Selected stock price target news of the day - November 13th, 2024

By: Matthew Otto

Zeta Global Exceeds Q3 Revenue Estimates, Raises FY2024 Guidance on AI-Driven Growth

Zeta Global Holdings released its third-quarter 2024 financial results, reporting a revenue of $268.3 million, surpassing the consensus estimate of $252.45 million and reflecting a 42% increase year-over-year. However, reported EPS for Q3 was ($0.09), falling $0.03 short of the analyst estimate of ($0.06).

Direct platform revenue, which grew 41% year-over-year, now represents 70% of Zeta’s total revenue, an increase of 300 basis points quarter-over-quarter. Scaled Customer ARPU reached a record $557,000, up 33% from the prior year, and cash flow from operating activities increased by 51% to $34 million. Free cash flow for the quarter showed even stronger growth, rising 93% year-over-year to $26 million.

Zeta raised its fourth-quarter 2024 revenue guidance to a range of $293 million to $297 million, which exceeds the consensus estimate of $268.8 million and represents a year-over-year increase of 39% to 41%. Adjusted EBITDA guidance for Q4 has also been revised to a range of $64.9 million to $66.9 million, targeting an adjusted EBITDA margin between 21.9% and 22.8%.

For full-year 2024, revenue guidance was adjusted upward to $984.1 million to $988.1 million, outperforming the consensus estimate of $943 million and marking an anticipated year-over-year increase of 35% to 36%.

Analysts Raise Targets Following Q3 Performance and Upbeat FY2024 Guidance

- Morgan Stanley analyst Elizabeth Porter maintained an Equal-Weight rating, yet raised the price target from $30 to $41.

- DA Davidson analyst Clark Wright reaffirmed a Buy rating and increased the price target from $39 to $42.

- Craig-Hallum analyst Jason Kreyer kept a Buy rating and lifted the price target from $37 to $45.

- Truist Securities analyst Terry Tillman reiterated a Buy rating and boosted the price target from $35 to $42.

- Canaccord Genuity analyst David Hynes maintained a Buy rating and raised the price target from $35 to $42.

- RBC Capital analyst Matthew Swanson held an Outperform rating and raised the price target from $37 to $43.

- Oppenheimer analyst Brian Schwartz reiterated an Outperform rating and raised the price target from $33 to $42.

- Needham analyst Ryan MacDonald maintained a Buy rating and increased the price target from $36 to $43.

Which Analyst has the best track record to show on ZETA?

Analyst Brian Schwartz (OPPENHEIMER) currently has the highest performing score on ZETA with 7/7 (100%) price target fulfillment ratio. His price targets carry an average of $6.87 (26.29%) potential upside. Zeta Global Holdings stock price reaches these price targets on average within 295 days.

Live Nation Beats Q3 Earnings Estimates Amid Record Concert Profitability and Strong Ticket Sales

Live Nation Entertainment reported its third-quarter earnings, with EPS of $1.66, outperforming the analyst estimate of $1.61 by $0.05. Revenue reached $7.7 billion, slightly below the consensus estimate of $7.77 billion.

Live Nation maintained profitability, with operating income at $640 million and adjusted operating income (AOI) of $910 million. The concert business was a major revenue driver, contributing $6.58 billion, complemented by $693.7 million in ticketing revenue. Operating expenses decreased from $6.30 billion in the same period last year to $5.78 billion.

Live Nation’s concert profitability showed an AOI of $474 million, reflecting a 39% increase and a margin of 7.2%, which rose over 200 basis points year-over-year. Venue Nation reported strong fan spending, with double-digit growth at major festivals and a 9% increase for comparable amphitheater events.

Ticketmaster’s October transacted ticket sales were up 15%, including a 23% rise in concert sales, while sponsorship commitments grew by double digits. Looking ahead, Live Nation has already sold over 20 million tickets for 2025, with recent stadium tours, such as Coldplay and Shakira, seeing double-digit growth in grosses per show.

Analyst Upgrades Reflect Optimism Amid Concert Profitability and Ticket Sales

- Goldman Sachs analyst Stephen Laszczyk kept a Buy rating and raised the price target from $132 to $148.

- Guggenheim analyst Curry Baker also maintained a Buy rating and boosted the price target from $130 to $146.

- TD Cowen analyst Doug Creutz reaffirmed a Buy rating and increased the price target from $108 to $145.

- Oppenheimer analyst Jed Kelly upheld an Outperform rating while raising the price target from $120 to $155.

- Evercore ISI Group analyst Ashton Welles kept an Outperform rating and elevated the price target from $110 to $150.

- Benchmark analyst Matthew Harrigan reaffirmed a Buy rating and adjusted the price target from $132 to $144.

Which Analyst has the best track record to show on LYV?

Analyst Eric Handler (ROTH MKM) currently has the highest performing score on LYV with 6/7 (85.71%) price target fulfillment ratio. His price targets carry an average of $17.59 (15.37%) potential upside. Live Nation Entertainment stock price reaches these price targets on average within 115 days.

monday.com Reports Q3 Performance, Exceeds Earnings and Revenue Estimates, and Raises Full-Year Guidance

monday.com reported its third-quarter performance for the period ending September 30, 2024, with revenue reaching $251.0 million, a 33% year-over-year increase, surpassing the consensus estimate of $246.17 million. monday.com also exceeded analyst expectations with Q3 earnings per share (EPS) of $0.85, beating the forecasted $0.63 by $0.22.

In addition, monday.com surpassed $1 billion in Annual Recurring Revenue (ARR). Net dollar retention improved to 111%, with retention rates for customers with more than $50,000 in ARR reaching 115%. The number of paid customers with over 10 users rose by 13% to 58,760, while those generating more than $50,000 in ARR increased by 40% to 2,907. Free cash flow for the quarter was $82.4 million, reflecting a 24% free cash flow margin.

monday.com reported a GAAP operating loss of $27.4 million, compared to a loss of $2.5 million in Q3 2023. However, non-GAAP operating income was $32.2 million, consistent with the previous year’s performance.

For Q4 2024, monday.com expects revenue to reach between $260 million and $262 million, in line with consensus estimates of $261 million, while full-year revenue guidance for 2024 is between $964 million and $966 million, slightly exceeding the consensus of $960.3 million.

Analysts Maintain Ratings and Adjust Price Targets Following Strong Q3 Results

- Canaccord Genuity analyst David Hynes maintained a Buy rating and raised the price target from $295 to $310.

- DA Davidson analyst Lucky Schreiner initiated coverage with a Neutral rating and set a price target of $300.

- Baird analyst Rob Oliver maintained a Neutral rating and increased the price target from $265 to $270.

- Needham analyst Scott Berg retained a Buy rating and lifted the price target from $300 to $350.

- Piper Sandler analyst Brent Bracelin kept an Overweight rating and raised the price target from $340 to $350.

Which Analyst has the best track record to show on MNDY?

Analyst Ivan Feinseth (TIGRESS PARTNERS) currently has the highest performing score on MNDY with 5/6 (83.33%) price target fulfillment ratio. Her price targets carry an average of $73.5 (27.58%) potential upside. monday.com stock price reaches these price targets on average within 289 days.

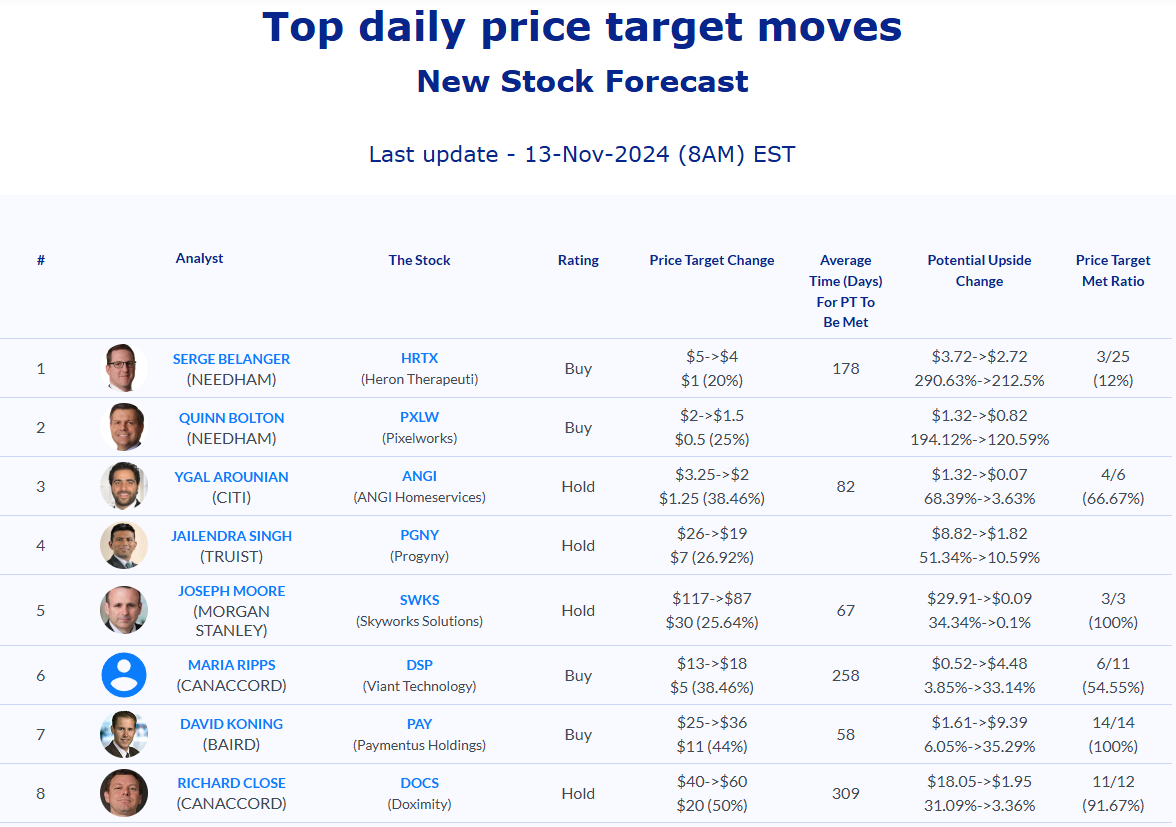

Daily stock Analysts Top Price Moves Snapshot