Selected stock price target news of the day - March 26th, 2024

By: Matthew Otto

Stoke Therapeutics’ 2023 Financial Results: Strong Cash Position Despite Rising Expenses

Stoke Therapeutics has released its financial results for the full year ending December 31, 2023 with a financial position of $201.4 million in cash, cash equivalents, and marketable securities. This is expected to sustain operations until the conclusion of 2025.

Stoke recognized $8.8 million in revenue from upfront license fees and services provided under its collaboration agreement with Acadia Pharmaceuticals, representing a decrease from the previous year’s figure of $12.4 million. However, Stoke incurred a net loss of $104.7 million for the year, or $2.38 per share, compared to $101.1 million, or $2.60 per share, in 2022. Research and development expenses for the year amounted to $82.2 million, up from $77.8 million in the prior year. General and administrative expenses rose to $41.3 million from $38.9 million in 2022.

In the fourth quarter of 2023, Stoke reported revenue of $2.8 million from upfront license fees and services provided under its collaboration agreement with Acadia Pharmaceuticals. The net loss for the quarter stood at $27.0 million, or $0.60 per share, compared to $25.7 million, or $0.65 per share, for the same period in 2022. Research and development expenses for the quarter totaled $21.8 million, slightly higher than the $21.1 million incurred in the fourth quarter of 2022, while general and administrative expenses increased to $10.6 million from $9.4 million in the same period last year..

Analysts Bullish, Upgrade Ratings and Raise Price Targets

- Canaccord Genuity’s Sumant Kulkarni maintained a Buy rating and increased the price target from $18 to $21.

- TD Cowen analyst Yaron Werber upgraded from Hold to Buy.

- HC Wainwright & Co.’s analyst Andrew Fein reiterated a Buy rating and the price target at $35.

- Needham’s Joseph Stringer maintained a Buy rating and raised the price target from $14 to $22.

Which Analyst has the best track record to show on STOK?

Analyst Joseph Stringer (NEEDHAM) currently has the highest performing score on STOK with 3/11 (27.27%) price target fulfillment ratio. His price targets carry an average of $8.73 (165.65%) potential upside. Stoke Therapeutics stock price reaches these price targets on average within 19 days.

Preliminary Financial Results Revealed by Aehr Test Systems for Q3 Fiscal 2024

Aehr Test Systems has disclosed its preliminary financial results for the third quarter of fiscal 2024. Revenue for the period ending February 29, 2024, is estimated at approximately $7.6 million. Aehr Test Systems anticipates a GAAP net loss in the range of $1.5 million to $1.8 million, equivalent to $0.05 to $0.06 per diluted share. Non-GAAP net loss is projected to be between $0.9 million to $1.2 million, or $0.03 to $0.04 per diluted share, excluding the impact of stock-based compensation. Notably, Aehr Test Systems secured bookings worth $24.5 million during the quarter, contributing to a backlog of $20 million as of the quarter’s end.

Looking forward to the full fiscal year ending May 31, 2024, Aehr Test Systems expects total revenue to exceed $65 million. GAAP net income is forecasted to surpass $11 million, translating to $0.38 per diluted share. Non-GAAP net income is projected to exceed $14 million, amounting to $0.48 per diluted share.

Analysts Downgrades Amid Market Challenges

- Craig-Hallum analyst Christian Schwab downgraded from Buy to Hold and set a $12 price target.

- William Blair analyst Jed Dorsheimer downgraded from Outperform to Market Perform.

Which Analyst has the best track record to show on AEHR?

Analyst Christian Schwab (CRAIG HALLUM) currently has the highest performing score on AEHR with 3/5 (60%) price target fulfillment ratio. His price targets carry an average of $6.41 (34.48%) potential upside. Aehr Test Systems stock price reaches these price targets on average within 167 days.

Financial and Pipeline Advancements: Sutro Biopharma’s 2023 Milestones

Sutro Biopharma reported financials for the full year 2023, with cash and investments totaling $333.7 million, coupled with approximately 0.7 million shares of Vaxcyte common stock valued at $41.9 million.

Sutro’s revenue surged to $153.7 million for the year ended December 31, 2023. This marks an increase from $67.8 million in 2022. Operating expenses for 2023 totaled $243.0 million, with research and development costs accounting for $180.4 million and general and administrative expenses reaching $62.6 million.

Sutro’s innovative pipeline plans to submit Investigational New Drug (IND) applications for STRO-003 and STRO-004 in 2024 and 2025, respectively. The company’s collaboration with Vaxcyte yielded financial gains. Vaxcyte exercising its option to enter a manufacturing rights agreement, resulting in a payment of $50 million to Sutro, and an additional $25 million obligation within six months.

Analysts Ratings and Price Targets Adjusted Amid Market Dynamics

- Wedbush analyst David Nierengarten maintained an Outperform rating and lowered the price target from $12 to $8.

- JMP Securities analyst Reni Benjamin reiterated a Market Outperform rating and a $17 price target.

- HC Wainwright & Co. analyst Andrew Fein maintained a Buy rating and lowered the price target from $16 to $12.

Which Analyst has the best track record to show on STRO?

Analyst Edward Tenthoff (PIPER SANDLER) currently has the highest performing score on STRO with 4/9 (44.44%) price target fulfillment ratio. His price targets carry an average of $9.54 (387.80%) potential upside. Sutro Biopharma stock price reaches these price targets on average within 402 days.

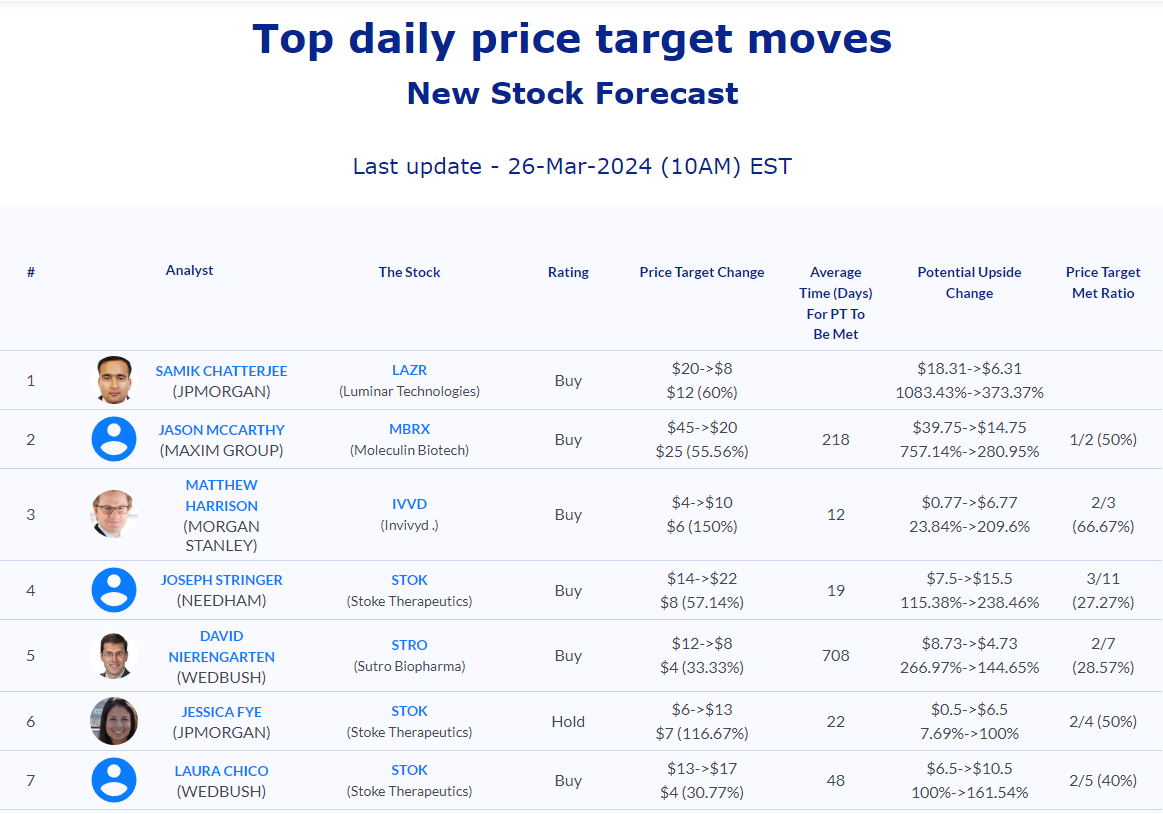

Daily stock Analysts Top Price Moves Snapshot