Selected stock price target news of the day - December 21st, 2023

By: Matthew Otto

Micron Soars on Q1 Beat and Upbeat Q2 Forecast

Micron Technology fiscal first quarter reported an adjusted loss of 95 cents per share, beating analyst expectations of a $1.01 loss. This translated into a revenue of $4.73 billion, slightly surpassing the consensus estimate of $4.58 billion. Looking ahead, Micron provided a revenue forecast for the current quarter, projecting $5.3 billion at the midpoint of its range, which is higher than the consensus forecast of $4.97 billion.

Furthermore, Micron is on the verge of a milestone with its advanced HBM3E memory chips, as the company enters the final stages of qualifying these chips for Nvidia’s highly anticipated H200 AI product.

Analysts Bullish on Micron: Price Targets on the Rise

- Stifel’s Brian Chin maintained a Hold rating and adjusted the price target from $76 to $80.

- UBS analyst Timothy Arcuri remained with a Buy rating and lifted the price target from $90 to $95.

- Morgan Stanley analyst Joseph Moore maintained an Underweight stance and raised the price target from $71.5 to $74.75.

- JP Morgan analyst Harlan Sur reiterated an Overweight outlook and increased the price target from $90 to $105.

- Citigroup’s Christopher Danely stayed with a Buy rating and adjusted the price target from $88 to $95.

- Raymond James analyst Srini Pajjuri reiterated an Outperform rating and increased the price target from $82 to $90.

- Needham analyst Quinn Bolton advised a Buy rating and raised the price target from $85 to $100.

- Deutsche Bank analyst Sidney Ho kept a Buy rating and adjusted the price target from $85 to $90.

- Mizuho analyst Vijay Rakesh maintained a Buy rating and increased the price target from $86 to $95.

- Goldman Sachs analyst Toshiya Hari held a Buy rating and elevated the price target from $85 to $97.

- Barclays analyst Tom O’Malley recommended an Overweight position and lifted the price target from $85 to $95.

- Keybanc’s John Vinh reiterated an Overweight stance and increased the price target from $90 to $100.

Which Analyst has the best track record to show on MU?

Analyst Matthew Bryson (WEDBUSH) currently has the highest performing score on MU with 13/17 (76.47%) price target fulfillment ratio. His price targets carry an average of $12.21 (18.01%) potential upside. Micron Technology stock price reaches these price targets on average within 75 days.

Amazon Positioned for Dominance in the Digital Frontier

In a recent analysis by Raymond James, Amazon emerges as a frontrunner in the rapidly evolving landscape of artificial intelligence integration into digital platforms. Analyst Josh Beck cited its dominance in cloud computing through Amazon Web Services. Beck envisions generative AI, projected to yield approximately $100 billion in revenue within a couple of years and potentially reaching $300 billion in five years. Although he doesn’t anticipate a material contribution from generative AI for Amazon in 2024, Beck foresees an aggregate annual recurring revenue increase of $10 billion in the subsequent years, bolstered by Amazon’s extensive suite of services catering to companies in need of AI tools and hardware..

Analysts Bullish Ratings and Raised Price Targets

- Wedbush analyst Scott Devitt maintained an Outperform rating and raised the price target from $180 to $210.

- Raymond James analyst Josh Beck initiated a Strong Buy rating and a target price of $185.

Which Analyst has the best track record to show on AMZN?

Analyst Barton Crockett (ROSENBLATT) currently has the highest performing score on AMZN with 5/7 (71.43%) price target fulfillment ratio. His price targets carry an average of $57.26 (44.83%) potential upside. Amazon stock price reaches these price targets on average within 43 days.

CarMax Beats Earnings Expectations Despite Industry Challenges

CarMax fiscal third-quarter results reported earnings of 52 cents per share, surpassing Wall Street expectations of 38 cents and demonstrating an increase from the previous year’s earnings of 24 cents per share. While CarMax’s revenue fell slightly short of analysts’ forecasts at $6.15 billion, compared to the expected $6.29 billion, the company showcased resilience in the face of industry challenges.

Despite a 2.9% decline in total retail used-unit sales and a 4.1% drop in comparable-store used-unit sales from the previous year, CarMax’s strategic decision to resume its share-repurchase program caught investors’ attention. The company repurchased 648,500 shares for $41.9 million during the quarter, with $2.41 billion remaining in its outstanding authorization as of November 30.

Analyst Outlook Diverges with Varied Price Targets

- Truist analyst Scot Ciccarelli Reiterated a Hold rating and the price target of $72.

- Wedbush analyst Seth Basham Maintained an Outperform rating and raised the price target from $80 to $90.

- Evercore ISI analyst Michael Montani Kepr an In Line rating and increased the price target from $72 to $74.

Which Analyst has the best track record to show on KMX?

Analyst Scot Ciccarelli (TRUIST) currently has the highest performing score on KMX with 19/20 (95%) price target fulfillment ratio. His price targets carry an average of $7.14 (11.01%) potential upside. CarMax stock price reaches these price targets on average within 127 days.

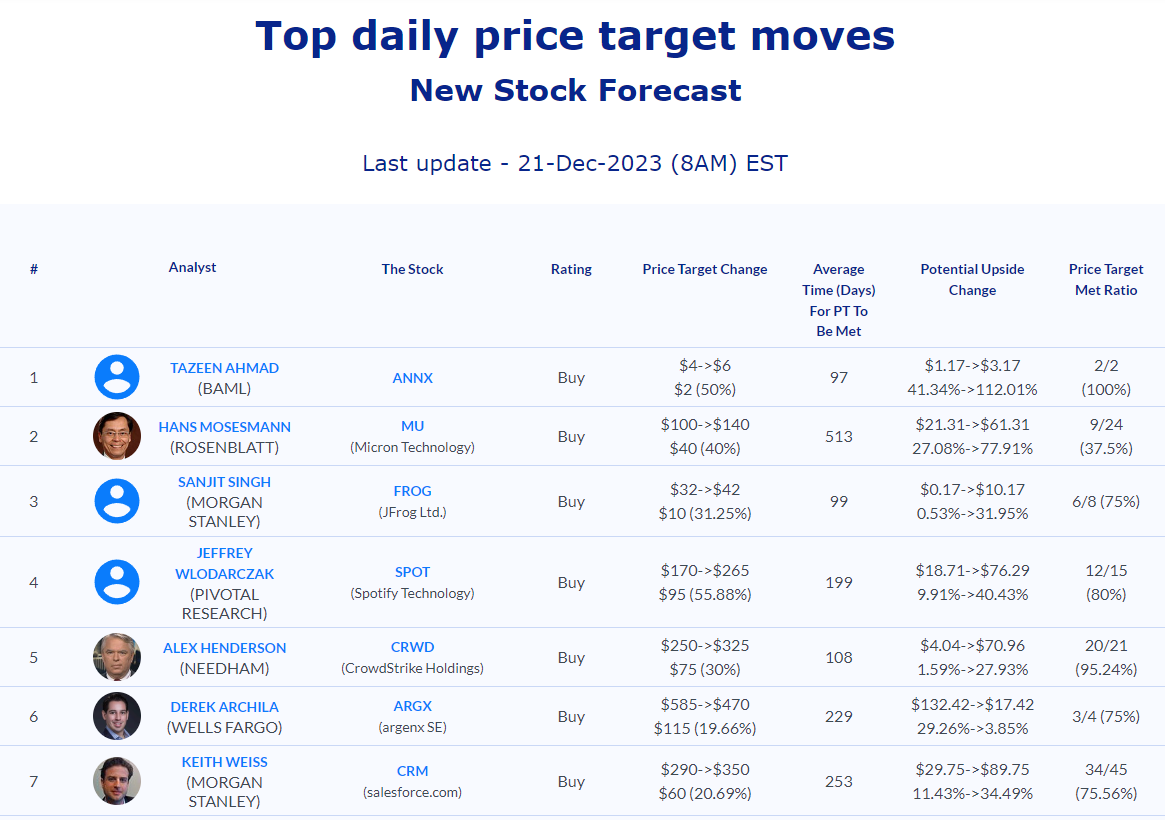

Daily stock Analysts Top Price Moves Snapshot