Selected stock price target news of the day - July 14th, 2025

By: Matthew Otto

BlackRock’s Panama Port Deal Spurs China Regulatory Response

BlackRock’s planned acquisition of two ports in Panama—part of a broader $2 billion USD divestment of global port assets by CK Hutchison Holdings—has led to regulatory repercussions in China affecting entities linked to the Li family.

Following the announcement of the port sale in early March 2025, Chinese regulators instructed state-owned enterprises to suspend new business dealings with companies connected to Li Ka-shing and his family. As a result, negotiations by Richard Li to obtain an insurance license for FWD Group in mainland China were placed on hold. The insurance license would have granted FWD access to a market with over $730 billion USD in annual premiums as of 2023.

The Panama port deal could provide strategic value to BlackRock. The two ports involved reportedly process over 3 million twenty-foot equivalent units (TEUs) annually and are situated near the Panama Canal, which facilitates more than 500 million tons of cargo transit each year. Control of these assets would expand BlackRock’s global infrastructure portfolio, which totaled over $65 billion USD in assets under management at the end of 2024.

Analyst Lowers Price Target Amid Uncertainty Over Panama Port Deal

- Barclays analyst Benjamin Budish maintained an Overweight rating but lowered the price target from $1220 to $1210.

Which Analyst has the best track record to show on BLK?

Analyst Kenneth Worthington (JPMORGAN) currently has the highest performing score on BLK with 15/16 (93.75%) price target fulfillment ratio. His price targets carry an average of $98.05 (11.02%) potential upside. BlackRock stock price reaches these price targets on average within 221 days.

Uber to Provide Mobility and Delivery Services for LA28 Olympic and Paralympic Games

Uber Technologies has been named the rideshare and on-demand delivery provider for the LA28 Olympic and Paralympic Games, as well as for Team USA. The company will implement its mobility solutions to support transportation across the Los Angeles metropolitan area during the events, which will take place in 2028.

According to a statement from LA28 Chairperson and President Casey Wasserman, mobility will play a key role in connecting venues, athletes, and attendees. Uber plans to coordinate cars, bikes, and scooters to facilitate multi-modal transportation throughout the city. The LA28 Games are scheduled to mark Los Angeles’ third time hosting the Summer Olympics, following the 1932 and 1984 Games, and the city’s first time hosting the Paralympics.

In addition to transportation services, Uber Eats will operate the on-demand delivery program for the Olympic and Paralympic Village, providing food delivery to athletes. The program will also include mobile ordering options for spectators at select venues, as outlined in the official LA28 announcement.

Uber will also collaborate with NBCUniversal to support media coverage for both the Milano-Cortina 2026 Winter Games and the LA28 Games. According to NBCUniversal Chairman Mark Marshall, the partnership aims to integrate transportation and coverage to enhance operational support and storytelling during the Olympic events.

Analysts Raise Price Targets Following LA28 Olympics Partnership

- KeyBanc analyst Justin Patterson maintained an Overweight rating and lifted the price target from $90 to $110.

- Needham analyst Bernie McTernan reiterated a Buy rating and raised the price target from $100 to $109.

Which Analyst has the best track record to show on UBER?

Analyst Thomas Champion (PIPER SANDLER) currently has the highest performing score on UBER with 3/3 (100%) price target fulfillment ratio. His price targets carry an average of $10.01 (14.30%) potential upside. Uber Technologies stock price reaches these price targets on average within 141 days.

Boeing Reaches Settlement Ahead of First 737 MAX Crash Trial

Boeing has reached a settlement with Paul Njoroge of Toronto, whose wife, three children, and mother-in-law were among the 157 people killed in the March 2019 Ethiopian Airlines crash involving a Boeing 737 MAX aircraft.

The settlement, announced by Njoroge’s attorney Robert Clifford, comes just days before a scheduled trial in U.S. District Court in Chicago, which would have been the first civil case to proceed against the aerospace company in connection with the two 737 MAX crashes in 2018 and 2019 that claimed a combined 346 lives. Terms of the agreement were not disclosed. In April, Boeing similarly avoided another scheduled trial by settling with the families of two other victims from the same incident.

The crashes prompted a global 20-month grounding of the 737 MAX, costing Boeing more than $20 billion in direct and indirect financial impacts. According to the company, more than 90% of civil lawsuits related to the two crashes have now been resolved through settlements, compensation agreements, and a deferred prosecution deal. In total, Boeing has paid billions of dollars in restitution and legal costs. A separate trial, involving families of six additional victims from the 2019 crash, is expected to begin on November 3.

Meanwhile, Boeing and the U.S. Department of Justice have jointly asked a judge to approve a 2024 plea agreement that would allow Boeing to avoid criminal conviction and independent oversight, despite opposition from some victims’ relatives. The charge stems from allegations that Boeing misled regulators about the Maneuvering Characteristics Augmentation System (MCAS), which played a central role in both accidents.

Analyst Lifts Price Target Amid Legal Developments

- Susquehanna analyst Charles Minervino maintained a Positive rating and raised the price target from $252 to $265.

Which Analyst has the best track record to show on BA?

Analyst Ronald Epstein (BAML) currently has the highest performing score on BA with 25/36 (69.44%) price target fulfillment ratio. His price targets carry an average of $48.53 (22.95%) potential upside. Boeing stock price reaches these price targets on average within 270 days.

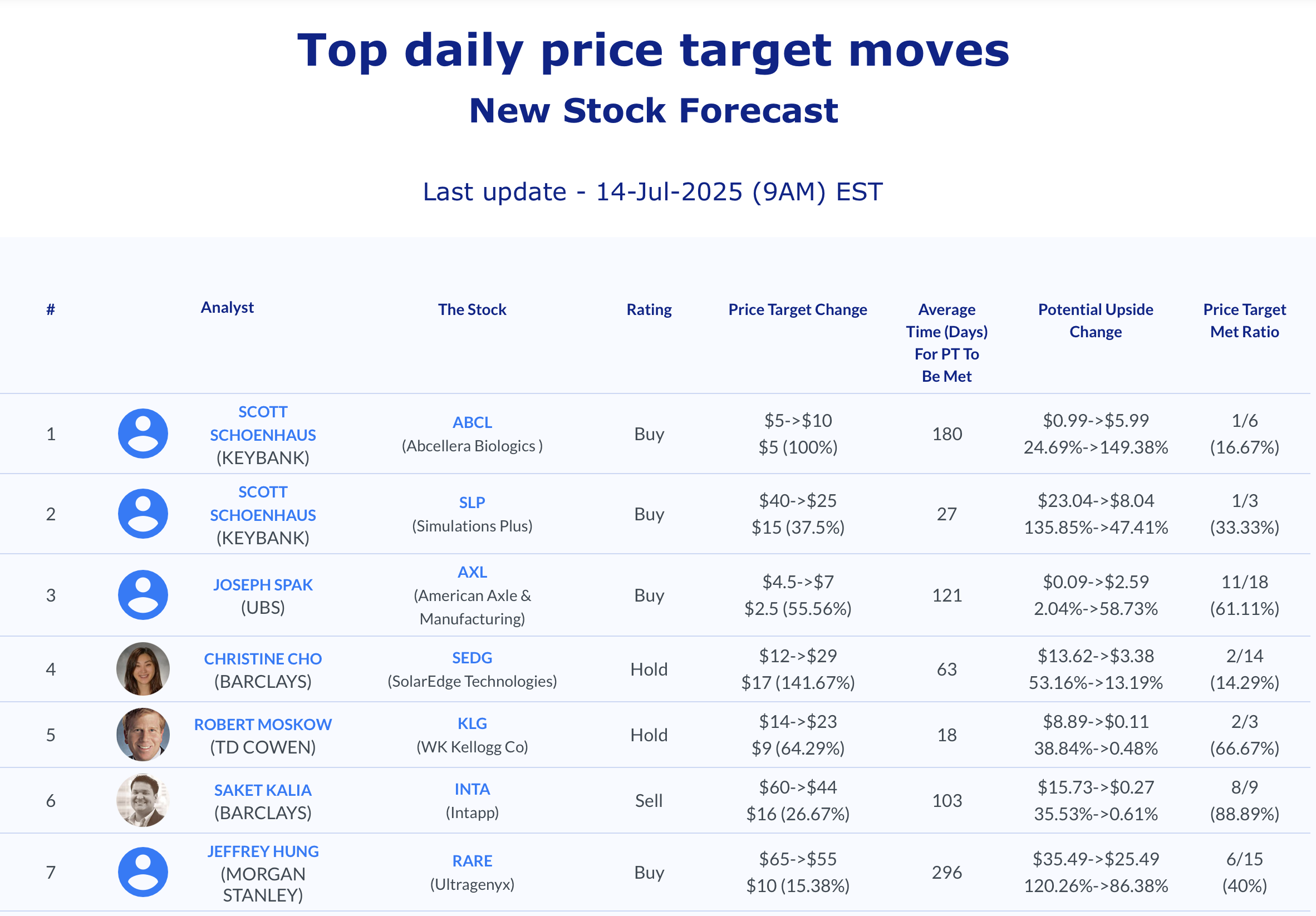

Daily stock Analysts Top Price Moves Snapshot