Selected stock price target news of the day - November 21st, 2023

By: Matthew Otto

Enanta Fiscal Results and Respiratory Virus Treatment Pipeline

Enanta Pharmaceuticals reported its fiscal fourth quarter and year-end financial results, highlighting total revenue of $18.9 million versus the consensus estimate of $20.56 million for the quarter, primarily derived from royalty revenue earned on AbbVie’s global MAVYRET net product sales. This figure represents a slight decline from the same period in 2022 when total revenue reached $20.3 million. For the full year ended September 30, 2023, total revenue amounted to $79.2 million compared to $86.2 million in the previous year. Enanta’s financials also reflected a strategic shift in its business approach, with a significant reduction in spending for fiscal 2024. The company expects research and development expenses to be between $100 million and $120 million, and general and administrative expenses to be between $45 million and $50 million.

The company is advancing two key compounds, EDP-938 and EDP-323, with Fast Track designation from the FDA. EDP-938 is being evaluated in two Phase 2 studies: RSVPEDs, a pediatric study, and RSVHR, a study in adults at high risk of complications. The goal is to complete enrollment in at least one of these studies with topline data expected in the third quarter of 2024. The initiation of a Phase 2a challenge study for EDP-323, with data expected in the third quarter of 2024.

Analysts Mixed Ratings for Enanta Pharmaceuticals

- HC Wainwright & Co. analyst Ed Arce maintained a Buy rating and lowered the price target from $30 to $28.

- JMP Securities analyst Roy Buchanan reiterated an Outperform rating and reduced the price target from $42 to $23.

Which Analyst has the best track record to show on ENTA?

Analyst Roy Buchanan (JMP) currently has the highest performing score on ENTA with 7/10 (70%) price target fulfillment ratio. His price targets carry an average of $24.7 (43.60%) potential upside. Enanta Pharmaceuticals stock price reaches these price targets on average within 125 days.

Symbotic’s Reports Revenue Growth and Doubled Gross Profit in Q4 2023

Symbotic reported financial results for the fourth quarter of fiscal year 2023 with a 60% year-on-year revenue growth, reaching $392 million versus the consensus estimate of $306.36 million. Symbotic’s proactive approach to deployment time reduction, strategic outsourcing partnerships, and standardization efforts contributed to the success, with 35 systems in progress at the end of the quarter—a staggering 100% increase compared to the same period last year. The company’s backlog, including the joint venture with SoftBank, stands at $23.3 billion.

Symbotic’s adjusted gross margin increased to 19.1%, with an 80 basis points improvement, and the adjusted EBITDA rate improved to 3.4%, compared to a 1% loss rate in the previous quarter. The fiscal year ended with $548 million in cash and equivalents.

Analysts Express Confidence in Symbotic with Raised Price Targets

- Goldman Sachs Analyst Mark Delaney maintained a Neutral rating and raised the price target from $36 to $40.

- Needham Analyst James Ricchiuti reiterated a Buy rating and the price target at $58.

- Keybanc Analyst Ken Newman kept an Overweight rating and increased the price target from $50 to $63.

Which Analyst has the best track record to show on SYM?

Analyst Matt Summerville (D.A. DAVIDSON) currently has the highest performing score on SYM with 3/3 (100%) price target fulfillment ratio. His price targets carry an average of $0.41 (16.45%) potential upside. Symbotic stock price reaches these price targets on average within 10 days.

Keysight Beats Q4 Expectations Amid Defense Demand

Keysight Technologies has surpassed market expectations for its fourth-quarter profit, driven by sustained demand in aerospace and defense sectors. In the quarter through October, the company reported a 4% increase in revenue from aerospace, defense, and government segments. This growth is attributed to strategic investments in defense technology modernization, electromagnetic spectrum operations, radar, and space and satellite applications.

Keysight Technologies reported earnings of $1.99 per share for the fourth quarter, surpassing the average analysts’ estimate of $1.87 per share, according to LSEG data. Looking ahead, Keysight Technologies provided guidance for the first quarter of 2024, forecasting an adjusted profit between $1.53 and $1.59 per share. This projection falls slightly below the LSEG estimates of $1.68 per share.

Analyst Perspectives Diverge on Keysight Technologies

- Baird analyst Richard Eastman maintained an Outperform rating and raised the price target from $155 to $160.

- Barclays analyst Tim Long reiterated an Equal-Weight rating and lowered the price target from $144 to $134.

Which Analyst has the best track record to show on KEYS?

Analyst Jim Suva (CITI) currently has the highest performing score on KEYS with 10/14 (71.43%) price target fulfillment ratio. His price targets carry an average of $24.45 (19.83%) potential upside. Keysight Technologies stock price reaches these price targets on average within 207 days.

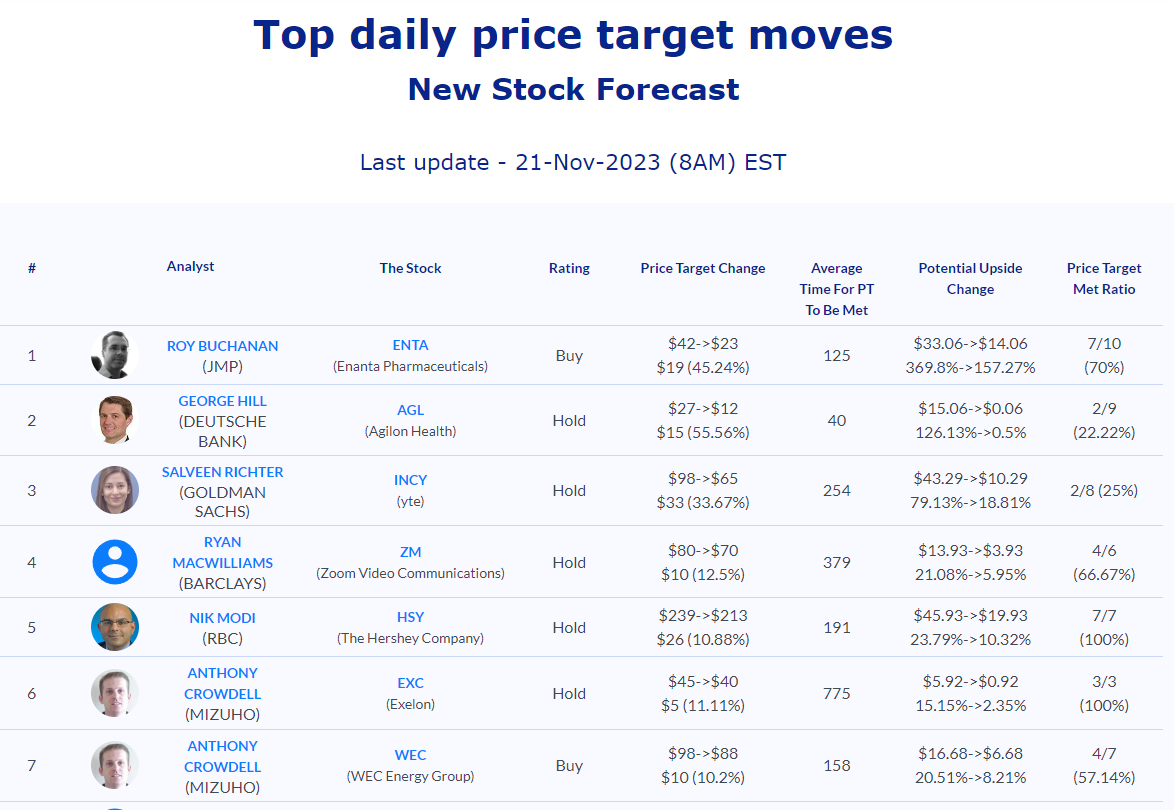

Daily stock Analysts Top Price Moves Snapshot