Selected stock price target news of the day - June 30, 2023

By: Matthew Otto

Nike Beats on Revenue; Earnings and Q1 Guidance Fall Short

Nike’s fiscal fourth-quarter results released show that the company has beaten revenue estimates but fallen short on earnings per share and issued first-quarter guidance that failed to meet expectations.

Nike reported revenue of $12.8 billion for its fiscal fourth quarter, ahead of estimates for $12.58 billion. However, it missed earnings per share predictions, coming in at 66 cents a share, lower than the expected 68 cents a share.

The company’s gross margins also took a hit, dropping 1.4 percentage points to 43.6% due to higher input costs and ongoing discounting to move excess inventory. Despite this, Nike returned about $1.9 billion to shareholders in the fourth quarter in the form of dividends and share repurchases.

Looking to the future, Nike forecasts that first-quarter revenue will either remain flat or grow by low-single digit percentage points, which is lower than Wall Street’s estimates for 6% growth. For fiscal 2024, Nike projects that its revenue will grow by mid-single digit percentages, in line with current analyst estimates.

Despite the concerns, the company remains confident in its ability to drive sustainable long-term growth, especially in China. Nike’s CFO, Matthew Friend, highlighted strong consumer momentum, a robust product innovation pipeline, healthy inventory, and a normalized flow of supply as advantages entering the new year. However, the company is also closely monitoring the macro environment, consumer behavior, and retail trends.

For the full fiscal year 2023, Nike’s reported revenues were $51.2 billion, up 10 percent compared to the prior year, and up 16 percent on a currency-neutral basis. Net income for the year was $5.1 billion, down 16 percent, and diluted earnings per share were $3.23, down 14 percent compared to the prior year.

Analysts Maintain Optimistic Outlook on Nike Despite Earnings Miss and Lowered Guidance

- Wedbush analyst Tom Nikic maintains an Outperform rating and has raised the price target from $129 to $131.

- Raymond James analyst Rick Patel also continues with an Outperform rating, but lowered the price target from $135 to $128.

- Telsey Advisory Group analyst Joseph Feldman reiterated an Outperform rating and maintains a $135 price target.

- Morgan Stanley analyst Alex Kurtz remains positive with an Overweight rating, but lowered the price target from $130 to $127.

- RBC Capital analyst Piral Dadhania continues with an Outperform rating but lowered the price target from $138 to $134.

- Jefferies analyst Randal Konik, while maintaining a Buy rating, lowered the price target significantly from $160 to $140.

Analyst Rick Patel (RAYMOND JAMES) has currently the highest performing score on NKE with 14/16 (87.5%) price target fulfillment ratio. His price targets carry on average an$12.78 (13.12%) potential upside and are fulfilled within average of 119 days.

Accolade Exceeds Q1 2024 Revenue Estimates, Raises Full-Year Guidance

Accolade announced financial results for the fiscal first quarter ended May 31, 2023, exceeding both its top and bottom line guidance. The firm reported revenues of $93.2 million, a 9% increase from $85.5 million in the corresponding quarter of the previous year and above the consensus estimate of $90.27 million.

The company reported a net loss of $38.4 million, which was a substantial improvement from a loss of $342.8 million in the same quarter of the previous year, largely due to a non-cash goodwill impairment charge that was recorded last year. The reported Q1 EPS of -$0.52 was $0.10 better than the analyst estimate of -$0.62.

Accolade’s non-GAAP financial data demonstrated growth as well, with Adjusted EBITDA improving by 18% to -$12.6 million, compared to -$15.4 million in the first quarter of the prior fiscal year. Adjusted Gross Profit also grew slightly, from $39 million in Q1 2022 to $40.6 million this quarter.

Accolade has raised its revenue and Adjusted EBITDA guidance for the fiscal year. For the fiscal second quarter ending August 31, 2023, the company expects revenue to be between $93 million and $95 million, which aligns with the consensus estimate of $93 million. For the fiscal year ending February 29, 2024, Accolade projects revenue to range between $410 million and $414 million, with the lower end of this range aligning with the consensus estimate of $410 million. The company has not provided a specific guidance for net loss.

Wall Street Action

- tifel’s analyst David Grossman maintains a Buy rating, raising the price target from $15 to $17.

- Morgan Stanley’s Ricky Goldwasser reiterates an Equal-Weight rating, keeping the price target at $14.

- Stan Berenshteyn from Wells Fargo maintains an Equal-Weight rating, while increasing the price target from $13 to $14.

- Credit Suisse’s Jonathan Yong holds a Neutral position, adjusting the price target upward from $13 to $15.

- Needham & Company’s Ryan MacDonald raises the price target from $15 to $17, holding the Buy rating.

Analyst Ricky Goldwasser (MORGAN STANLEY) has currently the highest performing score on ACCD with 4/10 (40%) price target fulfillment ratio. Her price targets carry on average an $7.07 (26.83%) potential upside and are fulfilled within average of 31 days.

FDA Grants Approval to BioMarin’s Roctavian

The U.S. Food and Drug Administration (FDA) has granted approval to Roctavian,

The treatment was developed by BioMarin Pharmaceutical. Roctavian, a one-time therapy, uses a viral vector to carry a gene for clotting Factor VIII, reducing the risk of uncontrolled bleeding. A cohort of 112 patients showed decreased annualized bleeding rates from 5.4 bleeds per year at baseline to 2.6 bleeds per year after Roctavian treatment.

A companion diagnostic test, the AAV5 DetectCDx, was also approved to identify eligible patients for the gene therapy. The test, developed by ARUP Laboratories, has been shown to accurately detect pre-existing anti-AAV5 antibodies that could reduce the effectiveness of the gene therapy.

The CDC estimates about 10 in 100,000 people have hemophilia A

Wall Street Adjust on Biomarin

- Citigroup analyst David Lebowitz maintains a Neutral stance Pharmaceutical and lowers the price target from $103 to $96.

- Baird analyst Joel Beatty reiterates an Outperform rating Pharmaceutical and maintains a $127 price target.

- Wedbush analyst Andreas Argyrides maintains a Neutral stance Pharmaceutical, but raises the price target from $69 to $73.

Analyst Joseph Schwartz (LEERINK) has currently the highest performing score on BMRN with 17/25 (68%) price target fulfillment ratio. His price targets carry on average an $34.03 (42.37%) potential upside and are fulfilled within an average of 883 days.

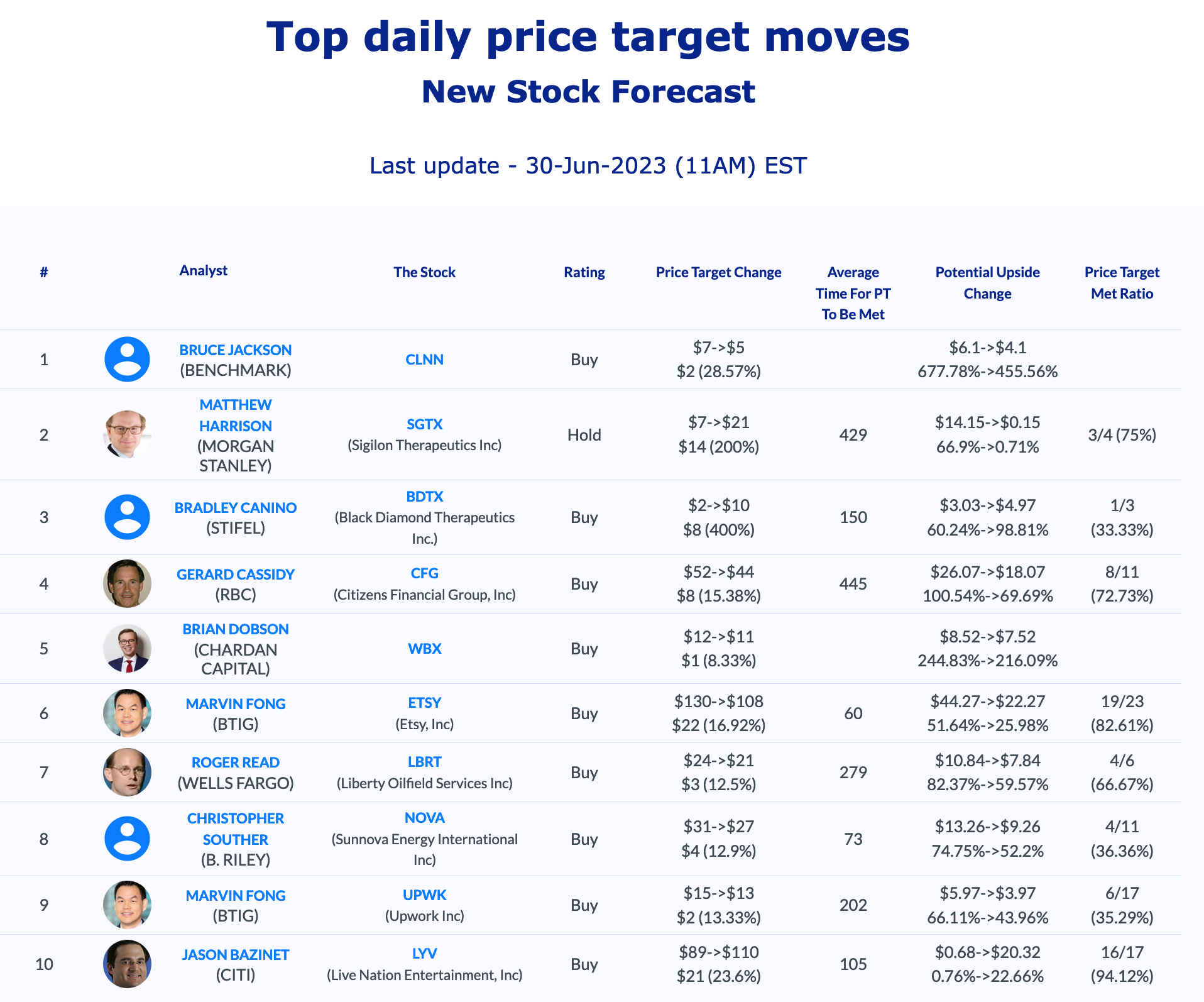

Daily stock Analysts Top Price Moves Snapshot