Selected stock price target news of the day - November 28th, 2023

By: Matthew Otto

Zscaler’s Market Dip: Analyst Insights

While the market appears disappointed with Zscaler’s cautious guidance, analysts such as Evercore’s Peter Levine emphasize that the quarter was well-executed, with most metrics outperforming expectations. Zscaler’s annual billings guidance maintaining a growth range of 24%-26% has sparked some concern, even though the company surpassed expectations for its first quarter and achieved a billings growth of 34%.

Analysts, however, remain optimistic about Zscaler’s prospects. Levine, undeterred by the guidance, maintains an Outperform rating and raises the target price. Similarly, RBC Capital Markets analyst Matthew Hedberg notes that the company’s caution is linked to changes in leadership, with the appointment of new chief revenue and marketing officers. Despite acknowledging the already strong quarter, Hedberg suggests that much of this success was already factored into the stock’s price. He emphasizes the potential future boost from Zscaler’s artificial-intelligence enabled products, foreseeing an impact on average selling prices. Hedberg maintains an Outperform rating. While Guggenheim Securities analyst John DiFucci remains more neutral, he acknowledges Zscaler’s unique asset with attractive growth and long-term financial characteristics, emphasizing the question of whether material moderation continues as implied in the guidance.

Analyst Ratings and Price Target Reflect Market Dynamics

- Morgan Stanley analyst Hamza Fodderwala Maintained an Equal-Weight rating and raised the price target from $170 to $180.

- Needham analyst Alex Henderson Reiterated a Strong Buy rating and increased the price target from $210 to $225.

- Evercore analyst Peter Levine Kept an Outperform rating and raised the target price to $215 from $200.

- RBC Capital analyst Matthew Hedberg Maintained an Outperform rating and set a target price of $220.

- Guggenheim Securities analyst John DiFucci Remained neutral.

Which Analyst has the best track record to show on ZS?

Analyst Keith Bachman (BMO) currently has the highest performing score on ZS with 12/15 (80%) price target fulfillment ratio. His price targets carry an average of $26.23 (13.82%) potential upside. Zscaler stock price reaches these price targets on average within 59 days.

Affirm Takes Buy Now, Pay Later Trend on Cyber Monday

Affirm Holdings is riding the wave of the buy now, pay later trend, with Cyber Monday proving to be a significant milestone. According to Adobe Analytics, shoppers are projected to spend a staggering $12 to $12.4 billion online on this shopping extravaganza, with a $782 million allocated to buy now, pay later services.

The data points to a broader trend of buy now, pay later growing popularity, particularly among budget-conscious consumers aiming to sidestep the additional costs associated with credit card transactions. Dan Dolev, an analyst at Mizuho Securities, emphasized the substantial adoption scale, highlighting buy now, pay later widespread appeal. Furthermore, Klarna’s survey revealed that nearly half of respondents expressed concerns about their ability to fully pay off credit card bills from holiday spending, underscoring the appeal of Affirm’s model. Affirm’s success extends beyond Cyber Monday, as the company witnessed a 29% increase in orders placed by U.S. shoppers on Black Friday.

Analyst Upgrades Affirm and Raises Price Target

- Jefferies analyst John Hecht upgraded from Underperform to Hold and raised the price target from $9.5 to $30.

Which Analyst has the best track record to show on AFRM?

Analyst James Faucette (MORGAN STANLEY) currently has the highest performing score on AFRM with 7/11 (63.64%) price target fulfillment ratio. His price targets carry an average of $18.48 (24.36%) potential upside. Affirm Holdings stock price reaches these price targets on average within 41 days.

Cerence Drives Performance and Future Growth with Q4 2023 Earnings

Cerence’s Q4 2023 earnings call reported a revenue reaching approximately $81 million, surpassing the consensus estimate of $74.37 million. The core auto business maintains a global auto penetration of 54% on a trailing 12-month basis. The financial metrics underscore the company’s strength, with non-GAAP gross margin at 72.9%, non-GAAP operating margin at 17.8%, and adjusted EBITDA reaching $16.6 million with a 20.7% margin. The reduction in annual fixed contracts from $40 million to $20 million starting in fiscal ’24 is a strategic move expected to yield benefits, eliminating additional discounts and accelerating the decline in consumption of existing inventory. Furthermore, Cerence’s shift in investment strategy towards generative AI and large language models positions it to enhance the user experience in the transportation space.

Analyst Price Target Adjustments Reflect Varied Views on Cerence

- Needham analyst Quinn Bolton maintained a Buy rating and lowered the price target from $34 to $23.

- Wedbush analyst Daniel Ives lowered the price target to $19.

- Craig-Hallum analyst Jeff L. Van adjusted the price target to $25.

- TD Cowen analyst Jeff Osborne reiterated an Outperform rating and lowered the price target $35 to $23.

Which Analyst has the best track record to show on CRNC?

Analyst Luke Junk (BAIRD) currently has the highest performing score on CRNC with 3/7 (42.86%) price target fulfillment ratio. His price targets carry an average of $7.49 (12.83%) potential upside. Cerence stock price reaches these price targets on average within 56 days.

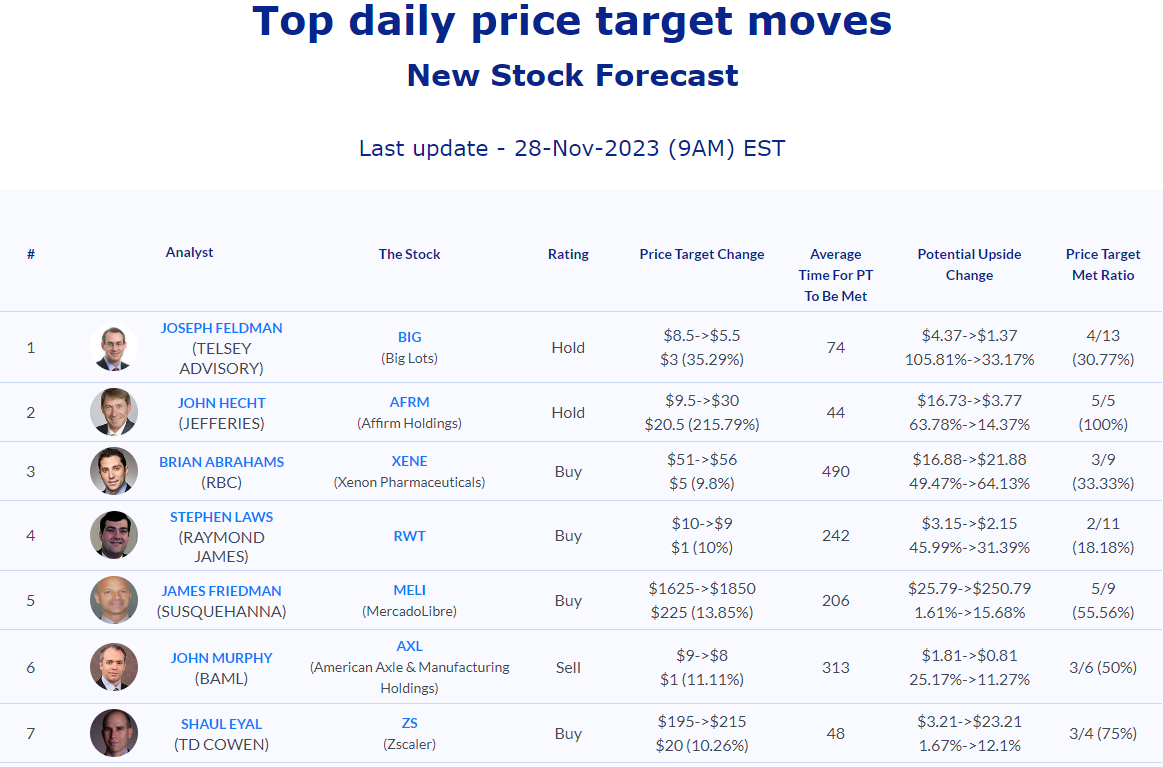

Daily stock Analysts Top Price Moves Snapshot