Selected stock price target news of the day - June 3rd, 2025

By: Matthew Otto

Applied Digital Signs 15-Year Lease Deal CoreWeave for AI Data Center Capacity

Applied Digital has signed two lease agreements with CoreWeave totaling 250 megawatts (MW) of critical IT load over approximately 15 years, with expected revenue of about $7 billion. The leases cover two buildings at Applied Digital’s Ellendale, North Dakota campus: one 100 MW facility scheduled to be operational in Q4 2025 and a second 150 MW facility expected to come online in mid-2026.

The agreements include fixed pricing with annual escalators and are not dependent on actual project costs. CoreWeave retains an option for a third 150 MW facility, currently in planning and anticipated for 2027, which would bring the total potential leased capacity to 400 MW.

Ellendale is designed for up to 1 gigawatt (GW) of power capacity, with more than 1 GW currently undergoing various stages of load study. The site is engineered for high-density compute loads and intended to support AI and high-performance computing (HPC) workloads.

Analysts Raise Price Targets Following CoreWeave Deal

- HC Wainwright & Co. analyst Kevin Dede maintained a Buy rating and lifted the price target from $7 to $12.

- Needham analyst John Todaro reiterated a Buy rating and raised the price target from $10 to $12.

- Citizens JMP analyst Greg Miller increased the price target from $12 to $18.

Which Analyst has the best track record to show on APLD?

Analyst Kevin Dede (HC WAINWRIGHT) currently has the highest performing score on APLD with 6/12 (50%) price target fulfillment ratio. His price targets carry an average of $3.56 (103.49%) potential upside. Applied Digital stock price reaches these price targets on average within 45 days.

Credo Reports Q4 and Full-Year 2025 Results Driven by Demand for High-Speed Connectivity

Credo Technology Group Holding reported fourth quarter results for fiscal year 2025, with earnings per share of $0.35, $0.08 above the analyst consensus of $0.27. Quarterly revenue reached $170 million, exceeding the consensus estimate of $159.59 million and representing a 25.9% increase from the prior quarter and a 179.7% increase year over year.

Gross margin for the quarter stood at 67.2%, while operating expenses were $80.4 million. Net income was $36.6 million, and closed the quarter with $431.3 million in cash and short-term investments.

For the full fiscal year, Credo generated $436.8 million in revenue, up 126% from the previous year, driven by accelerating demand for its high-performance, energy-efficient connectivity solutions, particularly within AI-focused hyperscale infrastructure.

Looking ahead, Credo expects first quarter fiscal 2026 revenue between $185 million and $195 million, compared to the consensus estimate of $162 million. Credo anticipates gross margin in the range of 63.4% to 65.4%, with operating expenses projected between $88.3 million and $90.3 million.

Analysts Lift Price Targets Following Q4 Results

- Barclays analyst Thomas O’Malley maintained an Overweight rating and increased the price target from $70 to $85.

- Needham analyst Quinn Bolton reiterated a Buy rating and raised the price target from $80 to $85.

- Stifel analyst Tore Svanberg lifted the price target to $80.

- Mizuho analyst Vijay Rakesh raised the price target to $81.

Which Analyst has the best track record to show on CRDO?

Analyst Richard Shannon (CRAIG HALLUM) currently has the highest performing score on CRDO with 5/5 (100%) price target fulfillment ratio. His price targets carry an average of $4.31 (6.10%) potential upside. Credo Technology Group Holding stock price reaches these price targets on average within 116 days.

UniFirst Reports Higher Earnings and Revenue Growth in Q2 2025

Campbell’s reported net sales of $2.48 billion for the third quarter ended April 27, 2025, up 4% from the prior year and exceeding the consensus estimate of $2.43 billion. Organic net sales increased 1%. Adjusted EBIT rose 2% to $362 million, while reported EBIT declined 35% to $161 million due to a $150 million impairment charge.

Adjusted EPS was $0.73, beating the analyst estimate of $0.65, but down 3% year over year. Reported EPS was $0.22, down from $0.44 in the previous year. Operating cash flow year-to-date totaled $872 million, with $403 million returned to shareholders through dividends and share repurchases.

The Meals & Beverages segment net sales increased 15% to $1.46 billion, with organic growth of 6%. The Snacks segment net sales declined 8% to $1.01 billion, with organic sales down 5%. Adjusted gross margin decreased 110 basis points to 30.1%.

Full-year fiscal 2025 guidance was reaffirmed, with adjusted EPS expected between $2.95 and $3.05, below the consensus of $2.98. Campbell’s estimated tariff-related costs could reduce adjusted EPS by $0.03 to $0.05 per share.

Analyst Price Target Revisions Reflect Cautious Outlook

- Barclays analyst Andrew Lazar maintained an Underweight rating and lowered the price target from $40 to $35.

- BofA Securities analyst Peter Galbo reduced the price target from $37 to $33.

- Stifel analyst Matthew Smith cut the price target from $40 to $38.

Which Analyst has the best track record to show on CPB?

Analyst Peter Galbo (BAML) currently has the highest performing score on CPB with 3/4 (75%) price target fulfillment ratio. His price targets carry an average of $2.77 (8.09%) potential upside. Campbell’s stock price reaches these price targets on average within 143 days.

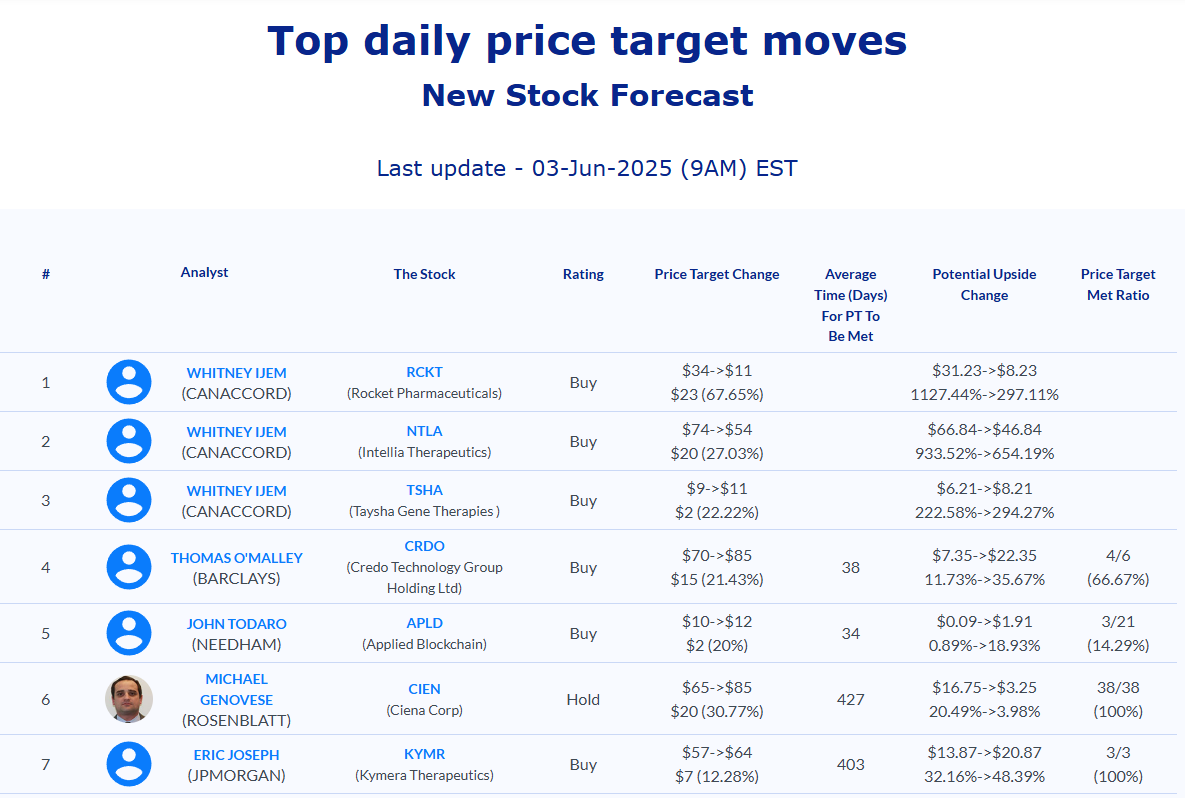

Daily stock Analysts Top Price Moves Snapshot