Selected stock price target news of the day - November 16th, 2023

By: Matthew Otto

Global-e Reports Q3 2023 Performance

Global-e’s Third Quarter 2023 Earnings Call revealed significant financial growth despite challenging macroeconomic conditions. The company’s Gross Merchandise Volume (GMV) saw a 35% year-on-year increase, reaching $839 million. This growth was coupled with a substantial 76% rise in adjusted EBITDA. Although the company faced headwinds that impacted same-store sales growth, these figures demonstrate a resilient financial performance.

In terms of revenue, Global-e reported $133.6 million for the quarter, marking a 27% increase compared to the same period last year. This figure, however, fell short of the consensus estimate of $140.83 million. The Earnings Per Share (EPS) for the quarter was a loss of $0.2, which was slightly better than the analyst estimate of a $0.24 loss.

The company’s Non-GAAP gross profit for Q3 reached $59.3 million, a 36% year-over-year increase and a gross margin of 44.4%. Operational expenses, excluding certain factors, stood at 28%, progressing toward the company’s long-term efficiency target of 25%. Adjusted EBITDA, reached to $22.1 million, showcasing a 76% year-on-year growth and an adjusted EBITDA margin of 16.5%.

Looking ahead, Global-e revised its annual guidance, projecting a GMV in the range of $3.49 billion to $3.54 billion for the full year of 2023, representing a 44% annual growth at the midpoint. The company expects revenue to be in the range of $563 million to $571 million, with an adjusted EBITDA forecast of $89.1 million to $94.1 million, translating into a 88% year-on-year growth at the midpoint.

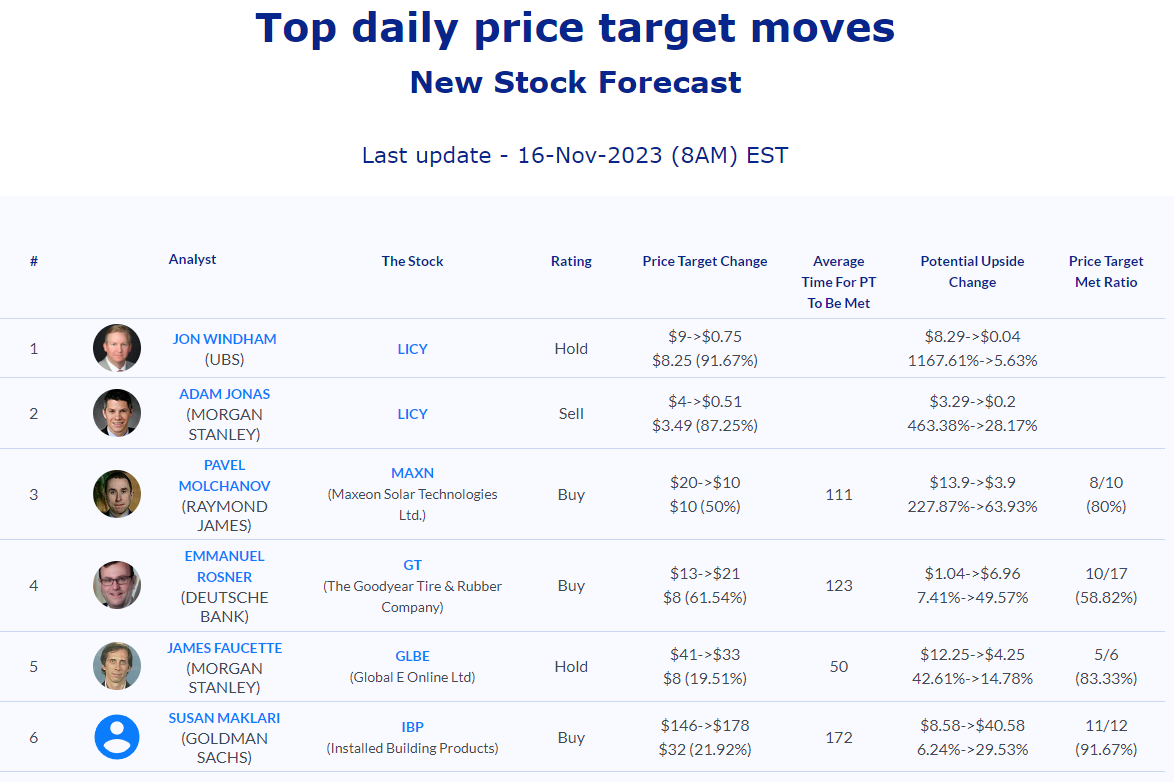

Analyst Mixed Sentiments for Global E Online as Price Targets Adjust

- Morgan Stanley’s James Faucette maintained at Equal-Weight and lowered the price target from $41 to $33.

- Needham analyst Scott Berg reiterated a Buy rating and a $48 price target.

- Keybanc analyst Josh Beck kept an Overweight rating and reduced the price target from $42 to $40.

- Raymond James analyst Brian Peterson maintained an Outperform rating and decreased the price target from $45 to $41.

- Piper Sandler’s Brent Bracelin reiterated an Overweight rating and lowered the price target from $47 to $45.

Which Analyst has the best track record to show on GLBE?

Analyst James Faucette (MORGAN STANLEY) currently has the highest performing score on GLBE with 5/6 (83.33%) price target fulfillment ratio. His price targets carry an average of $6.41 (24.46%) potential upside. Global E Online Ltd stock price reaches these price targets on average within 50 days.

CorMedix Receives FDA Approval for DefenCath

CorMedix received approval from the U.S. Food and Drug Administration for its antimicrobial drug, DefenCath, aimed at reducing catheter-related bloodstream infections in patients with kidney disease. The approval marks a milestone for CorMedix, whose drug had faced two previous rejections from the FDA over manufacturing concerns. The company plans to launch DefenCath commercially by the end of the first quarter of 2024.

DefenCath, a combination of taurolidine (an antimicrobial active ingredient) and heparin (a blood thinner), demonstrated its efficacy in a study involving 795 patients undergoing dialysis. The results showed a 71% reduction in the risk of catheter-related bloodstream infections in kidney failure patients. The FDA’s initial concerns regarding third-party manufacturing facilities and the heparin supplier prompted CorMedix to make adjustments, including changing its heparin supplier.

Analyst Varied Ratings and Price Targets Reflect Diverse Outlooks

- Needham analyst Serge Belanger Maintained a Buy rating and lowered the price target from $12 to $10.

- RBC Capital analyst Gregory Renza Sustained an Outperform rating and increased the price target from $6 to $10.

- Truist Securities analyst Joon Lee Reiterated a Buy rating and an $18 price target.

- JMP Securities analyst Jason Butler Kept a Market Outperform rating and a $19 price target.

Which Analyst has the best track record to show on CRMD?

Analyst Jason Butler (JMP) currently has the highest performing score on CRMD. His price targets carry an average of $12.55 (262.08%) potential upside.

Palo Alto Reports Q4 Revenue But Faces Concerns Over Billings and Guidance

Palo Alto Networks reported its financial performance for the October quarter. The cybersecurity company posted a revenue of $1.88 billion, marking a 20% increase from the previous year and surpassing both its own guidance range and the consensus estimate. Adjusted profit also outshone expectations at $1.38 per share, exceeding both the company’s forecast and the Street consensus. However, the results took a hit as billings for the quarter, which includes revenue plus deferred revenue, fell short of expectations at $2.02 billion.

For the fiscal second quarter ending in January, Palo Alto Networks anticipates revenue between $1.955 billion to $1.985 billion, with adjusted profit projected at $1.29 to $1.31 per share. While these figures align with consensus estimates, the bookings guidance of $2.335 billion to $2.385 billion fell below Street consensus at $2.413 billion, signaling potential challenges in the cybersecurity market.

Analyst Perspectives Diverge on Palo Alto Networks

- Raymond James analyst Adam Tindle maintained an Outperform rating and raised the price target from $250 to $260.

- Needham analyst Alex Henderson reiterated a Buy rating and a price target of $305.

- Wells Fargo analyst Andrew Nowinski raised the price target to $280.

- Citi analyst Fatima Boolani lowered the price target to $280.

- Barclays analyst Saket Kalia reduced the price target to $273 from $275.

Which Analyst has the best track record to show on PANW?

Analyst Yun Kim (LOOP CAPITAL) currently has the highest performing score on PANW with 15/16 (93.75%) price target fulfillment ratio. His price targets carry an average of $12.83 (11.11%) potential upside. Palo Alto Networks stock price reaches these price targets on average within 89 days.

Daily stock Analysts Top Price Moves Snapshot