Selected stock price target news of the day - July 23rd, 2024

By: Matthew Otto

Halliburton Reports Q2 2024 Earnings: International Growth Offsets North American Decline

During the second quarter of 2024, Halliburton achieved total revenue of $5.8 billion, below the consensus estimate of $5.95 billion, and an operating margin of 18%. Halliburton also reported earnings per share of $0.80, in line with analyst expectations.

International revenue reached $3.4 billion, marking an 8% year-over-year growth. Notable performance in Latin America, which saw a 10% increase. Conversely, North America revenue declined by 8% to $2.5 billion, reflecting a 12% decrease in rig count over the same period. Additionally, the company generated $1.1 billion in cash flow from operations and approximately $800 million in free cash flow, while repurchasing $250 million of its common stock.

Halliburton highlighted growth in the international markets, where revenue increased by 8% year-over-year. The Landmark Software business introduced innovations like unified ensemble modeling and AI-driven tools, which were well-received at the LIFE2024 forum in Athens. The artificial lift product line grew at double the rate of the overall international business, driven by new technologies such as the GeoESP line for geothermal environments. In drilling services, the iCruise X rotary steerable system and LOGIX autonomous drilling platform, particularly in the Middle East, achieved revenue surged by 30% year-over-year.

Looking ahead, Miller expressed steady growth for the remainder of 2024, anticipating a 10% revenue increase in the international market for the full year.

Analysts Maintain Positive Ratings Despite Lowered Price Targets

- Barclays analyst David Anderson maintained an Overweight rating and lowered the price target from $54 to $48.

- Morgan Stanley analyst Connor Lynagh maintained an Overweight rating but lowered the price target from $47 to $45.

- BofA Securities analyst Chase Mulvehill reiterated a Buy rating and decreased the price target from $41 to $40.

- Evercore ISI Group analyst James West reiterated an Outperform rating and downgraded the price target from $52 to $48.

- TD Cowen analyst Marc Bianchi kept a Buy rating and lowered the price target from $47 to $45.

- Benchmark analyst Kurt Hallead reiterated a Buy rating and a $42 price target.

- JP Morgan analyst Arun Jayaram maintained an Overweight rating and lowered the price target from $45 to $40.

- RBC Capital analyst Keith Mackey kept an Outperform rating and lowered the price target from $45 to $44.

- Piper Sandler analyst Luke Lemoine maintained an Overweight rating however downgraded the price target from $46 to $40.

- Susquehanna analyst Charles Minervino maintained a Positive rating and lowered the price target from $49 to $46.

Which Analyst has the best track record to show on HAL?

Analyst Stephen Gengaro (STIFEL) currently has the highest performing score on HAL with 6/13 (46.15%) price target fulfillment ratio. His price targets carry an average of $10.04 (27.92%) potential upside. Halliburton stock price reaches these price targets on average within 339 days.

Global IT Outage: CrowdStrike Update Causes Major Disruptions Worldwide

On Friday, a botched software update from CrowdStrike caused a global IT outage, grounding flights, halting hotel check-ins, and stopping freight deliveries. The malfunction, initially feared to be a cyberterrorist attack, turned out to be due to a problematic content update within CrowdStrike’s Falcon monitoring software.

This update affected millions of devices worldwide, highlighting the extent to which modern society relies on IT systems. According to Nick Hyatt, director of threat intelligence at Blackpoint Cyber, the auto-update feature deployed buggy code that disrupted endpoints like laptops, desktops, and servers. Although CrowdStrike quickly identified and began addressing the issue, experts like Eric O’Neill, a former FBI counterterrorism operative, estimate that it could take three to five days for affected organizations to fully recover.

Experts like Peter Avery, vice president of security and compliance at Visual Edge IT, emphasized the need for incremental updates and extensive pre-deployment testing in sandbox environments to prevent such widespread disruptions. Nicholas Reese, a former Department of Homeland Security official, pointed out the systemic issues in enterprise IT, where cybersecurity and data security are often underprioritized. He stressed that kernel-level code, like the one involved in the CrowdStrike incident, requires the highest level of scrutiny and separate processes for approval and implementation.

As businesses reassess their cybersecurity strategies, Javad Abed, an assistant professor of information systems at Johns Hopkins Carey Business School, urged companies to view cybersecurity as an essential investment rather than a mere cost, advocating for built-in redundancies to prevent single points of failure from causing extensive damage.

Analysts Adjust Ratings and Price Targets Amid Recent Disruptions

- Baird analyst Shrenik Kothari maintained an Outperform rating but lowered the price target from $350 to $335.

- HSBC analyst Stephen Bersey downgraded from Buy to Hold and the price target from $388 to $302.

- Morgan Stanley analyst Hamza Fodderwala maintained an Overweight rating yet lowered the price target from $422 to $396.

- Scotiabank analyst Patrick Colville downgraded from Sector Outperform to Sector Perform and the price target from $393 to $300.

- RBC Capital analyst Matthew Hedberg maintained an Outperform rating however downgraded the price target from $420 to $380.

- Wells Fargo analyst Andrew Nowinski kept an Overweight rating and lowered the price target from $435 to $350.

- Canaccord Genuity analyst Kingsley Crane maintained a Buy rating and a $405 price target.

- Piper Sandler analyst Rob Owens maintained a Neutral rating and lowered the price target from $400 to $310.

- BTIG analyst Gray Powell downgraded from Buy to Neutral.

Which Analyst has the best track record to show on CRWD?

Analyst Peter Levine (EVERCORE) currently has the highest performing score on CRWD with 5/6 (83.33%) price target fulfillment ratio. His price targets carry an average of $45.04 (14.77%) potential upside. Crowdstrike Holdings stock price reaches these price targets on average within 222 days.

Autoliv Misses Q2 Estimates but Maintains 2024 Guidance Amid Global Light Vehicle Production Decline

Autoliv reported its financial results for the second quarter of 2024, revealing earnings per share of $1.87, which fell short of analyst expectations by $0.35. Revenue for the quarter totaled $2.61 billion, missing the consensus estimate of $2.74 billion.

Autoliv achieved an adjusted operating income of $221 million, marking a 4% increase from the previous year. Autoliv’s adjusted operating margin increased to 8.5%, reflecting a 50 basis point improvement year-over-year.

Looking ahead, Autoliv’s guidance for 2024 reflects a cautious outlook due to anticipated global light vehicle production declines of around 3%. Autoliv expects organic sales growth of approximately 2%, supported by targeted cost compensation effects and reduced call-off volatility. Profitability is projected to improve in the second half of the year, with an anticipated adjusted operating margin of 11% to 12%.

Analyst Ratings: Q2 Earnings Impact and Price Target Revisions

- Evercore ISI Group analyst Chris McNally maintained an Outperform rating yet lowered the price target from $150 to $140.

- Citigroup analyst Itay Michaeli maintained a Neutral rating and lowered the price target from $119 to $108.

- Wells Fargo analyst Colin Langan reiterated an Equal-Weight rating and downgraded the price target from $122 to $103.

- Barclays analyst Dan Levy maintained an Equal-Weight rating and lowered the price target from $125 to $115.

- BofA Securities analyst Michael Jacks kept a Buy rating but lowered the price target from $145 to $133.

- Baird analyst Luke Junk kept a Neutral rating and lowered the price target from $128 to $111.

Which Analyst has the best track record to show on ALV?

Analyst Ryan Brinkman (JPMORGAN) currently has the highest performing score on ALV with 5/5 (100%) price target fulfillment ratio. His price targets carry an average of $12.35 (10.59%) potential upside. Autoliv stock price reaches these price targets on average within 32 days.

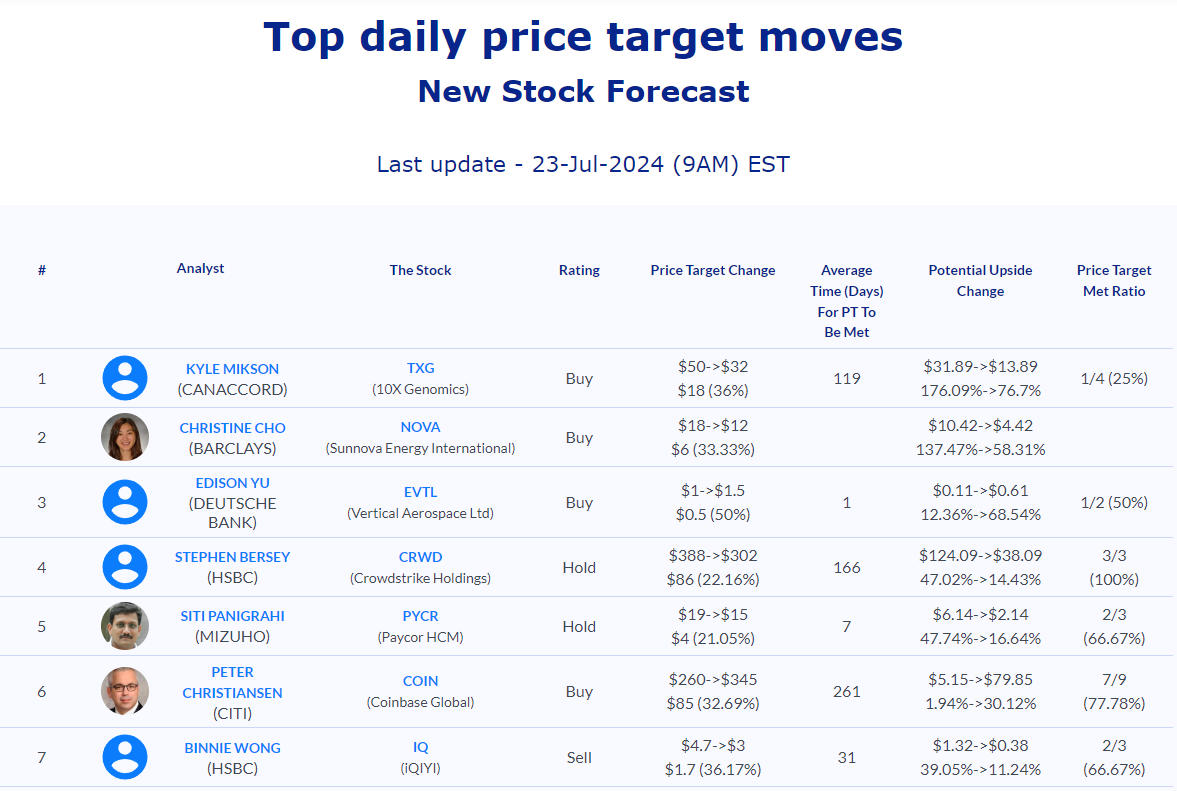

Daily stock Analysts Top Price Moves Snapshot