Selected stock price target news of the day - July 27, 2023

By: Matthew Otto

Meta Platforms Beats Q2 Expectations, Announces Plans for AI and Metaverse Expansion

Meta Platforms reported second-quarter results, with revenue up 11% to $32 billion and profits at $2.98 per share, both exceeding Wall Street predictions. The company also provided revenue guidance for Q3, which surpassed analyst estimates. CEO Mark Zuckerberg announced plans for new AI products and expressed optimism about Threads, Meta’s Twitter competitor, and Reels, the TikTok competitor.

The firm reported an increase in active users, with “daily active people” reaching 3.07 billion and Facebook daily active users hitting 2.06 billion. Despite this, the headcount has decreased by 14% in comparison to last year, due to recent layoff announcements.

Ad impressions across Meta’s family of apps rose by 34%, although the average price per ad decreased by 16%. In the Family of Apps segment, revenue increased by 12% to $31.7 billion, while in the Reality Labs segment, which focuses on VR and metaverse projects, revenue fell 39% to $276 million.

For 2023, Meta expects total expenses to range between $88 billion and $91 billion, an increase from previous projections due to legal expenses. It also anticipates capital expenditures to be between $27 billion and $30 billion, a decrease from previous estimates.

Meta plans to increase capital spending in 2024, focusing on investments in data centers and servers to support AI-related work. The company expects operating losses in the Reality Labs segment to rise in 2023 and again in 2024 due to product development efforts in augmented and virtual reality.

Wall Street Analysts Adjusts Higher on Meta’s Initiatives

- Oppenheimer’s Jason Helfstein retains Outperform rating, adjusts price target from $350 to $385.

- UBS’s Lloyd Walmsley continues with Buy rating, boosts price target from $335 to $400.

- Brian Nowak from Morgan Stanley upholds Overweight rating, elevates price target from $350 to $375.

- Goldman Sachs’s Eric Sheridan persists with Buy rating, revises price target from $335 to $384.

- Credit Suisse’s Stephen Ju maintains Outperform stance, enhances price target from $361 to $407.

- JMP Securities’ Andrew Boone sustains Market Outperform rating, increases price target from $350 to $380.

- Ronald Josey from Citigroup sticks with Buy recommendation, amends price target from $360 to $385.

- Ross Sandler from Barclays holds Overweight rating, advances price target from $320 to $410.

- Needham’s Laura Martin reiterates Underperform rating.

- Ken Gawrelski from Wells Fargo upgrades Meta Platforms from Equal-Weight to Overweight, escalates price target from $313 to $389.

- Deepak Mathivanan from Wolfe Research revises the price target upward to $390.

- RBC Capital’s Brad Erickson adjusts the price target to $400.

- Youssef Squali from Truist Securities elevates the price target to $390.

Analyst Daniel Salmon (BMO) has currently the highest performing score on META with 21/24 (87.5%) price target fulfillment ratio. His price targets carry on average an $20.42 (8.97%) potential upside. META Platforms stock price reaches these price targets on average within 81 days.

Union Pacific Misses on Earnings and Revenue, Changes Management

Union Pacific Corporation reported its Q2 2023 results, indicating some challenges amid the changing business environment. The company’s earnings per diluted share stood at $2.57 which is $0.17 worse than the analyst estimate of $2.7. Operating revenue also decreased by 5%, while the reportable derailment rate showed an improvement of 9%.

Revenue for the quarter came in at $6 billion versus the consensus estimate of $6.12 billion.

The company’s net income for the second quarter was $1.6 billion, lower than the Q2 2022 net income of $1.8 billion. Union Pacific’s CEO, Lance Fritz, attributed the results to softening consumer markets, inflation, a one-off labor expense, and increased workforce levels. Despite these challenges,

In terms of financial results, the operating revenue of $6 billion versus the consensus estimate of $6.12 billion. Revenue was driven by reduced fuel surcharge revenue, lower volumes, and an unfavorable business mix. However, this was somewhat offset by core pricing gains. Business volumes, as measured by total revenue carloads, were down 2%. The operating ratio experienced a 280 basis points increase to 63.0%. Operating income declined 12% to $2.2 billion. The company also reported a repurchase of 600,000 shares in Q2 2023, costing an aggregate of $120 million.

Union Pacific’s operating performance showed mixed results. Quarterly freight car velocity saw an 8% improvement to 202 daily miles per car, and locomotive productivity improved by 2%. However, the average maximum train length declined slightly, and workforce productivity decreased 5%. There was a minor deterioration in the fuel consumption rate, but notably, the first half reportable derailment rate showed a significant improvement, dropping 9% to 2.45 per million train miles.

Management Change Ahead of Turbulent Times

Looking forward, the company expects a challenging demand and cost environment to pressure the 2023 outlook, with consumer-related volumes likely driving full year volume expectations below Industrial Production. Union Pacific plans a capital allocation of $3.6 billion for 2023, while maintaining a dividend of $1.30 per quarter, with no further share repurchases planned for the year.

The company also announced leadership changes, appointing Jim Vena as CEO, Beth Whited as president, and electing Mike McCarthy as chairman. Two new independent directors, Doyle Simons and John Wiehoff, have also been appointed to the Board.

Wall Street Analysts Reacts Positively to New Leadership

- JP Morgan’s analyst Brian Ossenbeck upholds a Neutral rating and lifts the price target from $208 to $254.

- Mark Levin of Benchmark continues with a Buy rating and escalates the price target from $230 to $264.

- BMO Capital’s Fadi Chamoun sustains an Outperform rating and advances the price target from $240 to $270.

- Ariel Rosa from Credit Suisse persists with an Outperform rating and hikes the price target from $235 to $262.

- Citigroup’s Christian Wetherbee sticks with a Buy rating and enhances the price target from $235 to $270.

- Brandon Oglenski from Barclays retains an Overweight rating and boosts the price target from $230 to $285.

- Raymond James’ Patrick Tyler Brown preserves a Strong Buy rating and lifts the price target from $230 to $270.

- Oliver Holmes of Atlantic Equities downgrades Union Pacific from Overweight to Neutral and sets a new price target at $244.

- Wolfe Research’s Scott Group elevates the price target to $275.

- Bascome Majors from Susquehanna raises the price target to $240.

- Justin Long at Stephens revises the price target upward to $257.

- Jason Seidl from TD Cowen keeps an Outperform rating and increases the price target from $210 to $240.

Analyst Ravi Shanker (MORGAN STANLEY) has currently the highest performing score on UNP with 24/33 (72.73%) price target fulfillment ratio. His price targets carry on average an $-10.11 (-3.18%) potential downside. Union Pacific stock price reaches these price targets on average within 151 days.

ServiceNow Q2 2023 Earnings Surpass Expectations, Driven by Demand for AI Innovations

ServiceNow has reported its financial results for Q2 2023, exceeding guidance across all top-line growth and profitability metrics, which has prompted the company to raise its 2023 subscription revenues and operating margin guidance. Subscription revenues hit $2,075 million in Q2 2023, marking a 25% YoY growth, while total revenues amounted to $2,150 million, a 23% YoY growth. Current remaining performance obligations totaled $7.20 billion, a 25% YoY increase. The company concluded the quarter with 70 transactions over $1 million in net new ACV, a 30% YoY increase, and 45 customers with more than $20 million in ACV, a 55% YoY increase.

ServiceNow’s Chairman and CEO, Bill McDermott, attributes these supercharged results to unprecedented demand for the company’s organic innovation, particularly in the context of the AI world, which he claims is enabling substantial productivity increases. ServiceNow’s Q2 performance has also been bolstered by a range of new solutions that embed generative AI across the Now Platform, and partnerships with industry leaders like NVIDIA and Accenture to implement new generative AI use cases.

In the second quarter, the company also announced an expanded partnership with KPMG to reimagine finance, supply chain, and procurement operations, along with a partnership with Cognizant to accelerate the adoption of AI-driven automation across various industries. The company was recently named to the Fortune 500 list and recognized as a Visionary in the 2023 Gartner® Magic Quadrant for Application Performance Monitoring (APM) and Observability.

ServiceNow’s Q3 subscription revenue is forecasted to be in the range of $2.19 billion to $2.20 billion, exceeding analysts’ average expectation of $2.15 billion. The company also reported an adjusted earning of $2.37 per share for Q2 2023, surpassing the profit estimate of $2.05 per share.

Financial Analysts Adjust Price Targets on ServiceNow

- Analyst John Difucci from Guggenheim confirms a Buy rating for ServiceNow, maintaining the price target at $657.

- Mark Murphy from JP Morgan retains an Overweight rating for ServiceNow, and raises the price target from $600 to $620.

- Brian Schwartz, an analyst from Oppenheimer, reaffirms an Outperform rating, keeping the price target at $640.

- Keith Bachman from BMO Capital sustains an Outperform rating for ServiceNow, and increases the price target from $515 to $630.

- Michael Turrin, an analyst from Wells Fargo, maintains an Overweight rating, and boosts the price target from $625 to $650.

- Raimo Lenschow from Barclays continues with an Overweight rating, but slightly reduces the price target from $646 to $644.

- Samad Samana from Jefferies holds a Buy rating, and uplifts the price target from $525 to $650.

- Jackson Ader, an analyst from MoffettNathanson, keeps an Outperform rating, and hikes the price target from $549 to $600.

- Jack Andrews from Needham reiterates a Buy rating, holding steady on the price target at $660.

- Alex Zukin from Wolfe Research, Rob Oliver from Baird, Karl Keirstead from UBS, Matthew Hedberg from RBC Capital, and Richard Davis from Canaccord Genuity, also increase their price targets to $670, $650, $650, $665, and $625, respectively.

Analyst Gregg Moskowitz (MIZUHO) has currently the highest performing score on NOW with 25/27 (92.59%) price target fulfillment ratio. His price targets carry on average an $47.97 (10.88%) potential upside. ServiceNow stock price reaches these price targets on average within 85 days

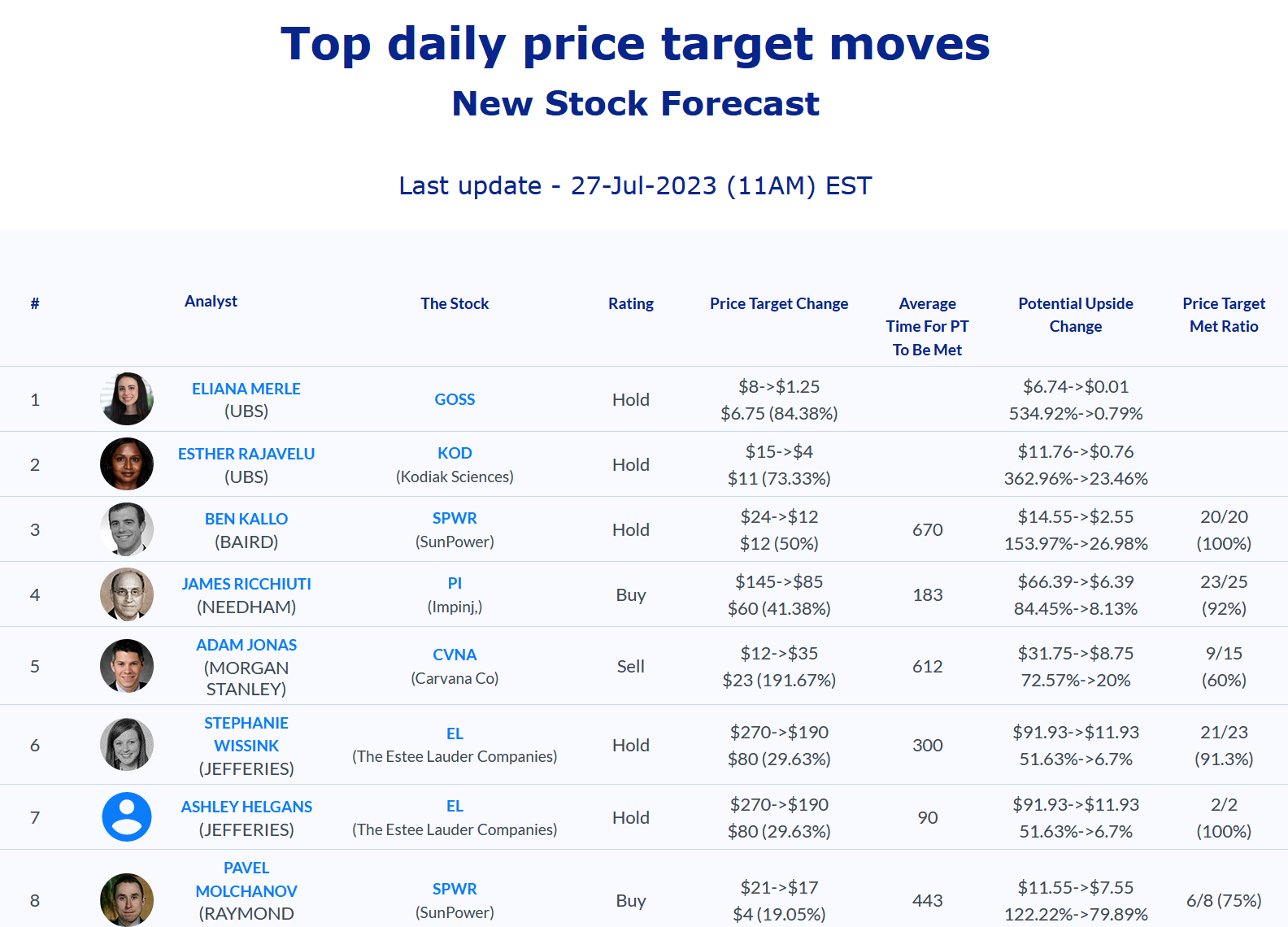

Daily stock Analysts Top Price Moves Snapshot