Selected stock price target news of the day - November 22nd, 2024

By: Matthew Otto

Palo Alto Networks Outpaces Q1 Estimates Amid Cybersecurity Growth

Palo Alto Networks reported its first-quarter results, with a revenue of $2.14 billion, exceeding the $2.12 billion forecast. Adjusted earnings per share (EPS) came in at $1.56, higher than analysts’ estimates of $1.48.

For the second quarter, Palo Alto projected revenue between $2.22 billion and $2.25 billion, closely aligning with analysts’ estimates of $2.23 billion. Also raised its full-year adjusted EPS guidance to a range of $6.26 to $6.39, up from the previous range of $6.18 to $6.31.

Additionally Palo Alto raised its fiscal 2025 revenue forecast to $9.12 billion-$9.17 billion, aligning with the $9.13 billion analysts anticipated. The results reflect continued investment in cybersecurity services amidst rising digital threats.

Analyst Ratings Reflect Confidence in Growth Potential

- Truist Securities analyst Anthony Hau maintained a Buy rating and the price target at $425.

- TD Cowen analyst Shaul Eyal maintained a Buy rating and raised the price target from $400 to $420.

- BTIG analyst Gray Powell continued with a Buy rating and increased the price target from $395 to $414.

- Citigroup analyst Fatima Boolani sustained a Buy rating and increased the price target from $395 to $432.

- Deutsche Bank analyst Brad Zelnick reiterated a Buy rating and lifted the price target from $395 to $415.

- BofA Securities analyst Tal Liani kept a Neutral rating but raised the price target from $400 to $430.

- BMO Capital analyst Keith Bachman reiterated an Outperform rating and increased the price target from $390 to $425.

- RBC Capital analyst Matthew Hedberg reiterated an Outperform rating and a $450 price target.

- Oppenheimer analyst Ittai Kidron reiterated an Outperform rating and a $450 price target.

- WestPark Capital analyst Paul Rodriguez maintained a Hold rating.

- Piper Sandler analyst Rob Owens sustained a Neutral rating but raised the price target from $330 to $385.

- Cantor Fitzgerald analyst Yi Fu Lee reiterated an Overweight rating and retained the $445 price target.

- Wells Fargo analyst Andrew Nowinski maintained an Overweight rating and raised the price target from $416 to $450.

- Susquehanna analyst Shyam Patil upheld a Positive rating and increased the price target from $420 to $435.

Which Analyst has the best track record to show on PANW?

Analyst Roger Boyd (UBS) currently has the highest performing score on PANW with 7/7 (100%) price target fulfillment ratio. His price targets carry an average of $-13.01 (-3.54%) potential downside. Palo Alto Networks stock price reaches these price targets on average within 51 days.

NVIDIA Delivers Q3 FY2025 Results, Beats Expectations, and Projects Robust Q4 Growth

NVIDIA reported its third-quarter fiscal 2025 results, achieving a revenue of $35.1 billion, well above the consensus estimate of $33.09 billion, reflecting a 94% year-over-year increase and 17% sequential growth. Earnings per share (EPS) came in at $0.81, beating the analyst estimate of $0.75 by $0.06. Net profit more than doubled year-over-year, reaching $20 billion.

NVIDIA’s data center revenue surged to $30.8 billion, up 112% year-over-year, driven by adoption of Hopper and H200 GPUs, which fueled cloud service providers and AI developers. Gaming revenue increased 15% year-over-year to $3.3 billion, supported by back-to-school demand for RTX GPUs.

Looking ahead, NVIDIA provided guidance for the fourth quarter of fiscal 2025, expecting revenue of $37.5 billion, plus or minus 2%, slightly above the consensus estimate of $37.1 billion. GAAP and non-GAAP gross margins are anticipated at 73.0% and 73.5%, respectively, plus or minus 50 basis points.

Operating expenses are projected at approximately $4.8 billion (GAAP) and $3.4 billion (non-GAAP). Other income is estimated at $400 million, and the tax rate is expected to be 16.5%, plus or minus 1%. NVIDIA expects its annualized software and services revenue to surpass $2 billion by year-end.

Analysts Raise Price Targets Amid Q3 Results and Guidance

- Truist Securities analyst William Stein maintained a Buy rating while increasing the price target from $167 to $169.

- Wedbush analyst Matt Bryson kept an Outperform rating and raised the price target from $160 to $175.

- Mizuho analyst Vijay Rakesh upheld an Outperform rating and boosted the price target from $165 to $175.

- TD Cowen analyst Matthew Ramsay reiterated a Buy rating and revised the price target upward from $165 to $175.

- Citigroup analyst Atif Malik maintained a Buy stance and raised the price target from $170 to $175.

- Deutsche Bank analyst Ross Seymore remained with a Hold rating but lifted the price target from $115 to $140.

- BofA Securities analyst Vivek Arya reaffirmed a Buy rating and the price target at $190.

- Oppenheimer analyst Rick Schafer reiterated an Outperform rating and the price target at $175.

- JP Morgan analyst Harlan Sur maintained an Overweight rating and increased the price target from $155 to $170.

- Barclays analyst Blayne Curtis upheld an Overweight rating while raising the price target from $145 to $160.

Which Analyst has the best track record to show on NVDA?

Analyst Richard Shannon (CRAIG HALLUM) currently has the highest performing score on NVDA with 18/21 (85.71%) price target fulfillment ratio. His price targets carry an average of $47.41 (40.32%) potential upside. NVIDIA stock price reaches these price targets on average within 46 days.

Snowflake Q3 Fiscal 2025 Earnings Exceed Expectations with Revenue Growth and Optimistic Q4 Outlook

Snowflake reported its financial results for the third quarter of fiscal 2025, with total revenue of $942.1 million, reflecting a 28% year-over-year increase and surpassing the consensus estimate of $899.3 million. Also reported earnings per share (EPS) of $0.20, beating analyst expectations by $0.05.

Product revenue, which constitutes approximately 96% of total sales, reached $900.3 million, marking a 29% growth from the same period last year. Snowflake’s net revenue retention rate stood at 127%, and its remaining performance obligations grew by 55% year-over-year to $5.7 billion. Snowflake’s customer base continued to expand, with 542 customers generating more than $1 million in trailing 12-month product revenue and 754 Forbes Global 2000 customers, reflecting increases of 25% and 8%, respectively.

Looking ahead, Snowflake provided an outlook for the fourth quarter, with product revenue expected to range from $906 million to $911 million, ahead of the analyst estimate of $890.7 million. Additionally raised its fiscal 2025 product revenue forecast to $3.43 billion, up from the previous guidance of $3.36 billion, implying 29% growth. Snowflake also expects its adjusted operating margin to improve to 5%, up from 3% previously.

Analysts Maintain Positive Outlook Following Q3 Performance

- Truist Securities analyst Ki Bin Kim maintained a Buy rating with a $210 price target.

- Wedbush analyst Daniel Ives kept a Neutral rating, while raising the price target from $130 to $160.

- Mizuho analyst Gregg Moskowitz held an Outperform rating and increased the price target from $165 to $195.

- TD Cowen analyst J. Derrick Wood maintained a Buy rating and raised the price target from $180 to $190.

- Deutsche Bank analyst Brad Zelnick continued with a Buy rating and lifted the price target from $180 to $190.

- RBC Capital analyst Matthew Hedberg maintained an Outperform rating, while raising the price target from $175 to $188.

- BofA Securities analyst Bradley Sills kept a Neutral rating and raised the price target from $160 to $185.

- Barclays analyst Raimo Lenschow maintained an Equal-Weight rating and increased the price target from $142 to $172.

- Oppenheimer analyst Ittai Kidron maintained an Outperform rating with a $180 price target.

- Jefferies analyst Brent Thill reiterated a Buy rating and raised the price target from $145 to $180.

Which Analyst has the best track record to show on SNOW?

Analyst David Hynes (CANACCORD) currently has the highest performing score on SNOW with 7/9 (77.78%) price target fulfillment ratio. His price targets carry an average of $74.79 (64.92%) potential upside. Snowflake stock price reaches these price targets on average within 93 days.

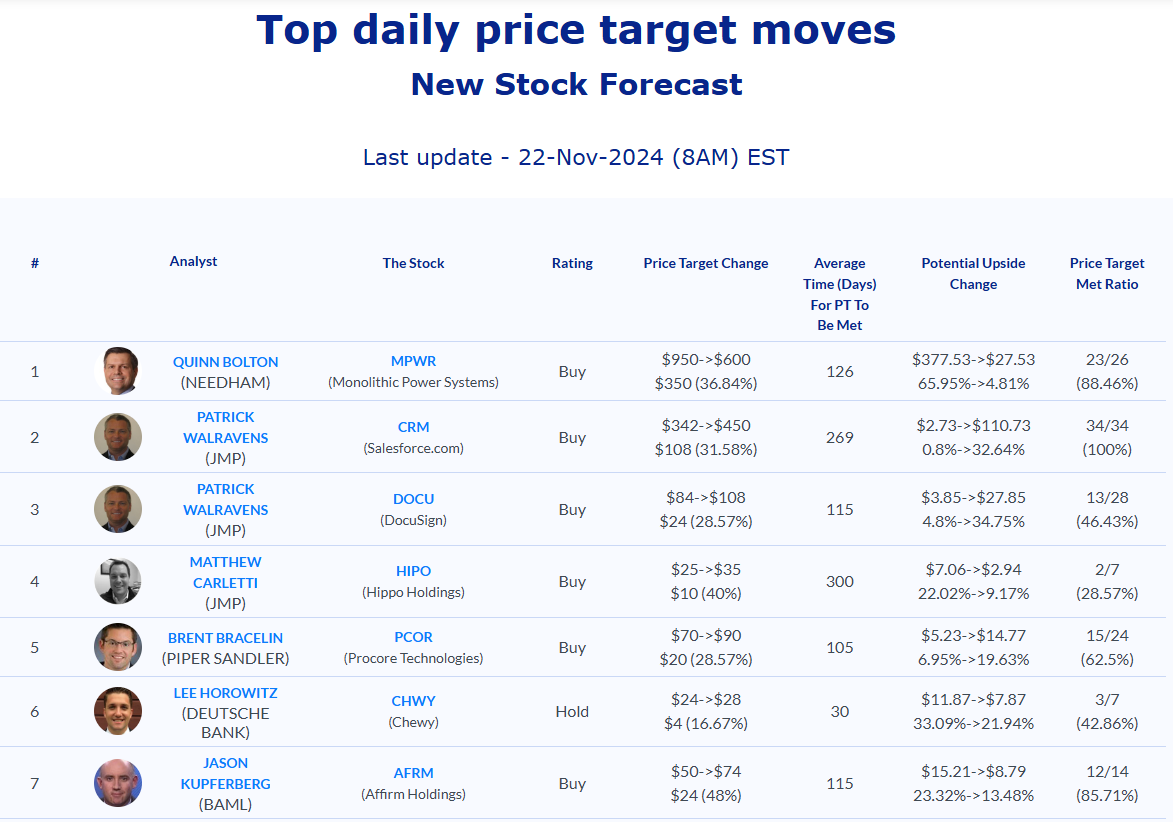

Daily stock Analysts Top Price Moves Snapshot