Selected stock price target news of the day - July 07, 2023

By: Matthew Otto

FIS Achieves Certification for FedNow Service, Paving the Way for Instant Payments

Fidelity National Information Services has announced that it completed the testing and certification for the Federal Reserve’s new instant payment offering called the FedNow Service. The certification obtained by FIS is specifically for “Credit Transfer – Receive Only” payments, which enables FIS to receive payments from any financial institution utilizing the FedNow network, send payment returns, and provide acknowledgements, requests, and responses.

By achieving this certification, FIS is fully prepared to assist its client financial institutions in leveraging the FedNow Service. This will enable these institutions to offer their customers 24/7 instant payments, enhance their competitiveness, and develop new products.

FIS recognizes the growth of digital payments and views the FedNow Service as a crucial solution for the industry. As a result, FIS has done early adoption and will contribute to the modernization of the U.S. payments system. The company continues enhancing its capabilities and features to enable its financial institution clients to participate in and better serve their customers through the FedNow Service.

Analyst Shows Mixed Ratings and Revised Price Targets

- Raymond James analyst John Davis Maintains Strong Buy rating and lowers price target from $83 to $79.

- Wolfe Research analyst Darrin Peller Reiterates Peer Perform rating.

- Stephens analyst Charles Nabhan Lowers price target to $69.

Analyst Jeff Cantwell (WELLS FARGO) has currently the highest performing score on FIS with a 7/9 (77.78%) price target fulfillment ratio. His price targets carry on an average of $12.82 (12.41%) potential upside and are fulfilled within an average of 92 days.

Microsoft Could Become the Next $3 Trillion Mega-Cap Tech Stock, Morgan Stanley says

Morgan Stanley has identified Microsoft as the next mega-cap tech stock likely to achieve a $3 trillion valuation, following Apple’s recent milestone. The analyst considers Microsoft a “Top Pick”, citing its strong position in the generative AI race and its ability to monetize this growing trend. The bank has increased Microsoft’s price target by 24% to $415 from $335.

According to Morgan Stanley’s Keith Weiss, Microsoft’s investment in OpenAI presents an opportunity for the company, potentially amounting to a $90 billion incremental opportunity in 2025. Weiss highlights Microsoft’s integration of AI capabilities into its software offerings, such as Office 365, Azure, and GitHub, as a factor that will contribute to its pricing power going forward.

Weiss also emphasizes that Microsoft’s financials will benefit from AI sooner rather than later as increased datasets drive higher revenues for the company’s Azure cloud service. Despite Microsoft’s stock already experiencing a significant year-to-date increase, Weiss concludes that the valuation remains reasonable compared to historical averages. The bank believes that Microsoft’s unrivaled position in generative AI, coupled with its attractive valuation, supports its potential for further growth in the AI market.

Analysts Express Positive Outlook on Microsoft with Raised Price Targets and Buy Ratings.

- Morgan Stanley analyst Keith Weiss maintains an Overweight rating and raises the price target from $335 to $415.

- Wedbush analyst Daniel Ives reiterates an Outperform rating and a $375 price target.

- D.A. Davidson analyst Gil Luria sets a Buy rating and a $270 price target.

Analyst Gil Luria (D.A. DAVIDSON) has currently the highest performing score on MSFT with

2/2 (100%) price target fulfillment ratio. His price targets carry on average an $53.6 (21.96%) potential upside and are fulfilled within an average of 73 days.

Levi Strauss Cuts Annual Profit Forecast as Costs Rise and Sales Decline

Levi Strauss has cut its annual profit forecast due to higher costs and declining sales at its wholesale channels in North America. Levi’s net revenues for the second quarter declined by 9%, marking the steepest quarterly drop since Q1 2021. To stimulate sales among price-sensitive shoppers, Levi Strauss reduces prices on select products sold through wholesale channels.

The company revised the profit forecast for 2023 and now stands between $1.10 and $1.20 per share, compared to the previous range of $1.30 to $1.40. Adjusted gross margin is also expected to contract, and the forecasted annual net revenue growth has been narrowed down.

Levi Strauss faced supply chain challenges in its US distribution centers due to inventory backlog. While revenue in the direct-to-consumer channel increased by 13% during the second quarter, the wholesale channel experienced a 22% decline as wholesalers tightened their inventories in North America and Europe. The company’s net income for the second quarter was $1.6 million, lower compared to $49.7 million in the same period the previous year.

Analysts Maintain Ratings for Levi Strauss, Lower Price Targets

- Citigroup analyst Paul Lejuez maintains a Neutral rating and lowers the price target from $15 to $14.

- Stifel analyst Drew Crum reiterates a Buy rating and lowers the price target from $19 to $17.

- Wells Fargo analyst Ike Boruchow remains an Overweight rating and lowers the price target from $18 to $15.

- Telsey Advisory Group analyst Dana Telsey maintains an Outperform rating and lowers the price target from $24 to $18.

Analyst Dana Telsey (TELSEY ADVISORY) has currently the highest performing score on LEVI with 4/11 (36.36%) price target fulfillment ratio. Her price targets carry on average an

$7.2 (44.86%) potential upside and are fulfilled within an average of 113 days.

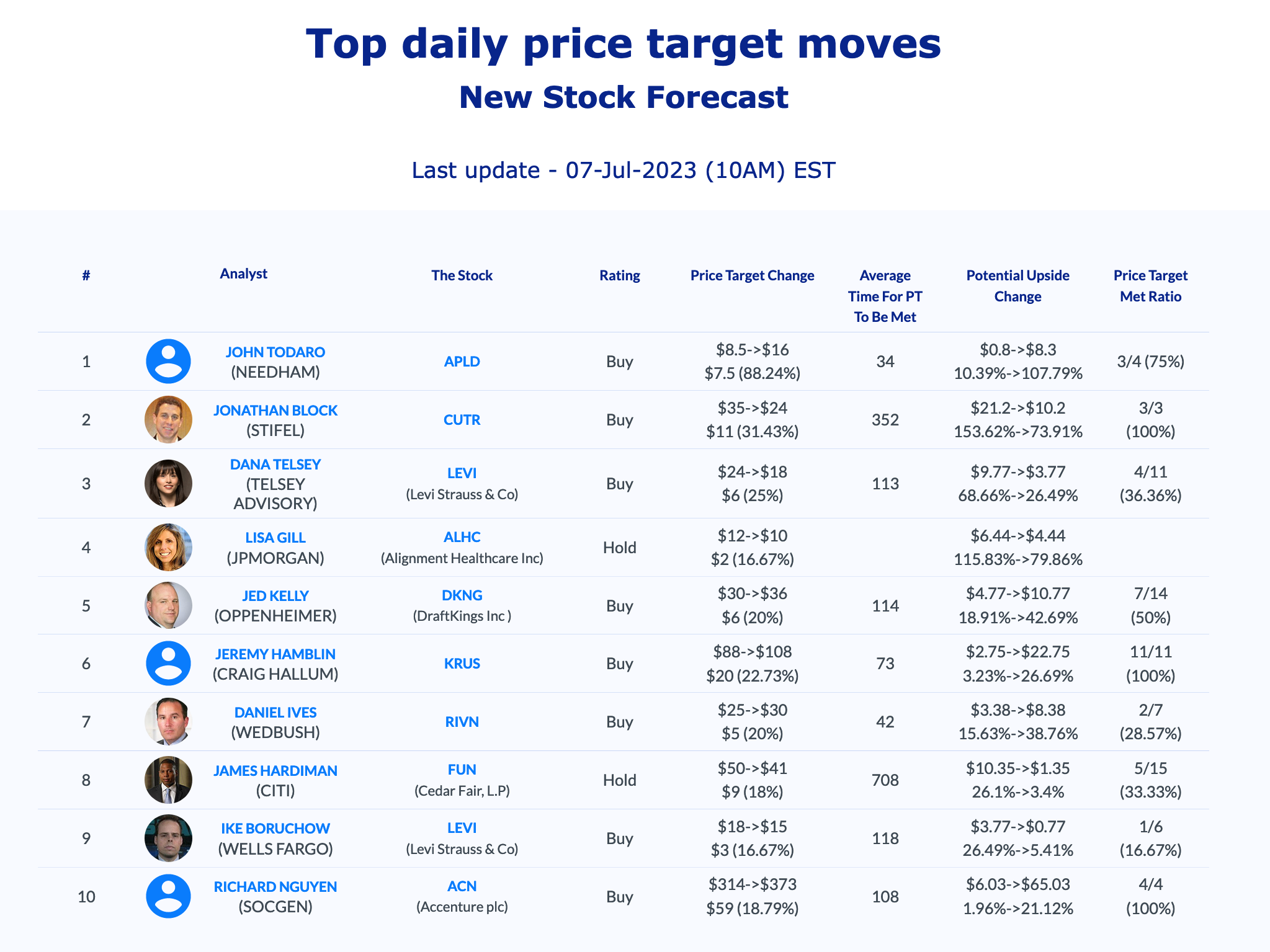

Daily stock Analysts Top Price Moves Snapshot