Selected stock price target news of the day - May 27th, 2025

By: Matthew Otto

U.S. Steel’s Sale to Nippon Steel Raises U.S. Oversight Prospects and Political Stakes

U.S. Steel may come under U.S. government control if a proposed $14.9 billion acquisition by Japan’s Nippon Steel moves forward. President Donald Trump stated on Sunday that “it will be controlled by the United States,” referring to the pending deal that would give Nippon Steel full ownership of U.S. Steel.

Trump also said he would not support the transaction without assurances of U.S. control, adding that the agreement was influenced by lawmakers urging him to secure the terms. Although the specific mechanism for U.S. control remains unclear, Japanese media have reported that Nippon Steel is considering issuing a golden share to the U.S. government, giving it veto power over key management decisions.

Under the terms of the deal announced on Friday, Nippon Steel plans to invest $14 billion into U.S. Steel’s domestic operations, including up to $4 billion allocated for a new steel mill. Trump claimed the merger would generate as many as 70,000 jobs.

U.S. Steel, headquartered in Pennsylvania and employing over 22,000 people, produced 14.5 million metric tons of steel in 2023, compared to Nippon Steel’s 44 million tons. The Committee on Foreign Investment in the United States (CFIUS) has reviewed the transaction twice, but a final decision has not been made.

Analyst Downgrades Reflect Caution as Acquisition Uncertainty Grows

- Jefferies analyst Christopher LeFemina downgraded from Buy to Hold, yet raised the price target from $50 to $55.

- Wolfe Research analyst Timna Tanners lowered from Outperform to Peer Perform.

Which Analyst has the best track record to show on X?

Analyst Bill Peterson (JPMORGAN) currently has the highest performing score on X with 8/9 (88.89%) price target fulfillment ratio. His price targets carry an average of $-3.82 (-9.13%) potential downside. U.S. Steel stock price reaches these price targets on average within 126 days.

Blue Bird School Bus Foundation Supports Ten Georgia Nonprofits Supporting Children’s Services

The Blue Bird School Bus Foundation, the charitable arm of Blue Bird Corporation, allocated $53,300 in donations to ten Georgia-based nonprofit organizations dedicated to supporting children’s education, health, and safety.

Grants ranged from $2,500 to $12,500, with the largest award of $12,500 given to Safe Kids Central Georgia. This funding is expected to help approximately 1,000 low-income families by providing free car seats and safety education, which aim to reduce the risk of injury for children during car travel.

Since its founding in 2015, the Foundation has donated more than $600,000 to over 85 nonprofits in Georgia, impacting an estimated 50,000 children and families. Alongside financial support, Blue Bird has provided three all-electric school buses since December 2023 to organizations in Georgia, Pennsylvania, and California. The bus donated to Peach County Schools serves roughly 1,500 students by supporting daily transportation and field trips with zero-emission vehicles.

Analyst Reiterates Rating, Cites Ongoing Community Support

- Needham analyst Chris Pierce reiterated a Buy rating and a $49 price target.

Which Analyst has the best track record to show on BLBD?

Analyst Chris Pierce (NEEDHAM) currently has the highest performing score on BLBD with 2/9 (22.22%) price target fulfillment ratio. His price targets carry an average of $11.77 (31.61%) potential upside. Blue Bird Corporation stock price reaches these price targets on average within 38 days.

Booz Allen Hamilton Reports FY25 Results and Sets FY26 Guidance

Booz Allen Hamilton announced its financial results for the fourth quarter and full fiscal year 2025. Full-year revenue increased 12.4% year-over-year to $12 billion, with organic revenue growth of 11.6%. Adjusted EBITDA rose 11.9% to $1.315 billion, maintaining an EBITDA margin of 11%.

Adjusted net income grew 13.4% to $815 million, while adjusted diluted EPS increased 15.5% to $6.35. Free cash flow surged to $911 million from $192 million in the prior year. Backlog reached a record $37.0 billion, up 15.3%, supported by a trailing 12-month book-to-bill ratio of 1.39x.

In the fourth quarter, revenue totaled $2.97 billion, slightly below the consensus estimate of $3.03 billion. Adjusted diluted EPS was $1.61, exactly in line with analyst expectations. Adjusted net income increased 17.3% to $203 million, and adjusted EBITDA rose 10.5% to $316 million, with a margin improvement to 10.6%. The quarterly book-to-bill ratio was 0.71x.

For fiscal 2026, Booz Allen projects revenue between $12 and $12.5 billion, compared to the consensus of $12.04 billion, and adjusted diluted EPS in the range of $6.2 to $6.55, slightly bracketing the consensus estimate of $6.35.

Analyst Keeps Rating Despite Lowered Price Target Amid FY25 Results

- Wells Fargo analyst Matthew Akers maintained an Overweight rating but lowered the price target from $148 to $135.

Which Analyst has the best track record to show on BAH?

Analyst David Strauss (BARCLAYS) currently has the highest performing score on BAH with 11/11 (100%) price target fulfillment ratio. His price targets carry an average of $9.26 (7.08%) potential upside. Booz Allen Hamilton stock price reaches these price targets on average within 107 days.

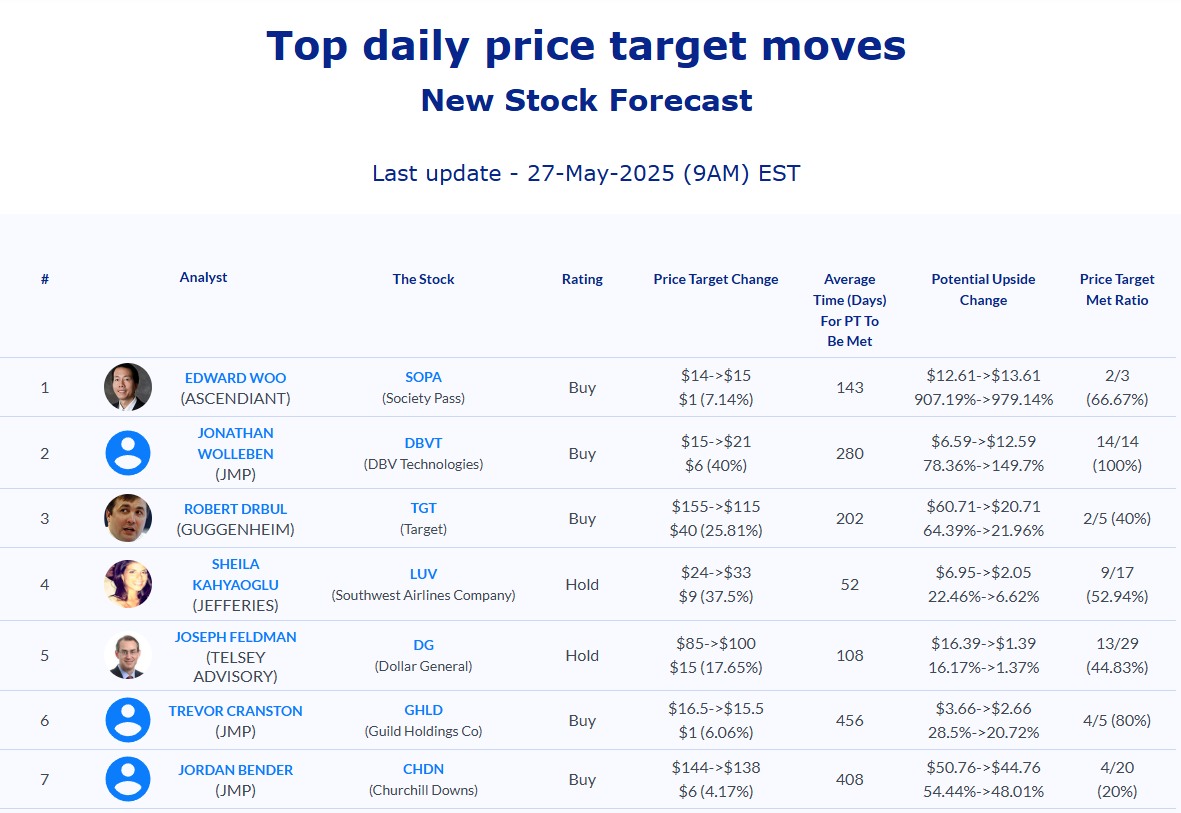

Daily stock Analysts Top Price Moves Snapshot