Selected stock price target news of the day - July 2nd, 2024

By: Matthew Otto

Anticipation Builds as Tesla Prepares to Report Q2 Deliveries

Tesla is set to report its second-quarter delivery numbers, traditionally Tesla announces global delivery figures on the second day of a new quarter. Current Wall Street estimates suggest Tesla will deliver approximately 420,000 vehicles for the quarter. A decrease from the 466,000 units delivered in the same period last year.

Guggenheim analyst Ronald Jewsikow noted in a report that deliveries are likely tracking ahead of both their estimate and broader investor expectations. Which are around 425,000 units, based on recent data from Europe.

Investors are hopeful that deliveries exceeding 420,000 units will be viewed positively, even though expectations have been increasing. The second-quarter earnings report for Tesla will be closely watched, as it has historically caused significant movements in the stock. Past quarterly reports have shown an average fluctuation of 11% following the earnings announcement.

Analysts Weigh In Ahead of Q2 Delivery Report

- Cantor Fitzgerald analyst Andres Sheppard reiterateed an Overweight rating and a $230 price target for Tesla.

- Wells Fargo analyst Colin Langan maintained an Underweight rating and a $120 price target for Tesla.

Which Analyst has the best track record to show on TSLA?

Analyst Chris Mcnally (EVERCORE) currently has the highest performing score on TSLA with 4/5 (80%) price target fulfillment ratio. His price targets carry an average of $-23.29 (-13.84%) potential downside. Tesla stock price reaches these price targets on average within 35 days.

French Antitrust Charges Loom for Nvidia Amid AI Dominance Scrutiny

Nvidia finds itself at the center of an escalating antitrust challenge, as the French regulator prepares to formally charge them for alleged anticompetitive practices in the AI chip market. According to Reuters sources, this marks Nvidia’s first antitrust challenge in the AI era, potentially impacting its market dominance.

The regulator’s concerns center on the risk of abuses within the chip sector, including potential issues like price fixing and unfair contractual conditions. While Nvidia has not been directly accused, its influence in AI chip technology, buoyed by its CUDA programming software, has drawn regulatory scrutiny. Despite these challenges, Nvidia maintains a position with a significant market share in AI chips, bolstered by key partnerships with industry giants such as Microsoft and Amazon.com.

Moreover, Nvidia’s strategic investments, including its support for CoreWeave in cloud-based GPU services, highlight efforts to diversify the AI ecosystem. This initiative not only fosters innovation among startups but also provides alternatives in the cloud-computing market, potentially easing concerns about monopolistic practices.

With potential fines up to 10% of global annual turnover looming, Nvidia faces a pivotal period navigating regulatory landscapes on both sides of the Atlantic, amidst broader scrutiny into Big Tech practices by the U.S. Department of Justice and Federal Trade Commission. As the situation unfolds, Nvidia’s response and the outcome of these investigations will be critical in shaping its future in the competitive AI chip market.

Analyst Upgrades Amid Regulatory Challenges and Market Optimism

- Morgan Stanley analyst Joseph Moore maintained an Overweight rating and raised the price target from $116 to $144.

- Truist Securities analyst William Stein reiterated a Buy rating and upgraded the price target from $128.8 to $140.

Which Analyst has the best track record to show on NVDA?

Analyst C J Muse (CANTOR FITZGERALD) currently has the highest performing score on NVDA with 12/14 (85.71%) price target fulfillment ratio. His price targets carry an average of $48.6 (38.45%) potential upside. Nvidia stock price reaches these price targets on average within 111 days.

Amazon Expands Payment Options in Italy Through Partnership with Nexi and BANCOMAT

Amazon’s Italian operations are set to expand their payment options following a strategic partnership with Nexi, a leading player in Italy’s payments sector. The collaboration will enable Amazon’s customers in Italy to utilize BANCOMAT Pay, a local debit card service facilitated by Italy’s ATM network operator BANCOMAT.

This initiative aims to enhance the convenience of online shopping by integrating a widely used payment method into Amazon’s platform. BANCOMAT, supported by a recent investment from Italian private equity firm FSI, manages approximately 2 billion transactions annually worth over $186 billion. Predominantly through its extensive network of 34 million debit cards used primarily for ATM withdrawals.

Filippo Signoretti, Director of Nexi Merchant Solutions Italy, highlighted the strategic fit between Nexi’s domestic presence and Amazon’s global stature. This partnership underscores the synergy between local market expertise and international scalability. FSI’s investment in BANCOMAT, alongside partnerships with major Italian banks like Intesa Sanpaolo and UniCredit, underscores Italy’s evolving payments landscape. This will position Amazon to capitalize on future opportunities in the dynamic digital payments sector.

Analysts Remain Bullish with Revised Price Targets

- Needham analyst Laura Martin has reiterated a Buy rating and a price target of $205.

- Wells Fargo analyst Ken Gawrelski maintained an Overweight rating and raised the price target from $234 to $239.

Which Analyst has the best track record to show on AMZN?

Analyst Barton Crockett (ROSENBLATT) currently has the highest performing score on AMZN with 9/10 (90%) price target fulfillment ratio. His price targets carry an average of $41 (22.91%) potential upside. Amazon.com stock price reaches these price targets on average within 133 days.

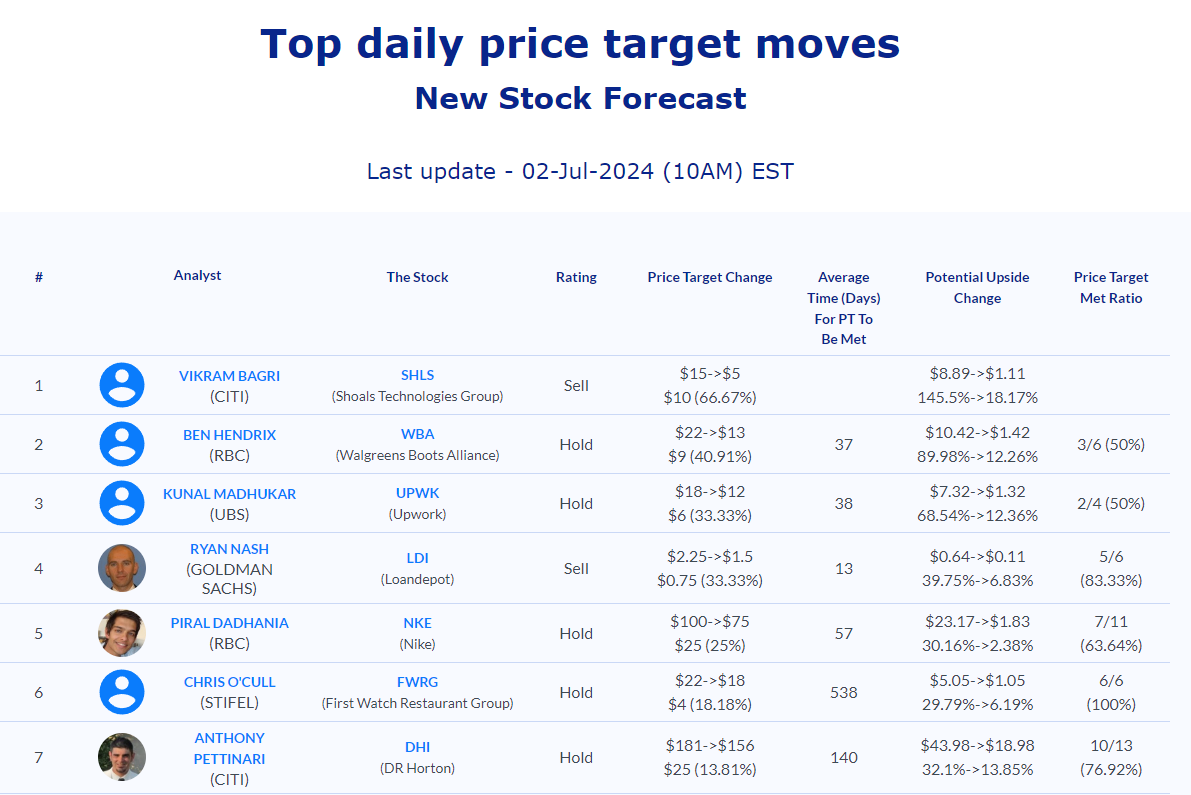

Daily stock Analysts Top Price Moves Snapshot