Selected stock price target news of the day - February 1st, 2024

By: Matthew Otto

Stryker Reports Q4 and Full-Year 2023 Results, Surpassing $20 Billion in Sales

Stryker announced financial results for the fourth quarter and full year of 2023, with sales surpassing $20 billion. The company reported over 11% sales growth in Q4, reaching $5.5 billion in revenue. This growth was driven by double-digit organic sales increases across various segments, including instruments, endoscopy, medical, neuro cranial, hips, knees, and trauma and extremities. International sales growth, excluding China VBP, continued its upward trajectory for the sixth consecutive year, with a 7.7% growth rate. On the other hand, U.S. organic sales growth stood at 12.7%.

The company’s adjusted earnings per share for the fourth quarter rose by 15.3% year-over-year, reaching $3.46 better than the analyst estimate of $3.27. Full-year adjusted EPS reached $10.60, marking a 13.5% increase compared to 2022. Stryker also provided guidance for 2024, forecasting organic sales growth in the range of 7.5% to 9%, with adjusted net earnings per diluted share expected to be between $11.70 and $12.

Analysts Bullish as Price Targets Raised Across the Board

- Citigroup analyst Joanne Wuensch maintained a Buy rating and raised the price target from $340 to $362.

- Truist Securities analyst Richard Newitter maintained a Hold rating and increased the price target from $330 to $345.

- RBC Capital analyst Shagun Singh reiterated an Outperform rating and raised the price target from $345 to $360.

- Roth MKM analyst Jason Wittes reiterated a Buy rating and upgraded the price target from $345 to $348.

- Canaccord Genuity analyst Kyle Rose upgraded from Hold to Buy and announced a $360 price target.

- Wells Fargo analyst Larry Biegelsen kept an Overweight rating and raised the price target from $336 to $364.

- UBS analyst Danielle Antalffy increased the price target to $339.

Which Analyst has the best track record to show on SYK?

Analyst Danielle Antalffy (UBS) currently has the highest performing score on SYK with 4/4 (100%) price target fulfillment ratio. Her price targets carry an average of $26.88 (9.95%) potential upside. Stryker stock price reaches these price targets on average within 164 days.

Moody’s Review Sparks Market Turbulence for New York Community Bancorp

Moody’s Investors Service has placed New York Community Bancorp under review for a potential downgrade, raising concerns over the bank’s credit rating sliding into junk territory. The bank’s market capitalization, which stood at around $7.5 billion before the downturn, experienced a significant contraction. Moody’s cited various concerning factors in its review, including an unexpected loss of $185 million in the latest quarter, driven by a substantial $552 million provision for credit losses. The lion’s share of these provisions was allocated to NYCB’s commercial real estate portfolio, which has been grappling with pandemic-induced office vacancies.

In addition to the downgrade concerns, NYCB’s recent move to cut its dividend by 70% has grabbed investor attention. The bank’s balance sheet expanded beyond the $100 billion regulatory threshold, leading to the bank’s decision to bolster its balance sheet by raising capital. As of December, NYCB reported total assets of $116.3 billion, a figure that exceeds the regulatory threshold and subjects the bank to heightened capital and liquidity requirements.

Analysts Downgrade Amidst Growing Concerns: Price Targets Slashed

- RBC Capital analyst Steven Duong downgraded from Outperform to Sector Perform and the price target from $13 to $7.

- Jefferies analyst Casey Haire lowered from Buy to Hold and the price target from $13 to $7.

- Raymond James analyst Steve Moss downgraded from Strong Buy to Market Perform.

Which Analyst has the best track record to show on NYCB?

Analyst Manan Gosalia (MORGAN STANLEY) currently has the highest performing score on NYCB with 7/8 (87.5%) price target fulfillment ratio. His price targets carry an average of $0.67 (6.82%) potential upside. New York Community Bancorp stock price reaches these price targets on average within 45 days.

Boston Scientific Reports Results for Q4 2023 and Anticipates Growth in 2024

Boston Scientific Corporation has reported financial results for the fourth quarter of 2023, showcasing a 15% growth in total operational sales compared to the same period in 2022. This growth exceeded the company’s earlier guidance range of 8% to 10%. The full-year operational sales growth of 13% versus 2022, alongside an organic sales growth of 12%, outperformed the company’s guidance of approximately 11% for the year. Notably, six out of eight business units experienced double-digit sales growth in the fourth quarter, contributing to the company’s performance throughout 2023.

Looking ahead to 2024, Boston Scientific projects an organic growth of 7% to 9% for the first quarter and 8% to 9% for the full year. The company expects its adjusted earnings per share to be in the range of $2.23 to $2.27 for the full year, reflecting a growth of 9% to 11%. Boston Scientific remained committed to achieving its goal of expanding adjusted operating margin by 30 to 50 basis points in 2024.

Analysts Raise Price Targets Following Q4 Performance

- JP Morgan analyst Robbie Marcus maintained an Overweight rating and raised the price target from $60 to $72.

- Raymond James analyst Jayson Bedford reiterated a Strong Buy rating and raised the price target from $67 to $73.

- Wells Fargo analyst Larry Biegelsen maintained an Overweight rating and increased the price target from $70 to $72.

- Needham analyst Mike Matson kept a Buy rating and raised the price target from $60 to $71.

- Jefferies analyst Matthew Taylor reiterated a Buy rating and increased the price target from $62 to $74.

Which Analyst has the best track record to show on BSX?

Analyst Vijay Kumar (EVERCORE) currently has the highest performing score on BSX with 7/7 (100%) price target fulfillment ratio. His price targets carry an average of $6.97 (13.14%) potential upside. Boston Scientific Corporation stock price reaches these price targets on average within 112 days.

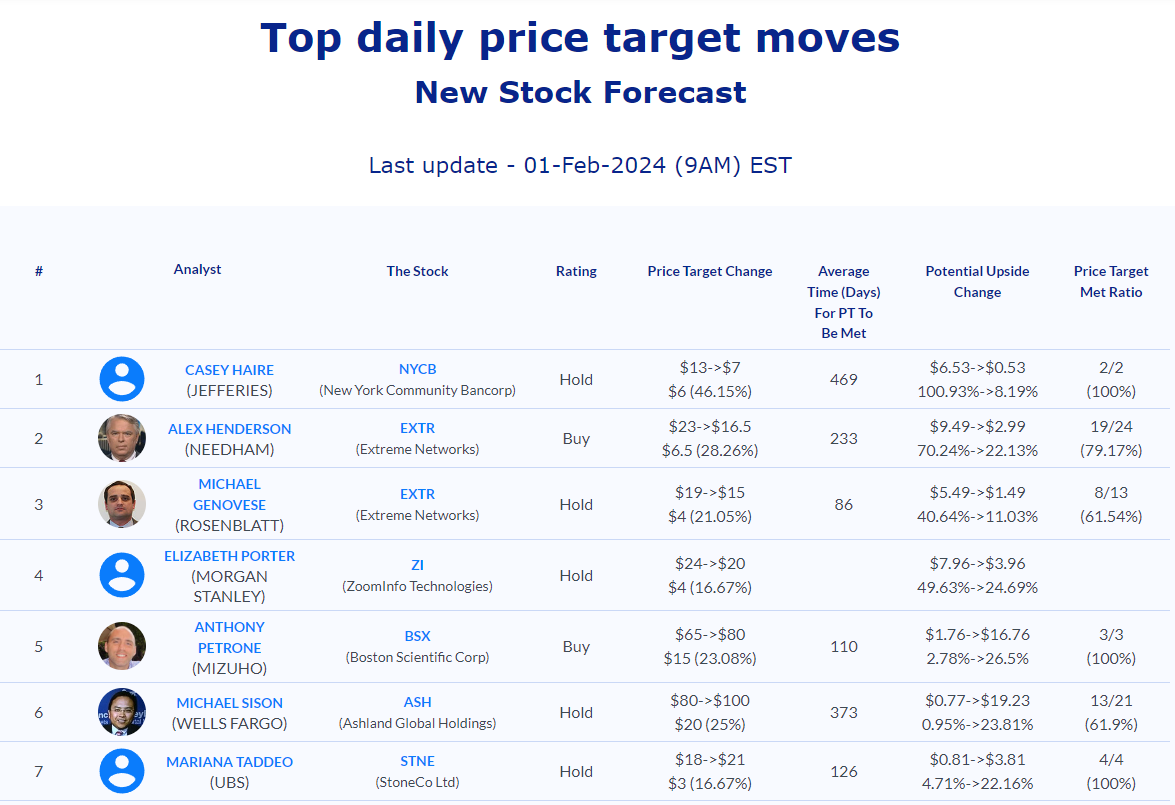

Daily stock Analysts Top Price Moves Snapshot