Selected stock price target news of the day - June 6th, 2025

By: Matthew Otto

Lululemon Tops Q1 Expectations but Trims FY2026 Outlook on Tariffs and U.S. Consumer Caution

Lululemon Athletica reported first-quarter fiscal 2025 results that surpassed analyst expectations, with diluted earnings per share of $2.6, $0.02 ahead of the $2.58 consensus and revenue of $2.4 billion, exceeding the $2.36 billion estimate. Comparable sales rose 1%, supported by a 6% gain internationally, but dragged by a 2% decline in the Americas.

Net income for the quarter was $314 million, down from $321 million a year earlier. Gross profit increased 8% to $1.4 billion, and gross margin expanded 60 basis points to 58.3%. Operating income rose 1% to $438.6 million, while operating margin declined 110 basis points to 18.5%. Lululemon ended the quarter with $1.3 billion in cash, 770 stores, and inventories up 23% year over year to $1.7 billion.

Lululemon lowered its guidance for the full year, now expecting fiscal 2026 EPS of $14.58 to $14.78, below the consensus of $14.94, and revenue of $11.15 to 11.30 billion, versus the $11.24 billion estimate.

For Q2 2026, Lululemon expects EPS between $2.85 and $2.90, well below the $3.32 consensus, and revenue of $2.535 to $2.56 billion, compared to the $2.57 billion estimate. Lululemon expects full-year gross margin to contract by approximately 110 basis points, wider than the 60 basis point reduction it previously forecast.

Analysts Lower Price Targets Following Guidance Cut

- Telsey Advisory Group analyst Dana Telsey reiterated an Outperform rating but revised the price target downward from $385 to $360.

- Needham analyst Tom Nikic maintained a Buy rating, although trimmed his price target from $366 to $317.

- UBS analyst Jay Sole reduced the price target from $330 to $290.

Which Analyst has the best track record to show on LULU?

Analyst Rick Patel (RAYMOND JAMES) currently has the highest performing score on LULU with 16/19 (84.21%) price target fulfillment ratio. His price targets carry an average of $53.34 (14.16%) potential upside. Lululemon Athletica stock price reaches these price targets on average within 147 days.

Guess? Inc. Reports First Quarter Results and Updates Fiscal 2026 Outlook

Guess? reported first quarter fiscal 2026 revenue of $648 million, reflecting a 9% year-over-year increase in U.S. dollars and 12% in constant currency. This result surpassed the consensus estimate of $630.38 million.

Guess? reported a net loss of $32.9 million, or $0.65 per share, $0.13 below analyst expectations of a $0.52 per share loss. Adjusted net loss was $22.3 million, or $0.44 per share, up from $13.8 million or $0.27 in the prior-year quarter. Operating loss rose to $33.3 million from $19.9 million, while the operating margin declined to (5.1)% from (3.4)%.

Revenues in Americas Wholesale grew sharply by 63%, while Asia revenues fell 20%. Europe and Americas Retail revenues increased by 8% and 9%, respectively, though both regions experienced declines in comparable sales.

For the second quarter of fiscal 2026, Guess? expects earnings per share between $0.11 and $0.21, below the current consensus of $0.31. For the full year, Guess? forecasts revenue growth between 5.5% and 7.4% in U.S. dollars. Full-year earnings per share are projected in the range of $1.32 to $1.64, bracketing the consensus estimate of $1.46. It also anticipates operating margins between 4.4% and 5.1% and a tariff impact of less than $10 million.

Analysts Hold Mixed Views Following Q1 Miss and Lowered Guidance

- Telsey Advisory Group analyst Dana Telsey maintained a Market Perform rating and a $13 price target.

- Small Cap Consumer Research analyst Eric Beder reiterated a Buy rating and a $23 price target.

Which Analyst has the best track record to show on GES?

Analyst Mauricio Serna (UBS) currently has the highest performing score on GES with 4/9 (44.44%) price target fulfillment ratio. His price targets carry an average of $0.9 (8.11%) potential upside. Guess? stock price reaches these price targets on average within 71 days.

Broadcom Reports Q2 FY2025 Results with Continued AI-Driven Growth

Broadcom reported second quarter revenue of $15 billion, a 20% increase from the prior year and slightly above the consensus estimate of $14.95 billion. Earnings per share came in at $1.58, exceeding analyst expectations by $0.01.

Net income for the quarter was $4.97 billion, up 134% year-over-year, with diluted earnings per share rising from $0.44 to $1.03 on a GAAP basis. Adjusted net income reached $7.79 billion, and adjusted EBITDA was $10 billion, or 67% of revenue. Semiconductor solutions generated $8.41 billion in revenue, up 17%, while infrastructure software revenue increased 25% to $6.6 billion.

Free cash flow totaled $6.41 billion, or 43% of revenue, supported by $6.56 billion in cash from operations and $144 million in capital expenditures. Broadcom returned $7 billion to shareholders through $4.22 billion in stock repurchases and $2.79 billion in dividend payments.

For the third quarter of fiscal 2025, Broadcom projects revenue of approximately $15.8 billion, slightly above the consensus estimate of $15.77 billion, with an adjusted EBITDA margin of at least 66%. Cash and cash equivalents at quarter-end were $9.47 billion.

Analysts Raise Price Targets Amid Q2 Performance

- Benchmark analyst Cody Acree maintained a Buy rating and raised the price target from $255 to $315.

- Rosenblatt analyst Hans Mosesmann increased the price target to $340.

- KeyBanc analyst John Vinh raised his price target from $275 to $315.

- Morgan Stanley analyst Joseph Moore lifted the price target from $260 to $270.

Which Analyst has the best track record to show on AVGO?

Analyst Joseph Moore (MORGAN STANLEY) currently has the highest performing score on AVGO with 6/9 (66.67%) price target fulfillment ratio. His price targets carry an average of $65.63 (33.77%) potential upside. Broadcom stock price reaches these price targets on average within 186 days.

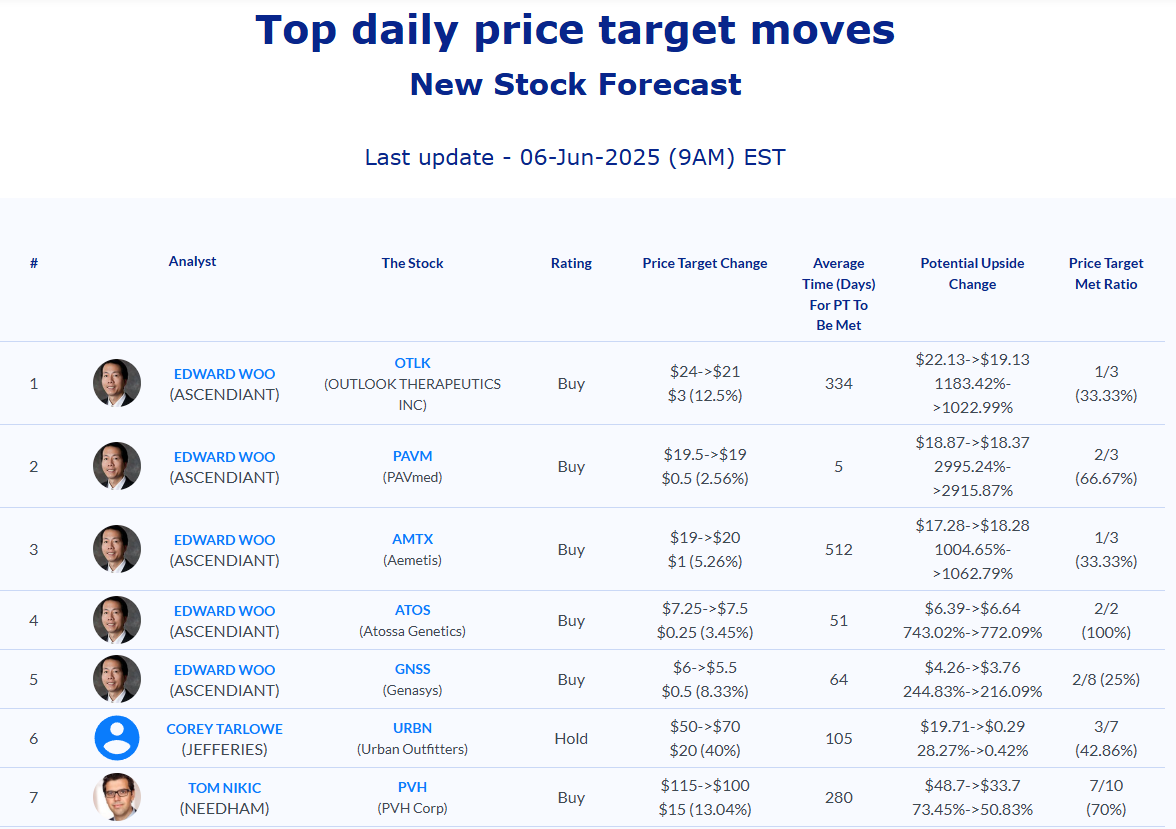

Daily stock Analysts Top Price Moves Snapshot