Selected stock price target news of the day - May 22nd, 2025

By: Matthew Otto

Snowflake Posts Q1 Beat and Raises FY2026 Product Revenue Outlook

Snowflake reported first-quarter fiscal 2026 revenue of $1.04 billion, surpassing the consensus estimate of $1.01 billion and reflecting 26% year-over-year growth. Product revenue contributed $996.8 million, also up 26% year-over-year.

Reported earnings per share of $0.24, exceeding analyst expectations by $0.03. Net revenue retention remained strong at 124%, and Snowflake now has 606 customers with trailing 12-month product revenue greater than $1 million, a 27% increase from the prior year. Snowflake also serves 754 Forbes Global 2000 customers, up 4% year-over-year.

Remaining performance obligations totaled $6.7 billion, up 34% year-over-year. Product gross profit reached $754.1 million, representing a margin of 76%, while operating income was $91.7 million, or 9% of revenue. Adjusted free cash flow stood at $206.3 million, equivalent to 20% of revenue.

Looking ahead, Snowflake provided second-quarter fiscal 2026 guidance with product revenue expected between $1.035 billion and $1.04 billion, indicating 25% year-over-year growth. Operating income for the quarter is projected at an 8% margin, with a weighted-average share count of 371 million.

For the full fiscal year, the company raised its product revenue outlook to $4.325 billion, up from a prior target of $4.28 billion, also representing 25% annual growth. Full-year guidance includes a product gross profit margin of 75%, operating income margin of 8%, and adjusted free cash flow margin of 25%, based on 372 million diluted shares.

Analysts Boost Price Targets Following Strong Q1 and Raised Outlook

- Needham analyst Mike Cikos maintained a Buy rating and increased the price target from $215 to $230.

- Barclays analyst Raimo Lenschow lifted the price target from $203 to $219.

- Scotiabank analyst Patrick Colville raised the price target to $230.

- Stifel analyst Brad Reback kept a Buy rating and increased the price target from $210 to $220.

- Baird analyst William Power increased the price target to $215.

- Raymond James analyst Simon Leopold revised the target upward from $196 to $212.

- Wells Fargo analyst Michael Turrin raised the price target to $225.

Which Analyst has the best track record to show on SNOW?

Analyst David Hynes (CANACCORD) currently has the highest performing score on SNOW with 8/10 (80%) price target fulfillment ratio. His price targets carry an average of $55.8 (33.98%) potential upside. Snowflake stock price reaches these price targets on average within 103 days.

Accenture Drives AI and Insurance Transformation with Strategic Partnerships

Accenture, in partnership with Dell Technologies and NVIDIA, has developed an on-premises AI deployment solution targeting enterprises with strict data residency, latency, and compliance requirements. The integrated system combines Accenture’s AI Refinery™ platform with Dell infrastructure and NVIDIA AI Enterprise software. It is designed to operate within environments requiring sub-5ms latency, 99.99% uptime, and adherence to data sovereignty laws across jurisdictions such as the EU, U.S., and APAC.

According to internal benchmarks, the use of prevalidated NVIDIA Enterprise AI Factory allows Accenture to claim the designs reduces deployment time by approximately 40% and lowers five-year infrastructure costs by up to 30% compared to fully cloud-based alternatives. Modular orchestration frameworks included in the platform allow for AI model updates and redeployment cycles to be cut from several weeks to under 72 hours.

In a separate project, Accenture has signed a multi-year agreement with OP Financial Group to modernize the IT systems of Pohjola Insurance. OP Financial Group oversees more than $112.86 billion in assets and serves over 4.5 million customers. The transformation includes migrating approximately 80 insurance applications to a cloud-based Guidewire platform, consolidating legacy infrastructure, and reducing overall IT maintenance costs by an estimated 25% to 30%.

Accenture will assume responsibility for the insurance division’s application lifecycle management and implement generative AI tools expected to decrease customer inquiry response times from 3 hours to under 10 minutes. Automation initiatives are projected to eliminate 20% to 25% of manual processing across claims and policy administration. Time to market for new insurance products is expected to accelerate by 40% to 50%.

Analyst Raises Price Target Amid AI and Transformation Initiatives

- UBS analyst Kevin Mcveigh maintained a Buy rating and raised the price target from $390 to $395.

Which Analyst has the best track record to show on ACN?

Analyst Arvind Ramnani (PIPER SANDLER) currently has the highest performing score on ACN with 28/34 (82.35%) price target fulfillment ratio. His price targets carry an average of $69.76 (24.46%) potential upside. Accenture stock price reaches these price targets on average within 176 days.

Wix Tops Q1 Estimates with Revenue Growth and Strong Outlook

Wix.com reported its first quarter of 2025, with total bookings reaching $510.9 million, up 12% year-over-year, and revenue of $473.3 million, surpassing the consensus estimate of $472 million. Earnings per share came in at $1.69, exceeding analyst expectations by $0.06. Creative Subscriptions revenue rising 11% to $337.7 million and Business Solutions revenue increasing 18% to $136 million.

Partners revenue grew 24% year-over-year to $171.6 million, while transaction revenue totaled $58.9 million, up 19%. Creative Subscriptions annual recurring revenue reached $1.373 billion by quarter-end, an increase of 10% from the prior year. Free cash flow for the quarter was $142.4 million, supported by $145.5 million in operating cash and $3.1 million in capital expenditures, maintaining a 30% margin.

During the quarter, Wix repurchased $200 million worth of shares and expanded its share repurchase authorization by an additional $200 million, bringing the total to $400 million. Looking ahead, Wix expects second-quarter revenue in the range of $485 to $489 million, compared to the current consensus estimate of $488.2 million.

Full-year 2025 guidance remains unchanged, with projected bookings of $2.025 to $2.06 billion, reflecting 11% to 13% year-over-year growth, and total revenue expected to reach $1.97 to $2 billion, up 12% to 14%. Also continues to forecast $590 to $610 million in free cash flow this year and remains on track to meet its Rule of 45 target by year-end.

Analysts Maintain Buy Ratings Amid Mixed Price Target Changes

- UBS analyst Chris Zhang maintained a Buy rating but lowered the price target from $255 to $230.

- Needham analyst Bernie McTernan reiterated a Buy rating and the price target at $250.

- Cantor Fitzgerald analyst Deepak Mathivanan reiterated an Overweight rating with a $200 price target.

- Wells Fargo analyst Alec Brondolo reduced the price target to $173.

- Citi analyst Ygal Arounian maintained a Buy rating but lowered the price target from $238 to $220.

Which Analyst has the best track record to show on WIX?

Analyst Mark Zgutowicz (BENCHMARK) currently has the highest performing score on WIX with 11/13 (84.62%) price target fulfillment ratio. His price targets carry an average of $56.35 (27.67%) potential upside. Wix.com stock price reaches these price targets on average within 332 days.

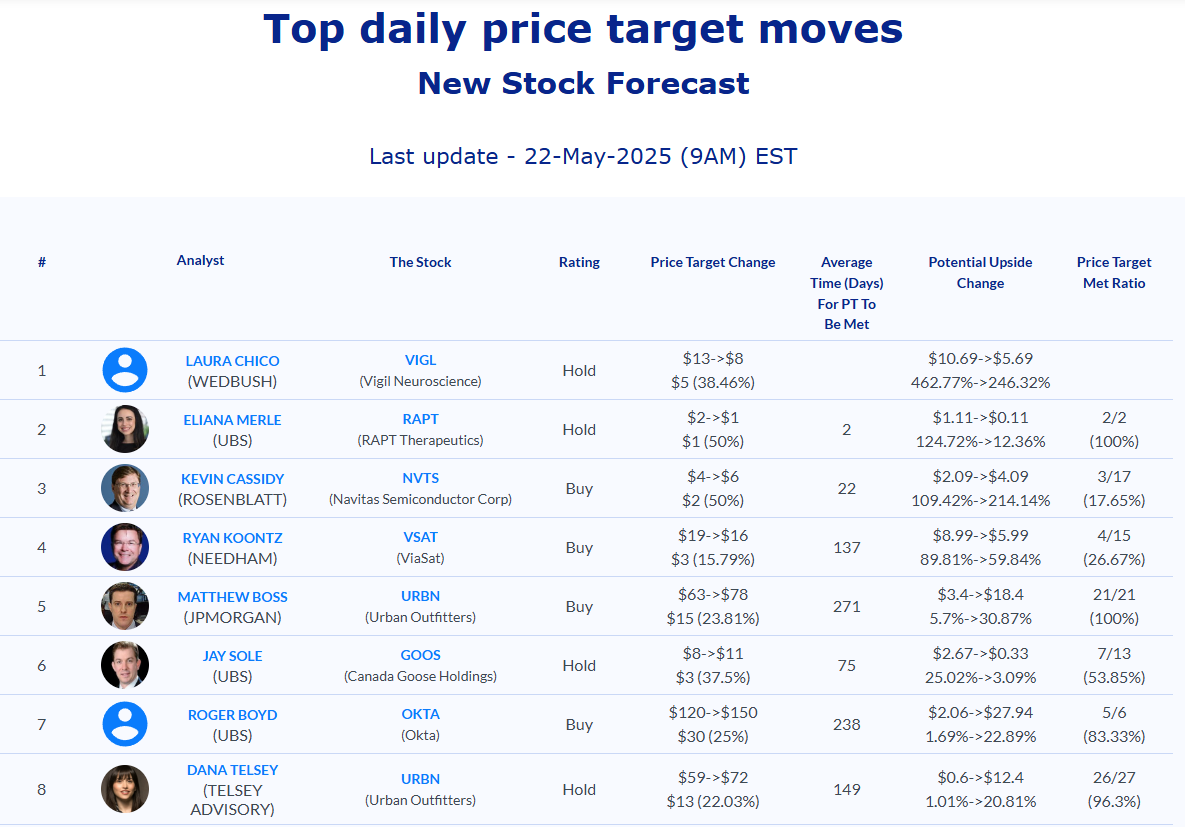

Daily stock Analysts Top Price Moves Snapshot