Selected stock price target news of the day - February 6th, 2024

By: Matthew Otto

Everbridge Enters Agreement for $1.5 Billion Acquisition by Thoma Bravo

Everbridge has entered into a definitive agreement to be acquired by Thoma Bravo in an all-cash transaction valued at approximately $1.5 billion. Under the terms of the agreement, Everbridge shareholders are set to receive $28.60 per share in cash, reflecting a 32% premium to the company’s 90-day volume-weighted average share price. Everbridge, founded in the aftermath of 9/11, with a diverse customer base of over 6,500 entities across various sectors, including multinational enterprises and government bodies. The acquisition, anticipated to close in the second calendar quarter of 2024, has been approved by Everbridge’s Board of Directors and is contingent upon customary closing conditions and regulatory approvals.

Thoma Bravo, a software investment firm with assets under management totaling approximately $134 billion as of September 30, 2023, is set to further solidify its position in the industry through this transaction. Over the past two decades, the firm has acquired or invested in more than 455 companies, representing a cumulative enterprise value of over $255 billion, encompassing both control and non-control investments.

Analyst Ratings Reflect Mixed Sentiment with Upgrades and Downgrades

- Wells Fargo analyst Michael Turrin upgraded from Underweight to Equal-Weight.

- William Blair analyst Arjun Bhatia downgraded from Outperform to Market Perform.

- Canaccord Genuity analyst Michael Walkley downgraded from Buy to Hold and set a $28.6 price target.

- Needham analyst Scott Berg downgraded from Buy to Hold.

- Baird analyst William Power raised the price target to $29.

Which Analyst has the best track record to show on EVBG?

Analyst Terry Tillman (TRUIST) currently has the highest performing score on EVBG with 12/13 (92.31%) price target fulfillment ratio. His price targets carry an average of $-0.93 (-4.44%) potential downside. Everbridge stock price reaches these price targets on average within 27 days.

Palantir Q4 Earnings Beat Expectations with Revenue Growth

Palantir Technologies reported an adjusted earnings per share of 8 cents, meeting expectations, while its quarterly revenue reached $608.4 million, surpassing analysts’ projections of $602.4 million. This marks a 20% increase in revenue from the previous year’s fourth quarter when it stood at $508.6 million. Palantir’s net income reached $93.4 million, or 4 cents per share, in contrast to $30.9 million, or 1 cent per share, in the same period last year.

Looking ahead, Palantir anticipates reporting revenue between $612 million and $616 million for the first quarter, with a full-year revenue forecast ranging from $2.65 billion to $2.67 billion. The company’s U.S. commercial revenue showcased 70% year-over-year increase, with its customer count growing by 55% from 143 to 221 customers.

Analysts Upgrades with Revised Price Targets Amidst Market Optimism

- Raymond James analyst Brian Gesuale maintained an Outperform rating and raised the price target from $22 to $25.

- Citigroup analyst Tyler Radke upgraded from Sell to Neutral and the price target from $10 to $20.

- Jefferies analyst Brent Thill upgraded from Underperform to Hold and the price target from $13 to $22.

- DA Davidson analyst Gil Luria maintained a Neutral rating and increased the price target from $18 to $19.

- Wolfe Research analyst Alex Zukin increased the price target to $14.

Which Analyst has the best track record to show on PLTR?

Analyst Brent Thill (JEFFERIES) currently has the highest performing score on PLTR with 10/16 (62.5%) price target fulfillment ratio. His price targets carry an average of $-2.98 (-18.65%) potential downside. Palantir Technologies stock price reaches these price targets on average within 117 days.

Estée Lauder Restructuring Plan and Analyst Optimism

Estée Lauder intends to trim its workforce by 3% to 5%, with the restructuring expected to incur pretax charges ranging between $500 million to $700 million. Despite these upfront expenditures, Estée Lauder projects annual gross benefits in the range of $350 million to $500 million.

Analysts, including Filippo Falorni from Citi, commended the unexpected restructuring plan, noting its potential positive impact on the market. Falorni, who maintains a Neutral rating on EL shares with a $140 price target. Falorni stated that the new restructuring plan, not expected by the market, will drive a positive reaction. Mark Astrachan of Stifel echoed the sentiment, emphasizing the company’s better-than-feared quarterly results and its indication that the worst might be behind them. Astrachan, who has a Buy rating on Estée Lauder shares and a $155 price target, remarked that from a stock standpoint, F2H24 organic sales guidance was better-than-feared and implies the worst is behind the company.

Analysts’ Upgraded Price Targets Following Restructuring Plan

- Raymond James analyst Olivia Tong maintained a Strong Buy and raised the price target from $150 to $175.

- Telsey Advisory Group analyst Dana Telsey reiterated a Market Perform and increased the price target from $115 to $155.

- Piper Sandler analyst Korinne Wolfmeyer kept a Neutral rating and raised the price target from $148 to $158.

- DA Davidson analyst Linda Bolton Weiser maintained a Buy rating and increased the price target from $163 to $179.

Which Analyst has the best track record to show on EL?

Analyst Fulvio Cazzol (BERENBERG) currently has the highest performing score on EL with 5/8 (62.5%) price target fulfillment ratio. His price targets carry an average of $7.62 (6.90%) potential upside. Estée Lauder stock price reaches these price targets on average within 112 days.

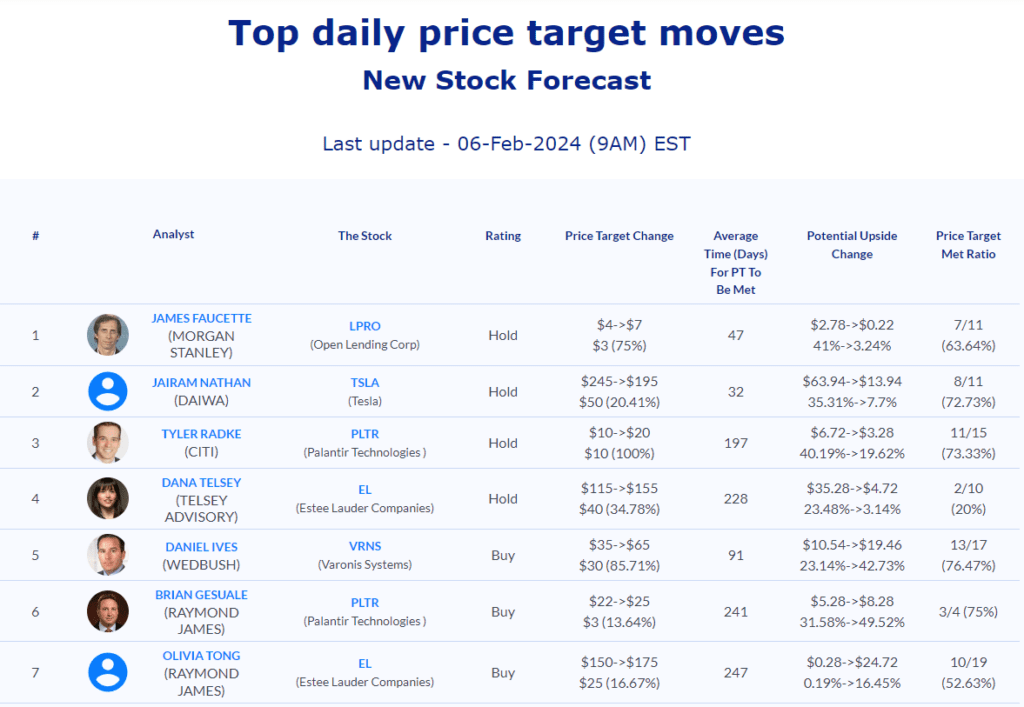

Daily stock Analysts Top Price Moves Snapshot