Selected stock price target news of the day - November 14th, 2024

By: Matthew Otto

Shopify Q3 2024 Results with Revenue Growth, Exceeds Expectations and Projects Positive Q4 Performance

Shopify reported its third-quarter results for 2024, with revenue growth of 26% year-over-year to $2.16 billion, exceeding analysts’ expectations of $2.12 billion. This growth was driven primarily by Shopify’s Merchant Solutions unit, which saw a 26% increase in sales to $1.52 billion.

Gross merchandise volume (GMV) rose by 24% to $69.72 billion, surpassing the anticipated $67.78 billion. Operating income for Q3 reached $283 million, an increase from $122 million in the same period last year.

Looking ahead, Shopify’s outlook for Q4 2024 includes an expected revenue growth rate in the mid-to-high twenties year-over-year, with gross profit anticipated to grow at a similar rate to Q3’s 24.1% increase. GAAP operating expenses are projected to represent 32% to 33% of revenue, and stock-based compensation is expected to total approximately $120 million. Shopify’s free cash flow margin, which was 19% in Q3, is anticipated to remain steady.

Analysts Raise Price Targets Amid Q3 Results and Q4 Outlook

- Wells Fargo analyst Andrew Bauch maintained an Overweight rating and raised the price target from $90 to $120.

- JMP Securities analyst Andrew Boone kept a Market Outperform rating and raised the price target from $80 to $120.

- Truist Securities analyst Terry Tillman held a Hold rating yet raised the price target from $65 to $110.

- Goldman Sachs analyst Gabriela Borges retained a Buy rating and increased the price target from $88 to $135.

- Barclays analyst Trevor Young maintained an Equal-Weight rating while raising the price target from $70 to $93.

- Keybanc analyst Josh Beck held an Overweight rating and lifted the price target from $80 to $130.

- RBC Capital analyst Paul Treiber upheld an Outperform rating and boosted the price target from $100 to $130.

- Canaccord Genuity analyst David Hynes kept a Buy rating and raised the price target from $80 to $125.

- Mizuho analyst Siti Panigrahi maintained a Neutral stance and increased the price target from $68 to $105.

- Baird analyst Colin Sebastian reiterated an Outperform rating and raised the price target from $90 to $126.

- Oppenheimer analyst Ken Wong upheld an Outperform rating and lifted the price target from $90 to $130.

- Piper Sandler analyst Clarke Jeffries kept a Neutral rating and raised the price target from $67 to $94.

Which Analyst has the best track record to show on SHOP?

Analyst Andrew Bauch (WELLS FARGO) currently has the highest performing score on SHOP with 7/8 (87.5%) price target fulfillment ratio. His price targets carry an average of $18.48 (25.84%) potential upside. Shopify stock price reaches these price targets on average within 70 days.

Spotify Reports Q3 Earnings Below Expectations, Upgrades Guidance for Q4

Spotify reported earnings of $1.54 per share on revenue of $4.22 billion, missing analyst estimates of $1.72 per share and $4.26 billion in revenue. Monthly active users (MAUs) increased by 10% year-over-year to 640 million, while premium subscribers grew by 12% to 252 million.

Spotify’s fourth-quarter guidance indicated stronger-than-expected profitability, forecasting operating income of $481 million, exceeding the consensus estimate of $433 million. Spotify also expects MAUs to rise to 665 million and premium subscribers to reach 260 million by the end of the fourth quarter.

Analyst reactions to Spotify’s results were mixed. PhillipCapital analyst Jonathan Woo downgraded his rating from Buy to Accumulate. However, Woo raised his price target by 15% to $485. Evercore’s Mark Mahaney raised its target by 9% to $500, KeyBanc’s Justin Patterson raised it by 6% to $520, and Benchmark’s Matthew Harrigan increased its target by 18% to $520.

Analysts Adjust Ratings and Price Targets with Upgrades Across the Board

- Macquarie analyst Tim Nollen maintained an Outperform rating and raised the price target from $395 to $500.

- TD Cowen analyst Doug Creutz held a Hold rating and lifted the price target from $356 to $416.

- BofA Securities analyst Jessica Reif Ehrlich reiterated a Buy rating while boosting the price target from $430 to $515.

- Benchmark analyst Matthew Harrigan kept a Buy rating and increased the price target significantly from $440 to $520.

- Wells Fargo analyst Steven Cahall remained an Overweight rating, yet raised the price target from $470 to $520.

- Piper Sandler analyst Matt Farrell held a Neutral stance but adjusted the price target upward from $330 to $450.

- Barclays analyst Kannan Venkateshwar stayed Overweight and raised the price target from $385 to $475.

- KeyBanc analyst Justin Patterson maintained an Overweight rating and hiked the price target from $490 to $520.

- JP Morgan analyst Doug Anmuth reiterated an Overweight rating and elevated the price target from $425 to $530.

- Morgan Stanley analyst Manan Gosalia remained Overweight, with an adjusted price target of $460, up from $430.

- PhillipCapital analyst Jonathan Woo downgraded from Buy to Accumulate, though raised the price target to $485.

Which Analyst has the best track record to show on SPOT?

Analyst Benjamin Black (DEUTSCHE BANK) currently has the highest performing score on SPOT with 7/9 (77.78%) price target fulfillment ratio. His price targets carry an average of $58.84 (15.44%) potential upside. Spotify stock price reaches these price targets on average within 179 days.

On Holding Reports Q3 Revenue and Profitability, Raises 2024 Outlook Despite EPS Miss

On Holding reported its third quarter with a net sales rose by 32.3% year-over-year to approximately $700 million, or 33.2% on a constant currency basis, exceeding the consensus estimate of $680 million.

This growth was propelled by a 49.8% increase in On Holding’s direct-to-consumer (DTC) channel, amounting to around $271 million and comprising 38.8% of total sales—a 450-basis-point rise from the previous year. Meanwhile, wholesale channel sales grew by 23.2% year-over-year to approximately $428 million, though slightly underperforming projections.

Despite these record sales, On Holding’s earnings per share (EPS) of $0.10 fell short of the analyst estimate of $0.16. Gross profit margin reached a post-IPO high of 60.6%, up from 59.9% a year ago, and exceeded the anticipated 60.1%. Adjusted EBITDA climbed 47.7% to approximately $132 million, surpassing the expected $120 million and resulting in an adjusted EBITDA margin of 18.9%.

For fiscal year 2024, On Holding raised its full-year revenue outlook to at least $2.52 billion, though slightly below the consensus forecast of $2.55 billion, and anticipates a gross profit margin near 60.5%. On Holding also projects an adjusted EBITDA margin at the upper end of its previous range of 16.0% to 16.5%.

Analysts Raise Price Targets Following Strong Q3 Performance

- Telsey Advisory Group analyst Cristina Fernandez maintained an Outperform rating and raised the price target from $53 to $62.

- UBS analyst Jay Sole reiterated a Buy rating and raised the price target from $61 to $63.

- TD Cowen analyst John Kernan kept a Buy rating and increased the price target from $58 to $60.

- Truist Securities analyst Joseph Civello held a Buy rating and a price target raised from $58 to $61.

- Barclays analyst Adrienne Yih reaffirmed an Overweight rating and lifted the price target from $47 to $63.

- Williams Trading analyst Sam Poser upgraded from Hold to Buy and the price target from $40 to $60.

- Baird analyst Jonathan Komp maintained an Outperform rating and adjusted the price target from $55 to $63.

- BTIG analyst Janine Stichter upgraded from Neutral to Buy and set a new price target at $64.

- Goldman Sachs analyst Richard Edwards kept a Buy rating while boosting the price target from $50 to $57.

Which Analyst has the best track record to show on ONON?

Analyst Jim Duffy (STIFEL) currently has the highest performing score on ONON with 9/10 (90%) price target fulfillment ratio. His price targets carry an average of $8.06 (15.82%) potential upside. On Holding stock price reaches these price targets on average within 198 days.

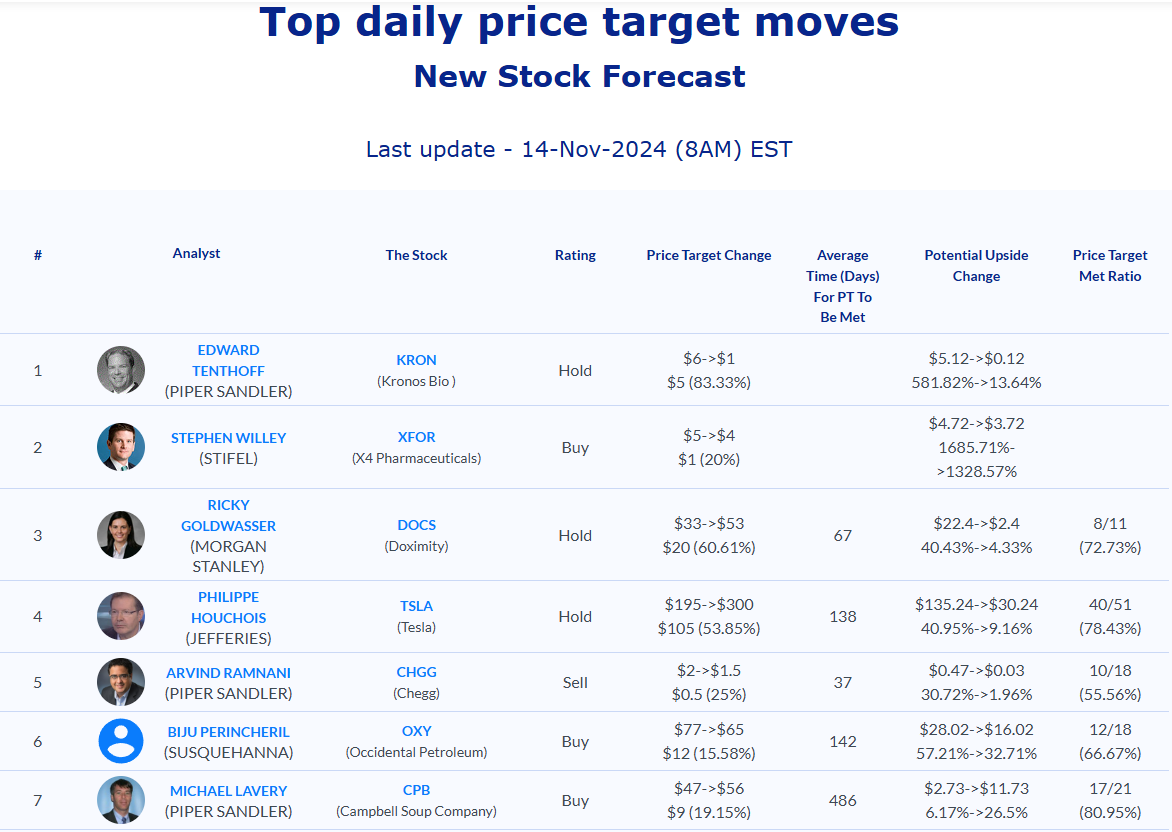

Daily stock Analysts Top Price Moves Snapshot