Selected stock price target news of the day - May 8th, 2025

By: Matthew Otto

Dutch Bros Reports Q1 Results Above Expectations, Reaffirms Full-Year Guidance

Dutch Bros reported its financial results for the first quarter ended March 31, 2025, with Q1 earnings per share (EPS) of $0.14, surpassing the analyst consensus of $0.11 by $0.03. Revenue totaled $355.2 million, beating estimates of $343.57 million and marking a 29.1% increase year-over-year from $275.1 million.

Company-operated shop revenues rose 31.6% to $326.4 million, while system same shop sales increased 4.7%, driven by a 1.3% increase in transactions. Company-operated same shop sales climbed 6.9%, with a 3.7% rise in transactions.

Dutch Bros opened 30 new shops during the quarter—25 of them company-operated—across 11 states. Net income rose to $22.5 million from $16.2 million in Q1 2024, while adjusted net income reached $24.8 million, up from $16.5 million. Adjusted EBITDA grew 19.7% to $62.9 million.

Gross profit from company-operated shops reached $71.5 million, with gross margin holding steady year-over-year at 21.9%, including 170 basis points of pre-opening costs. Contribution from company-operated shops rose 29.8% to $96.1 million, with a slight decline in contribution margin to 29.4%. Selling, general, and administrative expenses were $58.9 million (16.6% of revenue), while adjusted SG&A expenses came in at $53.5 million (15.1% of revenue).

For the full year, Dutch Bros reaffirmed its guidance, projecting revenue between $1.555 billion and $1.575 billion—slightly below the consensus estimate of $1.584 billion. Dutch Bros expects same shop sales growth of 2% to 4% and adjusted EBITDA of $265 to $275 million.

Analysts Adjust Price Targets Following Q1 Beat and Guidance

- Baird analyst David Tarantino maintained an Outperform rating and lifted the price target from $66 to $72.

- TD Securities analyst Andrew Charles reiterated a Buy rating and a $78 price target.

- Piper Sandler analyst Brian Mullan lowered the price target from $70 to $63.

Which Analyst has the best track record to show on BROS?

Analyst David Tarantino (BAIRD) currently has the highest performing score on BROS with 9/11 (81.82%) price target fulfillment ratio. His price targets carry an average of $12.92 (24.34%) potential upside. Dutch Bros stock price reaches these price targets on average within 20 days.

Carvana Reports Q1 2025 Results Driven by Retail Unit Growth and Expands Long-Term Objectives

Carvana reported its first quarter for fiscal 2025, reporting retail unit sales that rose 46% year-over-year to 133,898 vehicles. This contributed to $4.23 billion in total revenue, up 38% from $3.06 billion in Q1 2024.

Earnings per share came in at $1.51, well above the $0.67 consensus estimate. Reported also net income of $373 million (8.8% margin), adjusted EBITDA of $488 million (11.5% margin), and GAAP operating income of $394 million (9.3% margin). Approximately $158 million of net income was attributed to a favorable revaluation of warrants related to its partnership with Root Insurance.

Looking ahead, Carvana projects continued momentum in Q2 2025 with expected increases in both retail units sold and adjusted EBITDA. Also reaffirmed its full-year growth outlook and introduced a long-term strategic objective: to reach 3 million annual retail units sold with an adjusted EBITDA margin of 13.5% within the next 5 to 10 years.

Analyst Ratings Reflect Positive Outlook Following Q1 Results

- Baird analyst Colin Sebastian maintained a Neutral rating and raised the price target from $200 to $275.

- Needham analyst Chris Pierce reiterated a Buy rating and a price target of $340.

- Citi analyst Ronald Josey kept a Buy rating and raised the price target from $280 to $325.

- Wedbush analyst Scott Devitt lifted the price target to $290.

- BTIG analyst Marvin Fong maintained a Buy rating and raised the price target from $295 to $330.

Which Analyst has the best track record to show on CVNA?

Analyst Seth Basham (WEDBUSH) currently has the highest performing score on CVNA with 28/31 (90.32%) price target fulfillment ratio. His price targets carry an average of $-13.17 (-5.00%) potential downside. Carvana stock price reaches these price targets on average within 235 days.

Amplitude Reports First Quarter 2025 Results and Announces Share Repurchase Program

Amplitude reported a 10% year-over-year increase in first-quarter revenue, reaching $80 million for the period ending March 31, 2025. This performance exceeded analysts’ expectations, with revenue surpassing the consensus estimate of $79.81 million.

Annual Recurring Revenue (ARR) rose by 12%, totaling $320 million, up from $285 million in the first quarter of 2024. Remaining performance obligations grew 30%, reaching $325.9 million. Amplitude also reported an earnings per share (EPS) of $0, outperforming the analyst estimate of a $0.01 loss. The number of customers with ARR over $100,000 increased by 18%, totaling 617. Cash flow from operations and free cash flow were reported at $(8) million and $(9.2) million, respectively, showing a year-over-year decline.

Amplitude has provided guidance for Q2 2025, expecting EPS in the range of ($0.01) to $0.01, versus the consensus estimate of $0.01. For revenue, Amplitude projects a range of $80.3 million to $82.3 million, above the consensus of $80.26 million.

For the full year, Amplitude expects EPS between $0.05 and $0.1, exceeding the consensus of $0.07, with full-year revenue guidance ranging from $329 million to $333 million, surpassing the consensus estimate of $326.5 million. Additionally, Amplitude announced a $50 million share repurchase program, effective immediately.

Analysts Update Ratings and Price Targets After Q1 Performance and Outlook

- Baird analyst Rob Oliver maintained an Outperform rating but lowered the price target from $17 to $14.

- Needham analyst Scott Berg reiterated a Buy rating and a $16 price target.

- Piper Sandler analyst Brent Bracelin continued an Overweight rating and raised the price target from $14 to $15.

Which Analyst has the best track record to show on AMPL?

Analyst Taylor Mcginnis (UBS) currently has the highest performing score on AMPL with 8/11 (72.73%) price target fulfillment ratio. Her price targets carry an average of $1.15 (9.70%) potential upside. Amplitude stock price reaches these price targets on average within 64 days.

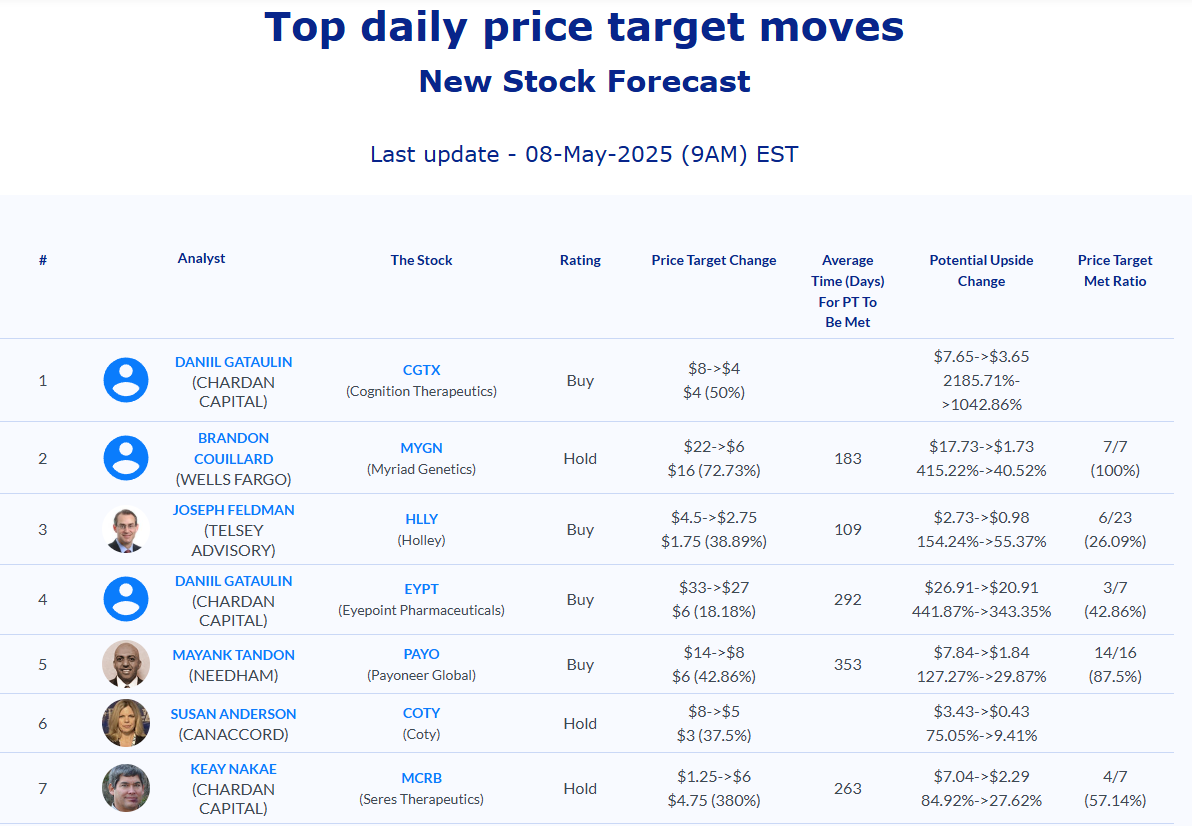

Daily stock Analysts Top Price Moves Snapshot