Selected stock price target news of the day - January 31st, 2024

By: Matthew Otto

Microsoft Beats Analyst Expectations, Market Reacts Cautiously

Microsoft’s fiscal second-quarter earnings reported $2.93 earnings per share on a revenue of $62 billion for the quarter ending in December. This performance surpassed analysts’ expectations, who had forecasted earnings of $2.77 per share on revenue totaling $61.1 billion. Azure and other cloud services witnessed a 30% increase in revenue on an annual basis, propelling the Intelligent Cloud segment’s overall sales growth to 20%, reaching $25.9 billion.

Despite the performance, the company’s outlook for Intelligence Cloud revenue in the upcoming quarter fell slightly short of $25.9 billion analysts expectations, with guidance ranging between $26 billion and $26.3 billion. This marks a quarter-over-quarter growth rate of just 1.5%, in contrast to the previous quarter’s 6.6% growth.

Analysts Raise Price Targets Amid Optimistic Outlook

- Wells Fargo’s Michael Turrin maintained an Overweight rating and increased the price target from $435 to $460.

- Raymond James’s Andrew Marok reiterated an Outperform rating and raised the price target from $400 to $450.

- Macquarie’s Sarah Hindlian also maintained an Outperform rating and raised the price target from $430 to $450.

- Barclays’s Raimo Lenschow kept an Overweight rating and lifted the price target from $421 to $475.

- Wedbush’s Daniel Ives reiterated an Outperform rating and a $450 price target.

- Wolfe Research’s Alex Zukin reiterated an Outperform rating and upgraded the price target from $480 to $510.

- CFRA’s Angelo Zino maintained a Strong Sell rating and increased the price target from $420 to $455.

- DA Davidson’s Gil Luria kept a Buy rating and raised the price target from $415 to $500.

- UBS’s Karl Kierstead kept a Buy rating and lifted the price target from $400 to $480.

- BofA Securities’s Brad Sills reiterated a Buy rating and raised the price target from $450 to $480.

Which Analyst has the best track record to show on MSFT?

Analyst Mark Murphy (JPMORGAN) currently has the highest performing score on MSFT with 24/24 (100%) price target fulfillment ratio. His price targets carry an average of $68.63 (21.69%) potential upside. Microsoft stock price reaches these price targets on average within 97 days.

Starbucks Reports Mixed Quarter with Revenue Miss and Growth Challenges

In its recent quarterly report, Starbucks revealed an increase in net income from $855.2 million to $1.02 billion compared to the previous year. Adjusted earnings per share fell slightly short of expectations at 90 cents, while analysts had anticipated 93 cents.

The company’s revenue of $9.43 billion also missed estimates of $9.59 billion.Starbucks witnessed a 5% rise in global same-store sales, trailing StreetAccount’s forecast of 7.2%. In North America, where same-store sales similarly increased by 5%, Starbucks experienced a decline in foot traffic from mid-November onward, with CEO Laxman Narasimhan attributing this downturn to misperceptions surrounding the company’s stance on the Israel-Hamas conflict.

Despite these challenges, Starbucks set a record with $3.6 billion loaded onto gift cards during the quarter. Internationally, while the Middle East market faced headwinds due to the conflict, China saw a 10% growth in same-store sales, although the average ticket size declined by 9%. Looking ahead, Starbucks revised its full-year revenue growth forecast to between 7% and 10%, down from the previously projected 10% to 12%.

Analysts Offer Varied Outlooks Amidst Market Challenges

- Stephens & Co. analyst Joshua Long reiterated an Equal-Weight rating and a $110 price target.

- Wedbush analyst Nick Setyan reiterated a Neutral rating and a $95 price target.

- Citigroup analyst Jon Tower maintained a Neutral rating and raised the price target from $102 to $103.

- Barclays analyst Jeffrey Bernstein maintained an Overweight rating and lowered the price target from $116 to $112.

- JPMorgan analyst John Ivankoe kept an Overweight rating and lowered the price target from $108 to $107.

- Baird analyst David Tarantino kept a Neutral rating and decreased the price target from $110 to $106.

Which Analyst has the best track record to show on SBUX?

Analyst Jon Tower (CITI) currently has the highest performing score on SBUX with 11/17 (64.71%) price target fulfillment ratio. His price targets carry an average of $8.13 (8.85%) potential upside. Starbucks stock price reaches these price targets on average within 79 days.

Alphabet’s Earnings: Surpasses Expectations Yet Faces Market Skepticism

Alphabet released its fourth-quarter earnings report. The company surpassed analysts’ expectations in key financial metrics, including earnings per share at $1.64 compared to the projected $1.59, and revenue reaching $86.31 billion versus the estimated $85.33 billion. While Google Cloud showcased a revenue hitting $9.19 billion, surpassing the expected $8.94 billion, YouTube ads fell slightly short, generating $9.2 billion compared to the anticipated $9.21 billion. Additionally, Alphabet’s traffic acquisition costs came in lower than expected at $13.9 billion, compared to the estimated $14.1 billion, reflecting a mixed performance across its various revenue streams.

Moreover, Alphabet’s financial report revealed restructuring costs, with severance and related charges totaling $2.1 billion for 2023, in addition to expenses associated with office closures amounting to $1.2 billion for the quarter and $1.8 billion for the year. Net income surged by 52% to $20.7 billion compared to $13.6 billion a year earlier, and operating margin expanded from 24% to 27%, investors remain wary. CFO Ruth Porat projected further severance-related expenses of approximately $700 million in the upcoming quarter.

Analysts Mixed Outlook with Price Target Adjustments

- Wedbush analyst Scott Devitt reiterated an Outperform rating and a $160 price target.

- Redburn Atlantic analyst James Cordwell maintained a Buy rating and raised the price target from $150 to $165.

- Wolfe Research analyst Deepak Mathivanan maintained an Outperform rating and increased the price target from $170 to $180.

- Needham analyst Laura Martin reiterated a Buy rating and a $160 price target.

- Barclays analyst Ross Sandler kept an Overweight rating and lowered the price target from $180 to $173.

- BofA Securities analyst Justin Post maintained a Buy rating and lowered the price target from $175 to $173.

Which Analyst has the best track record to show on GOOGL?

Analyst Scott Devitt (STIFEL) currently has the highest performing score on GOOGL with 16/19 (84.21%) price target fulfillment ratio. His price targets carry an average of $34.39 (27.38%) potential upside. Alphabet stock price reaches these price targets on average within 253 days.

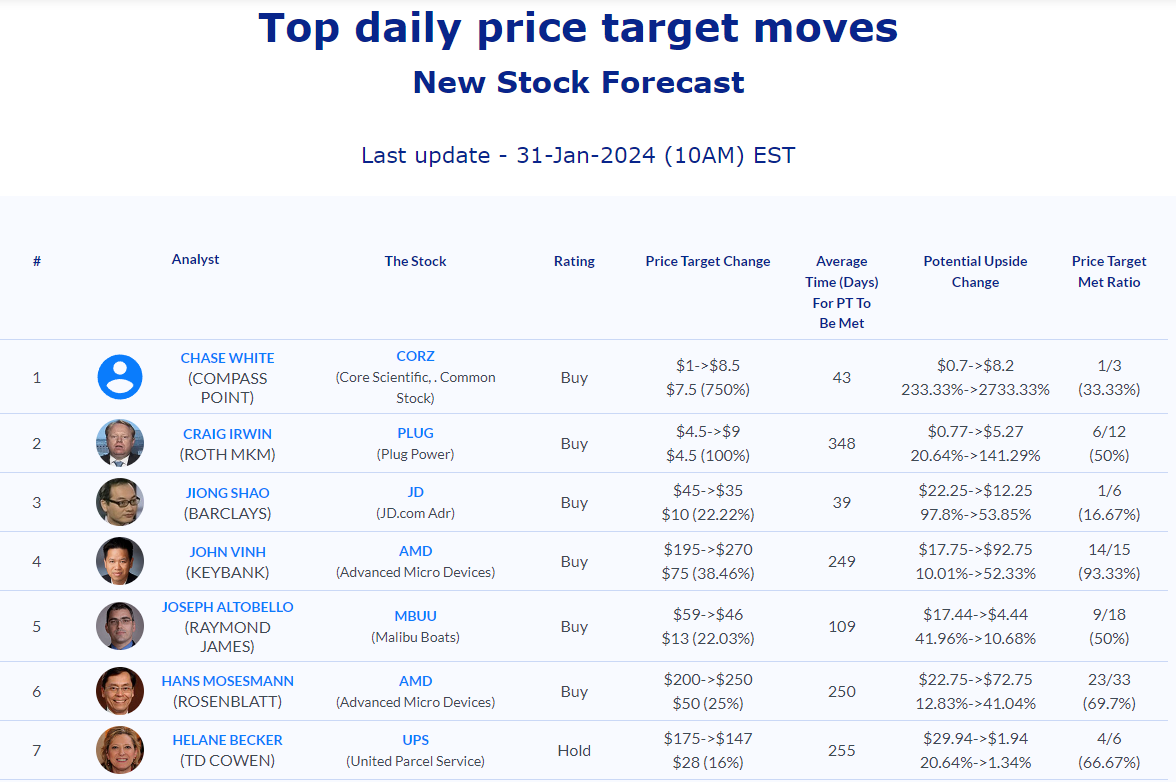

Daily stock Analysts Top Price Moves Snapshot