Selected stock price target news of the day - December 26th, 2023

By: Matthew Otto

Tesla Under Investigation for Suspension Failures

An ongoing investigation by the Norwegian Public Roads Administration into suspension failures in Tesla, specifically Model S and X vehicles. Sweden’s Transport Agency has confirmed its own inquiry into similar incidents. The Swedish agency revealed on Friday that it is actively engaged in investigative work regarding suspension failures in Tesla cars, echoing concerns raised by its Norwegian counterpart. The NPRA initiated its probe in September 2022 after numerous consumer complaints about lower rear control arms breaking on Tesla vehicles. The NPRA may recommend a recall if it deems the defects to pose a serious risk. This development follows a Reuters report highlighting how Tesla allegedly attributed suspension and steering failures to driver abuse in an attempt to cut down on repair costs, as revealed by internal documents and interviews with former employees.

The extent of these suspension failures and their impact on Tesla’s reputation is not yet fully known. The investigations raise questions about the company’s handling of known defects and its commitment to addressing safety concerns.

Analyst Affirmations with Reiterated Ratings and Price Target Boosts

- Piper Sandler’s Alexander Potter Reiterated an Overweight rating and set a $295 price target.

- RBC Capital’s Tom Narayan Maintained an Outperform rating and a $300 price target.

- Wedbush’s Daniel Ives Kept an Outperform rating and raised the price target for Tesla from $310 to $350.

Which Analyst has the best track record to show on TSLA?

Analyst Ravi Shanker (MORGAN STANLEY) currently has the highest performing score on TSLA with 32/42 (76.19%) price target fulfillment ratio. His price targets carry an average of $5.54 (9.11%) potential upside. Tesla stock price reaches these price targets on average within 273 days.

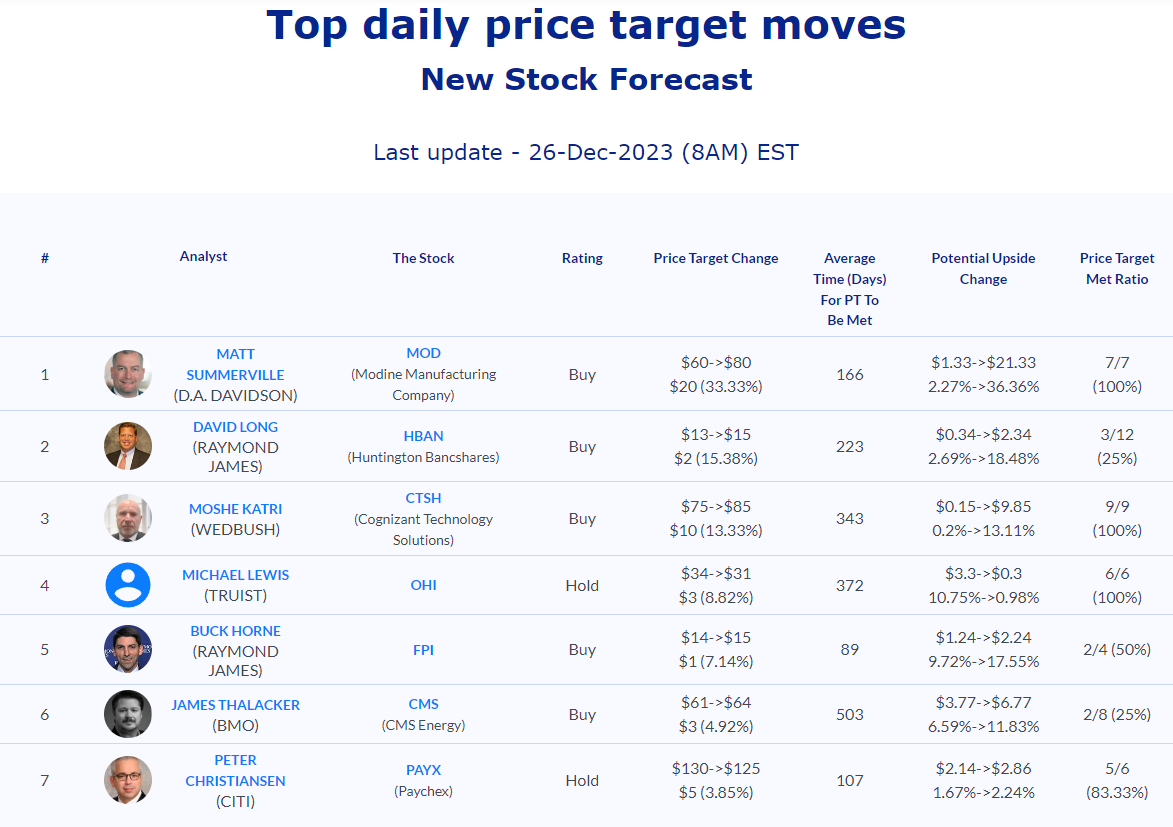

Daily stock Analysts Top Price Moves Snapshot