Selected stock price target news of the day - July 3rd, 2025

By: Matthew Otto

FranklinCovey Misses Q3 Estimates, Revises FY2025 Guidance Amid Enterprise Transition

Franklin Covey reported fiscal third-quarter 2025 revenue of $67.1 million, falling short of the consensus estimate of $77.39 million and down from $73.4 million in the same quarter last year. It also posted a net loss of $1.4 million, or $(0.11) per share, compared to analyst expectations of $0.32 in earnings per share—a miss of $0.43.

Adjusted EBITDA totaled $7.3 million, exceeding internal guidance but down from $13.9 million in Q3 FY2024. Enterprise Division revenue declined to $47.3 million, impacted by a $3.5 million decrease in North America and $1 million drop in international direct offices, while Education Division revenue fell to $18.6 million from $20.2 million.

Consolidated subscription and services revenue reached $57.7 million, with deferred subscription revenue up 7% year-over-year to $89.3 million. Unbilled deferred revenue totaled $62 million, down from $69.4 million a year ago.

Franklin Covey maintained liquidity with $33.7 million in cash and no borrowings on its $62.5 million credit facility. Operating cash flow for the first three quarters of FY2025 was $19 million, with free cash flow at $10.6 million, both below prior-year levels.

During the third quarter, FranklinCovey repurchased 372,000 shares for $8.3 million, bringing total fiscal year repurchases to $23 million. Management updated its full-year FY2025 guidance, projecting revenue between $265 million and $275 million, aligning with previous internal estimates but below consensus expectations. Adjusted EBITDA is now expected in the range of $28 million to $33 million.

The company anticipates stronger financial performance in FY2026, driven by recent restructuring actions and continued emphasis on multi-year contracts, which made up 62% of subscription revenue at quarter-end.

Analyst Reiterates Rating and Price Target Despite Q3 Miss

- Barrington Research analyst Alexander Paris maintained an Outperform and a $35 price target.

Which Analyst has the best track record to show on FC?

Analyst Alexander Paris (BARRINGTON) currently has the highest performing score on FC with 10/27 (37.04%) price target fulfillment ratio. His price targets carry an average of $15.36 (78.21%) potential upside. Franklin Covey stock price reaches these price targets on average within 290 days.

Constellation Brands Misses Q1 Expectations Amid Tariff Pressures and Sluggish Beer Demand

For the quarter ended May 31, 2025, Constellation Brands posted adjusted earnings per share (EPS) of $3.22, missing the consensus estimate of $3.29 by $0.07, according to data compiled by LSEG. Revenue totaled $2.52 billion, also below the projected $2.56 billion, and down 5.8% from the year-ago period.

Constellation’s beer segment, which accounts for roughly 80% of total revenue, continues to face challenges tied to shifting consumer behavior and increased costs. Quarterly beer depletion volume declined 2.6%, while shipment volume fell 3.3%, driven by softer demand across brands such as Modelo Especial and Corona Extra. Operating margin in the beer business dropped 150 basis points to 39.1%, affected by higher aluminum tariff-related expenses and marketing costs.

Constellation continues to project comparable EPS in the range of $12.6 to $12.9, in line with the consensus estimate of $12.65. It updated its reported EPS outlook to $12.07–$12.37. Management also reiterated its expectations for full-year operating cash flow between $2.7 billion and $2.8 billion and free cash flow of $1.5 billion to $1.6 billion.

Analysts Lift Targets While Maintaining Ratings Despite Q1 Shortfall

- JP Morgan analyst Andrea Teixeira maintained a Neutral rating while increasing the price target from $170 to $182.

- Needham analyst Gerald Pascarelli reiterated a Buy rating and raised the price target from $195 to $200.

- RBC Capital analyst Nik Modi kept an Outperform rating and a $233 price target.

Which Analyst has the best track record to show on STZ?

Analyst Bill Kirk (MKM) currently has the highest performing score on STZ with 10/21 (47.62%) price target fulfillment ratio. His price targets carry an average of $74.51 (41.05%) potential upside. Constellation Brands stock price reaches these price targets on average within 625 days.

Warner Music and Bain Capital Launch Joint Venture to Acquire Music Catalogs

Warner Music Group has entered into a $1.2 billion joint venture with Bain Capital to acquire music catalogs across recorded music and publishing, the companies announced on Tuesday.

According to company disclosures, Warner Music may benefit from a more diversified rights portfolio, potentially supporting recurring income through royalties, licensing, and streaming. The company has seen steady growth in digital revenues—streaming accounted for 66% of its total revenue in fiscal 2024, according to its annual report.

In a separate development, the Financial Times, which cited unnamed sources familiar with the matter, reported that Warner Music is currently in negotiations to acquire the Red Hot Chili Peppers’ catalog for over $300 million. Although Warner and Bain declined to comment, Billboard reported earlier this year that the band’s recorded masters could command as much as $350 million. Should the deal proceed, it would add a globally recognized rock catalog to Warner’s portfolio, complementing a lineup that already includes artists like Ed Sheeran, Bruno Mars, and Dua Lipa.

This potential acquisition, combined with the Bain partnership, indicates Warner’s stated strategy to expand its catalog footprint, in line with broader industry trends. The trend has also seen competitors such as Sony Music and Universal Music engage in multi-hundred-million-dollar acquisitions.

Analyst Reiterates Rating, Raises Price Target Amid Expansion Strategy

- Bernstein analyst Ian Moore maintained an Outperform rating and raised the price target from $32 to $34.

Which Analyst has the best track record to show on WMG?

Analyst Kannan Venkateshwar (BARCLAYS) currently has the highest performing score on WMG with 12/16 (75%) price target fulfillment ratio. His price targets carry an average of $0.64 (2.34%) potential upside. Warner Music Group stock price reaches these price targets on average within 92 days.

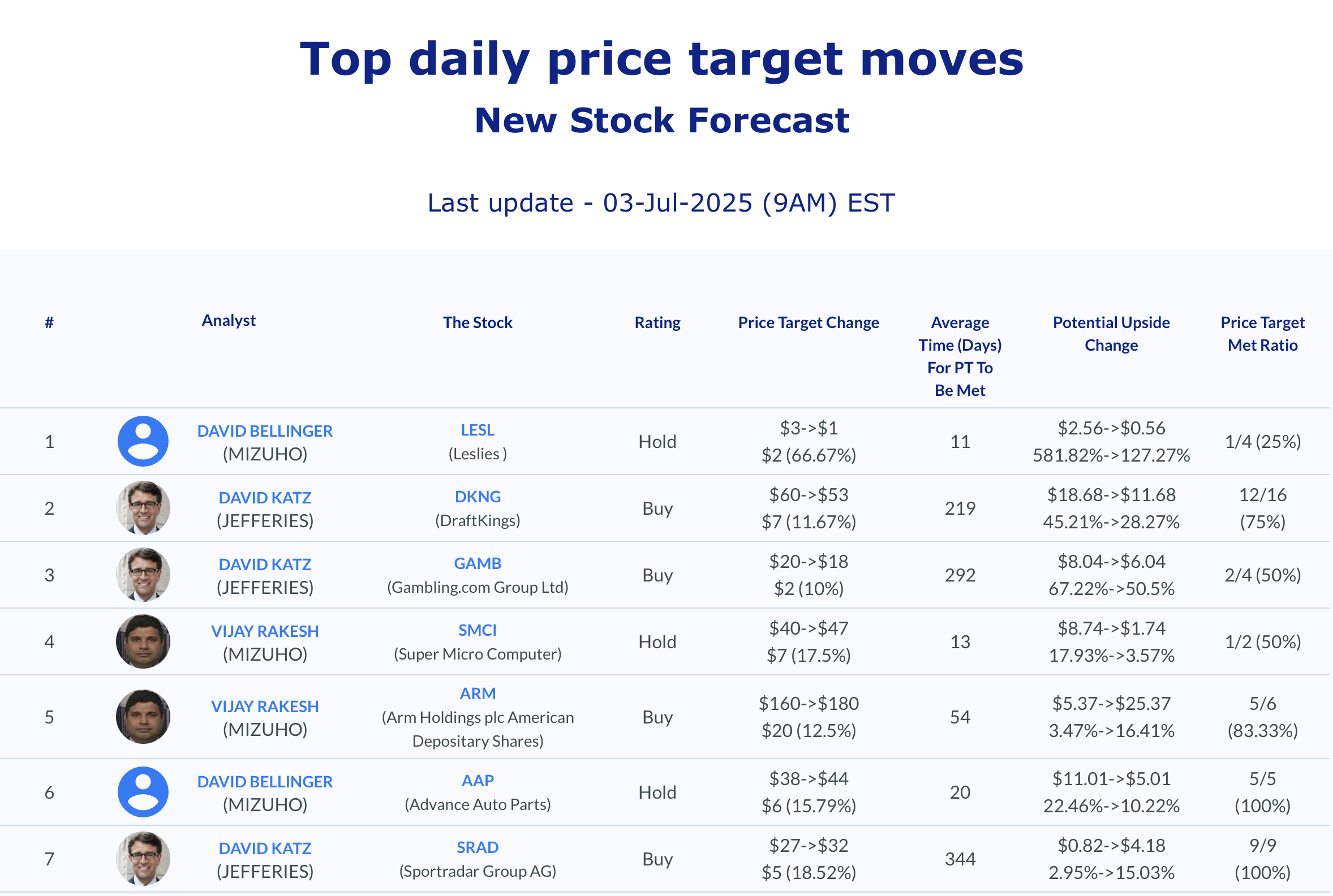

Daily stock Analysts Top Price Moves Snapshot