Selected stock price target news of the day - December 20th, 2024

By: Matthew Otto

NIKE Reports Second-Quarter Fiscal 2025 Results with Revenue Decline and Strategic Refocus

NIKE announced its fiscal 2025 second-quarter financial results, reporting earnings per share (EPS) of $0.78, surpassing the analyst estimate of $0.65 by $0.13. Revenue for the quarter was $12.4 billion, slightly ahead of the consensus estimate of $12.18 billion but down 8% on a reported basis and 9% on a currency-neutral basis compared to the prior year.

NIKE Direct revenues dropped 13% to $5.0 billion, driven by a 21% decline in NIKE Brand Digital and a 2% decrease in NIKE-owned stores. Wholesale revenues showed more resilience, declining 3% to $6.9 billion. Gross margin narrowed by 100 basis points to 43.6%, impacted by higher discounts and channel mix changes, offset partly by lower product input and logistics costs. Net income fell 26% to $1.2 billion, while diluted EPS decreased 24% year-over-year.

Analyst Ratings Reflect Mixed Sentiment Amid Q2 Results

- Morgan Stanley analyst Alex Straton maintained an Equal-Weight rating but reduced the price target from $80 to $74.

- Deutsche Bank analyst Krisztina Katai reiterated a Buy rating and raised the price target from $82 to $84.

- BofA Securities analyst Lorraine Hutchinson reiterated a Buy rating while lowering the price target from $95 to $90.

- Needham analyst Tom Nikic reaffirmed a Buy rating and the price target at $84.

- Telsey Advisory Group analyst Cristina Fernandez downgraded from Outperform to Market Perform and the price target from $93 to $80.

Which Analyst has the best track record to show on NKE?

Analyst Rick Patel (RAYMOND JAMES) currently has the highest performing score on NKE with 12/16 (75%) price target fulfillment ratio. His price targets carry an average of $7.8 (6.38%) potential upside. NIKE stock price reaches these price targets on average within 126 days.

Phase IIb PADOVA Study Results for Prasinezumab in Parkinson’s Disease

Prothena shared results from the Phase IIb PADOVA study, conducted with Roche, which investigated prasinezumab in 586 participants with early-stage Parkinson’s disease. Of these, 439 (75%) were on levodopa treatment.

In this subgroup, prasinezumab demonstrated a 21% reduction in the risk of confirmed motor progression (HR=0.79 [0.63-0.99], nominal p=0.0431). Across the broader study population, the risk reduction was 16% (HR=0.84 [0.69-1.01], p=0.0657). Covariate-adjusted analyses further improved these outcomes, with the levodopa subgroup showing a 24% risk reduction (HR=0.76 [0.61-0.95], nominal p=0.0175).

Safety data from the study, which involved over 900 Parkinson’s patients across multiple trials, including 500 treated for up to five years, confirmed prasinezumab’s tolerability with no new safety signals observed.

Parkinson’s disease affects approximately 10 million people globally, including nearly 1 million in the United States alone, with 60,000 new cases diagnosed annually in the U.S. The PADOVA results suggest that prasinezumab could offer a much-needed disease-modifying option for these individuals. The open-label extension phases of PADOVA and PASADENA studies will provide further insights, with the PASADENA trial already showing a 51% to 65% slower motor progression over four years compared to external controls.

Analysts Adjust Ratings and Targets Following Study

- HC Wainwright & Co. analyst Andrew Fein reiterated a Buy rating but reduced the price target from $84 to $48.

- Chardan Capital analyst Rudy Li initiated coverage with a Buy rating and set a price target of $40.

Which Analyst has the best track record to show on PRTA?

Analyst Jay Olson (OPPENHEIMER) currently has the highest performing score on PRTA with 5/13 (38.46%) price target fulfillment ratio. His price targets carry an average of $42.23 (213.61%) potential downside. Prothena stock price reaches these price targets on average within 96 days.

Darden Restaurants Reports Q2 Results, Driven by Sales Growth and Strategic Expansion

Darden Restaurants announced financial results for the second quarter reporting a 6% increase in total sales to $2.89 billion, exceeding the consensus estimate of $2.86 billion. This growth was driven by a 2.4% rise in same-restaurant sales, outperforming analysts’ expectations of 1.5%, and the addition of 103 Chuy’s restaurants and 39 net new locations.

Olive Garden, which accounts for over 40% of quarterly revenue, saw same-restaurant sales increase by 2.0%, surpassing the forecast of 1.4%. LongHorn Steakhouse continued its performance with a 7.5% increase in same-store sales, exceeding the expected 4.1% rise. The fine dining segment, including The Capital Grille and Ruth’s Chris Steak House, saw a 5.8% decline in same-restaurant sales.

Darden reported adjusted diluted earnings per share of $2.03, matching the analyst estimate, while reported diluted EPS was $1.82, reflecting $0.21 in costs related to the Chuy’s acquisition. Net income for the quarter increased slightly to $215.1 million from $212.1 million a year earlier. Segment profits improved for Olive Garden and LongHorn Steakhouse, with Q2 profits of $277.1 million and $134.2 million, respectively.

Looking ahead, Darden updated its full-year 2025 guidance, projecting EPS of $9.40 to $9.60, slightly below the consensus of $9.42, and revenue of $12.1 billion, surpassing the consensus of $11.94 billion. The company also plans to open 50 to 55 new restaurants and anticipates capital spending of $650 million for the fiscal year.

Analysts Adjust Price Targets Following Q2 Results

- Baird analyst David Tarantino maintained a Neutral rating and raised the price target from $180 to $194.

- Wedbush analyst Nick Setyan reiterated an Outperform rating and increased the price target from $200 to $220.

- Stephens & Co. analyst Jim Salera kept an Equal-Weight rating and lifted the price target from $164 to $175.

Which Analyst has the best track record to show on DRI?

Analyst John Ivankoe (JPMORGAN) currently has the highest performing score on DRI with 17/17 (100%) price target fulfillment ratio. His price targets carry an average of $5.83 (3.43%) potential upside. Darden Restaurants stock price reaches these price targets on average within 252 days.

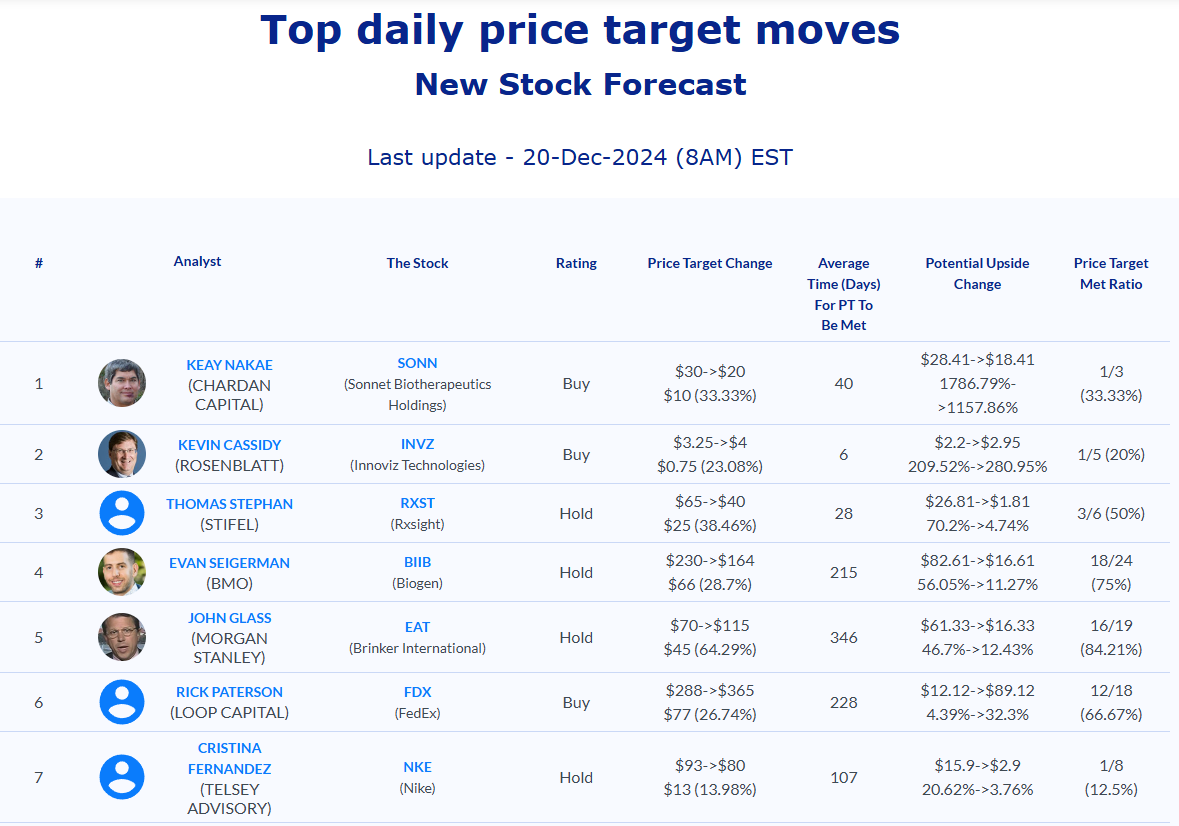

Daily stock Analysts Top Price Moves Snapshot