Selected stock price target news of the day - January 2nd, 2025

By: Matthew Otto

Parsons Corporation Secures Role in $7 Billion Austin Light Rail Project

Parsons Corporation announced its role as a major subconsultant in a team selected by the Austin Transit Partnership (ATP) to deliver the $7 billion Austin Light Rail project. The team, known as LINC Austin, comprises AECOM, Parsons, STV, Turner & Townsend, Ardmore Roderick, and CAS Consulting.

Under an initial four-year contract, LINC Austin will provide program and project management, construction oversight, and technical expertise during the planning, design, procurement, construction, and post-construction phases. Parsons will specifically support systems integration, interface management, construction oversight, quality assurance, and design coordination.

The Austin Light Rail project’s initial phase includes 9.8 miles of rail lines and 15 stations, serving an estimated population of over 2.4 million residents and accommodating more than 200,000 daily riders upon completion. The system will provide high-frequency service, reducing travel times by up to 30% and alleviating congestion on major corridors. By integrating seamlessly with existing transit networks, the project aims to expand mobility options for Austin’s growing population and its 30 million annual visitors.

Analyst Downgrades Amid Austin Light Rail Involvement

- Raymond James analyst Brian Gesuale downgraded from Outperform to Market Perform.

Which Analyst has the best track record to show on PSN?

Analyst Sangita Jain (KEYBANK) currently has the highest performing score on PSN with 4/6 (66.67%) price target fulfillment ratio. Her price targets carry an average of $13.84 (12.80%) potential upside. Parsons Corporation stock price reaches these price targets on average within 48 days.

Veru Divests FC2 Business to Focus on Biopharmaceutical Innovations

Veru has completed the sale of its FC2 Female Condom® business, including UK and Malaysian subsidiaries, to Riva Ridge Capital Management LP and co-investors for $18 million, subject to adjustments in the purchase agreement. After deductions, Veru expects net proceeds of approximately $12.5 million. This strategic shift reduces Veru’s workforce by 90%, from 210 employees to 22, and eliminates $9.9 million in liabilities under its Royalty Agreement with SWK Funding LLC.

Veru’s Phase 2b QUALITY clinical trial evaluates enobosarm’s ability to preserve muscle and reduce fat in 168 elderly patients (aged > 60) with sarcopenic obesity, a condition affecting 34.4% of the estimated 24 million U.S. adults aged 60+ with obesity. With 41.5% of U.S. adults over 60 considered obese, this represents approximately 61 million people who may benefit from effective treatments. Enobosarm, studied in 27 clinical trials with 1,581 participants, has demonstrated efficacy in increasing muscle mass and reducing fat.

Analyst Reaffirms Rating and Price Target Amid Strategic Transition

- HC Wainwright & Co. analyst Yi Chen reiterated a Buy rating and a $3 price target.

Which Analyst has the best track record to show on VERU?

Analyst Yi Chen (HCWAINWRIGHT) currently has the highest performing score on VERU with 4/14 (28.57%) price target fulfillment ratio. His price targets carry an average of $1.67 (125.56%) potential upside. Veru stock price reaches these price targets on average within 233 days.

V2X Secures $170 Million DEA Fleet Support Contract

V2X headquartered in Reston, Virginia, has been awarded a $170 million contract to provide continued support for the Drug Enforcement Administration’s (DEA) fleet of over 100 aircraft. This five-year agreement underscores V2X’s longstanding partnership with the DEA, which dates back to 1997.

The fleet comprises special mission aircraft integral to DEA operations, and V2X’s services include maintenance, pilot training, and operational readiness. The contract aligns with V2X’s extensive track record of supporting national security initiatives, leveraging its expertise to enhance the DEA’s critical capabilities in combating drug trafficking.

V2X employs approximately 16,000 professionals globally and integrates advanced technologies, including artificial intelligence and machine learning, into its operations. The contract solidifies V2X’s role in the lifecycle management of critical assets, encompassing defense, civilian, and international markets.

Analyst Adjusts Price Target Following DEA Contract Award

- Raymond James analyst Brian Gesuale downgraded from Strong Buy to Outperform and the price target from $72 to $65.

Which Analyst has the best track record to show on VVX?

Analyst Brian Gesuale (RAYMOND JAMES) currently has the highest performing score on VVX with 4/5 (80%) price target fulfillment ratio. His price targets carry an average of $11.91 (19.82%) potential upside. V2X stock price reaches these price targets on average within 417 days.

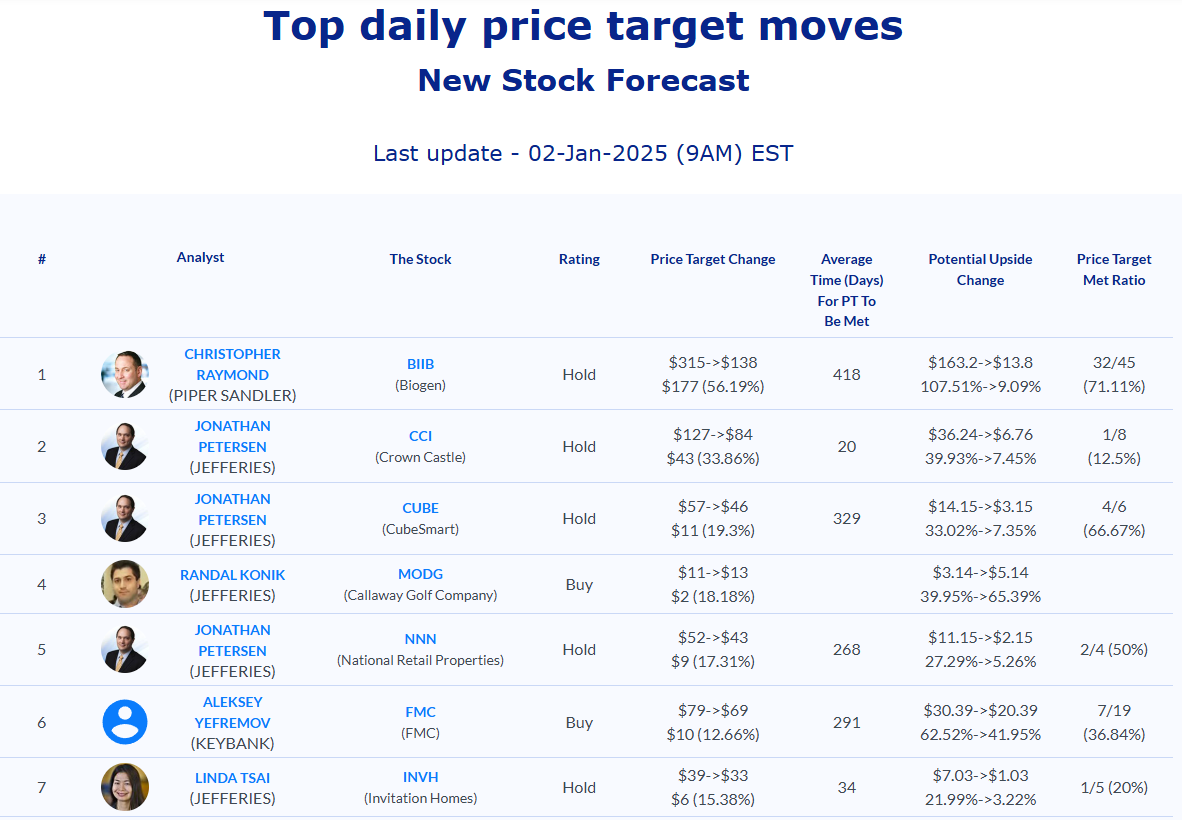

Daily stock Analysts Top Price Moves Snapshot