Selected stock price target news of the day - November 10th, 2023

By: Matthew Otto

Disney Sparks Investor Optimism with Cost Savings

Disney announced an additional $2 billion in future cost savings, elevating its total cost-cutting target to $7.5 billion. Seaport Research analyst David Joyce, maintaining a Buy rating on Disney stock, noted the mixed results but highlighted the potential for robust Free Cash Flow growth in 2024, with a likely dividend resumption. J.P. Morgan analyst Philip Cusick emphasized Disney’s strong asset mix and anticipated a swift decline in streaming losses over the next year. Cusick estimated Disney’s initial annual dividend at 40 cents a share.

The financial outlook for Disney is projected to rise from $4.9 billion in the recently concluded fiscal year to $8 billion in fiscal 2024. Despite concerns about the future of linear TV channels such as ABC and the shift towards a fully streaming model for ESPN, analysts suggest that Disney might not sell major linear channels but could find additional cost-cutting opportunities within the business. Analyst Tejas Dessai from Global X pointed out the potential boost in spending on political advertising on linear TV channels during the election cycle, estimating a substantial $12 billion overall expenditure by political advertisers.

Diverse Analyst Perspectives Shape Disney’s Outlook

- Wells Fargo’s Steven Cahall maintained an Overweight rating and raised the price target from $110 to $115.

- J.P. Morgan’s Philip Cusick reiterated an Overweight rating and set a target price of $120.

- Seaport Research’s David Joyce maintained a Buy rating and a target price of $96.

- DZ Bank’s Markus Leistner kept a Buy rating and raised the price target to from $115 to $120.

- Goldman Sachs analyst Brett Feldman lowered the price target to $120.

Which Analyst has the best track record to show on DIS?

Analyst Benjamin Swinburne (MORGAN STANLEY) currently has the highest performing score on DIS with 18/28 (64.29%) price target fulfillment ratio. His price targets carry an average of $25.62 (21.81%) potential upside. Disney stock price reaches these price targets on average within 272 days.

Unity Software Q3 Revenue Miss and Unveils Strategic Overhaul

Unity Software reported a loss of 32 cents per share, with revenue reaching $544.2 million—falling short of the expected $553.7 million. Despite a 69% year-over-year growth, attributed mainly to the $2.9 billion acquisition of ironSource. The Create Solutions segment, incorporating game-development tools, generated $189 million in revenue, slightly below the expected $204.7 million, influenced by reduced revenue from China due to gaming restrictions.

The company’s Grow Solutions segment, encompassing game publishing and advertising, contributed $355.3 million in revenue, marking a substantial nearly 166% increase, surpassing the StreetAccount consensus of $345.3 million. However, the impact of the new fees caused some challenges in this division. Unity’s shares have experienced a 12% decrease throughout the year, contrasting with the S&P 500 index’s 13% gain.

Varied Analyst Sentiment with Adjusted Price Targets

- Needham analyst Bernie McTernan maintained a Buy rating and lowered the price target from $50 to $40.

- Macquarie analyst Tim Nollen downgraded from Outperform to Neutral and set a new price target at $20.

- Piper Sandler analyst Brent Bracelin reiterated a Neutral rating and reduced the price target from $30 to $20.

Which Analyst has the best track record to show on U?

Analyst Kash Rangan (GOLDMAN SACHS) currently has the highest performing score on U with 3/4 (75%) price target fulfillment ratio. His price targets carry an average of $4.6 (4.11%) potential upside. Unity Software stock price reaches these price targets on average within 10 days.

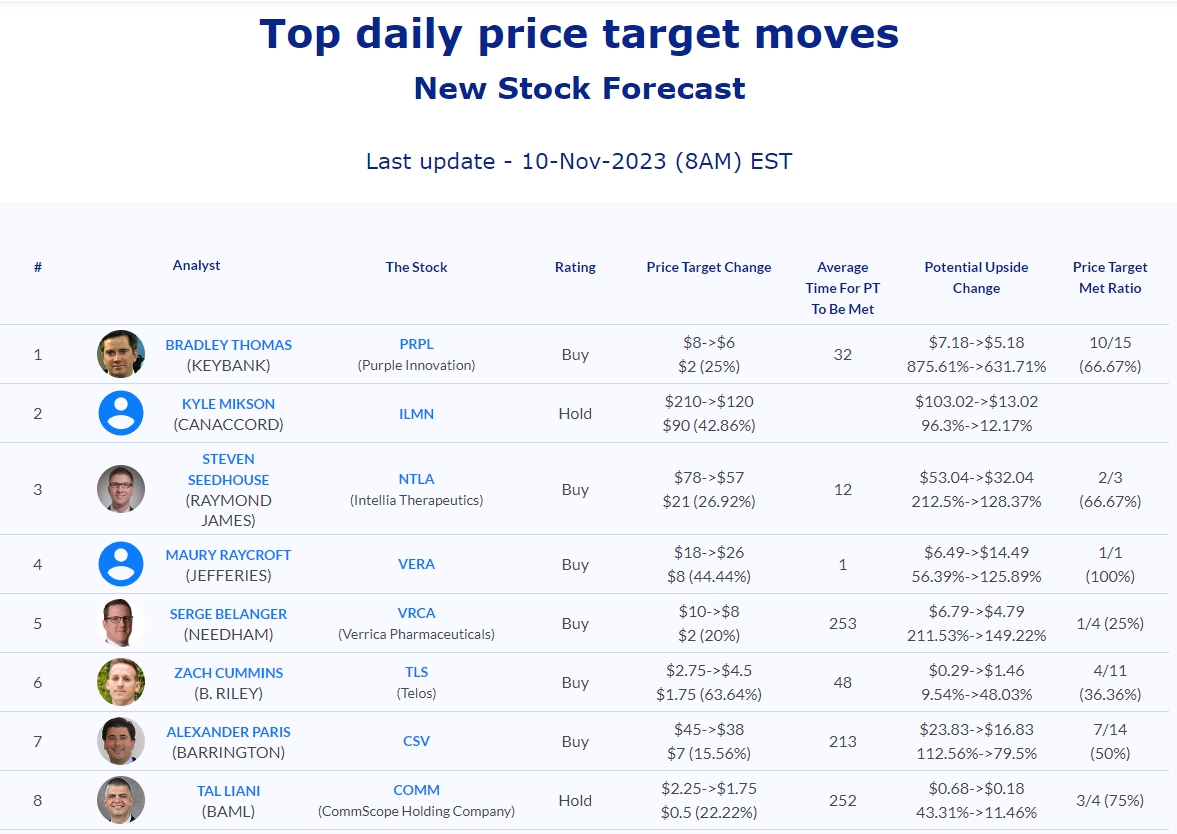

Daily stock Analysts Top Price Moves Snapshot