Selected stock price target news of the day - December 31st, 2024

By: Matthew Otto

Chimerix Submits NDA for Dordaviprone, Requests Priority Review

Chimerix announced the submission of a New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA) for dordaviprone, targeting accelerated approval for treating recurrent H3 K27M-mutant diffuse glioma. This filing requests Priority Review, potentially setting a Prescription Drug User Fee Act (PDUFA) action date in Q3 2025.

Dordaviprone has been granted Rare Pediatric Disease Designation, and Chimerix has applied for a Rare Pediatric Disease Priority Review Voucher (PRV) as part of this submission. If approved, dordaviprone would be the first FDA-approved treatment for this rare glioma subtype. Which affects approximately 400–500 patients annually in the United States. Of these, an estimated 200–300 patients with recurrent disease could benefit directly from the drug.

To support a potential commercial launch in 2025, Chimerix has secured a $30 million credit facility with Silicon Valley Bank (SVB). This agreement includes access to $20 million through February 28, 2026, and an additional $10 million through February 28, 2027, contingent on approval.

Analyst Reaffirms Rating, Aligning with Optimism for Dordaviprone Approval

- HC Wainwright & Co. analyst Edward White yesterday reiterated with a Buy and a $11 price target.

Which Analyst has the best track record to show on CMRX?

Analyst Edward White (HC WAINWRIGHT) currently has the highest performing score on CMRX with 2/10 (20%) price target fulfillment ratio. His price targets carry an average of $8.02 (269.13%) potential upside. Chimerix stock price reaches these price targets on average within 918 days.

Sangamo Regains Rights to Giroctocogene Fitelparvovec, Exploring Commercialization

Sangamo Therapeutics announced it will regain development and commercialization rights to giroctocogene fitelparvovec, an investigational gene therapy for moderately severe to severe hemophilia A, after Pfizer decided to terminate their global collaboration agreement.

Pfizer’s decision follows the positive results from the Phase 3 AFFINE trial, which involved 75 adult male participants with hemophilia A. The trial showed a significant reduction in the annualized bleeding rate (ABR) after treatment with giroctocogene fitelparvovec. This dropped from 4.73 (pre-treatment) to 1.24 (post-treatment), a 74% reduction (p-value = 0.0040). Hemophilia A affects about 25 in every 100,000 male births. 55-75% of these individuals experiencing moderate to severe disease.

The collaboration agreement will officially end on April 21, 2025, and Pfizer will transition the giroctocogene fitelparvovec program back to Sangamo. Sangamo also emphasized its ongoing focus on its Fabry gene therapy program, with plans for a Biologics License Application (BLA) submission in the second half of 2025.

Additionally, Sangamo’s clinical pipeline includes a Phase 1/2 trial for ST-503 targeting idiopathic small fiber neuropathy, with enrollment expected to begin in mid-2025. Giroctocogene fitelparvovec has the potential to benefit thousands of patients, as approximately 55,000 individuals are affected by hemophilia A worldwide.

Analyst Lowers Price Target Amid Collaboration Termination

- Wells Fargo analyst Jim Birchenough maintained an Equal-Weight rating and lowered the price target from $3 to $2.

Which Analyst has the best track record to show on SGMO?

Analyst Gena Wang (BARCLAYS) currently has the highest performing score on SGMO with 3/5 (60%) price target fulfillment ratio. Her price targets carry an average of $6.85 (318.60%) potential upside. Sangamo Therapeutics stock price reaches these price targets on average within 282 days.

Ondas Holdings Secures $30M in Funding to Accelerate Growth in Autonomous Drone Platforms

Ondas Holdings has announced the successful closing of a $18.9 million financing through the issuance of 3% senior convertible notes due 2026. This marks the third such investment by a single long-term investor since December 3, 2024. Additionally bringing the total net proceeds to $30 million over the past four weeks.

These proceeds will be allocated primarily to support Ondas Autonomous Systems (OAS) which reported $14.4 million in orders during Q3 2024. The funding achieves the targets set at OAS Investor Day in September 2024. This enabling it to capitalize on the growing demand for its Optimus System and Iron Drone platforms.

The Optimus System, the first FAA-certified small UAS for aerial security and data capture, and the Iron Drone Raider, a counter-drone solution, are central to meeting increasing global demand. Both platforms are highly automated and AI-driven, offering advanced capabilities for defense, industrial, and infrastructure applications.

Analyst Boosts Price Target to $4 Amid Funding and Growth Prospects

- Northland Capital Markets analyst Michael Latimore yesterday kept an Outperform rating and raised the price target from $1.5 to $4.

Which Analyst has the best track record to show on ONDS?

Analyst Michael Latimore (NORTHLAND CAPITAL MARKETS) currently has the highest performing score on ONDS with 2/5 (40%) price target fulfillment ratio. His price targets carry an average of $0.79 (111.27%) potential upside. Ondas Holdings stock price reaches these price targets on average within 310 days.

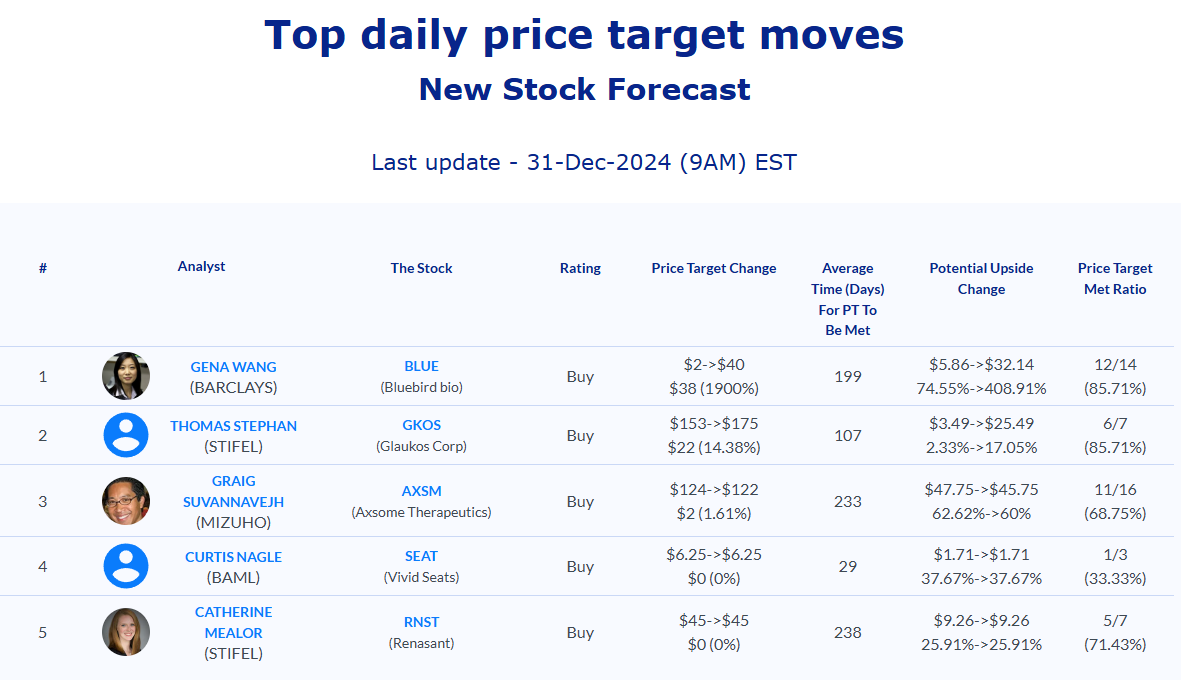

Daily stock Analysts Top Price Moves Snapshot