Selected stock price target news of the day - February 12th, 2025

By: Matthew Otto

Confluent Exceeds Q4 Expectations and Projects Continued Growth in FY 2025

Confluent reported its financial results for the fourth quarter and fiscal year 2024, reflecting continued growth in its data streaming platform. Fourth quarter subscription revenue reached $251 million, a 24% increase year over year, while Confluent Cloud revenue grew 38% to $138 million. Total revenue for the quarter was $261.2 million, exceeding the consensus estimate of $256.86 million and marking a 23% increase from $213.2 million in Q4 2023.

Confluent reported a GAAP operating loss of $105.8 million, compared to $84.7 million in the same period last year. Non-GAAP operating income rose to $13.6 million from $11.2 million, with a non-GAAP operating margin of 5.2%.

Earnings per share (EPS) for the quarter were $0.09, surpassing analyst expectations of $0.06. Confluent also achieved a significant increase in free cash flow, reaching $29.1 million compared to $6.8 million in Q4 2023. The number of customers with annual recurring revenue of $100,000 or more grew by 12% year over year, totaling 1,381.

For fiscal year 2024, subscription revenue amounted to $922.1 million, marking a 26% increase from $729.1 million in the prior year. Confluent Cloud revenue for the year was $492 million, up 41% year over year. Total annual revenue was $963.6 million, reflecting a 24% growth from $777.0 million in fiscal year 2023.

Confluent reduced its GAAP operating loss to $419.1 million, an improvement from $478.8 million last year. Non-GAAP operating income reached $27.5 million, compared to a non-GAAP operating loss of $57.3 million in fiscal year 2023. Additionally, Confluent reported a free cash flow of $9.5 million, recovering from a negative $124.3 million the previous year.

Looking ahead, Confluent projects Q1 2025 EPS between $0.06 and $0.07, aligning with the consensus of $0.06. For fiscal year 2025, Confluent expects EPS of $0.35, consistent with analyst expectations, and subscription revenue in the range of $1.117 billion to $1.121 billion. The non-GAAP operating margin is projected to be approximately 3% for Q1 2025 and about 6% for the full fiscal year.

Analysts Raise Price Targets Following Strong Q4 Performance

- Evercore ISI Group analyst Chirag Ved maintained an Outperform rating and raised the price target from $32 to $40.

- Canaccord Genuity analyst Kingsley Crane kept a Buy rating but increased the price target from $34 to $38.

- Stifel analyst Brad Reback maintained a Buy rating while raising the price target from $37 to $40.

- Needham analyst Mike Cikos reiterated a Buy rating and lifted the price target from $31 to $40.

- Barclays analyst Raimo Lenschow held an Overweight rating, however, raised the price target from $35 to $37.

- BofA Securities analyst Brad Sills maintained an Underperform rating yet increased the price target from $26 to $31.

Which Analyst has the best track record to show on CFLT?

Analyst Karl Keirstead (UBS) currently has the highest performing score on CFLT with 7/8 (87.5%) price target fulfillment ratio. His price targets carry an average of $-0.17 (-0.65%) potential downside. Confluent stock price reaches these price targets on average within 69 days.

Freshworks Exceeds Q4 Estimates and Delivers Strong Full-Year Performance

Freshworks reported its financial results for the fourth quarter and full year ending December 31, 2024. For Q4 2024, achieved total revenue of $194.6 million, reflecting a 22% year-over-year growth compared to $160.1 million in Q4 2023, and 21% on a constant currency basis. This surpassed the consensus estimate of $189.5 million.

Non-GAAP diluted net income per share was $0.14, outperforming the analyst estimate of $0.10. Despite a GAAP loss from operations of $(23.8) million, this marked an improvement from $(40.0) million in the prior year quarter. Non-GAAP income from operations rose to $40.3 million from $11.5 million in Q4 2023. Freshworks also reported a GAAP net loss per share of $(0.07), compared to $(0.09) in the previous year. Additionally, net cash provided by operating activities was $41.4 million, up from $30.9 million in Q4 2023, and adjusted free cash flow reached $41.7 million, compared to $28.6 million the previous year.

For the full year 2024, Freshworks posted total revenue of $720.4 million, a 21% increase from $596.4 million in 2023. GAAP loss from operations improved to $(138.6) million from $(170.2) million the previous year. Non-GAAP income from operations more than doubled to $99.1 million, compared to $44.5 million in 2023. GAAP net loss per share decreased to $(0.32) from $(0.47) in 2023, while non-GAAP diluted net income per share rose to $0.43 from $0.26.

Net cash provided by operating activities was $160.6 million, nearly double the $86.2 million generated in 2023, and adjusted free cash flow increased to $153.3 million from $77.8 million. As of December 31, 2024, the company held $1.07 billion in cash, cash equivalents, and marketable securities.

Looking ahead, Freshworks projects Q1 2025 revenue between $190.0 million and $193.0 million, reflecting 15% to 17% year-over-year growth, and full-year 2025 revenue between $809.0 million and $821.0 million, compared to the consensus estimate of $813.5 million.

Analyst Upgrades Reflect Confidence Amid Q4 and Full-Year Performance

- Cantor Fitzgerald analyst Brett Knoblauch maintained an Overweight rating and raised the price target from $18 to $22.

- Canaccord Genuity analyst David Hynes reiterated a Buy rating while increasing the price target from $19 to $23.

- Oppenheimer analyst Brian Schwartz kept an Outperform rating and boosted the price target from $22 to $24.

- Barclays analyst Raimo Lenschow maintained an Equal-Weight rating but raised the price target from $14 to $20.

- Needham analyst Scott Berg kept a Buy rating and lifted the price target from $20 to $25.

- Piper Sandler analyst Brent Bracelin kept an Overweight rating and raised the price target from $20 to $24.

Which Analyst has the best track record to show on FRSH?

Analyst Pinjalim Bora (JPMORGAN) currently has the highest performing score on FRSH with 5/7 (71.43%) price target fulfillment ratio. His price targets carry an average of $3.19 (18.98%) potential upside. Freshworks stock price reaches these price targets on average within 69 days.

DoorDash Exceeds Q4 2024 Revenue and Order Expectations

DoorDash reported financial results with revenue increasing by 24% year-over-year (Y/Y), reaching $2.9 billion in Q4 2024. This surpassed analysts’ estimates of $2.84 billion. Total Orders grew by 19% Y/Y to 685 million, exceeding the expected 673.04 million, while Marketplace Gross Order Value (GOV) rose by 21% to $21.3 billion.

DoorDash also achieved its first full year of positive GAAP net income, reporting $141 million in Q4 2024 compared to a loss of $154 million in Q4 2023. Adjusted EBITDA for the quarter increased to $566 million from $363 million in the same period the previous year.

Operational efficiency improvements contributed to a Net Revenue Margin of 13.5%, up from 13.1% in Q4 2023. DoorDash continued to invest heavily in marketing, with sales and marketing expenses rising 18% Y/Y to $541 million. DoorDash also authorized a share repurchase of up to $5 billion for fiscal 2025, a significant increase from the $1.1 billion announced in 2024.

Looking ahead, DoorDash expects Q1 2025 Gross Order Value between $22.6 billion and $23 billion and adjusted EBITDA between $550 million and $600 million.

Analyst Multiple Price Target Increases Following Q4 2024 Earnings Beat

- JP Morgan analyst Doug Anmuth maintained a Neutral rating while raising the price target from $155 to $205.

- Piper Sandler analyst Thomas Champion reiterated a Neutral rating and boosted the price target from $160 to $210.

- Cantor Fitzgerald analyst Deepak Mathivanan maintained an Overweight rating, increasing the price target from $200 to $230.

- Evercore ISI Group analyst Mark Mahaney kept an Outperform rating but raised the price target from $200 to $240.

- Citigroup analyst Ronald Josey maintained a Buy rating while lifting the price target from $211 to $240.

- Mizuho analyst James Lee continued with an Outperform rating, adjusting the price target from $200 to $222.

- Needham analyst Bernie McTernan maintained a Buy rating and upgraded the price target from $180 to $225.

Which Analyst has the best track record to show on DASH?

Analyst Mark Mahaney (EVERCORE) currently has the highest performing score on DASH with 5/8 (62.5%) price target fulfillment ratio. His price targets carry an average of $43.3 (27.63%) potential upside. DoorDash stock price reaches these price targets on average within 304 days.

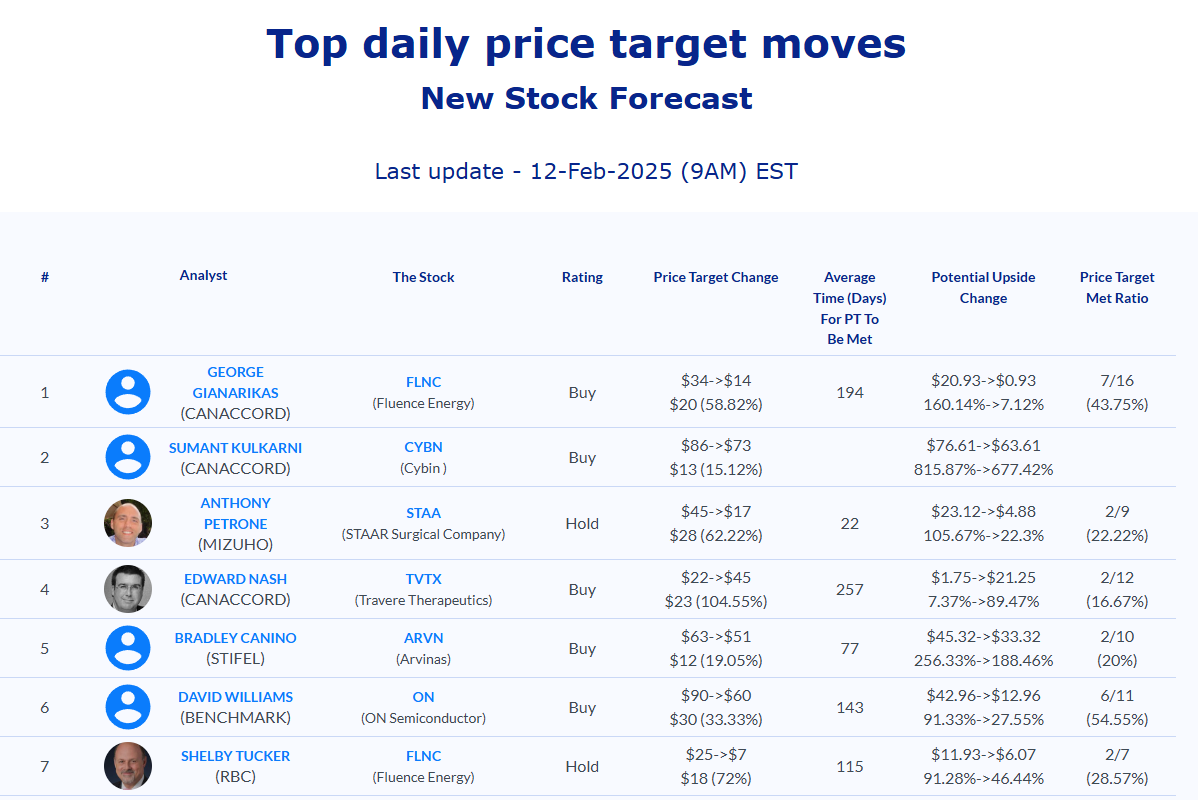

Daily stock Analysts Top Price Moves Snapshot