Selected stock price target news of the day - November 15th, 2023

By: Matthew Otto

Energizer’s Fiscal Year 2023: Resilience, Growth, and Strategic Priorities

Energizer’s fiscal year 2023 with an improvement in gross margin by 170 basis points. The company reported free cash flow generation of $340 million and successfully reduced its debt by $225 million. Energizer delivered adjusted earnings per share and adjusted EBITDA within the original guided ranges.

Energizer’s battery segment saw a 5% increase, making the category 5% larger than the pre-pandemic levels. The global battery category experienced a spike in volume growth during the pandemic as consumers spent more time at home. In the auto care category, Energizer showcased a $90 million increase in top line since 2020, representing a 6% compounded annual growth rate. The company focused on restoring profitability, increasing operating margins by almost 500 basis points over the previous year, and maintaining stability in the top line.

Looking forward to fiscal year 2024, the company expects organic revenues to be flat to down low single digits and gross margin improvement of roughly 100 basis points, reaching 40% for the full year. Project momentum is expected to generate $55 million to $65 million in 2024, contributing to adjusted EBITDA in the range of $600 million to $620 million and earnings per share in the range of $3.10 to $3.30.

Analyst Consensus meats mixed results

- RBC Capital analyst Nik Modi downgraded from Outperform to Sector Perform and the price target from $40 to $38.

- Morgan Stanley analyst Dara Mohsenian reduced from Equal-Weight to Underweight and announced a $33 price target.

- JP Morgan analyst Andrea Teixeira downgraded from Neutral to Underweight and set a $33 price target.

- Truist Securities analyst Bill Chappell upgraded his price target to $40.

Which Analyst has the best track record to show on ENR?

Analyst Bill Chappell (TRUIST) currently has the highest performing score on ENR with 2/9 (22.22%) price target fulfillment ratio. His price targets carry an average of $12.34 (31.94%) potential upside. Energizer stock price reaches these price targets on average within 294 days.

Target Surpasses Expectations with Holiday Quarter Forecast and Strategic Profit Growth

Target reported a forecast for the holiday quarter, with profits projected between $1.90 and $2.60 per share. This estimate surpassed Wall Street expectations of of $2.22 per share, according to LSEG data. The outlook follows a successful third quarter where Target experienced a 14% reduction in inventories and related costs, contributing to an improvement in gross margins from 24.7% to 27.4% compared to the previous year. The retailer also posted a smaller-than-expected decline of 4.9% in comparable sales for the quarter, defying estimates of a 5.25% drop.

Looking ahead to the holiday season, Target anticipates a mid-single-digit percentage decline in comparable sales, in line with its August expectations. The company plans to introduce over 10,000 new holiday items, featuring exclusive-to-Target brands and more than 2,500 toys priced below $25.

Analyst Maintains Confidence in Target with Revised Price Target

- Jefferies analyst Corey Tarlowe maintained a Buy rating and lowered the price target from $165 to $135.

Which Analyst has the best track record to show on TGT?

Analyst Michael Lasser (UBS) currently has the highest performing score on TGT with 15/20 (75%) price target fulfillment ratio. His price targets carry an average of $20.94 (19.30%) potential upside. Target stock price reaches these price targets on average within 196 days.

BeLite Bio Financials and Milestone Achievements in Q3 2023

BeLite Bio has reported financials for the third quarter of 2023 with research and development (R&D) expenses surged to $8.7 million, an increase from $1.2 million in the corresponding period last year. This surge is attributed to heightened expenditures associated with the ongoing DRAGON and PHOENIX studies, coupled with increased wages and salaries due to share-based compensation granted to the R&D team.

The company’s General and Administrative (G&A) expenses also witnessed an uptick, reaching $2.2 million, compared to $1.4 million in the same period last year. Once again, share-based compensation played a role in this increase. BeLite Bio’s net loss for Q3 stood at $10.9 million, marking a rise from the $2.4 million reported during the same quarter in the previous year. Despite this, the company showcased a resilient financial position, securing a $6.5 million cash inflow from warrant exercises, ATM offerings, and R&D refunds. With approximately $54.5 million in cash reserves by the end of Q3, BeLite Bio remains well-positioned to advance its pioneering drug, Tinlarebant, through the various phases of clinical development.

Analyst Maintained Ratings and Price Targets

- HC Wainwright & Co. analyst Yi Chen Reiterated a Buy rating and a price target of $59.

Which Analyst has the best track record to show on BLTE?

Analyst Yi Chen (HC WAINWRIGHT) currently has the highest performing score on BLTE with 0/7 (0%) price target fulfillment ratio. His price targets carry an average of $29.22 (125.71%) potential upside.

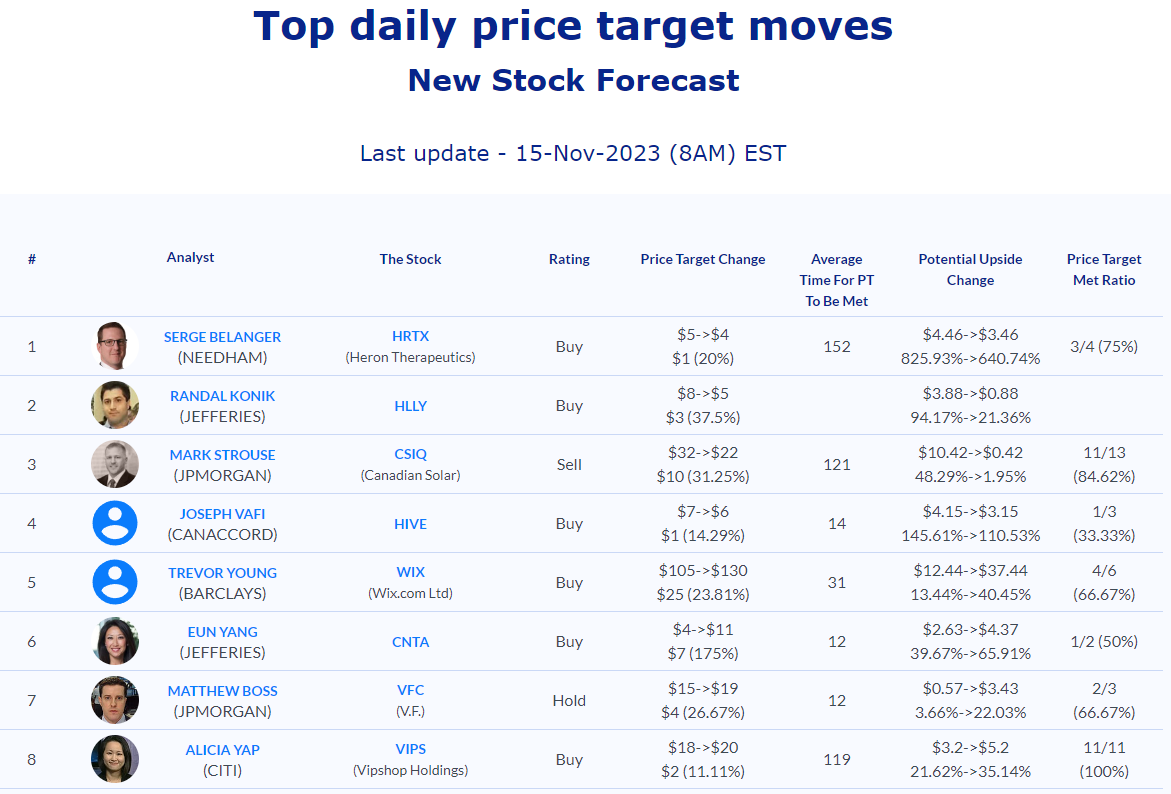

Daily stock Analysts Top Price Moves Snapshot