Selected stock price target news of the day - November 20th, 2023

By: Matthew Otto

Eli Lilly’s Investment in Germany for Diabetes and Obesity Therapies

Eli Lilly has announced an investment of $2.5 billion to build its first manufacturing plant in Germany, located in the town of Alzey. The move comes in response to the surging demand for diabetes and obesity therapies, with a focus on boosting the production of drugs like Mounjaro and Trulicity, along with the injection pens used for their administration. The new facility is expected to be operational by 2027 and will play a crucial role in enhancing Lilly’s supply of incretin drugs, such as Mounjaro, which mimic gut hormones to suppress appetite and stimulate insulin secretion.

The company aims to leverage the country’s expertise in engineering and science, establishing a manufacturing cluster that complements its existing sites in France and Italy. Eli Lilly’s strategic move aligns with the broader industry trend of pharmaceutical companies reevaluating global supply chains in response to the vulnerabilities exposed by the COVID-19 pandemic. The decision also reflects the company’s commitment to addressing supply constraints, with Lilly having announced investments exceeding $11 billion in global manufacturing over the past three years.

Analyst Reaffirms Positive Outlook for Eli Lilly

- Cantor Fitzgerald analyst Louise Chen reiterated an Overweight rating and a $630 price target.

Which Analyst has the best track record to show on LLY?

Analyst Geoff Meacham (BAML) currently has the highest performing score on LLY with 13/13 (100%) price target fulfillment ratio. His price targets carry an average of $32.82 (17.10%) potential upside. Eli Lilly stock price reaches these price targets on average within 97 days.

Microsoft’s Strategic Move for the Future of AI Research

Sam Altman, former CEO of OpenAI, faced an unexpected departure following his dismissal for alleged communication issues with the board of ChatGPT’s creators. Microsoft CEO Satya Nadella seized the opportunity to hire Altman and Greg Brockman, another OpenAI co-founder, to lead a new in-house advanced AI research team at Microsoft. This move not only retains Altman within Microsoft but also strengthens the company’s position in the AI landscape. With Altman and Brockman on board, Microsoft gains control over their expertise and innovations. This is a notable development, considering Microsoft’s previous 49% stake in OpenAI did not grant such influence. As Altman and Brockman join Microsoft’s AI research team, the company faces decisions on resource allocation between OpenAI and the newly formed division.

Analysts Positive Outlook for Microsoft

- Wedbush analyst Daniel Ives maintained an Outperform rating and raised the price target from $400 to $425.

- Goldman Sachs analyst Kash Rangan reaffirmed a Buy Rating.

Which Analyst has the best track record to show on MSFT?

Analyst Blair Abernethy (ROSENBLATT) currently has the highest performing score on MSFT with 9/9 (100%) price target fulfillment ratio. His price targets carry an average of $46.28 (17.27%) potential upside. Microsoft stock price reaches these price targets on average within 171 days.

Boeing’s Momentum: Optimism Grows as Aircraft Deliveries Ascend

Boeing is experiencing a notable shift in market sentiment, with Deutsche Bank analyst Scott Deuschle upgrading the stock to Buy and raising the price target. This upgrade is underpinned by an optimistic outlook on aircraft deliveries, a pivotal factor in Boeing’s financial performance. In 2022, Boeing delivered 480 jets, and this figure is expected to rise to approximately 520 units this year. Looking further ahead, the projections for 2024, 2025, and 2026 are even more promising, with anticipated deliveries of around 700, 800, and 820 units, respectively.

The company has weathered significant challenges in recent years, including the global grounding of the 737 MAX and the disruptive impacts of the Covid-19 pandemic. However, about 76% of analysts currently rate Boeing shares as Buy. An increase from the 43% during the turbulent period three years ago.

Analyst Sparks Optimism with Upgrade

- Deutsche Bank analyst Scott Deuschle upgraded from Hold to Buy and the price target from $204 to $270.

Which Analyst has the best track record to show on BA?

Analyst Noah Poponak (GOLDMAN) currently has the highest performing score on BA with 13/21 (61.9%) price target fulfillment ratio. His price targets carry an average of $44.62 (25.56%) potential upside. Boeing stock price reaches these price targets on average within 366 days.

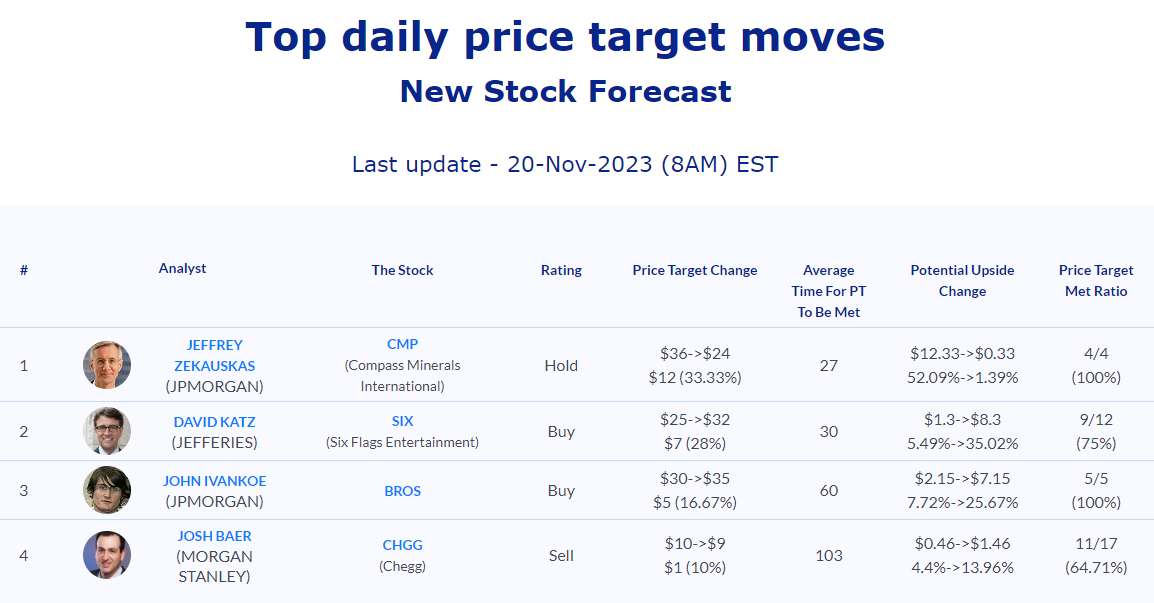

Daily stock Analysts Top Price Moves Snapshot