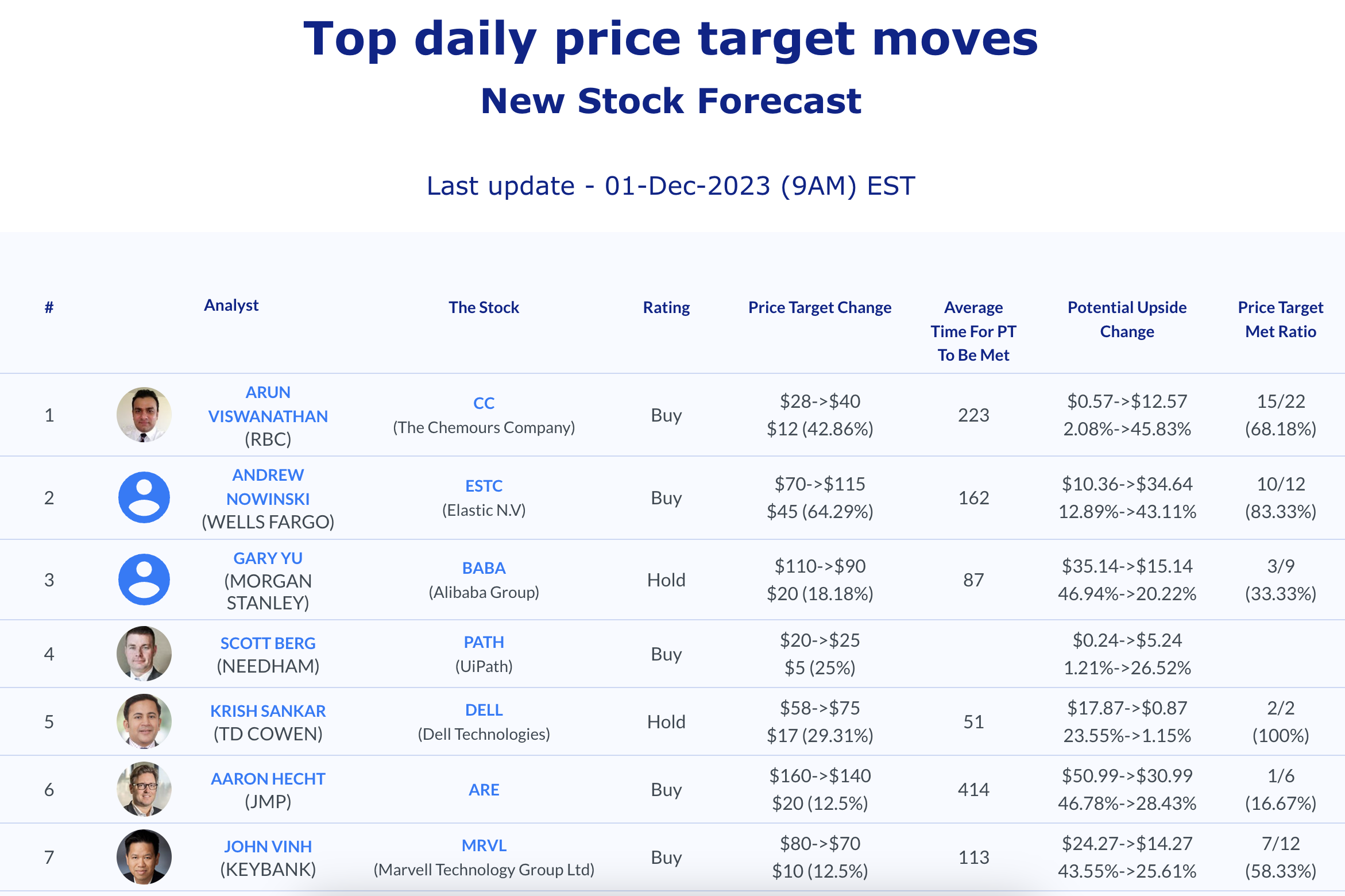

Daily stock Analysts Top Price Moves Snapshot