Selected stock price target news of the day - May 29th, 2025

By: Matthew Otto

SentinelOne Reports Revenue Growth in Q1 FY26 but Lowers Full-Year Outlook

SentinelOne reported first quarter fiscal 2026 revenue of $229 million, up 23% year-over-year and slightly above the consensus estimate of $228.34 million. Earnings per share came in at $0.02, matching analyst expectations.

Annualized recurring revenue rose 24% to $948.1 million, while the number of customers with annual contracts over $100,000 increased 22% to 1,459. SentinelOne maintained a gross margin of 79% and improved its operating margin to negative 2% from negative 6% a year ago. Net income margin stood at 3%, compared to 0% in the prior year. Free cash flow margin rose to 20%, up two points year-over-year, and the company ended the quarter with $1.2 billion in cash, cash equivalents, and investments.

SentinelOne revised its full-year revenue guidance downward to a range of $996 million to $1.001 billion, below the previous forecast of $1.01 billion to $1.012 billion and under the $1.01 billion consensus estimate. For the second quarter of fiscal 2026, it expects revenue of $242 million, compared to the $245 million analyst consensus.

Analysts React to Revised Outlook with Downgrades and Price Target Cuts

- JP Morgan analyst Brian Essex downgraded from Overweight to Neutral and the price target from $22 to $19.

- WestPark Capital analyst Casey Ryan reiterated a Buy rating but reduced the price target from $31 to $25.

- Bernstein analyst Peter Weed maintained an Outperform rating and trimmed the price target from $27 to $25.

- Wedbush analyst Daniel Ives lowered the price target to $23.

Which Analyst has the best track record to show on S?

Analyst Rob Owens (PIPER SANDLER) currently has the highest performing score on S with 9/13 (69.23%) price target fulfillment ratio. His price targets carry an average of $9.77 (53.59%) potential upside. SentinelOne stock price reaches these price targets on average within 31 days.

NVIDIA Reports Record Q1 Revenue Amid AI Demand and China Export Setback

NVIDIA reported first-quarter fiscal 2026 revenue of $44.1 billion, up 12% from the previous quarter and 69% year-over-year, surpassing the consensus estimate of $43.31 billion. Earnings per diluted share came in at $0.76, or $0.81 excluding certain charges. Adjusted for a $4.5 billion charge related to excess inventory and purchase obligations tied to H20 chips impacted by new U.S. export restrictions, earnings per share would have been $0.96, above the analyst estimate of $0.93.

NVIDIA’s data center division, which includes AI chips, generated $39.1 billion in revenue, up 73% year-over-year and accounting for nearly 90% of total revenue. Gaming revenue hit a record $3.8 billion, up 42%, while automotive and robotics revenue rose 72% to $567 million. Net income increased 26% to $18.8 billion from the year-ago period.

Due to recent export controls on its H20 chips bound for China, NVIDIA incurred a $4.5 billion charge and was unable to ship $2.5 billion in expected revenue. Excluding this impact, product margins would have been 71.3%, compared to the reported 61%. For the second quarter, NVIDIA expects revenue of $45 billion, plus or minus 2%, below the consensus forecast of $45.21 billion. The outlook reflects an estimated $8 billion revenue loss from the H20 restriction.

Product margins are projected at around 72%, with expectations to reach the mid-70% range later in the year. Operating expenses are projected to be $5.7 billion on a reported basis and $4 billion on an adjusted basis. Other income is estimated at $450 million, and the expected tax rate is 16.5%, excluding one-time items.

Analysts Remain Bullish Following Q1 Results and Guidance

- Benchmark analyst Cody Acree reiterated a Buy rating and the price target at $190.

- Needham analyst Quinn Bolton reaffirmed a Buy rating and a $160 price target.

- Summit Insights analyst Kinngai Chan upgraded from Hold to Buy.

- Rosenblatt analyst Hans Mosesmann kept a Buy rating and boosted the price target from $178 to $200.

Which Analyst has the best track record to show on NVDA?

Analyst John Vinh (KEYBANK) currently has the highest performing score on NVDA with 21/22 (95.45%) price target fulfillment ratio. His price targets carry an average of $48.65 (37.04%) potential upside. NVIDIA stock price reaches these price targets on average within 128 days.

C3 AI Reports 26% Quarterly Revenue Growth and Expands Strategic Partnerships in FY25

C3.ai reported fourth quarter revenue of $108.7 million, up 26% year-over-year and ahead of the consensus estimate of $108.53 million. Earnings per share for the quarter came in at ($0.16), beating analyst expectations of ($0.20) by four cents.

Subscription revenue rose 9% to $87.3 million, making up 80% of total revenue. Combined subscription and prioritized engineering services revenue increased 22% to $104.4 million, representing 96% of total revenue. Gross profit for the quarter totaled $75.2 million, with a gross margin of 69%. For the full fiscal year ended April 30, 2025, revenue reached $389.1 million, an increase of 25% from the prior year, while subscription revenue rose 18% to $327.6 million.

During FY25, C3.ai closed 264 agreements—up 38% year-over-year—including 174 initial production deployment agreements, a 41% increase. C3.ai saw momentum across sectors, including more than 100% year-over-year revenue growth in both its Generative AI and State & Local Government businesses. C3 AI renewed and expanded its partnership with Baker Hughes through June 2028, and closed 193 partner-driven agreements, a 68% increase from the prior year.

Looking ahead, C3 AI expects fiscal year 2026 revenue in the range of $447.5 million to $484.5 million, compared to the analyst consensus of $466 million.

Analysts Offer Mixed Price Target Following Q4 Earnings and Guidance

- Needham analyst Mike Cikos maintained a Hold rating.

- Morgan Stanley analyst Sanjit Singh raised the price target to $22.

- Canaccord Genuity analyst David Hynes Jr. lowered the price target to $28.

- Wedbush analyst Daniel Ives reduced the price target to $35.

- DA Davidson analyst Lucky Schreiner raised the price target from $18 to $25.

Which Analyst has the best track record to show on AI?

Analyst Gil Luria (D.A. DAVIDSON) currently has the highest performing score on AI with 8/9 (88.89%) price target fulfillment ratio. His price targets carry an average of $-2.06 (-10.27%) potential downside. C3.ai stock price reaches these price targets on average within 53 days.

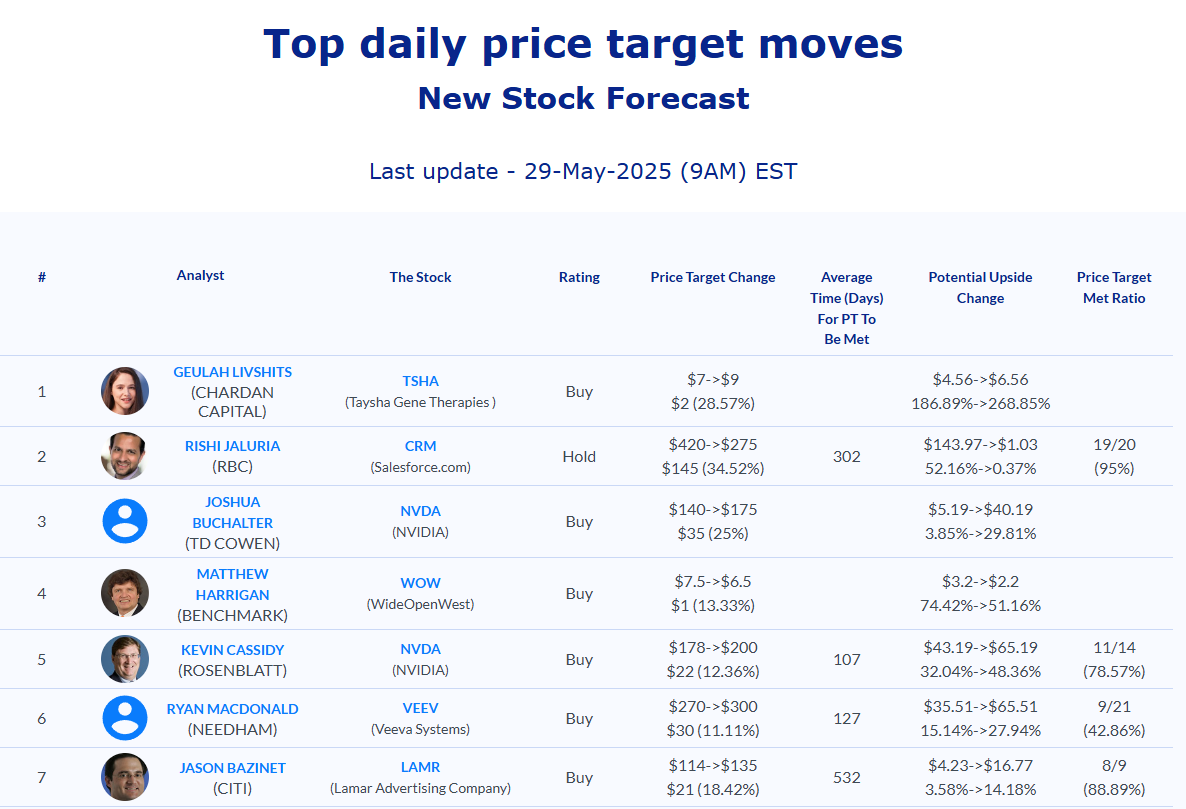

Daily stock Analysts Top Price Moves Snapshot