Selected stock price target news of the day - November 17th, 2023

By: Matthew Otto

Target Financial Triumph Amidst Challenges

Target reported surpassing $100 billion in annual revenue. Despite economic challenges, the company reported in the third quarter an earnings per share by over 40% to $2.10. The EPS for the first three quarters of 2023 exceeded 26% higher than the figures recorded in 2019. Q3 earnings per share (EPS) reached $2.10, surpassing the analyst prediction of $1.47 by $0.63. The quarter’s revenue amounted to $25.4 billion, exceeding the anticipated $25.29 billion.

GUIDANCE:

Target sees Q4 2024 EPS of $1.90-$2.60, versus the consensus of $2.22.

The company’s cautious inventory positioning resulted in total inventory on the balance sheet being 14% lower than the previous year, while discretionary category inventory saw a decrease of 19%. This agile approach to inventory management contributed to a gross margin rate of 27.4%, more than 2.5 points higher than the previous year.

Analysts Diverge as Price Targets Vary Amidst Market Dynamics

- Roth MKM analyst Bill Kirk reiterated a Neutral rating and a $140 price target.

- Citigroup analyst Paul Lejuez maintained a Neutral rating and raised the price target from $117 to $142.

- Stifel analyst Mark Astrachan maintained a Hold rating and increased the price target from $130 to $141.

- BMO Capital analyst Kelly Bania kept a Market Perform rating and increased the price target from $120 to $130.

- RBC Capital analyst Steven Shemesh reiterated an Outperform rating and lowered the price target from $161 to $157.

- JP Morgan analyst Christopher Horvers maintained a Neutral rating and raised the price target from $113 to $125.

Which Analyst has the best track record to show on TGT?

Analyst Scot Ciccarelli (TRUIST) currently has the highest performing score on TGT with 6/11 (54.55%) price target fulfillment ratio. His price targets carry an average of $11.47 (6.18%) potential upside. Target stock price reaches these price targets on average within 26 days.

Cisco Revised Annual Forecasts and Supply Chain Challenges

Cisco attributed the downward revision of its profit and revenue projections for fiscal year 2024 to a slowdown in orders during the first quarter. The organization cited excess customer inventory as a by-product of the supply chain crunch over the past two years. The company reported adjusted earnings per share of $1.11, exceeding the $1.03 LSEG estimate, and $4.67 billion in revenue for the quarter against the $14.61 billion projection. However, the weaker-than-expected revenue guidance for the fiscal second quarter and a reduction in the full-year revenue forecast raised concerns among analysts. Bank of America analyst Tal Liani noted a 20% decline in product orders, resulting in a $3.2 billion cut to Fiscal Year 2024 revenue guidance.

Analysts Adjust Ratings and Targets Amid Market Challenges

- Oppenheimer analyst Ittai Kidron Maintained an Outperform rating and lowered the price target from $58 to $54.

- UBS analyst David Vogt Reiterated a Neutral rating and reduced the price target from $55 to $54.

- Piper Sandler analyst James Fish Kept a Neutral rating and lowered the price target from $57 to $50.

Which Analyst has the best track record to show on CSCO?

Analyst James Fish (PIPER SANDLER) currently has the highest performing score on CSCO with 25/26 (96.15%) price target fulfillment ratio. His price targets carry an average of $6.95 (17.57%) potential upside. Cisco Systems stock price reaches these price targets on average within 343 days.

Globant Posts Record Q3 Revenue Demonstrating Growth and Market Leadership

Globant S.A. has reported financial performance in its Q3 earnings call. The company achieved a revenue of $545.3 million versus the consensus estimate of $545.16 million, marking an 18.8% YoY growth and a 9.6% QoQ increase. Over the last 12 months, Globant’s revenue surpassed $2 billion, reflecting its sustained profitability and resilient balance sheet amid global economic challenges..

Globant’s strategic initiatives and diversified client base are evident in its 100-squared vision, with 16 clients contributing over $20 million in annual revenue and a total of 305 clients providing more than $1 million of annual revenue, showcasing a 19.6% increase over the past year. Geographically, 58.9% of Q3 revenue came from North America, 21.6% from Latin America, 16.5% from EMEA, and 3% from Asia and Oceania. With a Net Promoter Score of 80 and a low attrition rate of 9.5% over the last 12 months, Globant continues to prioritize client satisfaction and employee well-being. The company’s financials reveal a net cash position, with cash and short-term investments totaling $219.3 million, and it maintains a healthy balance between profitability and financial discipline, with an adjusted operating margin of 15.3% in Q3. Looking ahead, Globant projects a full-year 2023 revenue of at least $2.094 billion, anticipating a 17.6% YoY growth.

Analysts Offer Varied Outlooks on Globant as Price Targets Shift

- Needham’s Mayank Tandon maintained a Buy rating and raised the price target from $205 to $215.

- Keybanc’s Thomas Blakey reiterated an Overweight rating and lowered the price target from $230 to $218.

- Piper Sandler’s Arvind Ramnani sustained an Overweight rating and increased the price target from $212 to $217.

- JPMorgan’s Tien-tsin Huang raised the price target to $235.

Which Analyst has the best track record to show on GLOB?

Analyst Bryan Bergin (COWEN) currently has the highest performing score on GLOB with 2/8 (25%) price target fulfillment ratio. His price targets carry an average of $16.37 (61.27%) potential upside. Globant S.A. stock price reaches these price targets on average within 53 days.

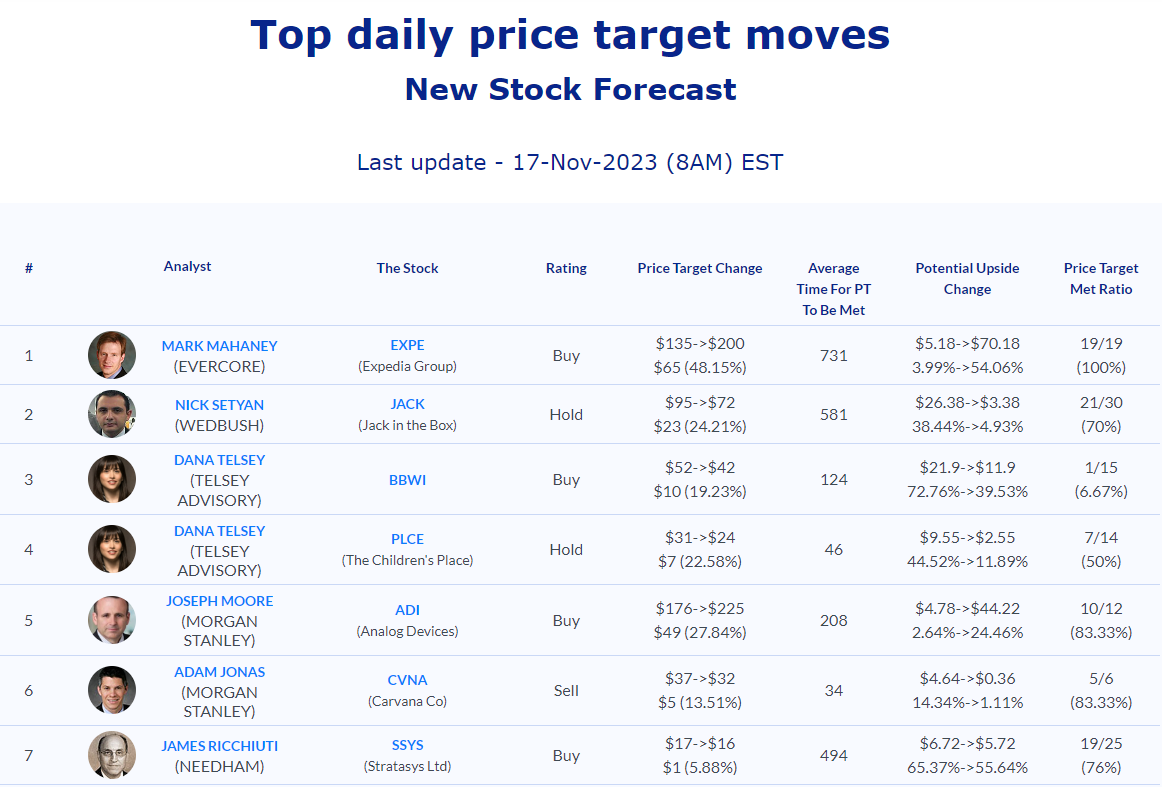

Daily stock Analysts Top Price Moves Snapshot