Selected stock price target news of the day - May 7th, 2024

By: Matthew Otto

MasTec’s First Quarter 2024 Earnings Call Highlights Performance and Strategic Outlook

MasTec reported first-quarter 2024 results, with revenue hitting $2.687 billion compared to the consensus estimate of $2.62 billion. This marked a 4% organic year-over-year increase. Adjusted EBITDA soared to $157 million, representing a 54% surge compared to the same period last year. Adjusted earnings per share outperformed consensus estimates, coming in at negative $0.13, which was $0.35 better than expected. MasTec’s backlog at the end of the quarter stood at $12.8 billion, reflecting an increase of $430 million.

MasTec’s forward-looking approach extends to emerging opportunities like data center infrastructure development, where the company has completed over $150 million in projects and a backlog of approximately $200 million. Looking ahead, MasTec maintains its outlook for the year, with revenue expected to reach $12.55 billion and adjusted EBITDA forecasted at $975 million.

Analysts Adjust Price Targets Upward Across the Board

- Stifel analyst Stanley Elliott maintained a Buy rating and raised the price target from $100 to $120.

- B. Riley Securities analyst Alex Rygiel reiterated a Buy rating and increased the price target from $104 to $120.

- Craig-Hallum analyst Christian Schwab reiterated a Buy rating while raising the price target from $96 to $125.

- TD Cowen analyst Marc Bianchi maintained a Buy rating yet raised the price target from $105 to $110.

- Barclays analyst Adam Seiden maintained an Overweight rating and lifted the price target from $106 to $130.

- Keybanc analyst Sangita Jain kept an Overweight rating and upgraded the price target from $104 to $113.

Which Analyst has the best track record to show on MTZ?

Analyst Stanley Elliott (STIFEL) currently has the highest performing score on MTZ with 2/3 (66.67%) price target fulfillment ratio. His price targets carry an average of $14.18 (13.40%) potential upside. MasTec stock price reaches these price targets on average within 50 days.

DraftKings’ Q1 2024 Earnings Call Reveals Revenue Surge and Enhanced Operational Efficiency

DraftKings unveiled financials for the first quarter of 2024, with EPS of $0.03, $0.32 better than the analyst estimate of ($0.29). Revenue soared by 53% year-over-year to $1.175 billion better than the estimate of $1.12 billion. Additionally, reported adjusted EBITDA of $22 million for the quarter, with improvements in key metrics such as customer retention and operational efficiency, reflecting a 60% adjusted EBITDA flow-through percentage. These trends have prompted DraftKings to revise its fiscal year 2024 revenue guidance to a range of $4.8 billion to $5 billion, with adjusted EBITDA expected to reach $460 million to $540 million, demonstrating a 53% year-over-year adjusted EBITDA flow-through percentage.

Analysts Price Target Upgrades Amid Positive Outlook

- Jefferies analyst David Katz maintained a Buy rating while raising the price target from $52 to $54.

- Stifel analyst Jeffrey Stantial also maintained a Buy rating yet increased the price target from $50 to $51.

- Deutsche Bank analyst Carlo Santarelli maintained a Hold rating but raised the price target from $34 to $35.

- Barclays analyst Brandt Montour reiterated an Overweight rating and raised the price target from $52 to $54.

- BMO Capital analyst Brian Pitz reiterated an Outperform rating and lifted the price target from $51 to $54.

- BTIG analyst Clark Lampen maintained a Buy rating and lifted the price target from $53 to $55.

- Needham analyst Bernie McTernan maintained a Buy rating while increasing the price target from $58 to $60.

Which Analyst has the best track record to show on DKNG?

Analyst Carlo Santarelli (DEUTSCHE BANK) currently has the highest performing score on DKNG with 8/12 (66.67%) price target fulfillment ratio. His price targets carry an average of $-9.07 (-20.58%) potential downside. DraftKings stock price reaches these price targets on average within 88 days.

Microchip Technology Reports Q4 FY2024 Financial Results Amidst Market Challenges

Microchip Technology has revealed its financial performance for the fourth quarter of fiscal year 2024. Despite a 24.9% sequential decline in net sales to $1.326 billion, the company showcased expense controls, resulting in a non-GAAP operating margin of 32.9%. Moreover, Microchip returned $629.9 million to shareholders in cash returns for the quarter, comprising $242.5 million in dividends and $387.4 million in share buybacks. The company’s net leverage ratio stood at 1.57x.

Looking forward, Microchip anticipates a revenue uptick from the June 2024 quarter, projecting net sales between $1.22 billion and $1.26 billion. Additionally, it aims to continue increasing cash returns to shareholders, targeting a return of 87.5% of adjusted free cash flow, which amounted to $389.9 million for the March quarter.

Analysts Bullish as Price Targets Surge Amidst Market Dynamics

- Piper Sandler analyst Harsh Kumar reiterated a Neutral rating and raised the price target from $80 to $90.

- Truist Securities analyst William Stein maintained a Buy rating and increased the price target from $93 to $96.

- Susquehanna analyst Christopher Rolland reiterated a Positive rating yet raised the price target from $100 to $105.

- Needham analyst Quinn Bolton maintained a Buy rating while increasing the price target from $90 to $100.

- Mizuho analyst Vijay Rakesh kept a Neutral rating and lifted the price target from $82 to $85.

Which Analyst has the best track record to show on MCHP?

Analyst Gary Mobley (WELLS FARGO) currently has the highest performing score on MCHP with 17/17 (100%) price target fulfillment ratio. His price targets carry an average of $5.89 (7.00%) potential upside. Microchip Technology stock price reaches these price targets on average within 158 days.

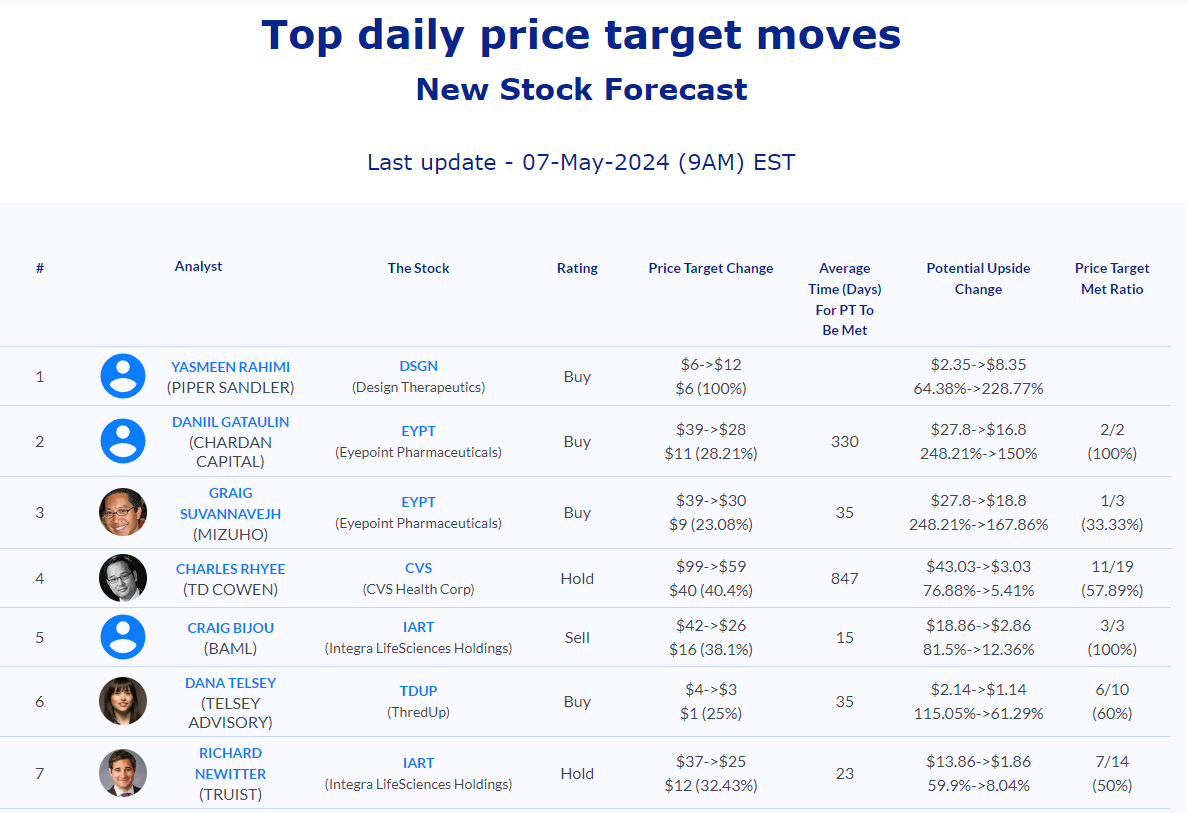

Daily stock Analysts Top Price Moves Snapshot