Selected stock price target news of the day - March 22nd, 2024

By: Matthew Otto

KB Home 2024 First Quarter Earnings: Financial Performance and Operational Efficiency

KB Home conducted its 2024 First Quarter Earnings Conference Call, unveiling total revenues of $1.5 billion and a diluted earnings per share of $1.76. Growth in net orders of 55% year-over-year , totaling 3,323 orders for the quarter.

Operational efficiencies were evident in the 30% reduction in construction cycle times compared to the previous year, with nearly 7,000 homes in production and plans to accelerate to meet growing demand. Additionally, land investment surged to approximately $590 million, marking a 60% increase year-over-year, while liquidity stood strong at $1.75 billion.

KB Home’s homebuilding operating income margin reached 10.8% and a housing gross profit margin of 21.5% for the quarter. KB Home’s effective tax rate of 20.6% reflected improved tax benefits, contributing to a 10% increase in net income to $138.7 million. With an average selling price of homes delivered at $480,000 and a projection of approximately $6.7 billion in revenues for the year.

Analysts Varied Perspectives, Adjusting Price Targets and Ratings

- Barclays analyst Matthew Bouley maintained an Overweight rating and raised the price target from $75 to $77.

- UBS analyst John Lovallo kept a Buy rating and increased the price target from $82 to $87.

- Evercore ISI Group analyst Stephen Kim reiterated an Outperform rating but lowered the price target from $82 to $78.

- RBC Capital analyst Mike Dahl maintained a Sector Perform rating yet raised the price target for KB Home from $63 to $69.

- Wells Fargo analyst Sam Reid reiterated an Equal-Weight rating and upgraded the price target from $65 to $70.

- Wedbush analyst Jay McCanless stuck with a Neutral rating but adjusted the price target upward from $60 to $64.

Which Analyst has the best track record to show on KBH?

Analyst Kenneth Zener (SEAPORT) currently has the highest performing score on KBH with 3/3 (100%) price target fulfillment ratio. His price targets carry an average of $-5.56 (-15.64%) potential downside. KB Home stock price reaches these price targets on average within 100 days.

Nike’s Fiscal 2024 Q3: Sales Surge in North America Amidst China Slowdown

Nike’s fiscal 2024 third-quarter results revealed a mixed bag of performance metrics, with North American sales rising by 3% to $5.07 billion, surpassing analyst projections of $4.75 billion. However, in China, sales growth decelerated as revenues reached $2.08 billion, just shy of the $2.09 billion forecasted by analysts. Overall, Nike reported net income of $1.17 billion, or 77 cents per share, compared to $1.24 billion, or 79 cents per share, in the same period the previous year. Excluding 21 cents per share related to restructuring charges, earnings per share would have been 98 cents.

Nike’s gross margin recovery, however, grew by 1.5 percentage points to reach 44.8%. Looking ahead, Nike aims to achieve revenue growth of 1% for fiscal 2024, reiterating its sales outlook, while anticipating slight revenue upticks in the current quarter.

Analysts Update Ratings and Price Targets Amidst Market Shifts

- Telsey Advisory Group analyst Joseph Feldman maintained an Outperform rating while lowering the price target from $120 to $115.

- UBS analyst Jay Sole upheld a Buy rating but adjusted the price target from $138 to $125.

- Goldman Sachs analyst Brooke Roach affirmed a Buy rating yet reduced the price target from $135 to $120.

Which Analyst has the best track record to show on NKE?

Analyst Rick Patel (RAYMOND JAMES) currently has the highest performing score on NKE with 12/16 (75%) price target fulfillment ratio. His price targets carry an average of $7.8 (6.38%) potential upside. Nike stock price reaches these price targets on average within 126 days.

Lululemon Reports Q4 Earnings, Yet Faces Growth Concerns Amidst Sluggish North American Market

Lululemon reported earnings in its fourth fiscal quarter, with earnings per share exceeding expectations at $5.29, compared to the anticipated $5.00. Additionally, revenue for the quarter hit $3.21 billion, marking an increase from the previous year’s $2.77 billion, representing a year-over-year growth of approximately 16%.

The North American market, which constitutes Lululemon’s largest region by sales, experienced a slowdown in growth, with sales rising by 9% compared to the 29% growth seen in the same period a year earlier. In contrast, international sales surged by 54%, fueled by growth rates of 78% in China and 36% in other international markets.

Looking ahead, Lululemon’s guidance for the next quarter anticipates net revenue between $2.18 billion and $2.20 billion, representing a growth of 9% to 10%, falling short of analysts’ expectations of $2.25 billion.

Analysts Diverge, Adjust Price Targets Amid Market Uncertainty

- BMO Capital analyst Simeon Siegel maintained a Market Perform rating while raising the price target from $408 to $420.

- Truist Securities analyst Joseph Civello reiterated a Buy rating yet lowered the price target from $561 to $498.

- Wedbush analyst Tom Nikic maintained an Outperform rating but lowered the price target from $548 to $492.

- Citigroup analyst Paul Lejuez maintained a Buy rating while lowering the price target from $520 to $500.

- Needham analyst Anna Andreeva reiterated a Buy rating but reduced the price target from $525 to $500.

- TD Cowen analyst John Kernan kept an Outperform rating though lowered the price target from $553 to $515.

Which Analyst has the best track record to show on LULU?

Analyst Rick Patel (RAYMOND JAMES) currently has the highest performing score on LULU with 15/17 (88.24%) price target fulfillment ratio. His price targets carry an average of $35.9 (7.42%) potential upside. Lululemon Athletica stock price reaches these price targets on average within 152 days.

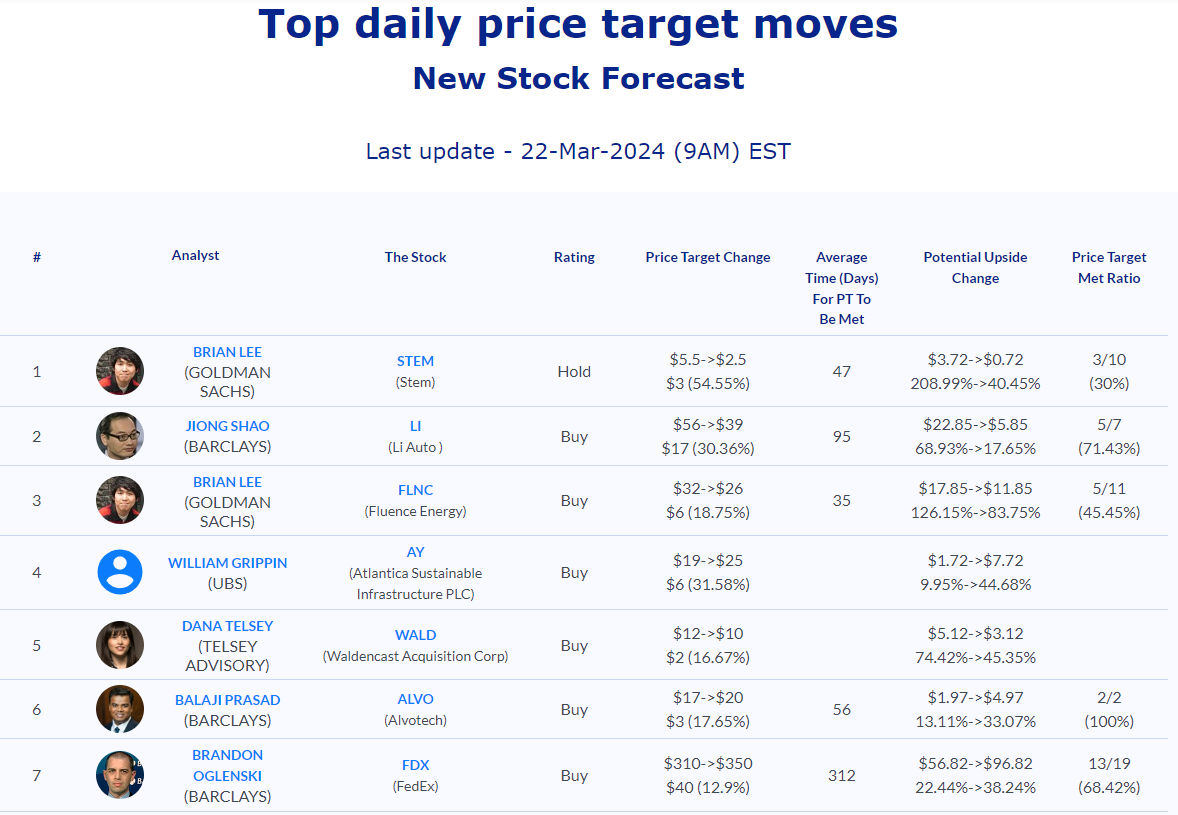

Daily stock Analysts Top Price Moves Snapshot