Selected stock price target news of the day - December 2nd, 2024

By: Matthew Otto

Autodesk Reports Q3 FY2025 Results: Revenue and Earnings Beat Expectations Amid Investor Concerns

Autodesk delivered solid third-quarter fiscal 2025 results, reporting adjusted earnings per share (EPS) of $2.17, beating analyst estimates by $0.05, and revenue of $1.57 billion, exceeding the consensus estimate of $1.56 billion. Additionally, Autodesk saw an 11% year-over-year revenue increase, driven by steady adoption of its design software across key industries, including construction, architecture, and animation.

Design revenue rose 9% to $1.30 billion, while revenue from the Make segment surged 28% to $171 million. Subscription revenue, which represents 97% of total revenue, grew 11%. Meanwhile, GAAP operating margin declined by 2 percentage points to 22%, and non-GAAP operating margin decreased by 3 percentage points to 36%.

Looking ahead, Autodesk provided guidance for the fourth quarter, expecting EPS between $2.10 and $2.16, compared to a consensus of $2.12. It forecasts Q4 revenue between $1.623 billion and $1.638 billion, ahead of the $1.62 billion consensus. For the full fiscal year, Autodesk raised the midpoint of its annual revenue outlook to $6.125 billion and adjusted EPS to a range of $8.29 to $8.35.

Analysts Mixed Opinions Amid Revenue and EPS Beats

- UBS analyst Taylor McGinnis initiated coverage with a Buy rating, while setting a price target of $350.

- Citigroup analyst Tyler Radke maintained a Buy rating and raised the price target from $358 to $361.

- HSBC analyst Stephen Bersey downgraded from Buy to Hold and announced a price target of $290.

- Mizuho analyst Matthew Broome kept a Neutral rating but adjusted the price target upwards from $260 to $280.

- Piper Sandler analyst Clarke Jeffries maintained a Neutral rating and raised the price target from $257 to $311.

Which Analyst has the best track record to show on ADSK?

Analyst Michael Funk (BAML) currently has the highest performing score on ADSK with 5/5 (100%) price target fulfillment ratio. His price targets carry an average of $26.6 (10.29%) potential upside. Autodesk stock price reaches these price targets on average within 105 days.

Dell Technologies Reports Q3 Revenue Growth Driven by ISG Performance and AI Demand

Dell Technologies reported fiscal Q3 2025 revenue of $24.4 billion, a 10% year-over-year increase, though it fell short of analyst expectations of $24.67 billion. Earnings per share (EPS) were $1.58, up 16%, while non-GAAP EPS came in at $2.15, surpassing the consensus estimate of $2.06.

Net income rose 12% to $1.12 billion. Operating income grew 12% to $1.7 billion on a GAAP basis and $2.2 billion non-GAAP. However, fourth-quarter guidance of $24 to $25 billion in revenue and $2.50 adjusted EPS trailed Wall Street forecasts of $25.57 billion and $2.65, respectively.

The Infrastructure Solutions Group (ISG) achieved $11.4 billion in revenue, up 34%, driven by a 58% surge in servers and networking sales to $7.4 billion, fueled by high AI demand. Dell reported $2.9 billion in AI server shipments and $3.6 billion in booked future orders.

Meanwhile, Client Solutions Group (CSG) revenue dipped 1% to $12.1 billion, with commercial client revenue rising 3% to $10.1 billion, offset by an 18% drop in consumer sales to $2 billion. Dell ended the quarter with $6.6 billion in cash and investments, alongside cash flow from operations of $1.6 billion.

Analysts Adjust Price Targets Amid Mixed Q3 Results

- Deutsche Bank analyst Sidney Ho maintained a Buy rating but adjusted the price target downward from $144 to $142.

- Melius Research analyst Ben Reitzes kept a Buy rating and raised the price target from $140 to $155.

- Mizuho analyst Vijay Rakesh retained an Outperform rating while lowering the price target from $155 to $150.

- Citigroup analyst Asiya Merchant held a Buy rating yet reduced the price target from $160 to $156.

- Barclays analyst Tim Long maintained an Equal-Weight rating and lifted the price target from $106 to $115.

- Wells Fargo analyst Aaron Rakers stayed with an Overweight rating and raised the price target from $140 to $160.

Which Analyst has the best track record to show on DELL?

Analyst Toni Sacconaghi (BERNSTEIN) currently has the highest performing score on DELL with 8/8 (100%) price target fulfillment ratio. His price targets carry an average of $24.46 (21.17%) potential upside. Dell Technologies stock price reaches these price targets on average within 133 days.

HP Reports Fiscal 2024 Results, Meets Q4 Estimates, and Issues Cautious FY2025 Guidance

HP announced its fiscal 2024 results, delivering mixed performance amidst ongoing challenges in the personal computing market. For the fourth quarter, HP reported GAAP and non-GAAP diluted EPS of $0.93, aligning with analyst expectations. Quarterly revenue reached $14.1 billion, exceeding the consensus estimate of $13.99 billion and reflecting a 1.7% year-over-year increase.

For the full fiscal year, HP’s net revenue was $53.6 billion, down 0.3% from the prior year, with non-GAAP diluted EPS of $3.38, within the guidance range of $3.35 to $3.45 and up from $3.28 in fiscal 2023.

Looking ahead, HP issued cautious guidance for fiscal 2025, expecting first-quarter adjusted EPS in the range of $0.70 to $0.76, below the consensus estimate of $0.86. For the full fiscal year, HP projects adjusted EPS between $3.45 and $3.75, with a midpoint aligned with the consensus estimate of $3.60.

Analysts Adjust Ratings and Price Targets After Fiscal 2024 Results

- HSBC analyst Stephen Bersey downgraded from Buy to Hold and the price target from $39 to $38.

- TD Cowen analyst Krish Sankar maintained a Hold rating but raised the price target from $32 to $39.

- Citigroup analyst Asiya Merchant kept a Neutral rating yet reduced the price target from $37 to $36.5.

- Barclays analyst Tim Long reiterated an Equal-Weight rating and raised the price target from $32 to $35.

Which Analyst has the best track record to show on HPQ?

Analyst Erik Woodring (MORGAN STANLEY) currently has the highest performing score on HPQ with 11/12 (91.67%) price target fulfillment ratio. His price targets carry an average of $0.54 (1.52%) potential upside. HP stock price reaches these price targets on average within 83 days.

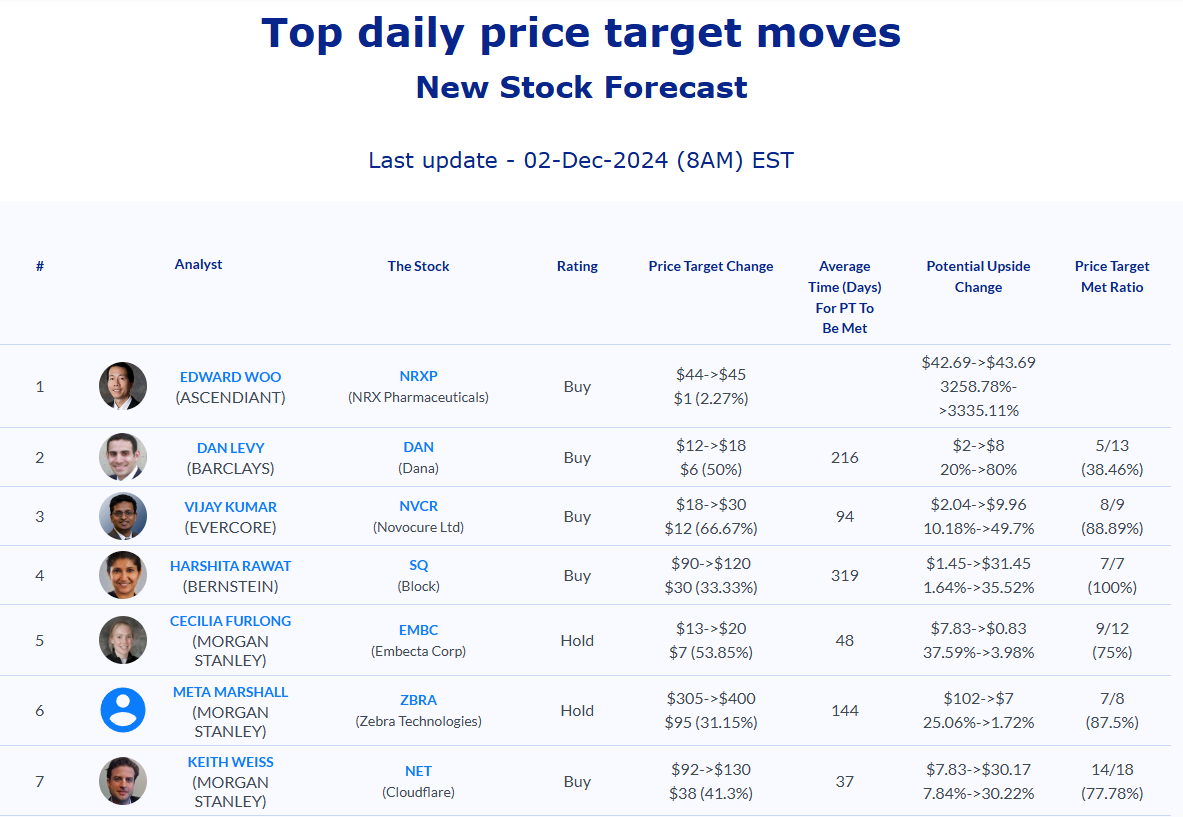

Daily stock Analysts Top Price Moves Snapshot